Do you know there are over 10,000 cryptocurrencies in the market as of 2021? Now, if you’re trying to invest in one of those, then it can be tedious to choose one and begin investing. So, in this article, we will be covering almost everything a beginner should consider and know before investing in crypto assets.

However, before diving into which coin you should trade/ HODL, you must understand the basics of cryptocurrency to do your market research successfully.

Table of contents

- Summary (TL;DR)

- What is Cryptocurrency?

- Where did it all start?

- What is blockchain technology, and how does it work?

- How can blockchain technology revolutionize the internet?

- Which is the next coin going to the moon?

- So how do you invest in an asset?

- Assets to trade as a beginner

- Do Your Own Research (DYOR)

- Reading and Understanding

- Being a part of the community

- Understanding Crypto Trading Strategies

- Using the Technical Indicators

- Adopting proper risk management

- Best Cryptocurrency Platform in India

- Best mobile apps for crypto trading

- Steps to invest in cryptocurrency

- Crypto wallets

- Using a Trading Terminal

- Crypto Signals

- Best Trading Bots

- Crypto Cards

- Margin or Leverage Trading

- Crypto Tax Software

- Crypto Lending

- Cryptocurrency Savings Account

- Crypto Staking

- Things not to do as a beginner in crypto trading

- Guide to Invest in Cryptocurrency: Conclusion

- Frequently asked questions

Summary (TL;DR)

- A cryptocurrency is a type of digital money you can use to buy/ sell goods.

- Satoshi Nakamoto created a peer-to-peer digital currency peer-to-peer system called Bitcoin.

- Blockchain technology enables us to build decentralized services and products.

- The technology can revolutionize the internet and the financial system, most importantly, as it enables private currencies, which is of the people, by the people, and for the people, the true definition of democracy.

- Nobody knows which coin is going to the moon and going in the bin; however, you can learn about good projects through its fundamental analysis.

- As a beginner, you can mostly stick to popular coins such as bitcoin and ethereum.

- You should adopt a trading strategy and keep learning from the trades you make.

- Learning to use the technical indicators in trading will help you make an informed decision and not just moving ahead with guesswork.

- Risk management can be considered an essential part of trading, as gaining returns is okay, but losing your capital is not good.

- You can begin trading at any local exchange and follow the steps further in the article to start.

- If you need proper security, then get hardware or an offline wallet to store your assets.

- You can use trading terminals and connect different exchanges through APIs to trade them all at a given time.

- Crypto tax softwares allow you to calculate the amount you owe without any hassle.

- Rather than storing your assets, you can use staking or crypto lending to gain yield on them.

What is Cryptocurrency?

A cryptocurrency is a form of the digital asset. Blockchain technology helps crypto-assets exist and store all the information in a decentralized manner. In other words, there are no central entities in the network. To learn more read our article on What is blockchain?

Blockchains are secured by cryptography; making it really difficult to alter a block in a blockchain and add new blocks, making it highly secure. Also, being a decentralized currency, no central authority has control over crypto assets. Let’s now understand how cryptocurrency came into existence.

Where did it all start?

On 31st October 2008, an anonymous developer or a team of developers known as Satoshi Nakamoto published a paper named Bitcoin: a peer-to-peer Electronic cash system, mentioning a new decentralized currency and its applications. Bitcoin had an initial value of 0.008 USD and now, after more than a decade, has a worth of 60,000 USD in April of 2021.

Bitcoin miners solve complex mathematical puzzles in order to process Bitcoin transactions and provide security to the network, in return the Bitcoin blockchain rewards them bitcoins. To learn more read our simple explanation of Bitcoin.

What is blockchain technology, and how does it work?

Did you know that blockchain technology emerged from bitcoin, and it was not the other way around? Blockchain technology allows us to store data in the form of blocks. This data is stored on all the devices running blockchain nodes on the internet in a decentralized manner. And when a new block comes into existence in a chain, it is added to all the nodes.

Blockchain technology not only supports a new decentralized currency instead, but it also has many other applications, such as the copyright issues of digital creators. Digital creators lose millions of dollars due to copyright infringement, as anyone on the internet can easily copy their content. When they add their record to a blockchain, it is easy to prove the content ownership publically.

If you wish to learn more about blockchain technology, you can refer to our article on top cryptocurrency and blockchain courses.

How can blockchain technology revolutionize the internet?

Since we know that blockchain technology is still in its initial stages, hence its applications are enormous than we realize today. A whole range of financial transactions can take place over the blockchain. You can scrap much unnecessary paperwork, and blockchain can also enable online voting during elections.

Blockchain technology allows us to create digital native assets, therefore, now we can bake incentives in digital services and create a new type of digital assets. It will change the way we monetize services on the internet and will create a more open and inclusive digital native monetary system.

Which is the next coin going to the moon?

Dogecoin. I bet you wanted to read this, but hold on, nobody on this planet can tell you which coin is going to the moon. However, the number of bitcoin is limited to 21 million. Hence, its value tends to rise over time. And if anyone tells you about a cryptocurrency and is sure that it’s going to be the next million-dollar coin. Do not believe him/ her, and invest at your own risk, as they can be scammers.

So how do you invest in an asset?

There are more than 10,000 known cryptocurrencies, and more than three-fourth of them are scams. So, to be honest, if you want to learn about where to invest, you need to do your research about that particular cryptocurrency.

Assets to trade as a beginner

When it comes to trading as a beginner, we recommend starting with a minimal amount, so it wouldn’t hurt much if you lose that money. If you’re going to invest as a beginner, it is confined only to ETH and BTC, as they are the top two cryptocurrencies in the market.

Do Your Own Research (DYOR)

Now, suppose you want to invest in a cryptocurrency other than the top ten in the market cap. In that case, you need to research that particular project. While doing market research, you can keep the following things in your mind:

- The first step would be to check the project’s legitimacy, so check the team, investors, and people related to it.

- You should also check important metrics such as Total supply, Circulating supply, tokenomics, top holders, etc.

- You can read various blogs on the internet, watch youtube videos, read the white paper of that particular cryptocurrency.

- Follow the news related to the cryptocurrency you’re interested in investing in.

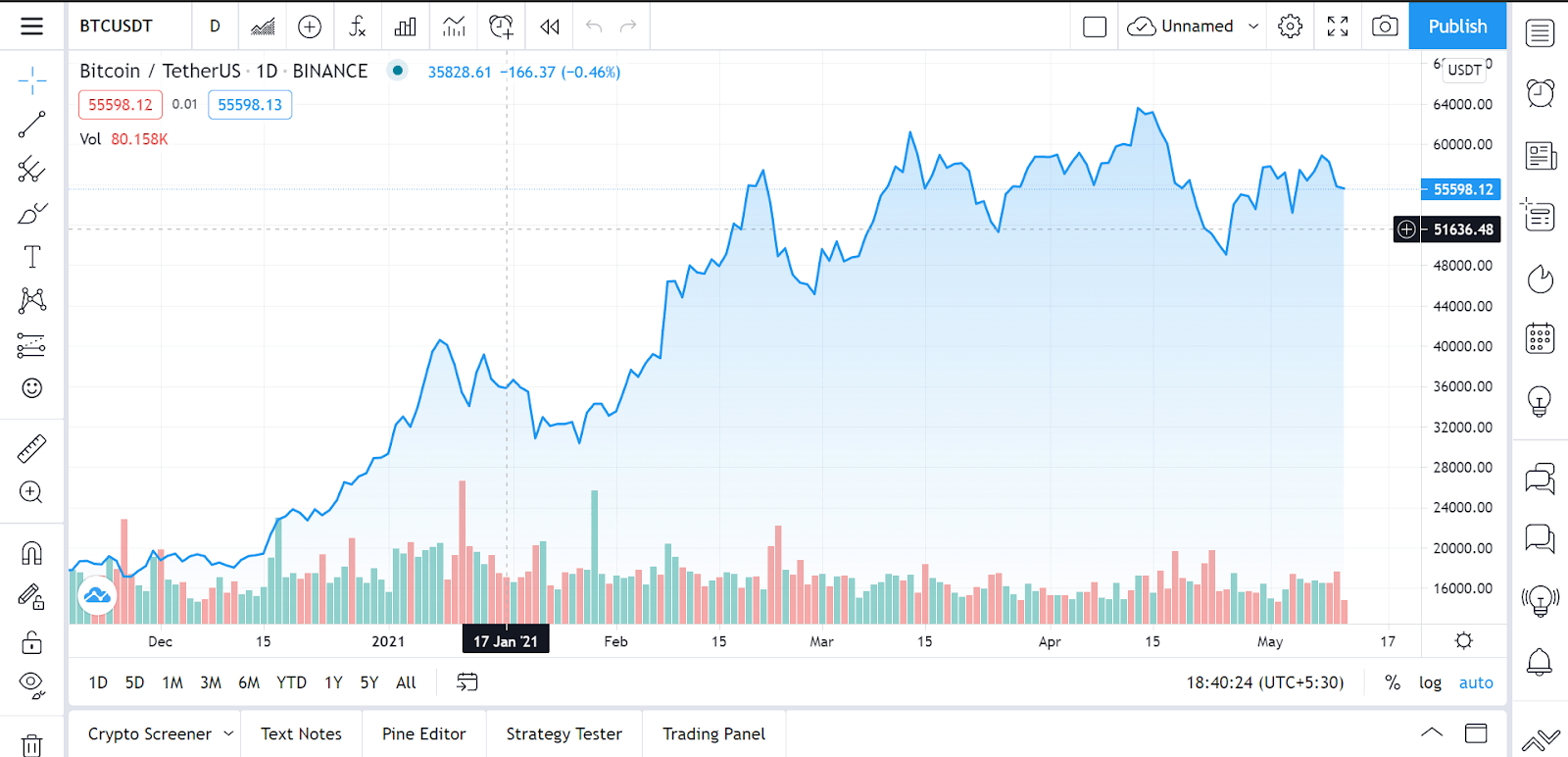

- You can use the various tools of TradingView to estimate the market movements of the asset.

- Finally, research the fundamentals of the coin. Most of the coins out there are trying to offer what a coin is already offering. In that case, the newer coin might be of lesser importance. So always be on the lookout for a project that offers something unique and difficult to replicate.

Reading and Understanding

The most critical part about investing in cryptocurrency is understanding the asset you’re putting your money on. You must adhere to reading blogs, news, and any relevant thing that can increase your understanding of crypto assets. You can start from the articles listed here.

The thing about investment is, if you’re investing your money by doing proper research and analysis of a particular crypto asset, then it’s an investment, else it is gambling.

Being a part of the community

The Crypto community is ever-growing, and you must be a part of the investors’ network to interact with them. Making friends in the crypto community is not just about connecting on LinkedIn and then forgetting about the person. Instead, the communities are far more active. To understand more about the importance of community, head over to our article on networking and making friends in crypto.

We also have a Telegram group, you can join it too.

Understanding Crypto Trading Strategies

A trading strategy is crucial for a beginner. It helps you minimize your risk, tackle all the situations with a pre-planned strategy, and not take unnecessary emotional decisions. There are mainly five types of trading strategies which are as follows:

1. Day trading

Day trading is the most popular trading strategy, usually adopted by professional traders. Day trading involves opening and closing positions on the same day.

2. Swing trading

Swing trading stays somewhere between day and trend trading. It allows a trader to buy and sell the assets within a few week spans, which is longer than Day trading but shorter than trend trading. Swing traders mostly use fundamental analysis to make their trades. Hence, it might even take a longer time for their trading strategy to play out.

3. Trend trading

Trend traders typically use fundamental analysis, i.e., studying the application of the coin in enriching the blockchain, and hence involves holding for at least a few months. Traders hope for the trend to continue in their favorable direction; however, there can be trend reversals. Hence, they use technical indicators.

4. Scalping

Scalping is one the fastest trading strategies in the market. A trader using this strategy might even perform thousands of trades in a single day. However, it is more profitable to use leverage in scalping and lets bots do the hard work. We will look at how trading bots can ease scalping for you in a later section of this article.

5. Index investing

You invest in ETFs and indices on the crypto exchanges. Index investing allows a trader to put a bet on an entire industry rather than a specific token. For example, you can invest in a privacy coin index and hope to take returns from the sector as a whole rather than a particular token.

Using the Technical Indicators

Almost all the platforms offer a chart with many features. You can instead use the one available at TradingView to access virtually all the technical indicators available. Five of the essential technical indicators are as follows:

- Relative strength index (RSI): The RSI of an asset shows whether the asset is in an overbought or oversold state at a particular moment. Briefly, it is time to sell when the RSI value goes above 75, and it’s time to buy when it goes below 25. However, at times, you cannot be dependent on RSI alone.

- Moving Average (MA): The moving average helps you determine the direction of the trend. It depends on historical data; hence it is a lagging indicator.

- Moving Average Convergence Divergence (MACD): MACD is preferably used to observe the momentum of an asset by representing a relationship between two moving averages. It is primarily used in combination with RSI, as both determine the momentum but use different factors.

- StochasticRSI (StochRSI): You can determine the StochRSI by applying a formula known as the Stochastic Oscillator formula to typical RSI values. However, since it is more sensitive than RSI, it tends to generate a few misleading signals.

- Bollinger Bands (BB): The Bollinger Bands measure the market’s volatility and the overbought and oversold conditions.

Adopting proper risk management

Risk management is considered the most crucial part of any type of investment. It is so because before entering a trade, it is best to mitigate your risks and minimize your losses. You must make more winning trades at the end of the day than the losing ones. Only then you’ll be able to strive in the crypto trading market.

Best Cryptocurrency Platform in India

Many of the popular platforms can be overwhelming for beginners. Hence, you should most preferably begin with one of your local and trustable trading platforms such as WazirX, Bitbns, or CoinDCX.

Once you get accustomed to observing the charts and trading, then you can slowly shift to Binance. This shift is recommended as these local platforms charge a humongous trading fee, and you might end up using a significant amount of your returns in paying the trading fee. You can read our article on the best crypto exchanges or the 5 best bitcoin exchanges in India.

Best mobile apps for crypto trading

Many trading platforms provide trading services worldwide right from your smartphone. However, if you’re a beginner trying to check on the prices, then Binance mobile app can be overwhelming for you. Hence, going with Wazirx, CoinDCX, Bitbns, etc., would be a better choice. You can read our guide to the best mobile apps for crypto trading or the best bitcoin exchange in India to learn more.

Steps to invest in cryptocurrency

Once you’ve decided which platform to make your first trade on, you can follow the below steps to begin trading on that platform:

- First, visit the official website of the platform and create an account.

- The next step would be to deposit funds into your account.

- Go to the fund’s section and deposit some FIAT using the available payment methods.

- Now, go to the exchange section and choose the asset you wish to buy.

- Finally, enter the amount of the asset you wish to buy, and hit the buy button.

You can also read our article on How to buy bitcoin in India or How to buy ETH in India for a better understanding. Now, when you’ve bought some bitcoin and wish to hold for a more extended period. Then it is vital to know some good wallets to protect you from online scams.

Crypto wallets

Where would you store your crypto assets once you’ve bought everything you could? Well, this is where the crypto wallets come in; they provide you with a secure online/ offline storage option. There are mainly two types of crypto wallets; let’s talk about them a bit.

Hardware Crypto Wallet

These are devices where you can store your crypto asset in an offline secured drive. These wallets usually do no connect to the internet directly and are also incapable of running complex applications. There are many hardware wallets available in the market, and some of those are:

Reading our article on Ledger Nano S vs. Trezor one vs. Trezor T vs. Ledger Nano X can help you decide which wallet to choose. You must be aware of everything before using a crypto hardware wallet, so you don’t lose any asset.

Mobile Crypto Wallets

If you’re a beginner, you might not want to get a hardware wallet. They are costly and are primarily used for HODLing your assets over a longer duration. Mobile wallets allow you to store funds in their secured wallets. The platforms such as Coinbase offer you a hot wallet for faster transactions and a cold wallet for more secure storage of your assets.

There are also two major crypto wallets in the market, whose primary purpose is to provide you a safe environment to store your assets.

- Metamask: Metamask is a browser and mobile-based crypto wallet that allows you to connect with blockchain networks and interact with Ethereum Dapps. You can learn more about Metamask from our article on Setting up Metamask for Binance Smart Chain.

- Trust Wallet: Trust wallet has recently been acquired by Binance and is a multi-currency mobile wallet. It is a non-custodial wallet and supports Binance Dex. You can learn more about Trust wallet from our article on Best crypto wallets.

You can learn more from our article about different types of crypto wallets and also choose the best wallet for you from our article on best crypto wallets. Security is a must in handling your crypto assets on online mobile or desktop wallets; hence you can read about some security measures to be taken from our article on crypto wallet best practices.

Using a Trading Terminal

Suppose you aren’t able to use a particular feature on the platform you use for trading. Hence, in that case, a trading terminal allows you to connect exchanges through APIs. Trading terminals can act as a single help that will enable you to connect your portfolios on different exchanges.

You can use Shrimpy, Altrady, or Atani as a beginner as it offers a simple interface. You can also use HyperTrader, a desktop-based Trading terminal.

Crypto Signals

It is highly possible that as a beginner, you wouldn’t be able to figure things out about the market. Hence there are many platforms and experienced traders who provide crypto trading signals. These signals provide you with details such as opening/ closing positions, stop loss, take profit, etc. They have pre-set goals to achieve in a particular trade, and many of these signals provide bots to trade on your behalf.

Here are the best telegram channel for crypto trading signals:

To learn more, read the best crypto signals for telegram. If you’re on the lookout for free signals, then head over to the best 4 free crypto signals telegram channels.

Best Trading Bots

Crypto trading bots help you automate your trading strategy and execute orders on your behalf. Most of the trading bots offer DCA and GRID trading strategies. Some of the best trading bots are provided by:

If you wish to trade a bit safely then you can even use the new Spot-Futures crypto Arbitrage trading bot by Pionex for a relatively higher return of up to 50% APR. The new Bitsgap Futures bot also provides its exclusive services in the futures market.

Furthermore, you can even automate your crypto signals using the Cornix telegram bot or the CryptoHopper telegram bot. And if you’re looking for a bot to use on Binance, then refer to the top 5 Binance trading bots.

Crypto Cards

What if there was a way to spend your crypto assets using a debit card? The crypto debit card provides you with an opportunity to spend your crypto assets without the hustle of converting them to FIAT manually. These cards automatically do so for you, and there are many crypto debit cards available in the market; some of them are:

Margin or Leverage Trading

It is highly recommended that beginners stay away from leverage trading. But knowing about something and using it are two different things. Margin trading allows you to open a position of a higher amount than your actual capital. The platform lends you extra coins, depending on your leverage, and it does so by keeping your capital as collateral. You can try any of the trading platforms for margin trading:

You can learn more about margin trading from our article on what is margin trading. We can also help you chose a platform that suits you best from our articles on the best bitcoin margin trading exchanges and Top 5 crypto margin trading exchanges.

Crypto Tax Software

Once you start trading and gaining returns from your trades, you’ll have to pay a tax to the government. Doing your crypto taxes manually can be a hell of a job, and this is where the crypto Tax softwares come into play.

The crypto tax softwares offer various tools and automatically download your transactions from the exchange and generate an easy-to-read report. There is much efficient tax software available in the market, and some of them are:

Crypto Lending

Once you successfully buy bitcoin, you can store it in some vault and wait for the price to double, or you can lend your asset and gain interest. You can use any of the platforms below for crypto lending and earn up to 12% APY:

You can understand crypto lending better from our article on Top 6 crypto lending platforms in 2021. You wouldn’t want to use a platform just for lending, hence this is where Crypto.com comes in, it allows you to perform many other tasks including crypto lending. You can learn more from our article on the Crypto.com review.

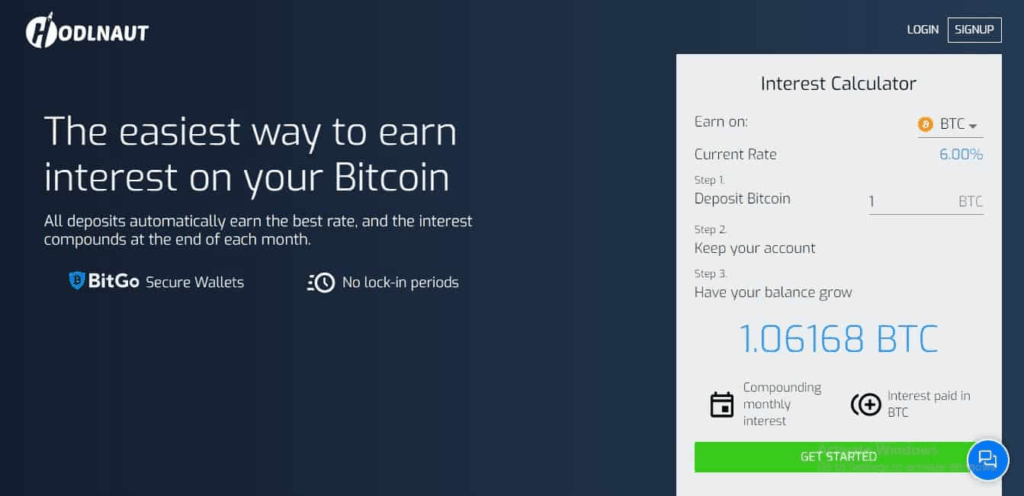

Cryptocurrency Savings Account

You might have a savings account in your local bank? But did you know that you can have one for your crypto assets too? The crypto savings account a decent interest on the number of crypto assets you store. There are no deposit fees in these savings accounts, and you can also withdraw your funds anytime. You can learn more about the crypto savings account from our article on the top 7 cryptocurrency savings account.

Crypto Staking

You can either lend your assets and gain interest in them or use staking. Staking allows you to use the assets you hold at an exchange and stake them to support blockchain operations. For example, you can use Locked or DeFI staking for a particular period and gain interest in your stake’s assets.

You can also withdraw the assets whenever you want to; however, in that case, you wouldn’t be eligible for the interests earned to date. Binance offers Locked, DeFi, and ETH 2.0 staking, and in case you are using Binance to staking your assets, you can read our article on Staking on Binance to better understand it. Furthermore, you can also opt for Coinbase staking.

Things not to do as a beginner in crypto trading

All of us make mistakes, we do, but if it’s your hard-earned money at stake, you should be careful about the mistakes you make. Now, let us understand things you should not do as a beginner:

- We highly recommend starting trading from smaller amounts, and you should focus on taking smaller returns.

- You must remember that the crypto market is highly volatile, and things can change within the blink of an eye.

- Before investing even a tiny amount, you should keep your human emotions, such as greed, fear, etc., out of your trading.

- It is best if you start with spot trading and do not go into leverage trading. Even though leverage offers higher returns as you can also lose all of your capital in margin trading.

- You should always use a stop-loss to minimize your losses and implement all of your risk management skills.

- You should stay away from pump or dump calls on many discords or telegram channels as a beginner.

- You should always have a trading plan in your head and try and make more winning trades than you lose.

- Many beginners go for cheaper coins and expect them to pump, but that’s not how cryptocurrencies work. To understand better, you should study the fundamentals of the coin.

Guide to Invest in Cryptocurrency: Conclusion

As a beginner, you can be very attracted to crypto trading and commit some mistakes that might end your trading career. So you must know that almost all of the traders lose their initial trades, and it’s okay to fail initially. But this does not mean that you won’t learn from your mistakes, cause if you don’t, you’ll keep losing money and soon be rekt.

So it is crucial to understand how cryptocurrencies and the blockchain itself work. As then, you’ll determine which of the projects are fundamentally sound and which of the projects are just scams. You can then use many trading features such as trading bots, hardware/ software wallets, lending, staking, etc. However, you should always invest with a strategy and maintain proper risk management.

Frequently asked questions

How to day trade in cryptocurrency?

While using a day trading strategy, you open and close a position in a single day. There is no limit to opening or closing positions in a day; however, day trading is hard work since you have to stick to the screen for the entire day.

Which cryptocurrency will survive?

Nobody knows which cryptocurrency will survive or die out with time because it is all about investors’ demand. If people stop buying bitcoin tomorrow, then it will have no value. If suddenly someone buys half of the bitcoins in the market, its price will rise significantly.

How to short bitcoin?

If you wish to short bitcoin, then you’ll have to use margin trading. While going short on bitcoin, you borrow funds from the exchange using your capital as collateral and sell it at a higher price. When the price lowers, you repurchase the bitcoins and return the borrowed amount keeping the difference as your profit.

How to earn bitcoin in India?

You can do many odd jobs and take bitcoins as payment on the internet. You can also earn free bitcoin in many other ways.