Some of the best apps to buy bitcoin in India are WazirX, Bitbns, and CoinDCX. Furthermore, this article will provide you with all the necessary information to make an informed decision on choosing the best platform according to your requirements.

| App Name | Invitation Code | Android | iOS | UPI |

|---|---|---|---|---|

| WazirX | ad4e888q | Link | Link | No |

| Bitbns | 64358 | Link | Link | YES |

| Unocoin | U-305402 | Link | Link | YES |

| Colodax | IFO102589090270 | Link | Link | YES |

| CoinDCX | 70297373 | Link | N/A | No |

| Zebpay | REF43483299 | Link | Link | YES |

| CoinSwitch Kuber | Rd8P | Link | Link | No |

Summary

- A bitcoin exchange app allows you to trade on the go.

- There are many apps on the play store and apple store providing this service.

- WazirX stands as the most popular bitcoin trading app in India and provides almost all methods to deposit.

- Bitbns offers a simple user interface and allows to use of credit cards through Mobikwik wallet.

- Unocoin comes with a simple user interface and secure app; however, with a high fee.

- Colodax has one of the fastest verification processes and keeps your fee inversely to your trading volume.

- CoinDCX is the most versatile app with the best referral program offering you up to 25 USDT per signup through this link.

- ZebPay is often referred to as ‘Bitcoin ki dukaan’ and offers high security and a high fee.

- CoinSwitch Kuber hasn’t been in the crypto market for long. However, they aren’t charging any trading fee from its first 100K users for the initial 100 days.

What is a bitcoin exchange app?

An application that allows you to buy, sell, and trade Bitcoin through your phone is called the bitcoin exchange app. They free you from the hustle and bustle of carrying the laptop everywhere and make trading remote.

You can trade on the go using a mobile app, or even as a beginner; you can start investing in bitcoin using an app. The simple and interactive user interface can be available in many apps, but let’s look at the best app to buy Bitcoin in India.

7 Best bitcoin exchange app in India

Many platforms have recently started providing their services through mobile applications, and it can be challenging to know the best one for you. Hence, we have curated a list of the top seven apps for your help.

1. Bitbns

Bitbns is an Indian crypto exchange platform to keep things simple, attractive, and secure. The app offers margin trading, pool sales, and many a time crypto drops. The app also offers a Fixed Income Plan, which assures you returns on investments in cryptocurrencies. The platform has its own hardware wallet that you can get from the official website. Furthermore, the platform is soon going to launch its options trading and has already launched the testnet for the same. To learn more, read Bitbns review.

Is Bitbns Safe?

Yes, Bitbns is safe to use and they use cold storage to store most of your assets. Furthermore, the app has two-factor authentication and a Google authenticator for the personal security of the wallet. You can also buy the Bitbns Cold wallet and securely store your funds.

Bitbns Fees

Bitbns has a flat 0.25% trading fee, which is one of the highest in the market. Furthermore, the platform charges a 1.77% fee on depositing Mobikwik. For withdrawals, they charge a fee based on the following slab:

| Withdrawal range | Fee |

|---|---|

| Up to INR 999 | INR 4 |

| Up to INR 24,999 | INR 6 |

| Up to INR 2,00,000 | INR 9 |

The trading fee depends on your trading volume and can vary over time.

Bitbns Accepted Payment Method

Bitbns provides you an option to deposit through MobiKwik wallet. You can use your credit card at Mobikwik and then use Mobikwik to pay here. The app also allows you to pay through IMPS, NEFT, Bank transfer, USDT P2P, UPI, and bank P2P.

Bitbns – Pros and Cons

| Pros | Cons |

|---|---|

| You can deposit through a credit card using a Mobikwik wallet. | They have a slow support system. |

| The app has a simple and clean UI. | Low liquidity and high fees |

| Margin trading. | Users have been facing issues regarding deposits. |

2. Flitpay

Founded in 2017, Flitpay is one of the first Bitcoin and cryptocurrency exchanges in India. Flitpay is best known for its seamless crypto trading and investing services. Through its interactive interface, high liquidity, instant support and quick buy/sell services, Flitpay has won the hearts of over 1+ million crypto investors across India. You can effortlessly buy, sell, and trade Bitcoin, Ethereum, USDT, and 350+ cryptocurrencies on the platform. Flitpay also has a referral program where users can earn 50% commission in INR on the trading fees of their referrals and the platform’s native FLT tokens.

Is Flitpay Safe?

Safety and security have always been the top priority at Flitpay. Flitpay has implemented multiple security measures, such as 2FA, at various stages of deposits and withdrawals to ensure a secure environment. Additionally, Flitpay stores 99% of users’ funds in cold wallets to safeguard the invaluable crypto assets of users from online breaches and hacks.

Flitpay Fees

Flitpay charges no platform fee; however, a fixed 0.2% trading fee applies to buying and selling cryptocurrencies. The platform also does not charge any fees for crypto deposits and withdrawals, which means you can transfer funds fee-free.

Flitpay Deposits and Withdrawals

With Flitpay’s instant INR deposit and withdrawal services, you can quickly deposit and withdraw amounts as low as INR 100. Flitpay offers uninterrupted crypto withdrawals and deposits, giving users full custody of their crypto investments.

Flitpay Payment Methods

At Flitpay, you can instantly deposit INR funds using IMPS, NEFT, or RTGS mode of payments through bank transfer or UPI apps like Gpay or PhonePe.

Flitpay Pros and Cons

| Pros | Cons |

| Seamless crypto/INR deposits and withdrawals | There are only about 200 cryptocurrencies to trade and invest in. |

| 24*7 Instant Whatsapp andTelegram support | Fingerprint unlock option unavailable. |

| The platform has Earn feature that let’s users earn extra interest of up to 12% on the crypto investment. | The platform’s native token, FLT, is not yet live. |

3. WazirX

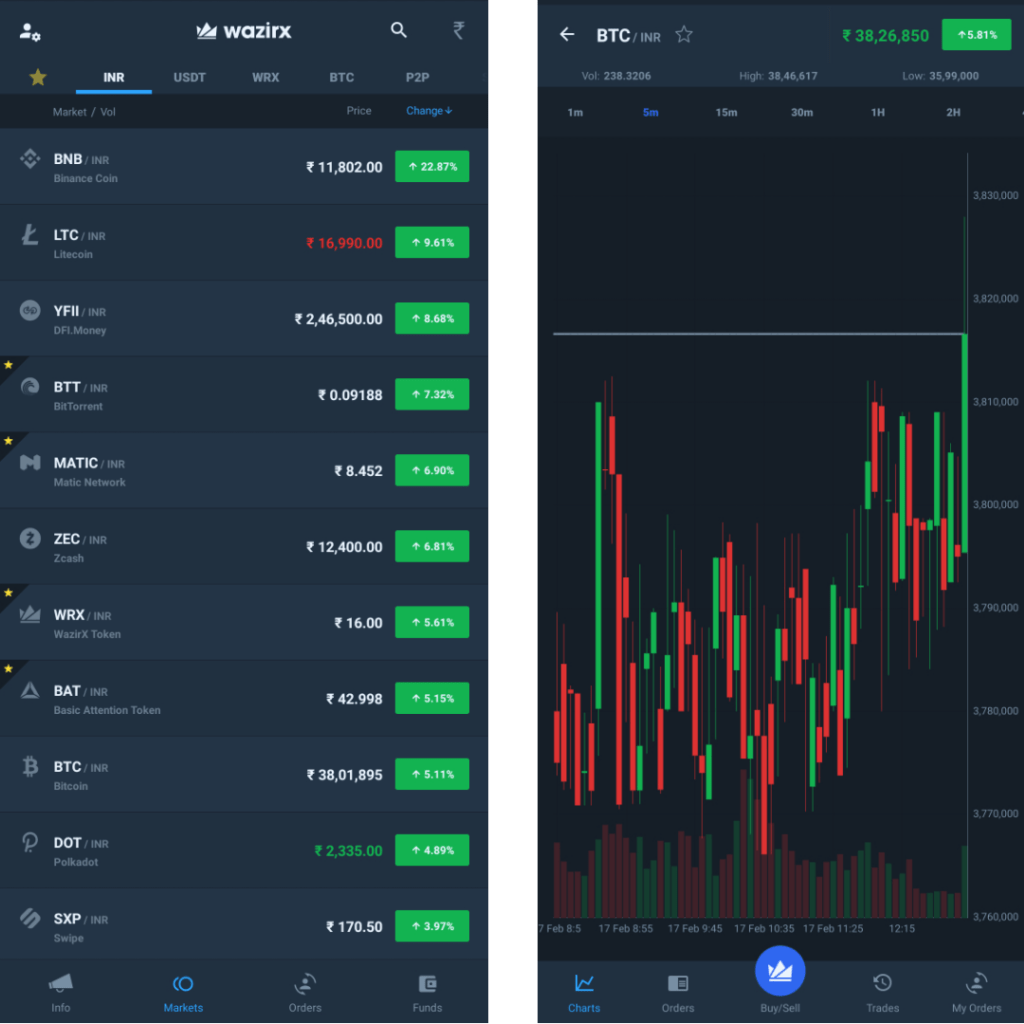

Through WazirX, you can invest in a wide range of crypto assets using INR, USDT, BTC, and even WRX (the platform’s native token). Furthermore, the platform hosts various contests and airdrops and you can keep track of those through the homepage. You can also invite your friends and earn through WazirX referral on the settings page.

Moreover, WazirX also has its coin known as WRX, and you can use INR to buy WRX and then use WRX to invest in many other crypto assets. To learn more, read the WazirX review.

Is WazirX Safe?

Yes, WazirX is safe to use as it stores almost all of your assets in cold storage and keeps only a small fraction in Hot wallets. You can increase your security by activating Two-factor authentication and App Passcode from the settings. Further, the platform notifies you through notifications on the successful execution of your orders.

Finally, WazirX has been acquired by the biggest crypto exchange in the world, Binance, providing it with an additional layer of trust.

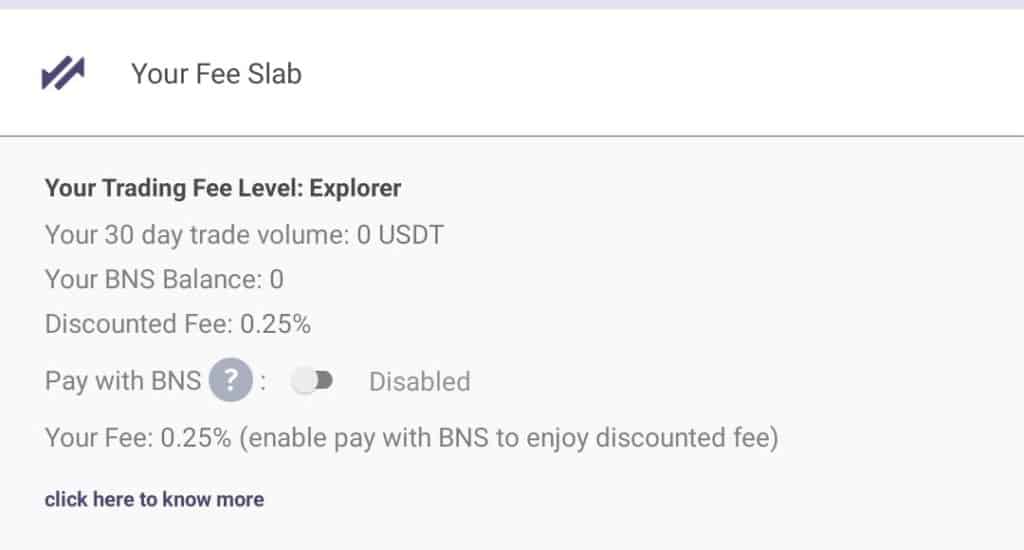

WazirX Fees

WazirX charges a 0.2% taker and maker fee, which is apart from the transaction fee. However, the app offers a feature called ‘Pay trading Fee with WRX.’ On enabling it from the fee setting, you can pay the transaction fee with WRX and enrol in a 50% discount on the trading fee.

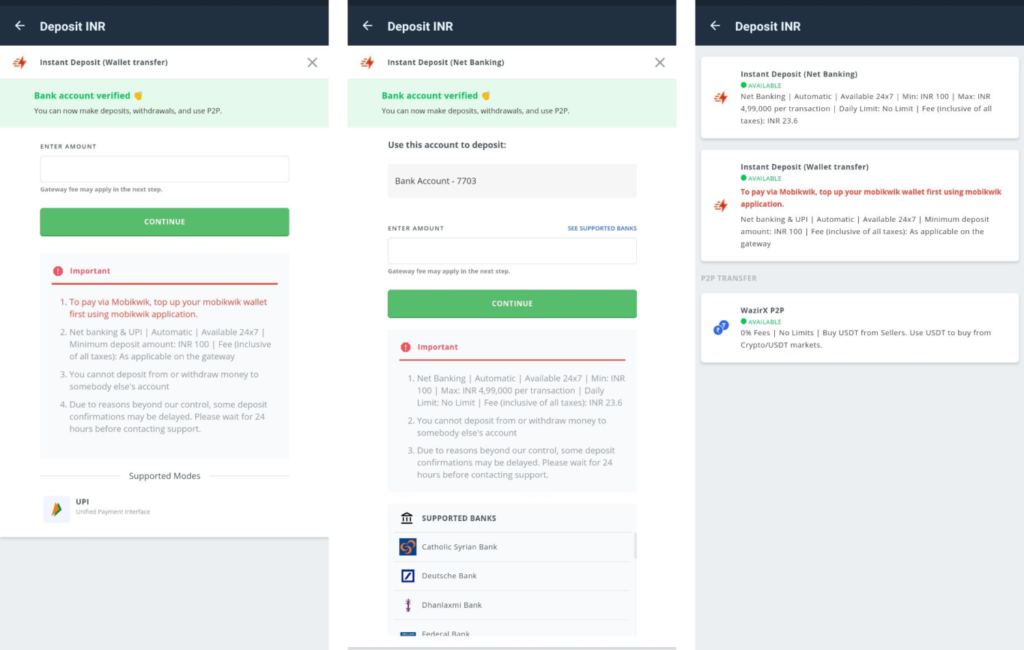

WazirX Deposits/ Withdrawals

Due to high uncertainty in the Indian market, the platform frequently faces deposit issues and has to change its deposit methods. As of 22nd September 2021, you can deposit INR in your WazirX wallet you can deposit using Net banking with a minimum deposit amount of INR100 and a fee of INR 24. Further, you can use MobiKwik for deposits and pay fees as applicable on the payments gateway. You can also use the WazirX P2P, for free USDT deposits. To learn more, read our guide on WazirX P2P.

For withdrawal, you can make instant withdrawal’ with a fee of 10 INR and a limit of 2 lakhs per transaction. You can also use NEFT with a fee of 5 INR and a limit of 10 lakhs per transaction.

WazirX – Pros and cons

| Pros | Cons |

|---|---|

| WazirX is acquired Binance, the best crypto exchange. | High trading fees |

| The app has one of the best referral programs in India. | They have high charges on INR deposits. |

| Different payment options are available. |

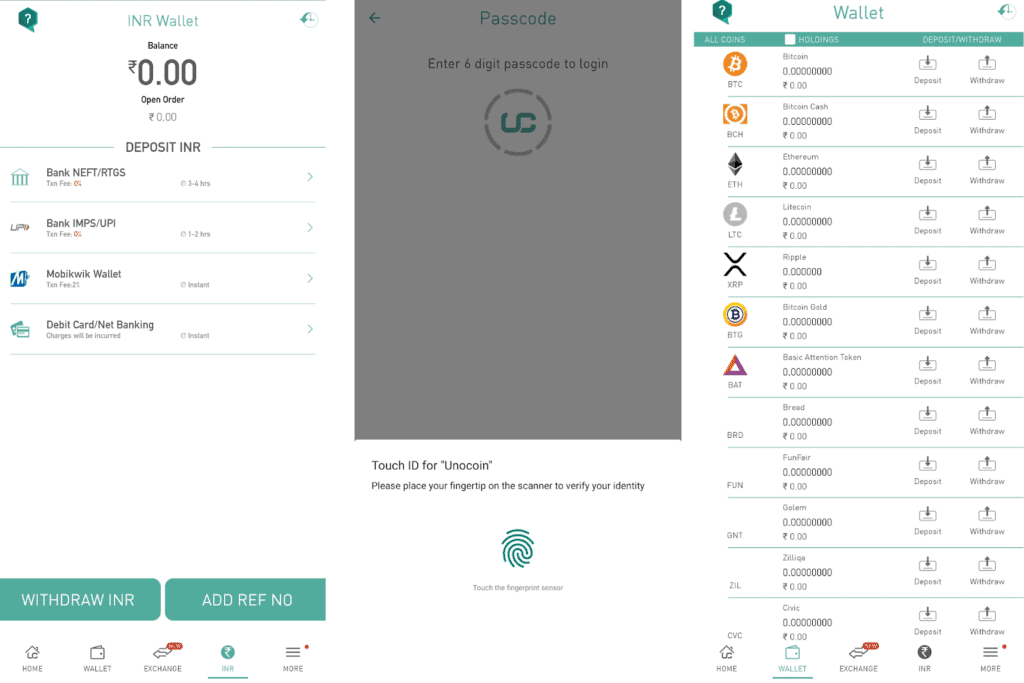

4. Unocoin

The Unocoin app has a straightforward user interface while supporting multi-crypto assets. The Unocoin app provides an auto-sell feature in the profile tab, which helps its users schedule an asset’s sale. You can begin investing through the app by simply creating an account and then completing your KYC.

Use Unocoin referral code U-305402 get a discount on the trading fee.

Is Unocoin Safe?

Yes, Unocoin is safe to use as the application provides you with Two-factor authentication. You can also set a digit pin and fingerprint authentication to login into the app. Whenever you enter a wrong pin or your fingerprint isn’t matching with records, the app logs you out.

You can reach the support team through the app settings, via call, email, or even chat with their bot.

Unocoin Fees

Unocoin charges a buy/sell fee of 0.7% for minimum usage of 60 days. After that, they charge a fee of 0.5%, upgrading you to ‘Gold Membership. Unocoin doesn’t charge any maker or taker fee.

However, the platform charges for making a deposit are as below.

Unocoin payment method

You can deposit through NEFT, RTGS, IMPS, and UPI without any transaction charges. You can also use MobiKwik wallet, with a transaction fee of 2%, and debit or credit cards with a certain fee.

The minimum deposit amount is INR 1000; however, the maximum deposit amount is INR 1,50,00,000.

Use Unocoin referral code U-305402 to get a discount on the trading fee.

Unocoin: Pros and cons

| Pros | Cons |

|---|---|

| The app supports deposits through debit/credit cards. | They charge a high trading fee. |

| Fingerprint lock available. | The minimum deposit fee is INR 1000. |

| Easy to reach customer support. |

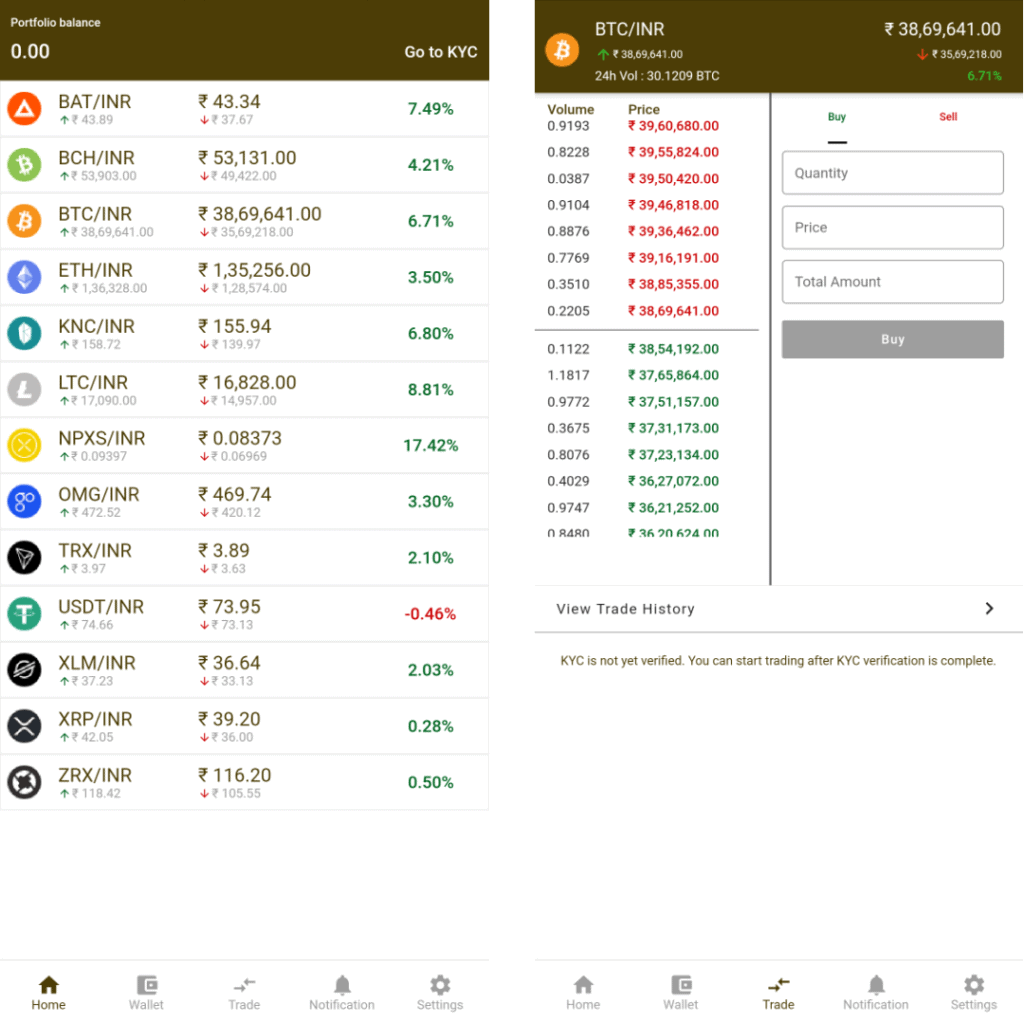

5. Colodax

At Colodax, you can begin investing within a few minutes after downloading the app. They provide simple and fast signup and KYC verification process.

After you’re done verifying, you can deposit INR and begin investing. There are no legislations on cryptocurrency in India yet. However, colodax assures its users always o follow the government regulations whenever the rules are released.

Is Colodax Safe?

Colodax provides its users with two-factor authentication and email OTP protection. They also let you enable an authenticator from the settings tab. You can reach their support team by raising a ticket through their website.

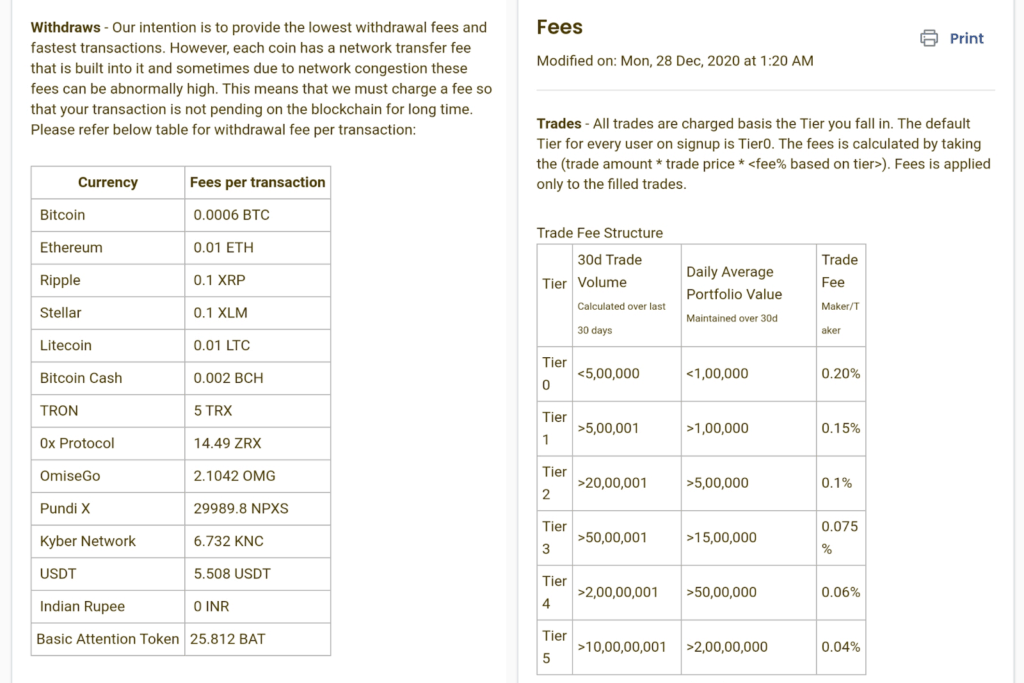

Colodax Fees

The platform doesn’t charge you for deposits; however, you have to pay the transaction charges on depositing through specific methods.

The trading fee at Colodax varies depending on the volume you trade in a 30 day period. Also, there is a charge on withdrawal on cryptos, which you can see in the table below:

Colodax payment method

They allow you to deposit any of the cryptocurrencies available on the platform. You deposit INR through bank transfer, NEFT, IMPS, RTGS, and UPI.

Colodax – Pros and cons

| Pros | Cons |

|---|---|

| The app offers a fast KYC process. | The only way to contact support is through tokens. |

| You can invest higher volume to pay lesser fees. | The interface isn’t impressive. |

| No fingerprint security option is available. |

5. CoinDCX

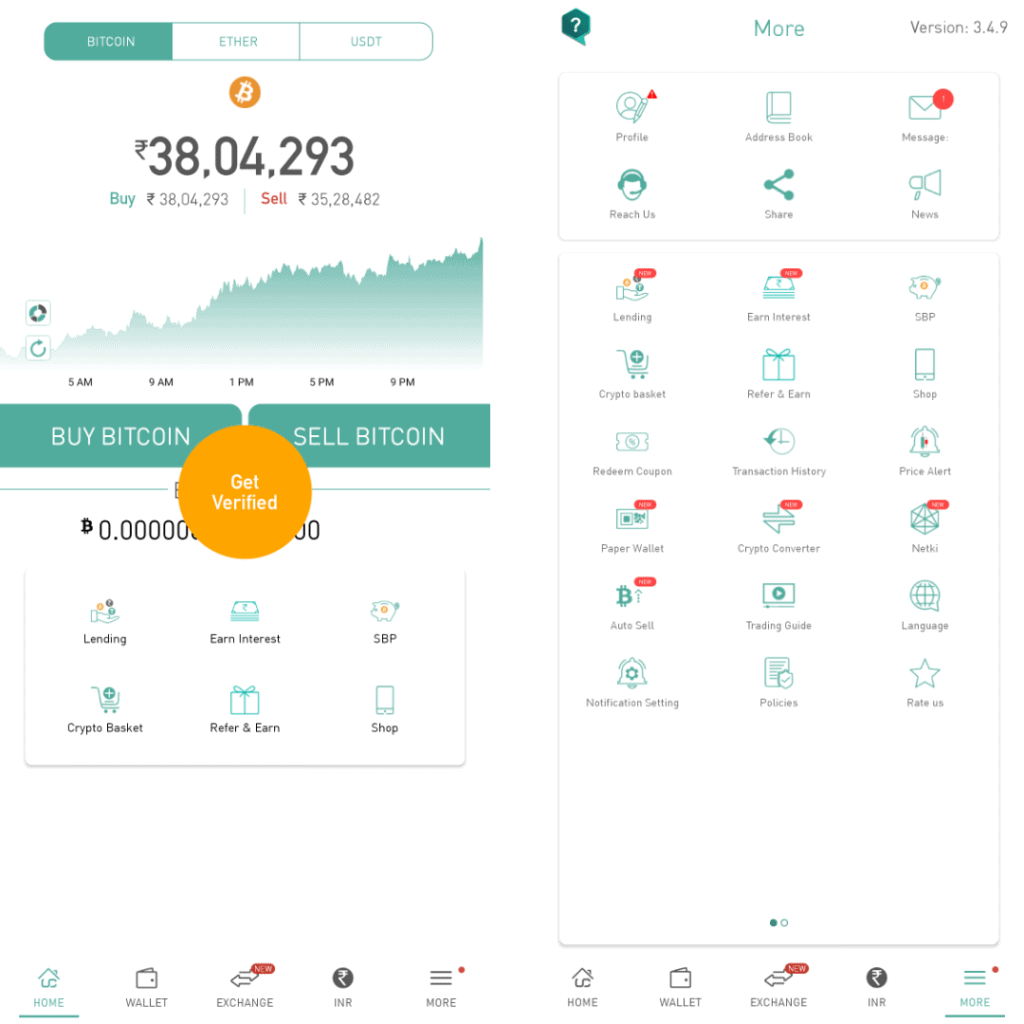

CoinDCX provides the highest liquidity in India and gives you an option to trade in 200+ coins. You can complete the signup procedure in seconds by entering the OTP sent on your mobile and mail. CoinDCX can be considered the most versatile platform. They even teach the basics of investing on the settings tab.

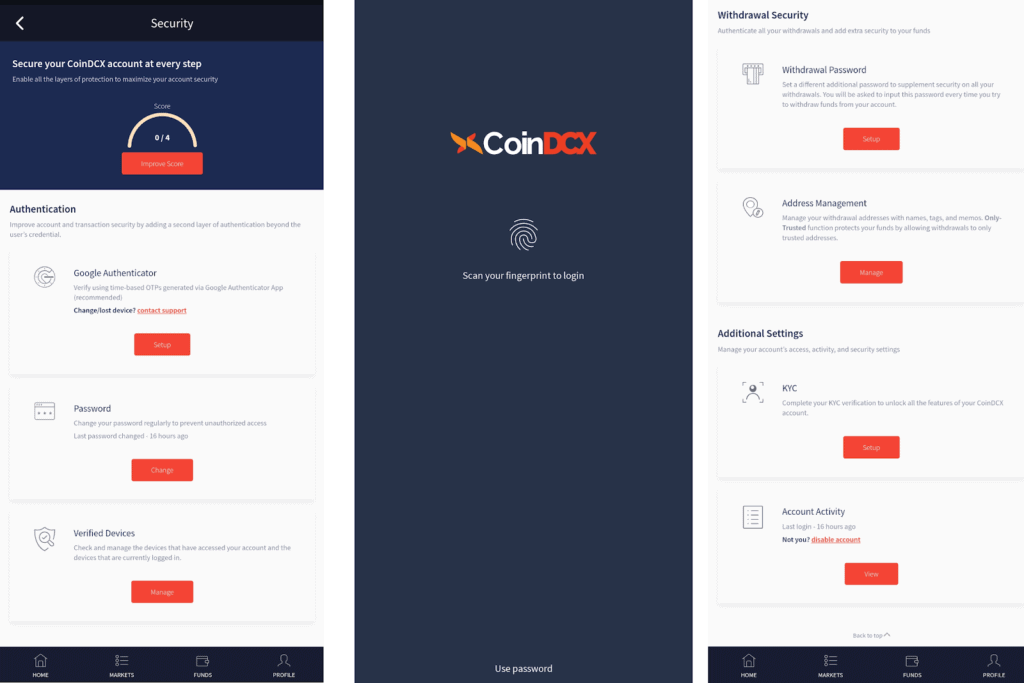

Is CoinDCX Safe?

Yes, CoinDCX is safe to use as the first layer of security CoinDCX provides is through the Google authenticator app. They allow you to use a device for investing only after verifying it. You need to set up a different withdrawal password to confirm for every withdrawal you process.

The app also provides you an option to unlock it through your fingerprint.

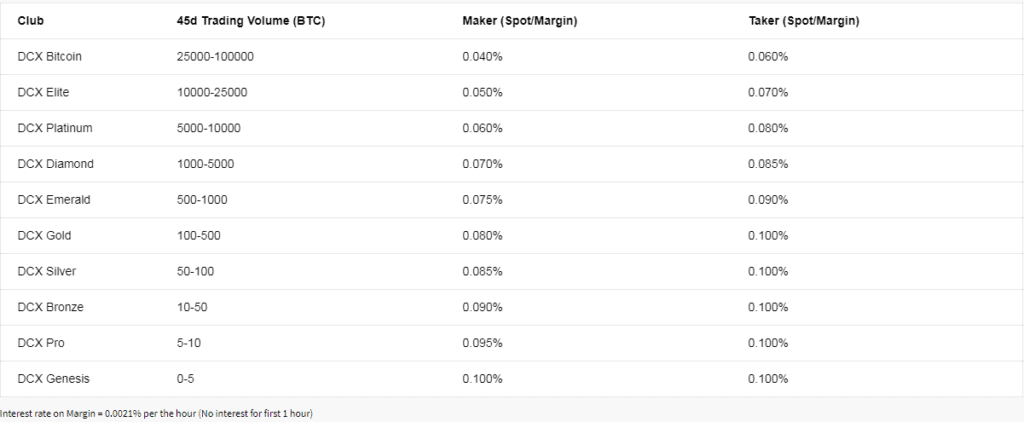

CoinDCX Fee

CoinDCX charges you a 0.1% maker and taker fee. The minimum withdrawal limit is INR 1000, and there is no fee on it. The Spot and Margin trading fee at CoinDCX depends on your trading volume. It can be classified into tiers as shown in the table below:

CoinDCX payment method

DCXinsta helps you buy or sell a cryptocurrency in INR. You can deposit INR through UPI, NEFT, IMPS, RTGS, and bank transfer.

CoinDCX – Pros and cons

| Pros | Cons |

|---|---|

| They provide a limitless with a rarely ending order book. | There have been cases when users suffer problems while depositing. |

| They provide video guides in the tab next to notifications. | |

| The app has a great referral program with rewards of up to 25 USDT. |

6. Zebpay

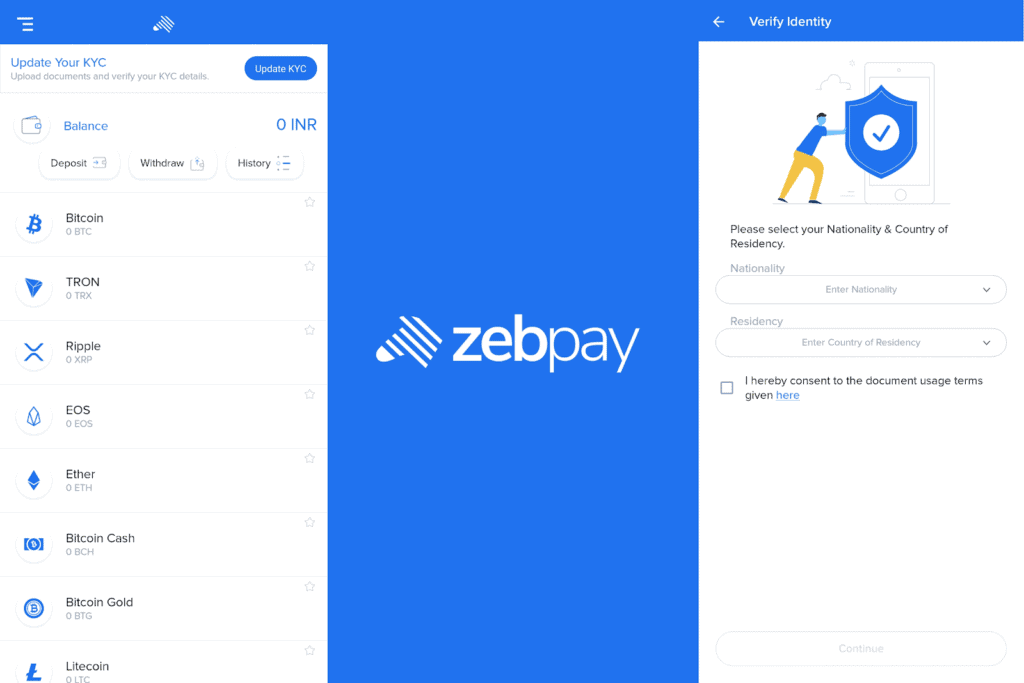

ZebPay loves calling itself the “Bitcoin Ki Dukaan” and has been providing crypto investment services since 2015. You can signup through your mobile number and complete their ‘quick KYC’ to start trading.

ZebPay has a refer and earn feature, where you get paid 50% of the trading fees on new signups through your links for a year.

Security

When you trade with ZebPay, 98% of your assets are in cold storage. ZebPay uses a technology called Omnitrixx, which secures all the transactions between hot and cold wallets by a multi-chain security system.

The app has a four-digit pin for account safety, and you can also use your fingerprint to access the app.

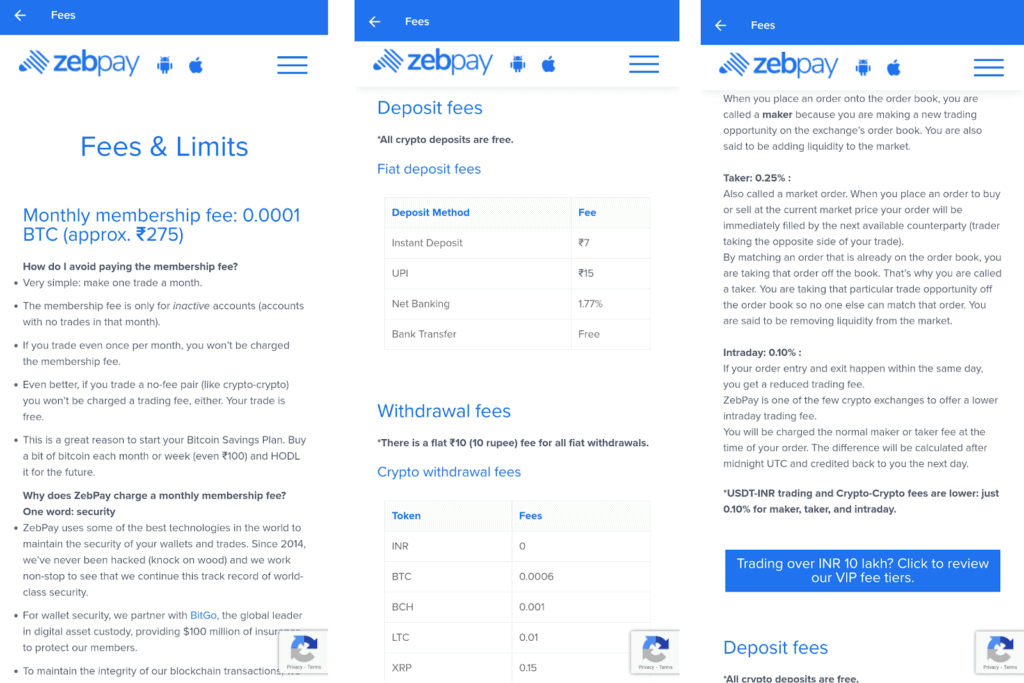

ZebPay Fee

ZebPay charges a membership fee of 0.0001 BTC per month. However, you can avoid this membership fee by being an active investor.

The platform charges you a 0.15% maker fee and a 0.25% taker fee. ZebPay reduces your trading fee to 0.10% if your order entry and exit happens on the same day.

All crypto deposits at ZebPay are free. However, there is a deposit fee of INR 15 on UPI and 1.77% on Net Banking. There is an INR 10 fee for all the fiat withdrawals and a 0.0006 BTC per BTC withdrawal.

On making a trade over INR 10 lakhs, ZebPay provides you a VIP fee tier.

ZebPay – Accepted payment method

You can deposit INR through IMPS, RTGS, NEFT, UPI, bank transfer, and Net Banking. There is a minimum deposit amount of INR 100 through UPI and INR 1000 from any other source stated.

ZebPay – Pros and cons

| Pros | Cons |

|---|---|

| Attractive and straightforward user interface. | The app endeavors only fundamental features. |

| Highly secure cold storage facility. | Charges a monthly fee if the user is inactive. |

| They charge a high deposit fee. |

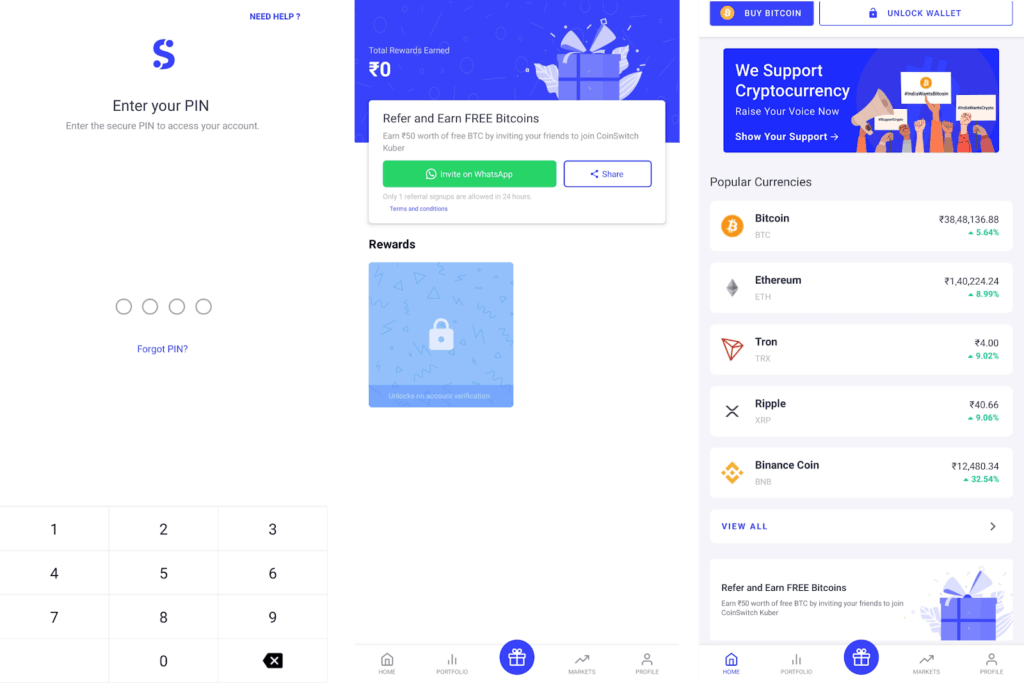

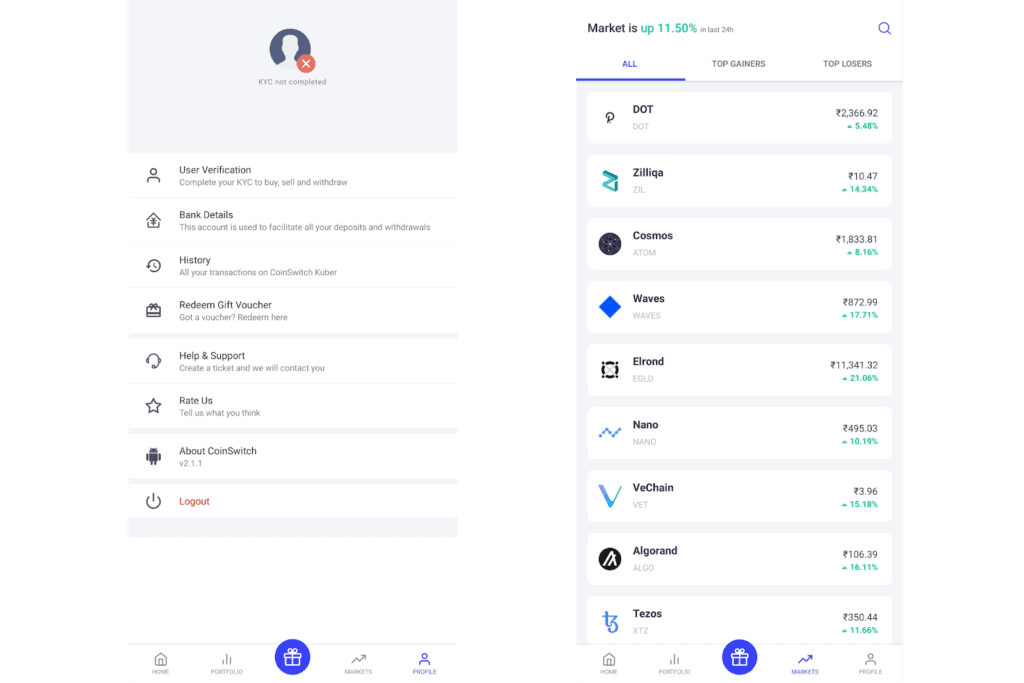

7. CoinSwitch Kuber

CoinSwitch app has a simple signup process, and you can directly create an account by providing your phone number. However, to begin trading, you need to complete your KYC.

The app is backed up by SEQUOIA, Ribbit Capital, and Paradigm, one of the biggest crypto names.

Here you can trade with 100+ cryptocurrencies at the best rate and with a wide range of payment options.

Security

CoinSwitch doesn’t provide much information about the security offered. Hence the safety of your asset and your personal information is highly questionable.

However, the app does provide a pin code to maintain personal security.

CoinSwitch Fee

The company came up with an offer for the first 100k users during the pre-launch of CoinSwitch Kuber. They will be paying no trading fee for 100 days.

CoinSwitch payment method

They accept cryptocurrency deposits and payments in INR through NEFT, bank transfer, and UPI.

CoinSwitch – Pros and cons

| Pros | Cons |

|---|---|

| They aren’t charging any fee for the first 100K pre-launch users. | The graphs of the app are inaccurate. |

| The app has a clean and simple user interface. | They have a slow response time on raising tickets through the mail. |

| Users face login issues at times. | |

| The app is still lacking a lot of features and doesn’t provide all the details. |

Apps to buy Bitcoin in India – Conclusion

In conclusion, the app with a proper balance of security, the fee charged, and the services it provides can be considered as the best app to invest in crypto. According to us, WazirX and CoinDCX provide an efficient mobile interface and can be your choice to begin trading on the go. You can also give a shot to ZebPay and Unocoin.

Frequently Asked Questions

Which app is best for Bitcoin in India?

How can I get free Bitcoins fast?

You can earn bitcoin by completing odd tasks online, and some survey companies also pay to complete their surveys. You can also help crypto exchanges find loopholes in their platforms, and then they pay you in Bitcoin.