The complexity of crypto taxes is often underestimated by individuals and firms completing their forms for the first time. The Internal Revenue Service (IRS) mandates that every transaction must be reported in U.S. dollars line-by-line along with the purchase price because they are taxed as property.

Mining, staking and other income are reported separately, so it is important to work with an accounting firm with CPA services in-house.

The British, Canadian, Australian, Dutch, and other tax authorities have similarly complex tax reporting standards for cryptocurrencies. Whether you are a resident of these countries, a digital nomad living abroad, or a company operating internationally, TokenTax supports all countries with individual and corporate crypto tax filing requirements.

TokenTax crypto tax software automates the entire tax filing process for individuals. Forms are automatically filed and available for download in all the formats an individual may need. And if you want, the TokenTax accounting team can file your tax return for you.

Read TokenTax Reviews on CoinCodeCap

Summary of TokenTax solutions

- The main benefit of using TokenTax is that all of the processes are automated from transaction history import to tax form download.

- The user experience is the most simple of all crypto tax services, with the dashboard guiding you through three easy steps.

- TokenTax has the most extensive performance, audit and security features of all crypto tax competitors.

- As the white glove crypto tax firm, TokenTax is the market leader in special situations. For example margin trading, complex financial statements, decentralized finance, ad-hoc projects, and backfilling data lost due to exchange closures.

- TokenTax also offers a full suite of enterprise financial solutions. This includes full financial statements and assistance with business dealings that require specialized expertise to facilitate communication.

Pros of using TokenTax

The major advantage of using TokenTax crypto tax software is automation at every step in the tax filing process. The dashboard provides automated data upload, organization and tracking of your taxable transactions. It also automates all capital gain/loss calculations while adhering to the tax authority requirements in any country.

TokenTax automates the creation of tax forms in any export format you may need, including filled PDF tax reports, Excel spreadsheets, and TurboTax import files. TokenTax also offers a full tax professional suite so that CPA firms can leverage the software for their clients.

If you do not already have a CPA, TokenTax can offer one in-house to complete forms for individuals and corporations.

Additionally, when your enterprise is ready to do business with other firms, TokenTax accountants are already prepared to help guide you by explaining your business model to other companies. Whether you are seeking margin lines of credit or going public, TokenTax can help you with any ad-hoc special situation projects.

Cons of using TokenTax

In an ideal world, there would be no need to bridge the gap between the old and new worlds of finance. The only major con is that the services are not free.

Another downside is simply that exchange closures can happen at any time with limited access to transaction histories after the closure. In the case of lost data, it takes time to piece together email receipts for trades; however, TokenTax will go through this process for their VIP clients and will file an extension for you if more time is needed.

Crypto tax and accounting features

TokenTax was the first crypto tax software to help clients with

- Tax loss harvesting

- Specific identification accounting methods

- Margin trading taxes

- Decentralized finance taxes

- Options trading taxes

- Mock trade tax implications

- Hedge fund accounting

- Ad-hoc corporate accounting projects

- Underwriting guidance

- IPO tax planning

How TokenTax works

The easiest way to understand how TokenTax works is to watch their concise introduction video or read their concise Bitcoin tax guide. Alternatively, you can get started by downloading their free crypto tax e-book.

Comparison with other products

TokenTax also handles margin trading, decentralized finance, and ad-hoc accounting projects. It is also the only crypto tax firm with in-house CPA services.

User experience

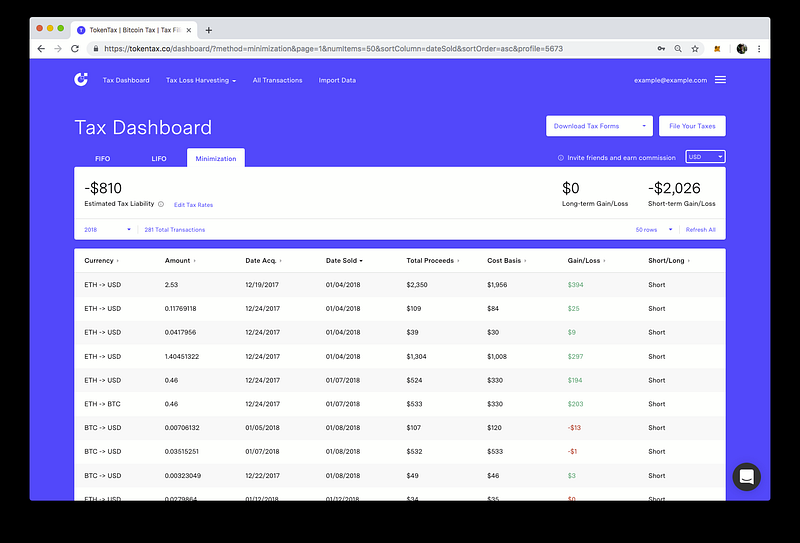

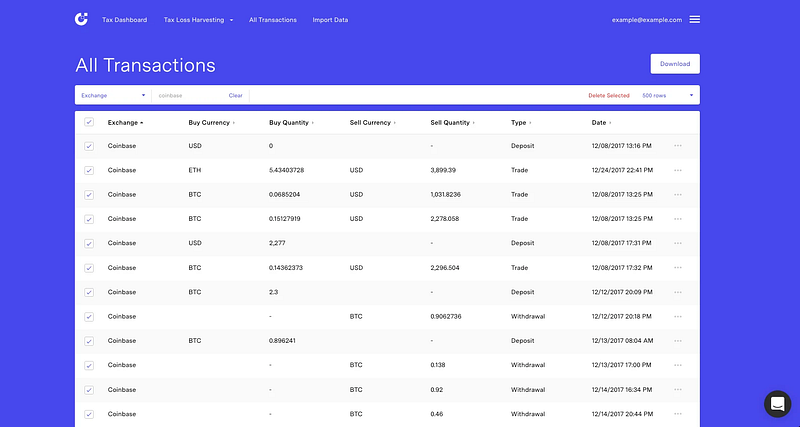

TokenTax takes only three simple steps to create your tax forms once you log in to your dashboard.

- The TokenTax dashboard provides step-by-step instructions on how to upload your data.

- Once all of your data is synced, the TokenTax team checks for any errors. In addition, it also allows you to choose which accounting method you want to use for calculating your capital gains/losses.

- As the last step, you can download your completed forms as a PDF, an Excel file, or as a direct upload into TurboTax.

Performance

TokenTax crypto tax software can process tax calculations for millions of transactions a day, which is why crypto funds trust them with their tax reporting.

They are also the only crypto tax and accounting firm that correctly handles special situations, such as margin trading, decentralized finance, and ad-hoc accounting projects.

They were the first crypto tax firm to create a proprietary specific identification accounting algorithm, which the IRS allowed in their 2019 guidance.

Security

You can use TokenTax completely anonymously, without providing any identifying information to protect your information. Additionally, their crypto tax software does not require Social Security numbers.

Audit support comes included with the more complex tax packages. Therefore, you do not need to worry about your tax filings. Additionally, TokenTax also helps with amendments and guiding clients who have received IRS letters.

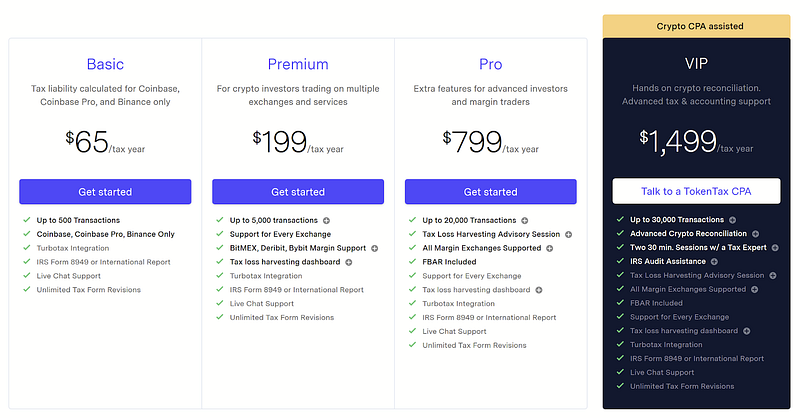

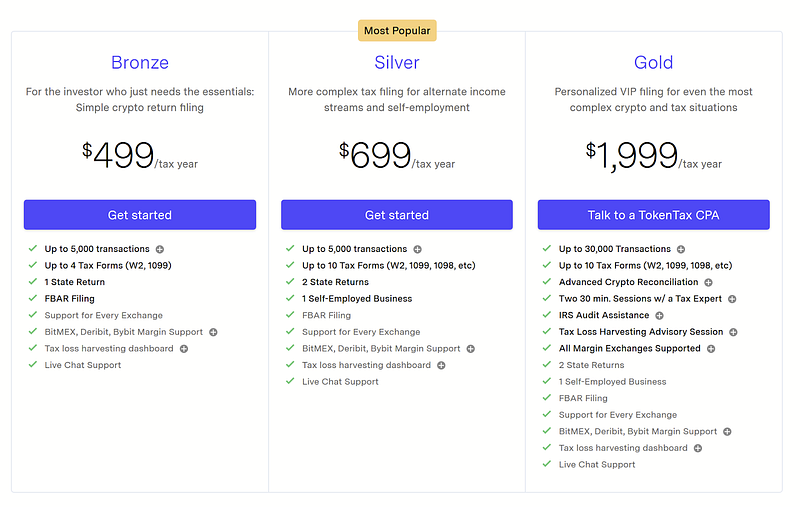

Pricing

The TokenTax pricing plans vary depending on the number of transactions as well as the complexity of your trading activity and the number of tax forms. You can either purchase the crypto tax software as a stand-alone or add a full-filing service.

Conclusions

If you have traded more than a few times in the past year; over the past few years; or across more than one platform, you should consider using TokenTax crypto tax software.

Special accounting situations are the place where TokenTax shines as the market leader that can figure out any crypto finance challenge.

If you need help with specific tax questions, you can also reach out to schedule a call with TokenTax or chat with them.

- Crypto wallet best practices

- CLEO.one Review – Trading Automation Made Simple

- ChangeNOW review – A reliable way to exchange crypto

- How to Create a Crypto Deal on CoinCodeCap?

- How to Predict Cryptocurrency Selloffs?

- Quadency Review- A Crypto Trading Automation Platform

- NOWPayments Review: A Non-custodial Crypto Payment Gateway

- Coygo Review: Crypto arbitrage and Trading