In this article, we will review Quadency, a crypto trading automation platform launched in 2018. It brings you a smarter way to trade, automate, and manage your crypto.

Table of Contents

Summary

- Quadency is a multi-exchange crypto trading and automation platform.

- It supports top exchanges: Binance, Kucoin, OKEx, Kraken or Liquid.

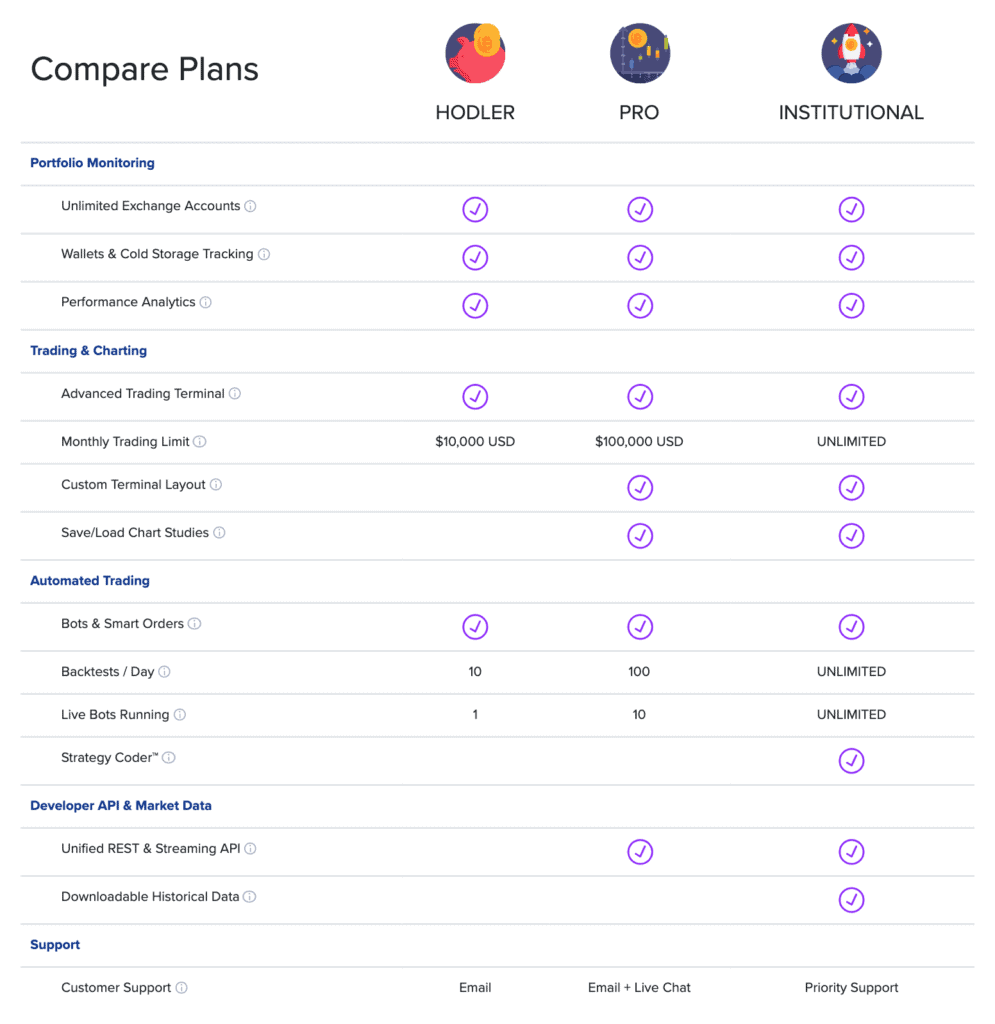

- You can choose between 3 plans: HODL, Pro & Institutional.

- The platform is great to use for both beginners and professionals.

- Provide pre-build simple trading bots for beginners

- Allow you to code your own trading strategy in python

Features

We could divide all the features into 3 parts: Management, Trading & Automation (Trading Bots).

Management

Quadency features an all in one dashboard used for portfolio tracking. On this dashboard, you can track your overall portfolio performance and allocation on all linked exchanges. User can also add their offline wallets to keep track of their whole portfolio.

The Portfolio tab allows you to get more information about your portfolio per crypto asset: open orders, trades, history & transfers.

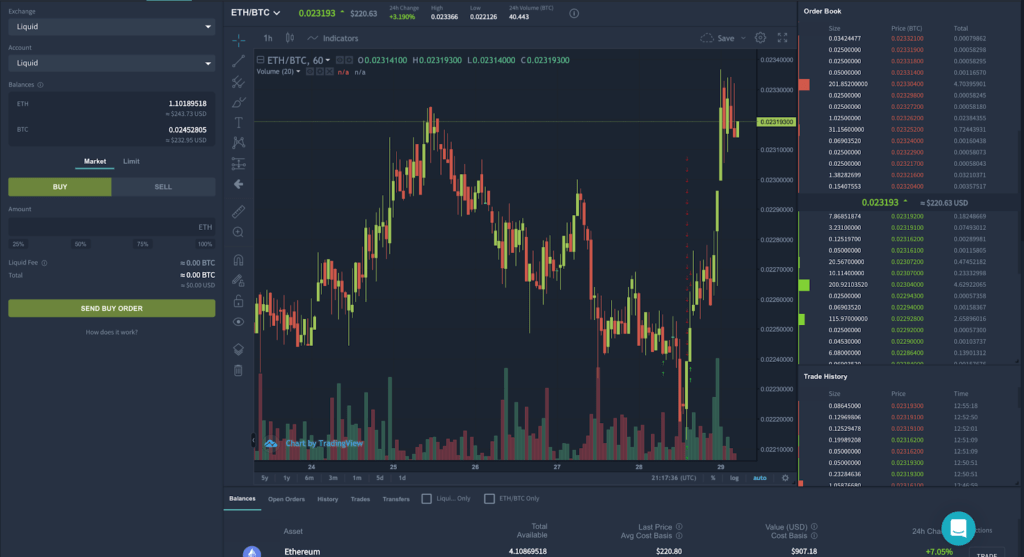

Trading

The trading tab works seamlessly and integrates advanced charting from TradingView with over 100 technical indicators and drawing tools. It offers the possibility to easily switch between exchanges and accounts. You can create market and limit orders and switch between market pairs in one click. Below the graph, the balance tab gives you quick access to all the assets you own.

Automation (Trading Bots)

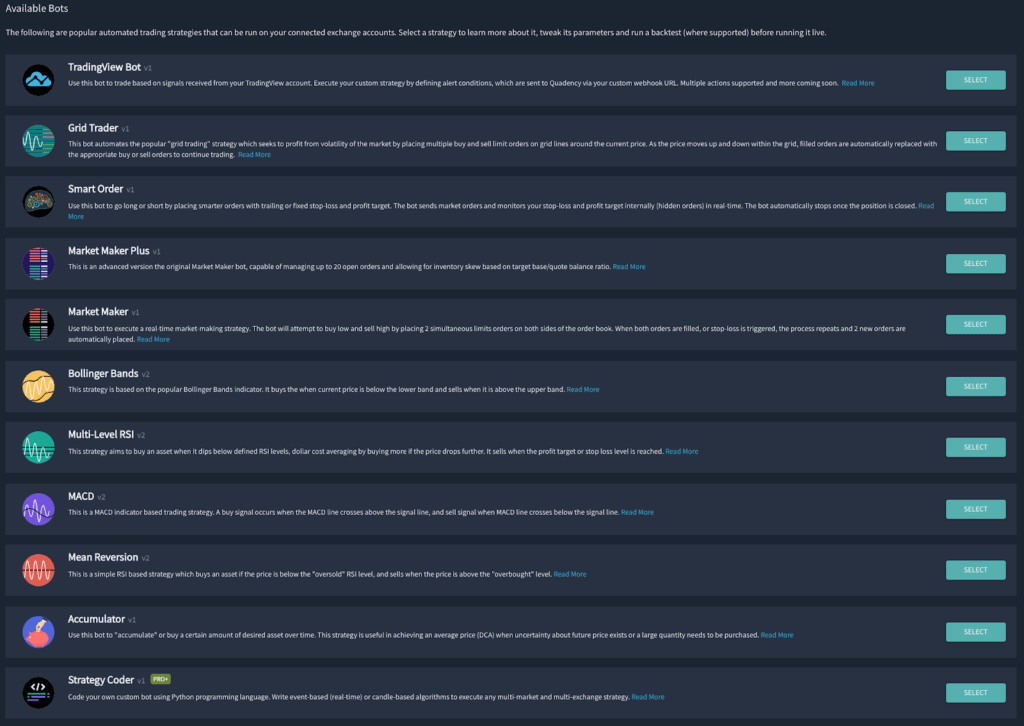

Quadency currently has 11 trading bots available for Pro plan users. Some of their bots are based on popular indicators like MACD. And others are based on trading strategies like the RSI and Grid Trader. The TradingView bot offers you the possibility to transform your Trading View alerts into trades automatically. Meanwhile, if you need something even more specific, the Strategy Coder is for you. Users can code their strategies using Python.

Available Trading Bots on Quadency

Let’s see some of the trading bots and automation strategies available on Quadency.

Portfolio Rebalancer

This portfolio helps you to diversify your portfolio. You can select any assets and allocate their portion to your portfolio. So whenever the price moves, the bot will automatically liquidate and purchase the assets based on your portfolio allocation. This bot can also help you sell multiple assets into a single asset, such as Bitcoin (BTC). Read more about Portfolio rebalancing.

Grid Trading Bot

This trading bot automates the popular “grid trading” strategy, which seeks to profit from the market’s volatility by placing multiple buy and sell limit orders on grid lines around the current price. As the price moves up and down within the grid, filled orders are automatically replaced with the appropriate buy or sell orders to continue trading.

Market Maker Bot

This trading bot will help you make profits by placing two simultaneous limit orders on both sides of the order book to buy low and sell high. When both orders are filled, or stop-loss is triggered, the process repeats, and two new orders are automatically placed. This strategy is also called Market-making.

Smart Order

Using this trading bot, you can go long or short by placing smarter orders with trailing or fixed stop-loss and profit target. The bot sends market orders and monitors your stop-loss and profit target using hidden orders in real-time. The bot automatically stops once the position is closed.

TradingView Bot

You can also integrate your TradingView account with Quadency using Webhooks. Therefore, you can execute your custom strategy by defining alert conditions based on your Trading view account’s signals. The team also plans to expand the capability of this trading bot by supporting multiple actions.

Multi-Level RSI

This trading helps you accumulate an asset when it dips below defined RSI levels and helps you with dollar-cost averaging by buying more if the price drops further. It sells when the profit target or stop loss level is reached.

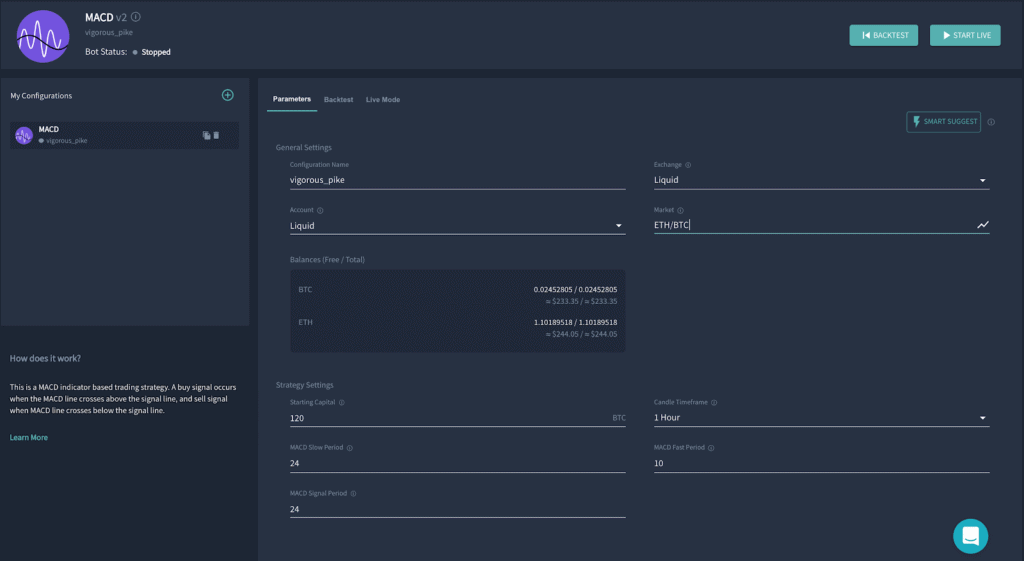

MACD

This bot is based on MACD trading indicator. It buys an asset when the MACD line crosses above the signal line and sell when the MACD line crosses below the signal line.

Mean Reversion

This is a simple RSI based strategy which buys an asset if the price is below the “oversold” RSI level, and sells when the price is above the “overbought” level.

Accumulator

This trading bot helps you to accumulate or buy an asset over time at a specific price. It is handy when buying a large quantity of assets or implementing Dollar-cost averaging (DCA).

Create your own trading bot strategy

If none of the above strategies fits for you, Quadency allows you to code your own trading bot using Python programming language. You can write event-based (real-time) or candle-based algorithms to execute any multi-market and multi-exchange strategy.

How Quadency Works?

Total Time: 5 minutes

Sign Up

First, create your account on Quadency.

Connect Exchange

link your account with one of the supported exchanges with your API keys. The process slightly changes depending on the exchange but is basically the same.

Create Orders And Trading Bot

Now, simply place an order or start a bot on the selected exchange via Quadency.

User Experience

The user interface is sleek and easy to use. The bot configuration process is made easy as each setting has a small tooltip to help.

All the general settings are the same but the strategy settings differ. You can directly view your balances and check the markets while configuring your bot.

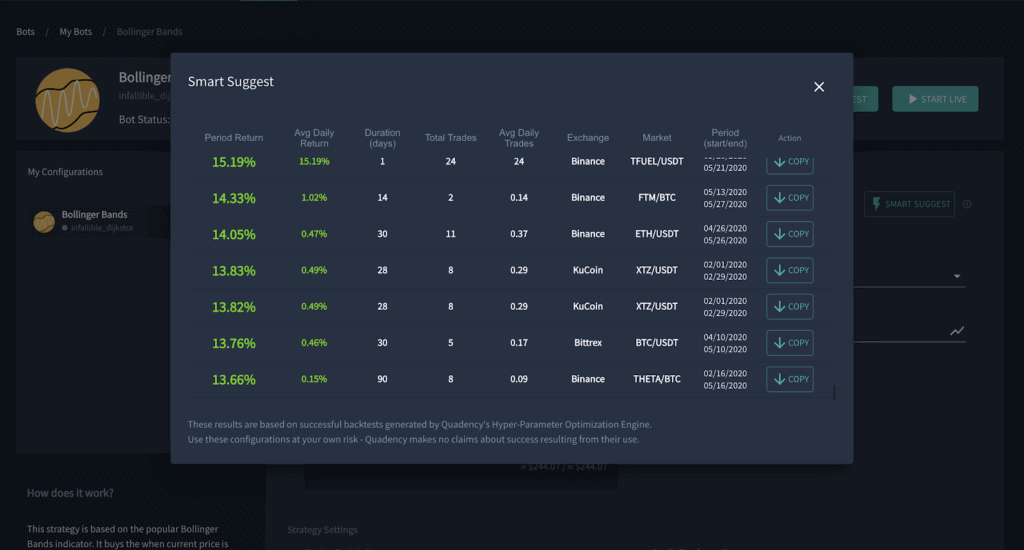

One of the coolest features is probably Smart Suggest.

Quadency provides hundreds of profitable backtested configurations that users can copy and edit to their needs.

Backtesting

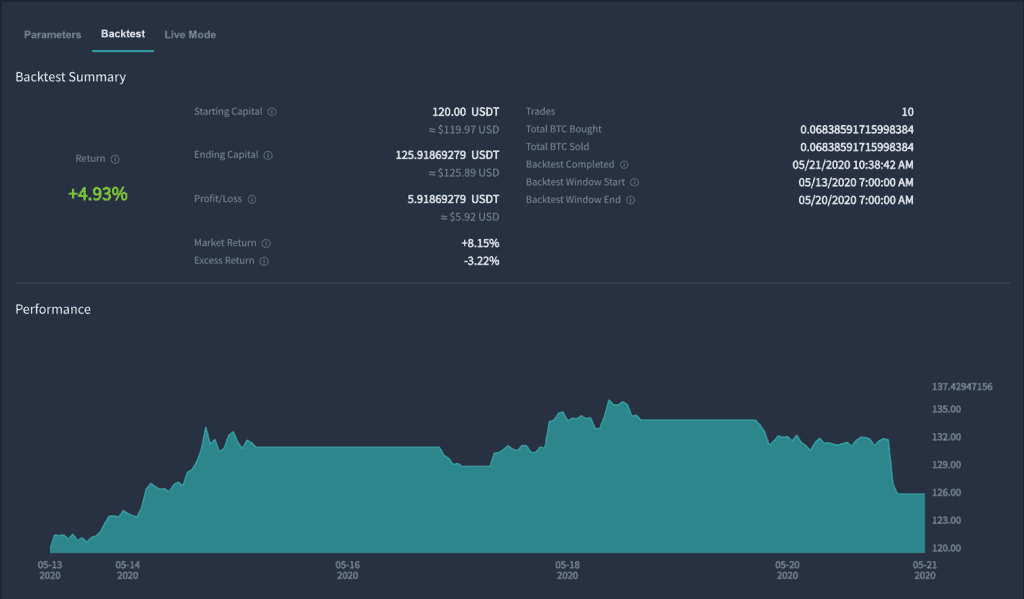

The backtest feature lets you test your configuration using historical data.

In the backtest tab you will see a summary of the back tested configuration with the ROI and Profit/loss.

The support side offers articles to help users configure their bots or answer any questions they have.

It is possible to contact the team directly through a live chat for any support questions.

Performance and Security

Quadency doesn’t promise X% of profits for their trading bots. The performance depends on the market and your bot configuration. Your account is secured through 2FA.

Pricing

Quadency offers 3 plans: HODL, Pro & Institutional.

1. HODL plan is free.

- Run 1 bot at a time & backtest up to 10 configurations per day.

2. Pro Plan starts at $39 paid annually or $49 paid monthly.

- Get access to limited Pro features like Smart Suggest.

- Run up to 10 bots at a time, backtest up to 100 configurations per day and enjoy unlimited trading volume.

3. Institutional is priced at $199.

If you linked your Quadency account with one of their official partners, you can automatically claim a free Pro Plan upgrade for up to 6 months. So be sure to check their partners list.

Quadency Pros and Cons

Pros

- Professional-grade trading tools

- Easy to configure

- Intuitive Interface

- A rich library of trading strategies

Cons

- Margin trading not available

- No mobile app

Conclusion

In conclusion, Quadency is a unified platform offering advanced charting, automated trading & portfolio analytics in a comprehensive interface. No matter if you are a beginner or a pro-trader, Quadency is definitely for you!

Frequently Asked Questions

How can Quadency help a beginner trader?

You can use Quadency to accumulate assets, use Grid trading bot to simply buy and sell assets in a specific rage. Or just trade on multiple exchanges using a single Quadency interface.

Is Quadency legit or safe?

Yes, Quadency is safe and legit. I know the Quadency team from 2018 and they are working hard to provide a best trading bot software in the crypto space.

Does Quadency have mobile app?

Quadency does not have a mobile app for iOS or Android devices, for now. But, Quadency has fully responsive website and you can check it on mobile browsers.

What are the trading fees?

Quadency is not a crypto exchange like Coinbase or Binance. It connects to crypto exchange to provide powerful trading tools and charge based on monthly subscription plan.

Quadency has APIs?

Yes, Quadency provides fast, reliable and unified API for accessing cryptocurrency market data and executing orders on all major exchanges.

Quadency Alternatives

- Bitsgap, a one-stop crypto trading platform that caters to all your trading needs. It allows its users to bring all their crypto-exchange accounts under the same roof and trade from an integrated interface. Read our Bitsgap review.

- HaasOnline is one of the oldest and most reputable automated trading companies in crypto. Their distinguished reputation comes from their trade automation software that has been executing trading strategies for crypto traders since 2014. Read our HaasOnline Review.

- 3Commas is an online platform for people interested in trading cryptocurrencies using automated bots. It is especially attractive for people without a technical background in finance or extensive experience in stock markets. Read our 3Commas review.

You might also be interested in: