Whether you’re a total newbie or a pro, it is no secret that the cryptocurrency space is known for its extreme price swings. With market volatility being prevalent in the digital currency space, it is important – if not essential – to find ways to earn greater yield no matter which direction the market is heading towards.

If you’re living in the UK and are keen on kickstarting your journey to earning passively with your cryptocurrencies, we’re here to help. Ahead, find our edit of the top 5 crypto lending platforms in the UK to consider setting up an account with.

Also Read: 10 Best Crypto Lending Platforms

Table of Contents

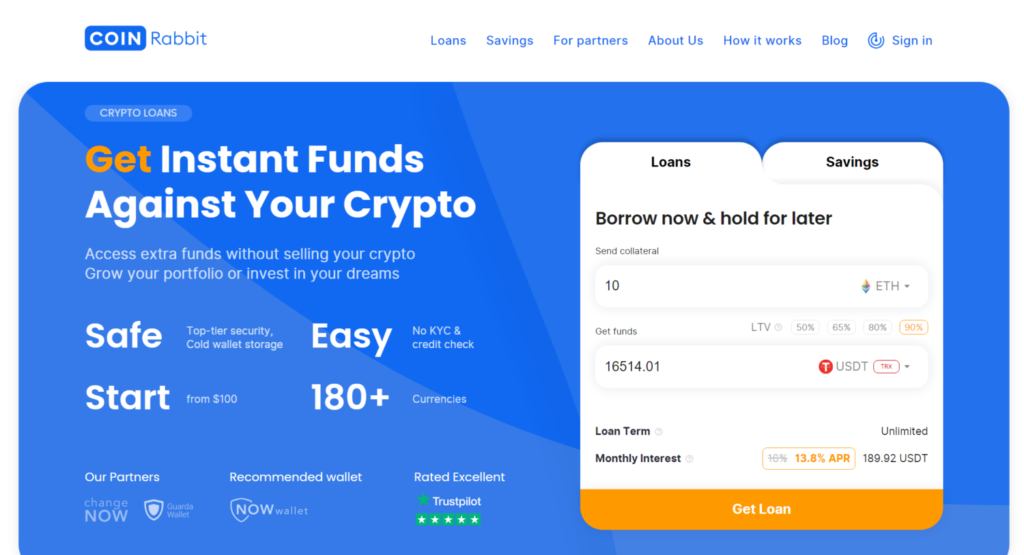

1st Crypto Lending Platform in the UK: CoinRabbit

When it comes to crypto financing, there is just one solution: CoinRabbit. CoinRabbit is the greatest alternative for beginners as well as specialists who value their time because to its easy interface and non-KYC approach (you simply need your email or phone number to open an account). Despite its ease of use, CoinRabbit places a high priority on the security of its clients’ assets.

The APR is only 1.2% per month, and it is complemented by entirely free withdrawals available at any time, as well as unlimited time frames for repaying your loans – repay them in full or in part when you feel the time has come.

Furthermore, CoinRabbit provides a system that allows you to reduce your liquidation price as much as you wish.

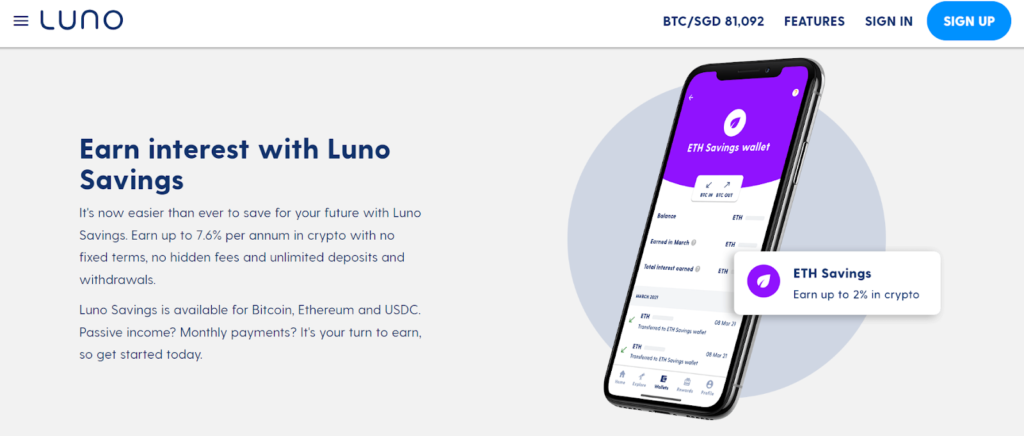

2nd Crypto Lending Platforms in the UK: Luno

In 2018, Luno was made available to users in the UK to allow them to access the platform’s range of services. Not only does it enable users to earn interest of up to 7.6% per annum, but the platform also allows users to buy crypto with fiat currency easily.

Besides, Its lending feature, known as Luno Savings, does not come with fixed terms or hidden fees and allows for unlimited deposits and withdrawals. The feature supports three assets, namely BTC, ETH, and USDC.

Users can also choose to store their crypto in a Luno Wallet, which stores 95% of crypto in “deep freeze” by using multi-signature wallets protected by many layers of encryption. Do note that for UK users, there are certain trade fees as well as verification levels and limits to be aware of. More information on that can be found here.

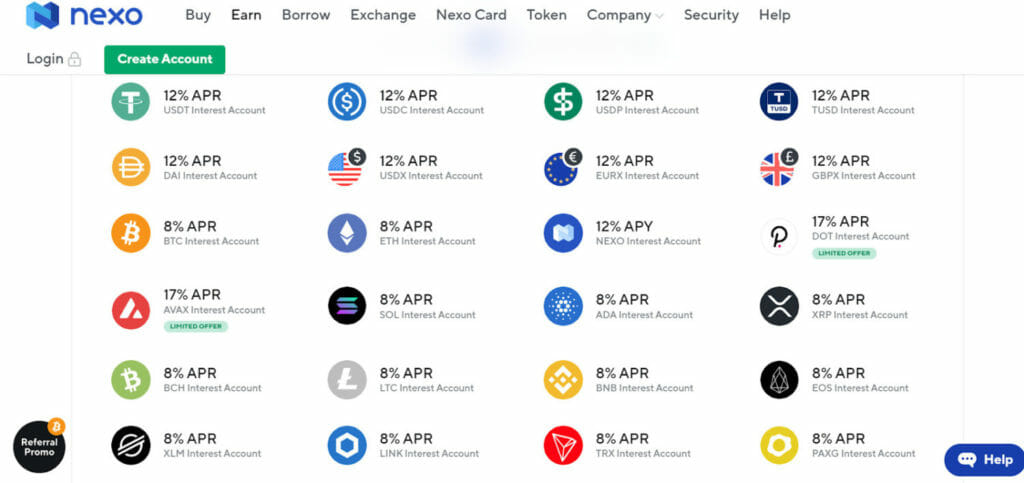

3rd Crypto Lending Platforms in the UK: Nexo

Based in London, Nexo offers a multitude of products. This includes interest accounts where users can earn interest on their crypto or fiat assets, crypto loans, and even the Nexo Card, a debit card that grants users access to the Crypto Credit Line where they can spend without selling their crypto.

Its primary aim is to replace the traditional banking system and maximize the value of digital assets by offering tax-efficient, high-yield, and sophisticated crypto products for its users.

At present, Nexo supports 18 crypto assets and a slew of fiat currencies such as the Pound Sterling. It also offers users up to 12% APY for those who choose to earn in Nexo tokens.

Also Read: Crypto Lending vs Crypto Staking

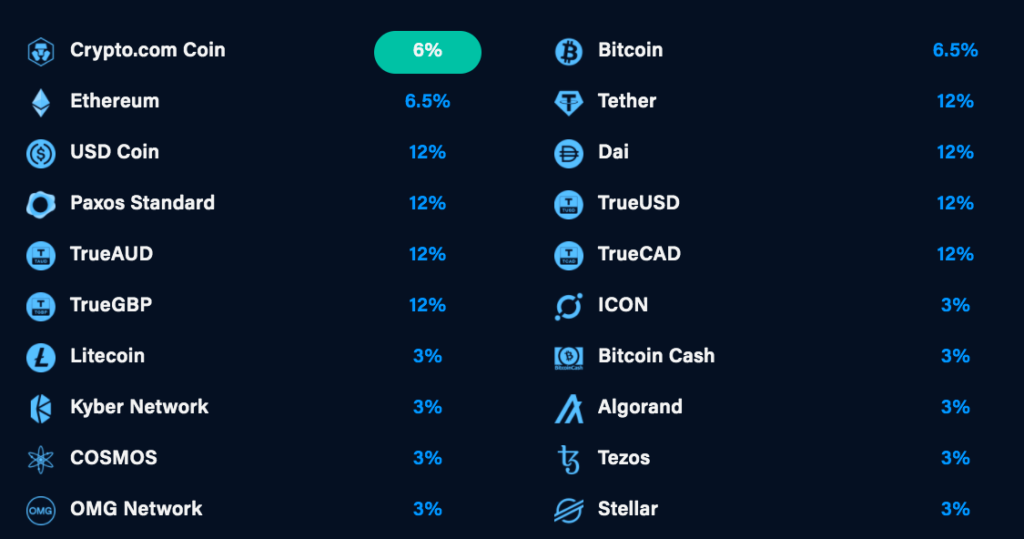

4th Crypto Lending Platforms in the UK: Crypto.com

Though the firm is headquartered in Hong Kong, the features have been made available for UK users as well. The platform is equipped with a variety of services, allowing users to buy, sell, trade, and spend cryptocurrencies. Users can purchase over 50 different cryptocurrencies, manage their Crypto.com Visa Card where they can top up with fiat or crypto, and make crypto payments quickly.

Apart from that, crypto.com users can lend out their crypto assets to earn up to 14.5% APY. Bonus: It has just expanded its free crypto tax reporting to users in the UK as well.

Read our Crypto.com review to learn more.

Also Read: How to Start Earning Passive Income With Crypto Lending

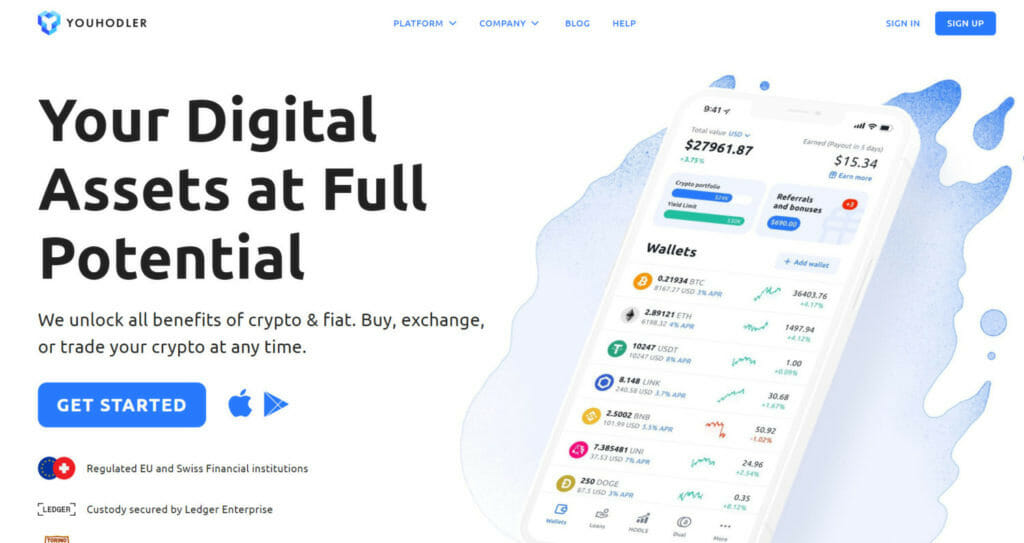

5th Crypto Lending Platforms in the UK: Youhodler

YouHodler should not be overlooked while discussing the crypto loan exchanges that stand out the most for Australian investors. It is on par with Crypto.com in terms of variety, as the facility offers lending across 50 different cryptocurrencies.

There are a variety of interest rates available, however Tether has the highest rate at 12.3% APY, followed by USD Coin at 12.0% APY and Bitcoin at 4.8% APY.

YouHodler‘s distinct characteristics set it apart from other lending platforms. You can, for example, use the crypto in your savings account as collateral for crypto loans by taking out crypto loans.

Hodlnaut vs CakeDefi vs Celsius: Which Offers Best Interest Rates?

Conclusion: The Top 5 Crypto Lending Platforms in the UK

For all crypto users based in the UK who have yet to start depositing their crypto holdings into such platforms, it’s time to do so now. It’s one of the easiest, most convenient ways to earn passive income with your digital assets without having to actively do much. All you will need to do is sign up for an account, deposit your crypto in, and #hodl!

Also Read,