In this Nexo card review, a crypto card using which you can easily make both online and offline purchases with a click of your fingers. Nexo is a crypto lending platform that provides various crypto products including Nexo Card.

Table of Contents

Summary (TL;DR)

- The Nexo card is a Mastercard, so you can only use it in places where MasterCard transactions are accepted.

- This crypto debit card supports about 33 varieties of fiat and cryptocurrencies.

- The nexo.io website states that 40 million merchants around the world can accept this Nexo card for payment.

- This Nexo MasterCard also offers cashback on all the purchases you make.

- Free withdrawal of cryptocurrencies; Nexo doesn’t charge any amount for withdrawal. The minimum withdrawal amount varies from the type of coin you have.

- It is easy to learn the basics of this card. It is available as a cryptocurrency savings account.

- The interest rates on crypto and fiat currencies range from 6% to 12%, depending on your distributions and assets.

- The loan interest rates start from 0% APR.

- No minimum deposit charges.

What is a Nexo Card?

Nexo provides a crypto-powered debit card in partnership with Mastercard. The card has a unique feature that allows you to spend your crypto without selling it. This takes place through a crypto lending system which according to Nexo allows you to borrow starting from 0%. The maximum interest rate is 13.9%.

Nexo is a trusted automated loan platform launched in 2017. Over 2 years, it has processed more than $5 billion. The platform also offers crypto-to-crypto and crypto-to-fiat loan transactions. The Nexo card is directly linked to the Nexo account which you can use to access funds without relying on banks.

Further, withdrawal is done very easily. The Nexo card rewards you with a crypto incentive of up to 5%.

How to get your own Nexo card?

- You have to first download the Nexo Wallet app via Google play store or Apple store. Then you have to create an account in the app and order the card.

- Then you need to answer a few questions accurately in the app. The questions will be regarding your personal information, which Nexo needs for the confirmation of your account.

- You can use the Nexo app via mobile or desktop platform.

Nexo Card Review: Features

You can access all the features of the Nexo card via the Nexo Wallet app. The features are listed below.

- If your card gets stolen or lost, you can freeze or unfreeze it with a single tap.

- You can receive and manage all notifications of your Nexo card transactions.

- There is an option for you to create virtual Nexo cards for safer online shopping.

- You can easily view your PIN and also change it at the nearest ATM anytime.

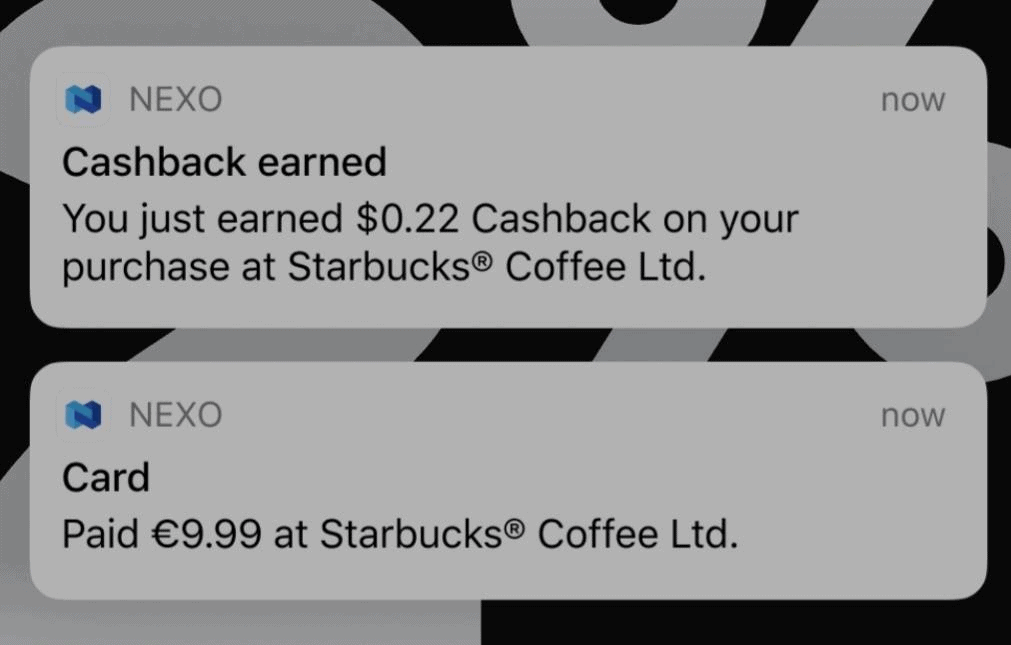

- Enjoy 2% cashback on all your purchases.

- You can make payments in local currencies.

Nexo Card Review: Cashback Rewards

Every time you swipe the Nexo card and make some purchases, Nexo will reward you with a 2% cashback, when you set your reward currency to Nexo Tokens. For Bitcoin rewards, the amount is set at 0.5%. You will automatically see the cashback rewards credited to your Nexo Account when you log in to the app. So, your only concern remains to make purchases; the rest is taken care of by the Nexo card and the Nexo account.

Nexo Card Review: Earn Interest With Nexo Card

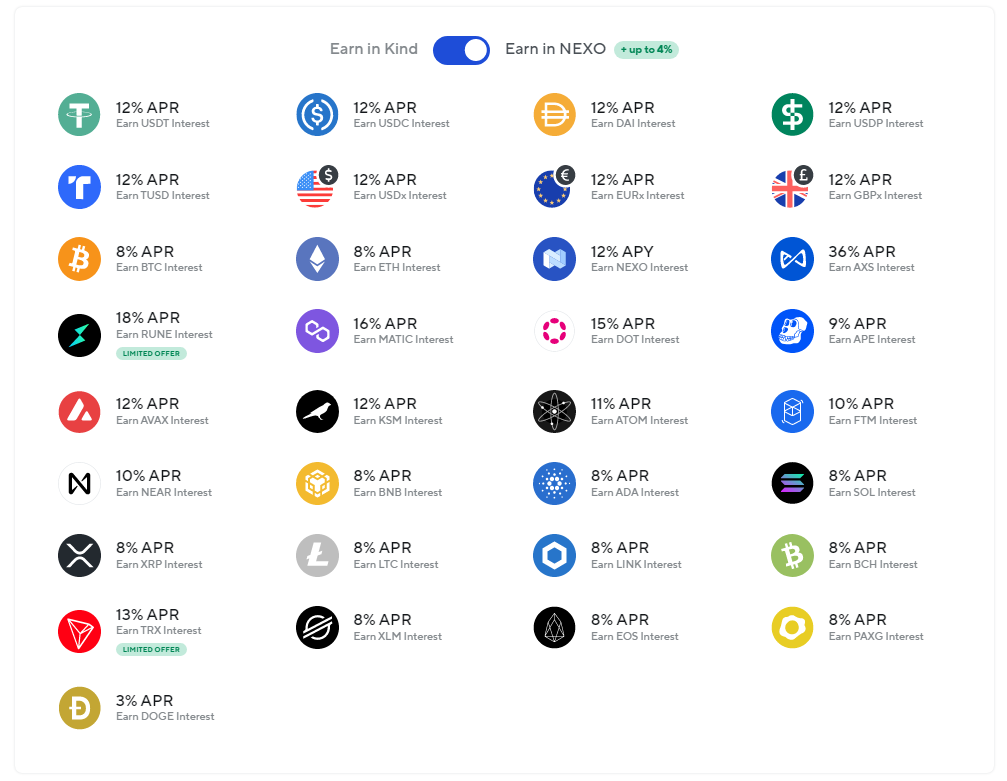

Nexo lets you earn high interest on your crypto savings through Nexo Savings Account. The interest rates are higher than average industry standards and can reach up to 18%. Though the interest rates vary from coin to coin, it is offered on 33 coins and currencies such as Tether, USDC, DAI, Bitcoin, Ethereum, Matic, AVAX, Sol, ADA, etc.

The interest rates start from 8%(BTC, ETC, LINK, etc) and reach up to 12% for stablecoins. The interest rate for AXS is as high as 36%. The interest rates are higher when you earn your interest in NEXO Tokens and a bit lower in other coins. You can link your bank account to your Nexo account and directly transfer assets to your Nexo account.

Nexo calculates and pays you interest daily. Funds will be directly transferred to your Nexo account. This is good for user because you need not to wait an entire week or month like other platforms. You can freely deposit and withdraw tokens at any time. There is no minimum amount in your Nexo account to participate in this interest dealings.

Where to buy Nexo Tokens?

Nexo Tokens can be bought from all popular cryptocurrency exchanges such as Binance, KuCoin, and Nexo Exchange. To help you further, here is a full list of cryptocurrency exchanges.

Nexo Card Review: Benefits of Nexo Card

- You get up to 2% cashback on all the purchases you make with a Nexo card.

- Through its mobile app, you can freeze the card immediately if it gets lost or stolen. Via the mobile app, you can even have a virtual Nexo card for online purchases. Nexo will immediately notify you whenever you will make online transactions with the Nexo card.

- If you have used crypto holdings as your collateral for getting loans, you instantly gain access to your funds as soon as your loan is granted. This is very beneficial because after your loan is approved; it usually takes many days for funds to show up in your account; this does not happen with Nexo.

- The Nexo platform provides ‘High-yield’ interest rates that range from 6% to 12%, and they calculate interest daily in your Nexo account.

Nexo Card Review: Nexo Card Fees

You can freely withdraw cryptocurrencies at any time. There is no money charged for it. When you do transactions from a crypto exchange wallet to your Nexo account, you only need to pay brokerage fees and no transaction fees. Like a traditional savings account, Nexo debit card’s crypto savings account also charges reasonable fewer fees. Also, there are no fees charged for account maintenance.

The minimum withdrawal of cryptocurrencies changes depending on the type of cryptocurrencies your wallet holds. Your account doesn’t need to have a minimum number of cryptocurrencies to start generating interest.

Is Nexo Crypto Card safe?

Yes, Nexo card is safe to use. According to the Nexo website, the platform is powered with military-grade 256-bit encryption and fraud 24/7 monitoring mechanisms throughout the year. Nexo took this important step to ensure the safety of customers’ funds and transactions.

Nexo Card’s Insurance Policy

Nexo has partnered with one of the leading hardware wallet solutions, the Ledger, to store crypto assets. Also, the crypto assets are insured worth $150 million in insurance policy dealings between Arch and Marsh.

In a latest offer of intent on June 13, 2022, Nexo offered to buy a portion of Celsius’s collateralized loan portfolio. Such an acquisition would make more liquidity for users and better profits and survival for the company.

In addition, custodian BitGo provides cold storage wallets. And BitGo carries $100 Million insurance protection through Lloyd’s. The policy also covers the hack or theft of private keys, lost keys, or insider theft.

Nexo Card Review: Nexo Card Customer Support

There is a 24/7 support team ready to assist you. Just use any one of the below contact options to get assistance immediately

- Via Email – You can email your queries to [email protected]

- Via Live Chat: On the Nexo card‘s official website, nexo.io, you can live chat in the blue speech bubble available in the right-side corner of the website.

- Via Text message: You can type your doubts in the ‘Request’ text box available in the ‘Help section’ of the nexo.io card website.

Nexo Card Review: Pros and Cons

Like two sides of a coin, everything has its pros and cons. We have tabulated some of the advantages and disadvantages of using the Nexo card below. You can take a quick look at them in the table below and decide further.

| Pros | Cons |

|---|---|

| It can be used as a standard card and it is accepted by over 40 million merchants across the world. | This card is only useful for people who are already users of the Nexo platform for various other reasons. |

| The Nexo MasterCard allows you to spend while not selling our cryptocurrency holdings. | This card is only useful for those who are willing to borrow fiat currency against their crypto holdings. If you are not interested in this type of borrowing then this card is not for you. |

| The savings account of the Nexo Mastercard provides a high interest compared to other traditional banking sectors. The interest rates are up to 36% on crypto coins and fiat currency. | You can only be able to access and order the Nexo card via the Nexo Wallet app. |

| Up to 2% cashback is rewarded for all the purchases. | |

| You can create a Virtual card to have a safer online shopping experience. | |

| It supports 33 cryptocurrencies and fiat assets. |

Is the Nexo Debit Card a right choice for me?

The answer depends on how you will access the value linked with your crypto holdings. You already know that the Nexo card comes with tax benefits if you borrow cryptocurrencies holdings instead of selling them every time your card balance gets low. But for the loans, interest will be charged.

However, if you are someone who wants to have a simple crypto debit card and sell your cryptocurrencies for accessing the associated dollars or other fiat currency, then this Nexo debit card is not the right choice of card for you. The advantages and disadvantages of the Nexo card depend on your usage of the card.

Is the Nexo Card the best card in the crypto market?

Yes, Nexo crypto card has been hailed as one of the best crypto card in the market by many people. There are many reasonable justifications for the Nexo card’s heightened position

- Just like any other traditional cardholder, you can easily use the Nexo card with the swipe of your hand. For people who make most of their payments using the card, Nexo rewards up to 2% cashback to them. This makes the card popular among many people.

- The amount of rewards you can yield from the Nexo.io card depends on your fund holdings’ range.

- Just like Visa card, MasterCard also has a wide range of perks and bonuses. Since MasterCard backs the Nexo card, you can enjoy Nexo MasterCard’s benefits. The card performs so well that it is even above American Express.

- With a Nexo.io card, you don’t need to go to the bank for withdrawal. Link your Nexo card directly with the Nexo account, and you can now access the funds without a bank transfer.

Nexo Card Review: Conclusion

If you are a first-time user of a crypto savings account, don’t miss out on this user-friendly platform to begin your saving journey. Nexo is an easy-to-use crypto debit card.

Nexo debit card operates with MasterCard. Reap the full benefits of Nexo card by ordering and managing the card’s transaction and account-related details via its mobile app. Just carefully enter and verify the personal information and start using the Nexo card. Also, enjoy numerous cashback with your Nexo card purchases.

The Nexo platform is well suited for long-term investors looking to gain wealth by leveraging their crypto.

Frequently Asked Questions

Is the Nexo card anonymous?

No, the Nexo Mastercard is not anonymous. To access the services of the Nexo card, the users must compulsorily go through the entire identity verification process of the Nexo platform.

Is Nexo Regulated?

Yes, Nexo is a licensed and regulated digital currency providing platform. It also corresponds with more than 200 jurisdictions around the world. Nexo’s team makes sure that all legal terms are approved before accepting further customers from countries worldwide.

Which countries can use Nexo Mastercard?

You can access the Nexo Card in all countries except:

Bulgaria

The Central African Republic

Cuba

Estonia

Iran

The US state of New York

The US state of Vermont

North Korea

Syria

How to buy or sell Nexo Tokens?

When does Nexo token pay dividends?

Nexo token dividends and rewards are paid on a daily basis.