What is BlockFi?

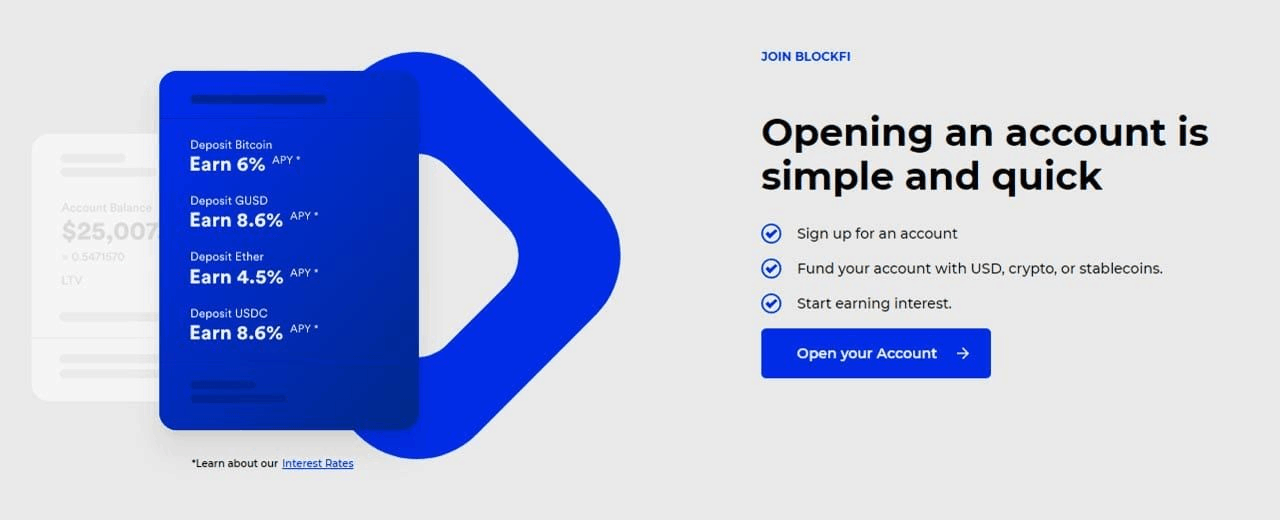

BlockFi is a cryptocurrency management platform that helps you hold your cryptos in an account, earn interest, and use them efficiently. Zac Prince and Flori Marquez founded the New Jersey-based company in 2017 and it has grown into a famous platform that provides bank-like facilities. They were the first ones to provide the Crypto Interest Account holding system. With a BlockFi Interest Account, you can buy, sell, trade cryptocurrencies while earning up to 8.6% interest each year. In late 2019, BlockFi confirmed that it has 225,000 users. Not only does BlockFi manage more than $8 billion in assets, but it also generates interests worth tens of millions for its clients.

Table of contents

- What is BlockFi?

- What does BlockFi trying to achieve?

- What is BlockFi Bitcoin Reward Credit Card?

- Summary (TL;DR)

- Why choose BlockFi?

- Is BlockFi for me?

- How to Join BlockFi Credit Card Waiting List?

- How to join if you don’t already have BlockFi Interest Account?

- Block Reward Credit Card Review: Eligibility

- How to improve your position on the waitlist?

- BlockFi Credit Card Review: Features

- BlockFi Credit Card Review: Security

- BlockFi Credit Card Review: Customer Support

- BlockFi Mobile App

- BlockFi Credit Card Review: Pros and Cons

- BlockFi Credit Card Review: Conclusion

- Frequently Asked Questions

What does BlockFi trying to achieve?

BlockFi aims to blur the lines between traditional finance and blockchain technology.

It strives to empower its clients on a global level and reap great benefits with every purchase. It is secure since it works within the United States federal and state guidelines.

BlockFi keeps upping the game by coming up with innovative products and has now devised a new product called the ‘BlockFi Credit Card.’ This is new in the crypto market, and we shall discuss it in length in this article. However, if you want to learn more about BlockFi interest accounts please read our comprehensive BlockFi Review.

Sign up for BlockFi Credit Card Waiting List.

What is BlockFi Bitcoin Reward Credit Card?

BlockFi is launching the world’s first-ever Bitcoin reward credit card. It will be available to entitled U.S. residents in the spring of 2021. BlockFi partnered with Visa, credit card company Deserve, and Evolve Bank to launch this thrilling reward credit card. While there are plenty of Bitcoin reward cards, BlockFi is undoubtedly doing something enticing by launching a reward ‘credit card’, especially in a business industry full of miles, cash back, and points. The BlockFi Credit Card Waiting List opened for the general public in January 2021. Once approved, you will receive a credit limit in USD. Henceforth, on every transaction of yours, you will gain an immediate 1.5% cashback in Bitcoin. BlockFi also gives not only this but various other offers to help you manage and earn crypto interest.

Summary (TL;DR)

“Our goal for BlockFi has always been for it to facilitate cryptocurrencies going mainstream – and each day provides more evidence that is what is occurring,”

Marquez, SVP of the Company’s Pperations

Their back-to-back launch of different crypto products and schemes certainly shows that their desire to mainstream cryptocurrencies while providing a safe, productive platform is truthful. BlockFi, a relatively young medium, has a robust global presence and retail clients in over 100 countries.

BlockFi’s innovation of Bitcoin reward credit cards has a great many things to offer. We have summarized them here.

- Immediate 1.5% cashback in bitcoin gained on every transaction.

- The annual fee to hold the credit card is $200.

- You will receive a signup bonus of $250 in bitcoin if, within your first three months, you spend $3,000.

- The credit card is made out of metal and has a sleek design.

- You can use this credit card everywhere where Visa is accepted.

- It also offers bonuses, extra APY, added incentives, and several kinds of cashback to users.

- Currently available for US residents, except for New York( due to regulatory issues/limitations)

- Easily and speedily pay with bitcoins anywhere where Visa is accepted.

- You can join the waitlist even if you don’t have an account in BlockFi.

- Shipping of the credit card will start in the spring of 2021.

- BlockFi works within the United States federal and state guidelines, and the New York Department of Financial Services (NYDFS) regulates it.

- If you face trouble, BlockFi takes quick, practical steps to solve it as it offers assistance in various ways to all types of users.

- According to the reports, towards the end of 2019, BlockFi was having 225,000 users. Renowned crypto and insurance companies have also backed BlockFi.

- BlockFi has a mobile app that is available on Android and iOS.

Why choose BlockFi?

With the increase in demand for bitcoin, the demand for safe and easily accessible cryptocurrency interest accounts increases. This is where BlockFi helps you and provides the best bitcoin savings account in the market.

Is BlockFi for me?

If you are ‘crypto curious’ as said by Zac Prince, the CEO, and founder of BlockFi, then this Credit card will appeal to you. If you are devoted to crypto and aren’t planning on spending your rewards immediately, then yes, this credit card would be beneficial for you.

How to Join BlockFi Credit Card Waiting List?

If you decide to apply for the BlockFi bitcoin reward credit card, you should know the quick and simple steps. So, if you’re already holding an account in BlockFi, then you can join the waiting list through your account. But what if you don’t have a BlockFi Interest Account (BIA)?

How to join if you don’t already have BlockFi Interest Account?

Even if you don’t have a BlockFi Interest account, there are no worries as the waiting list opened for the general public in January 2021. So, you can easily visit their main website, submit your name, email address, and you are all done. But not everyone who applies would be eligible.

Block Reward Credit Card Review: Eligibility

BlockFi will look at Geographic, regulatory, and underwriting factors before your qualification. Since many people would be applying for credit cards, it would be better to improve your place in the line.

How to improve your position on the waitlist?

BlockFi says that the qualification is based on “first-in, first in line.” The earlier you apply, the greater your chances are to qualify. Although, the ultimate deciding factor is the number of referrals you make. So, by joining early and making successful referrals, you can better your qualifying chances.

Now that we know about the company’s aims and application process, we can look at the core features of this platform. What exactly does BlockFi offer you?

BlockFi Credit Card Review: Features

You will have a credit limit, and it won’t charge any interest on the balance if you keep paying the statement balance every month. You get to earn interest on your bitcoin rewards, and with all the offers BlockFi gives you, you could gain bonuses of bitcoin rewards worth $750 or above.

- The annual fee to hold the credit card is $200.

- You will gain 1.5% cashback in bitcoin on every transaction. The cashback will accumulate in your account and will convert to bitcoin on a regular monthly basis.

- This 1.5% cashback rate is the highest bitcoin rewards rate offered for any card product in the market.

- You will receive a signup bonus of $250 in bitcoin if, within your first three months, you spend $3,000.

- You will receive 3.5% bitcoin rewards on all of your purchases in the year’s second quarter (Max $100 in bitcoin).

- If you hold stable coin assets like USDC, GUSD, PAX in your BIA, then you will get an additional 2% APY on the mean daily stable coin balance during the first year of your credit card ownership. And how does this exactly work? The bonus will accumulate over the year, and on an annual renewal, it will pay you the bonus. This 2% APY bonus equates to $200 in bitcoin.

- You will gain 0.25% back in bitcoin on all entitled trades. This means you can receive a maximal value of $500 in bitcoin per month.

- Per the ‘Refer-a-Friend program,’ you can get an additional $30 in bitcoin for every successful referral you make.

- The credit card is made out of metal and has a sleek design.

- You can use this credit card everywhere where Visa is accepted.

BlockFi Credit Card Review: Security

BlockFi is continuously expanding across multiple platforms with transparency and actively working risk management. The New York Department of Financial Services (NYDFS) regulates BlockFi and it is backed by renowned institutional investors and has no utility token. BlockFi’s primary custodian is Gemini, a famous digital currency exchange. Aon, a famous insurance company, insures the stored funds of Gemini, whose 95% assets are in cold storage and 5% in hot wallets. Deloitte has given BlockFi a SOC2 Type 1 Compliance Audit.

Data transmission occurs through solid encryption. BlockFi has security tools like two-factor authentication, PII Verification, and allow listing. They have joined hands with the world’s leading identity management company, Auth0, to ensure a secure, authentic, and accessible crypto business.

BlockFi claims to place its client funds ahead of equity in losses or employee funds to minimize risk. To keep improving its security, BlockFi lets external security firms conduct penetration tests and provide suggestions.

In addition, BlockFi has a solid foundation since it’s backed by chief industry investors, namely Valar Ventures, Coinbase Ventures, Morgan Creek Capital Management, Susquehanna Government Products, Galaxy Digital, Winklevoss Capital, and more.

BlockFi Credit Card Review: Customer Support

If you are a funded, active client, you can seek help overcall at +1 646 779 9688.

BlockFi’s support service site is [email protected]. BlockFi has a youtube channel that provides interviews of BlockFi staff solving various problems. They also have a Twitter account.

BlockFi claims that its AI-powered intelligent assistant, BotFi, will help you find answers to your questions instantly. However, if, due to any reason, your queries aren’t solved, then with the bot’s help, you can submit a ticket stating your question. A client service representative will review it and respond immediately.

If you land up with a compromised account in the worst-case scenario, BlockFi will freeze it for a week. BlockFi will schedule a video call with you for the verification of identity. Once you have completed verification, you will have to change your email address and password. Soon, you would retrieve control of your account.

BlockFi Mobile App

BlockFi mobile apps are available on Android and iOS.

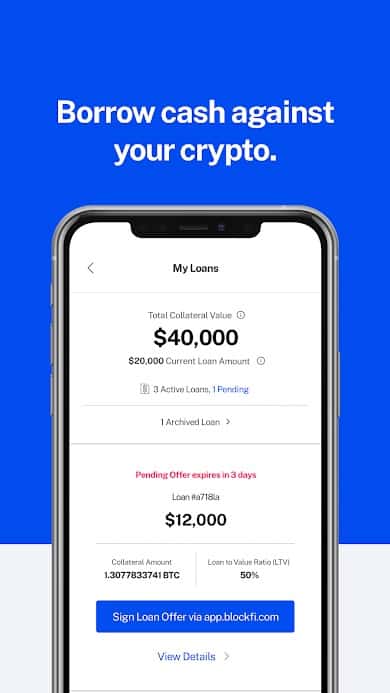

They have a straightforward and intuitive User Interface. Their app is easy to use. You can gain access to your account through the total safe feature of biometric login. You can manage your account, keep an eye on balance, borrow money, trade, and earn interest.

BlockFi Credit Card Review: Pros and Cons

While BlockFi does provide outstanding reward credits on every purchase, it also has its downsides. We have summarized the perks and shortcomings in a table. You can take a quick look at it to get a clear idea.

| Pros | Cons |

|---|---|

| Financial services are of institutional quality | High annual fees |

| Enticing bonuses and reward offered during the first year | Apart from signature Visa offers, not much is offered |

| 1.5% cashback in bitcoin on every purchase | Bitcoin’s potential is subject to high volatility |

| Aon insures the funds and Gemini is the primary custodian, making BlockFi a safe platform | |

| No utility token required | |

| Responsive customer service | |

| User-friendly mobile app |

BlockFi Credit Card Review: Conclusion

Above all, we could say that BlockFi is a trustworthy, productive, and profitable crypto lending platform. Famous crypto business companies back it; it abides by the laws and financial regulations of the US and has numerous innovative bitcoin reward offers along with high yield and comparatively lower risk. You won’t have trouble using the app since it’s highly user-friendly, and they also have extensive, supportive customer care service.

We can also conclude that BlockFi’s Bitcoin Reward Credit Card is a one-of-a-kind product with enticing, fruitful interest offers. The service is straightforward with apparently no hidden fees. As long as you are 18 or above, you can directly apply for the reward credit card by providing your name and email address. The platform is more suitable for someone well-versed in the cryptocurrency business or even someone who is crypto-curious and wants to explore the bitcoin world.

Although the FDIC or SIPC does not insure BlockFi, Gemini uses strict security measures to lower the risk. The rewards, advantages won’t benefit you if you’re paying late fees or interest. If you can spend time only, then you should consider applying for this reward credit card. There is no doubt there is a risk even here as the reward credit depends on bitcoin’s then market value. But if you are considering opting for this credit card, we assume you must be aware that all crypto businesses are subject to risk.

So, in all, the Bitcoin credit card is indeed very beneficial if you aren’t looking forward to spending it all away immediately. Additionally, many companies in the market also looking to launch such crypto reward credit cards soon. Therefore, there may be better options in the future, but BlockFi’s Reward credit card is the best bet for now. BlockFi’s clean, transparent services and offers are competent enough and can surely help you reap the benefits of more excellent reward rates.

Frequently Asked Questions

Is BlockFi safe and legit?

Yes, since it functions within the financial laws of the U.S. and the New York Department of Financial Services (NYDFS) regulate it.

How does the BlockFi Credit card waitlist work?

If you don’t yet have a BlockFi Interest Account, then you can still join the waitlist. The waitlist opened for the general public in January 2021. You can visit their main website, submit your name and email address, and you are all done.

How to check my status on the Credit Card waitlist?

After you sign up for the waitlist, you will receive an email stating your custom status link. You can bookmark the link to check your position in the line.

When will the BlockFi Credit card be available?

The bitcoin reward credit cards will be available to qualified U.S. citizens in the spring of 2021. For further information, you can visit blockfi.com.

How do I know if I’m on the BlockFi Credit Card waitlist?

You will know when you receive a confirmation link in your email after you sign up. Or you can also log in to app.blockfi.com and click on the promotional banner on top. If you see “You’re on the list!” on the page, then you are all set. If not, you can apply for the list by clicking on the “Get on the list” option.

Are there any fees to be paid for joining the waitlist?

No. You can join the waitlist without paying any kind of fee.

What counts as a successful referral?

You will receive a unique referral link after successfully joining the waitlist. Someone who uses this unique referral link to join the waitlist will be considered a successful referral.

When are the bitcoin rewards paid out?

The bitcoin reward cashback will accumulate in your account, convert to bitcoin, and payout regularly.