Estimated reading time: 13 minutes

This article reviews three centralized finance (CeFi) crypto lending platforms: BlockFi vs Celsius Network vs Hodlnaut.

BlockFi

BlockFi is a major player in the crypto lending sector and solidified in their $350M recent investment round. It is a type of financial management platform that offers market-leading financial tools to help crypto investors earn interest on their crypto and get USD funding through crypto-backed loans.

Founded in 2017, BlockFi aims to be one of the most reputable financial services providers in the crypto market. The company provides market-leading rates with institutional benefits through their interest account that supports multiple cryptocurrencies such as BTC, ETH, LTC, USDC, GUSD, and PAX.

Features

BlockFi offers three products on its platform: BlockFi Interest Account, Trading Account, and Crypto-Backed Loans. With the BlockFi Interest Account, users can earn up to 8.3% when depositing their cryptocurrencies. The interest is paid out at the beginning of every month, and since it is compounding, the annual yield is increased. BlockFi generates the interest by lending the assets held in the interest account to corporate borrowers on collateralized terms.

The Trading Account lets users trade between various cryptocurrencies and earns interest when the trade is placed. For example, users can deposit 1 BTC at the beginning of the month and convert to ETH in the middle of the month, then the total interest earned is half from BTC and half from the traded crypto (ETH).

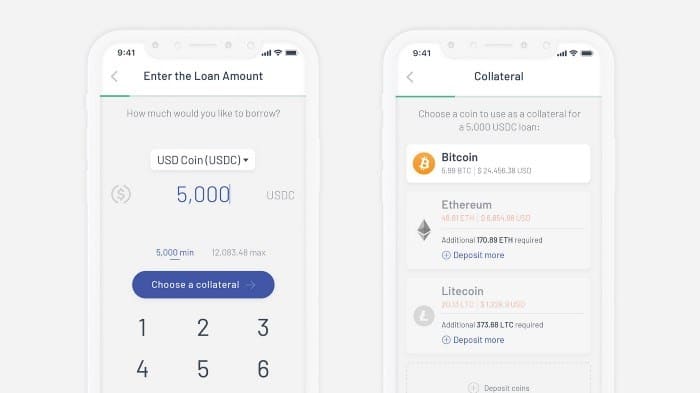

Another feature from BlockFi is Crypto-Backed Loans. Users don’t have to sell their crypto to get the loan; instead, they can borrow funds against crypto assets as collateral. That way, they can get a loan while continuing to hold. Furthermore, the Interest Payment Flex feature allows users to select the interest payments currency and diversify their portfolio without buying new crypto assets.

BlockFi Interest Rates

BlockFi users earn interest when they deposit their assets into the BlockFi Interest Account. The compounding interest is paid at the beginning of every month, thus increasing our clients’ annual yield.

| Currency | Amount ** | APY |

| BTC (Tier 1) | 0 – 2.5 | 6% |

| BTC (Tier 2) | > 2.5 | 3.2% |

| ETH | > 0 | 5.25% |

| LTC | > 0 | 5.0% |

| USDC | > 0 | 8.6% |

| GUSD | > 0 | 8.6% |

| PAX | > 0 | 8.6% |

| PAXG | > 0 | 4% |

| USDT | > 0 | 7% |

Account Withdrawals

Users can withdraw their funds at any time. They’re also entitled to 1 free crypto withdrawal and 1 free stablecoin withdrawals. Anything more will be charged fees listed as below:

| Currency | Withdrawal Limit | Fees*** |

|---|---|---|

| BTC | 100 per 7-day period | 0.0025 BTC |

| ETH | 5,000 per 7-day period | 0.0015 ETH |

| LTC | 10,000 per 7-day period | 0.0025 LTC |

| Stablecoins | 1,000,000 per 7-day period | $0.25 USD |

| PAXG | 500 per 7 day period | 0.0025 PAXG |

Crypto-Backed Loan Rates at BlockFi

BlockFi allows users to borrow USD with crypto assets as collateral and secured with a loan-to-value (LTC) ratio.

| LTV | Interest Rate | Origination Fee |

|---|---|---|

| 50% | 9.75% | 2% |

| 35% | 7.9% | 2% |

| 20% | 4.5% | 2% |

Fees Schedule

BlockFi aims to keep the fees low and subject to change based on market conditions.

| Currency | Withdrawal Limit | Fees*** |

|---|---|---|

| BTC | 100 per 7-day period | 0.0025 BTC |

| ETH | 5,000 per 7-day period | 0.0015 ETH |

| LTC | 10,000 per 7-day period | 0.0025 LTC |

| Stablecoins | 1,000,000 per 7-day period | $0.25 USD |

| PAXG | 500 per 7 Day period | 0.0025 PAXG |

As mentioned before, all BlockFi Interest Account users are entitled to 1 free crypto and 1 free stablecoin withdrawal per calendar month.

BlockFi: Security & Risks

As with any financial institution, it’s normal for users to ask, “Is BlockFi Safe?” Based on my observation and research, it is relatively safe to deposit and earn crypto interest at BlockFi. The assets are stored in Gemini, which is the primary custodian with 95% of its assets are in cold storage and the rest are in insured hot wallets.

To be able to offer users interest on crypto, BlockFi lends out the assets to institutional counterparties. They’re vetted and reviewed carefully to ensure that the risks of default is as low as possible. Since digital currencies are not legal tender, they’re not backed by the government and not free from risks.

BlockFi platform has suffered from a data breach in the past. Earlier in May, a BlockFi employee’s phone number was breached and utilized by an unauthorized third party. The perpetrator accessed personal information such as name, email address, date of birth, address, and activity history. Furthermore, the hacker attempted to do unauthorized withdrawals but without success.

Ease of Use

The website recently went through a redesign process which gives the platform a fresh and sleek look. Overall, the platform is fairly easy to use and efficient. There aren’t that many complicated features so expect to find your way around the platform in no time. The main thing to note here is you can either deposit your funds or request a loan. You can also convert your assets within the platform, for example, swapping BTC to ETH.

Although you can withdraw at any time, the process could take up to 3 days to complete. They might also ask for another verification if needed, especially if you’re withdrawing a large sum of crypto assets.

Another thing that can be frustrating is BlockFi shows the amount of BTC in USD. Furthermore, they don’t offer much flexibility in terms of displaying foreign currencies which can pose difficulties for international users.

You might also be interested in:

Celsius Network

Crypto on your terms. That’s the slogan that Celsius Network has been introducing to its users. As one of the leading providers of interest accounts and lending in the crypto space, Celsius sets the bar high for other crypto lending platforms with its dynamic features and rates.

Something unique and worth investigating further when depositing with Celsius is the usage of its native crypto called CEL token. It offers a more competitive interest rate for both interest accounts and loans.

Features

Celsius has a range of products available on its platform. Besides the crypto interest accounts, Celsius also offers gold interest accounts, buy crypto, crypto loans, CelPay (its own crypto wallet), CEL Token, and merchandise.

Celsius is beginner-friendly where it focuses on making borrowing and lending crypto as easy as possible. In terms of available assets, Celsius excels more than BlockFi with its 25 different cryptocurrencies available on the platform. The headlining feature for Celsius is obviously its own CEL Token. With it, users can get cheaper loans and a more compelling interest account. In addition, CEL holders also get a share of the profit earned by the company.

Celsius Network: Rates & Fees

Celsius doesn’t charge any fees for its services including withdrawal, deposit, transaction, early termination, or origination fees. Celsius has some of the highest interest rates in the market, especially for its stablecoins with 11.55% APY (In-Kind).

Celsius Interest Rates

| Cryptocurrency | CEL Reward (APY) | In-Kind Reward (APY) |

|---|---|---|

| ETH | 9.28% | 7.06% |

| CEL | 5.12% | |

| BTC | 6.20% | 4.51% |

| SNX | 21.49% | 16.16% |

| MATIC | 21.49% | 16.16% |

| DAI | 15.26% | 11.55% |

| BUSD | 15.26% | 11.55% |

| SGA | 15.26% | 11.55% |

| TCAD | 15.26% | 11.55% |

| THKD | 15.26% | 11.55% |

| TAUD | 15.26% | 11.55% |

| TGBP | 15.26% | 11.55% |

| TUSD | 15.26% | 11.55% |

| GUSD | 15.26% | 11.55% |

| PAX | 15.26% | 11.55% |

| USDT | 15.26% | 11.55% |

| USDC | 15.26% | 11.55% |

| LPT | 13.86% | 10.51% |

| DASH | 7.21% | 5.50% |

| BAT | 6.68% | 5.10% |

| LTC | 6.61% | 5.05% |

| BCH | 5.90% | 4.51% |

| LINK | 5.90% | 4.51% |

| BSV | 5.90% | 4.51% |

| XAUT | 5.90% | 4.51% |

| ZRX | 5.90% | 4.51% |

| PAXG | 5.90% | 4.51% |

| EOS | 5.83% | 4.45% |

| XRP | 4.72% | 3.61% |

| ZEC | 4.59% | 3.51% |

| OMG | 4.06% | 3.11% |

| XLM | 4.04% | 3.10% |

| ETC | 3.92% | 3.00% |

| KNC | 3.30% | 2.53% |

Security and Risks

Fireblocks and PrimeTrust are Celsius’ custodians and they both provide insurance on the stored assets. They come highly trusted in crypto-asset security. Unlike BlockFi, Celsius also has no serious data breach or security incidents. However, it’s important to know that when Celsius lends out the assets to third-parties, the said assets are not insured.

Celsius claims to lend out responsibly from their pool of assets. The assets loans are collateralized up to 150% and the borrowers are vetted. In case of bankruptcy or extraordinary circumstances that prevent Celsius to maintain the assets, the company will use their balance sheet to cover the loss.

Ease of Use

The sign-up process at Celsius is quick and easy. Users would need to provide basic information to create an account. In order to use other features such as opening an interest account or requesting a loan, users would need to go through a full KYC (Know-Your-Customer) verification process.

Although their website has a fresh and colorful look, Celsius primarily offers mobile-first experience through their mobile apps with no sign-in option from a web browser like BlockFi.

The mobile apps offer a range of features from buying crypto, earning rewards, and taking out loans among other things. Withdrawals are quick and easy with some delays for further verification for withdrawals above $50,000.

You might also be interested in:

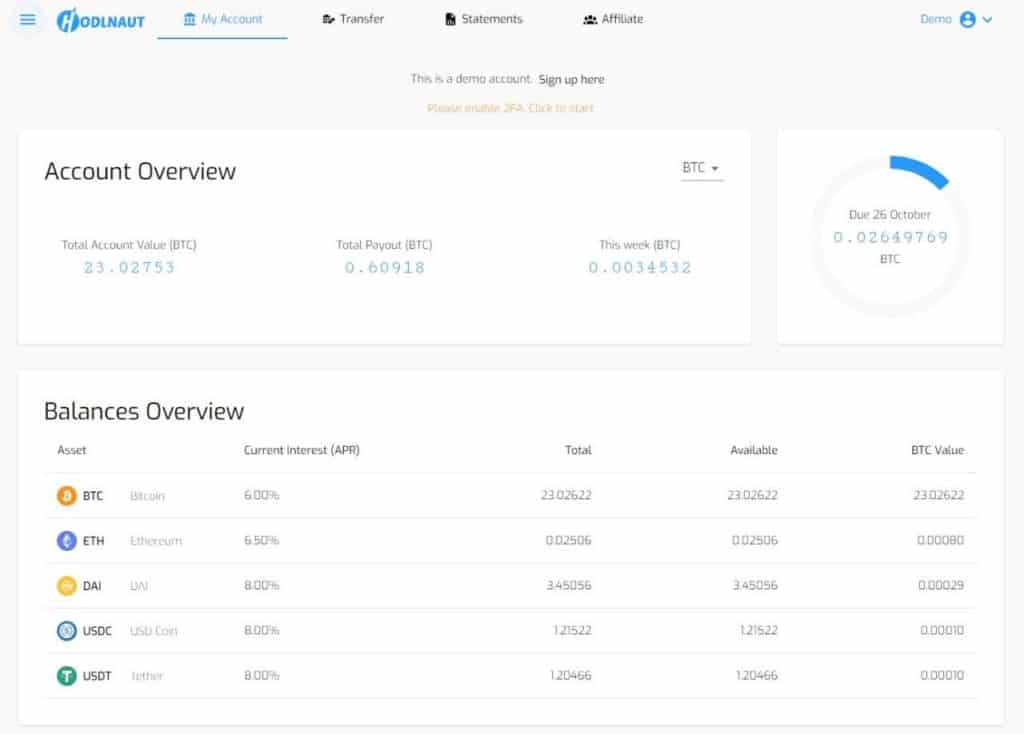

Hodlnaut

Hailing from Singapore, Hodlnaut is a crypto lending platform that offers financial services to individual investors and crypto aficionados. Started by two bitcoin maximalists Juntao Zhu and Simon Lee, Hodlnaut aims to help users to get the most out of their crypto assets easily. The company offers Interest Account that supports crypto assets such as BTC, ETH, DAI, USDC & USDT. In addition, Hodlnaut also provides Corporate Loans with flexible terms and customizable to the client’s needs.

Launched in April 2019, Hodlnaut currently has over 650 users and close to 800 BTC in assets. The company is part of Antler’s portfolio company, a global VC firm backing early-stage startups. Hodlnaut offers some of the highest rates in the market for hodlers to grow and diversify their crypto portfolio. Let’s take a look at the features and other variables.

Features

There are two main features at Hodlnaut: Interest Account and Corporate Loans. With 5 major asset classes in the belt, Hodlnaut Interest Account provides users the opportunity to grow their portfolio with some of the highest interest rates in the market. Supporting BTC, ETH, DAI, USDC, and USDT with an effective annual percentage yield up to 8.3%.

There are no minimum deposit or lock-in periods for the interest account. It takes minutes to sign up for an account with Hodlnaut. Once users have gone through the mandatory KYC (Know-Your-Customer verification process, they can begin earning interest immediately. Hodlnaut will credit the accrued interest to the user’s account every week on Monday. Furthermore, Hodlnaut also offers 10% commission on its affiliate program for each successful referral.

Besides Interest Account, Hodlnaut also offers Corporate Loans. Through the crypto loans, clients can obtain a credit line using their crypto assets as collateral. With loans starting from $50,000 and flexible loan-to-value, 25%-100%, Hodlnaut can tailor the loans to fit the client’s business needs.

Hodlnaut Interest Rates

Similar to BlockFi, Hodlnaut is able to offer attractive interest rates to users by lending the assets to vigorously vetted margin traders in the form of crypto loans. Below is the list of supported assets for the Interest Account.

| BTC | ETH | DAI | USDC | USDT | |

|---|---|---|---|---|---|

| Interest Rates | 6% | 6.5% | 8% | 8% | 8% |

| APY* | 6.2% | 6.7% | 8.3% | 8.3% | 8.3% |

*These are Hodlnaut’s effective annual interest rates, which takes into account the compounding effect

Account Withdrawals

Withdrawals fees at Hodlnaut is regularly reviewed and adjusted based on the blockchain conditions. Currently, the withdrawal fees are kept to minimal and as follows:

| Currency | Minimum | Transaction Fees |

|---|---|---|

| Bitcoin | 0.0005 BTC | 0.0005 BTC |

| Ethereum | 0.005 ETH | 0.005 ETH |

| Dai | 3 DAI | 3 DAI |

| USD Coin | 1 USDC | 3 USDC |

| Tether | 1 USDT | 3 USDT |

Corporate Loans

Hodlnaut’s Corporate Loans is tailored to the client’s needs and highly customizable. Because they’re structured in more complex ways depending on the lender, the terms and conditions may differ. Generally, loans are starting from USD 50,000 and clients can choose between open terms or 3+ months fixed terms. Furthermore, the loan-to-value ratio is flexible ranging from 25%-100% with no hidden fees.

Security & Risks

As centralized finance (CeFi) crypto lending platform, Hodlnaut requires its users to go through a KYC (Know-Your-Customer) verification process. Certified Fintech company by the Singapore Fintech Association (a recognized credential by the Monetary Authority of Singapore), the company meets all the requirements for Digital Payment token License, has submitted the paperwork, and currently in the reviewing process for the Singaporean Standard Payment Institution License.

Hodlnaut platform runs on secure AWS (Amazon Web Services) cloud infrastructure with all traffic SSL encrypted. Furthermore, Hodlnaut uses industry-standard algorithms for password hashing and procedures while encouraging users to enable two-factor authentication (2FA) for account transactions. Taking a security-first approach, there are no hot wallets at Hodlnaut.

As for risks, there are some measures that Hodlnaut has taken to prevent loss of funds. By applying a stringent capital requirements for their counterparties, Hodlnaut also minimizes the risk of default by only lending to funds that have a mandate to borrow less than 1x of their Net Asset Value. In the worst case scenario where a default happens, the company said they will be taking on the loss and paying the users from their equity funds.

Considering all things above, I conclude that it is generally safe to hodl with Hodlnaut. Of course, users need to read the fine prints and make an informed decision before depositing.

Ease of Use

At a glance, Hodlnaut’s platform is user-friendly and straightforward. Users can check the overview of their assets balance and the transaction history in their dashboard easily. They can also deposit, withdraw, and check their interest statement quickly within the same dashboard.

Another thing that’s also convenient is that you can generate and share your unique referral link. You’ll be able to check how many friends you’ve referred to and how much payouts you’ve received. As for the rewards, you can earn 10% commission for each successful referral.

Unfortunately, Hodlnaut currently doesn’t have mobile apps though that’s something they’re working on to provide in the future.

Conclusion – Celsius Network vs BlockFi vs Hodlnaut

BlockFi, Celsius Network, and Hodlnaut offer competitive products, however, there are differences. BlockFi has a Tier system for BTC where the bigger amount you deposit, the lower your interest rate would be. Celsius offers higher interest rates if you opt to be paid in its native CEL Token. As for Hodlnaut, the interest rate remains the same at 6.2% APY no matter the amount.

BlockFi suffered from a data breach in the past though contingency plans have been put in place while Celsius has no recorded security incidents. Hodlnaut is currently in the process of getting the Singaporean Standard Payment Institution License.

All have intuitive platforms that are user friendly and offer attractive interest rates for different asset classes. While BlockFi managed to scale further with their recent investment round, and Celsius continuously innovating their range of financial services, Hodlnaut is also growing rapidly with users enjoying attractive rates and dedicated support from their tight-knit team while hodling.

You might also be interested in: