When it comes to cryptocurrency lending, tons of factors equate to a good earning profile. Also, the borrowing part of the lending ecosystem is almost always missed out on. Therefore the article covers concepts of lending, borrowing, and process steps for the 10 best crypto lending platforms.

Table of Contents

What is Cryptocurrency Lending?

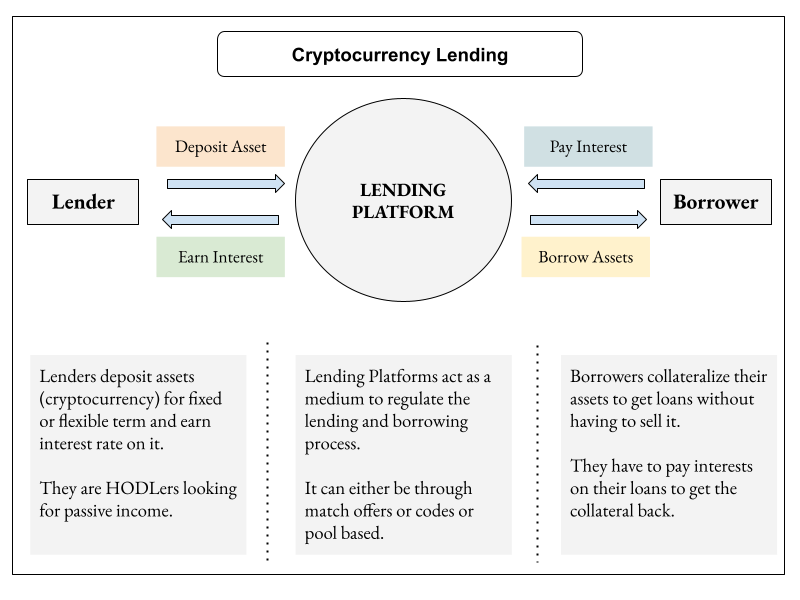

The method of lending crypto assets or fiat currency to the person who wants to borrow it at an agreed-upon interest rate constitutes crypto lending. Therefore, it has the same execution as that of investments and loans in a traditional banking system.

- Lenders: They are usually someone who has an accumulation of cryptocurrency and is looking for a way to earn passive income.

- Borrowers: They are usually someone who requires a loan against their crypto asset. Getting a loan helps them to retain their asset without selling them.

- Lending Platform: The platform which allows users to lend or borrow crypto assets.

Where to Lend your digital assets?

- Centralized Finance (CeFi) Platforms

The platform which acts as a middleman in the execution of the lending process comes under this. It means that the lenders and borrowers give up their respective asset and collateral to this platform until the time borrowed amount is settled in full.

Both parties will not have control over their assets. Moreover, a KYC process is standard on these platforms, meaning that anonymity is not possible.

- Decentralized Finance (DeFi) Platforms

These platforms have code-based contracts known as Smart Contracts to execute lending. The contract executes when the specified demands are fulfilled, and this process is automated. Thus, one does not need to undergo the KYC process, and since it works on a set of rules, it is pretty transparent.

How does Crypto Lending work?

Let’s have a look at lending at an operational level.

Pros and Cons of Crypto Lending

| Pros | Cons |

|---|---|

| It is readily available to anyone who is holding crypto. | Security is a big hurdle. |

| The process is not as long as traditional systems. | Centralized platforms are vulnerable to online attacks. |

| High interest rates and reward incentives. | The Crypto market is volatile. |

| Highly diversified in nature. | Over collateralization of assets. |

Best Cryptocurrency Lending Platforms

Here is a list of some of the best crypto-lending platforms

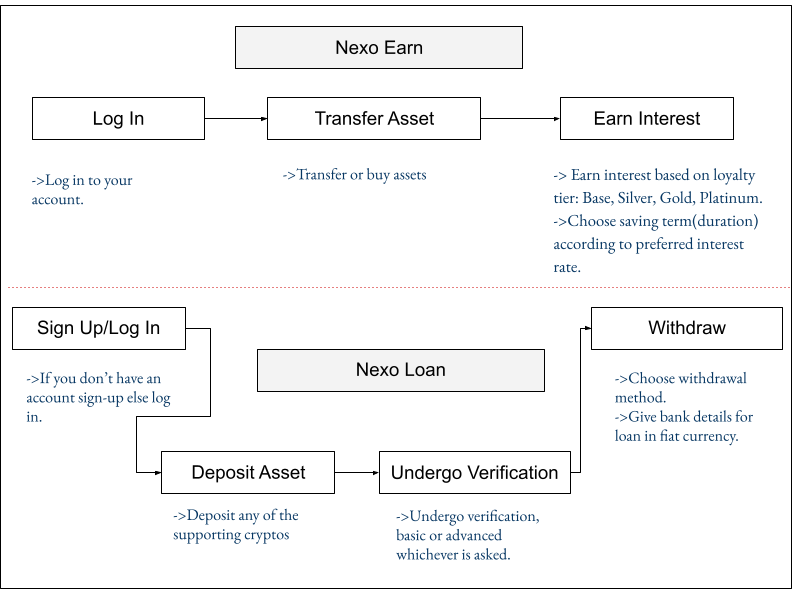

1. Nexo

Nexo is a cryptocurrency platform that provides instant crypto loans. It is centralized and aims to remove inefficiencies wrt to lending in the crypto world. In addition, it extends its lending to 40+ Fiat currencies across 200 jurisdictions. To learn more, read Nexo Card Review.

Nexo Crypto Lending and Borrowing

| Features | Description |

|---|---|

| Accessible | Across Web and mobile platforms (iOS and Android). |

| Nexo Security | Military Grade Security and 256-bit encryption. ISO 27001:2013 Compliant. Funds are stored in cold storage. 24/7 Customer Support. |

| Nexo Insurance | $375M |

| Tokens Supported | Major tokens are supported, and more token support is underway. Does not support wrapped coins. |

| Nexo Interest Rates | Cryptocurrency: 4%-5% Fiat Currencies: 4%-6% Stable coins: 8%-10% +2% on all (When paid in Nexo) Nexo: 7% |

| Terms for Earning Interest | Fixed Terms: 1 and 3 months. Flexible Terms: No lock-in. |

| Token Supported for Loaning | 40+ Fiat currencies stable coins: USDT or USDC. They can be swapped easily for crypto of your choice. |

| Borrow Interest Rates | Ranges from 13.9% to 6.9% depending on loyalty tier. |

| Maturity of Nexo Loans | 12 months |

| Eligibility for Loans | Nexo account necessity. Deposit funds onto the Nexo account. Loans in fiat currency require Basic and Advanced verification. |

| Multiple Loans | Possible depending on Credit Line amount. |

| Liquidation of Collateral | Threshold value: 83.3%, above this, collateral will be liquidated. |

| Minimum Loan | $5000 in stablecoins. $500 in fiat currencies. |

| Maximum Loan | $2,000,000 equivalent stablecoin. |

| Nexo KYC | Required. |

| Withdrawal Fees | Some free withdrawal depending on loyalty tier, after that network fee applicable. |

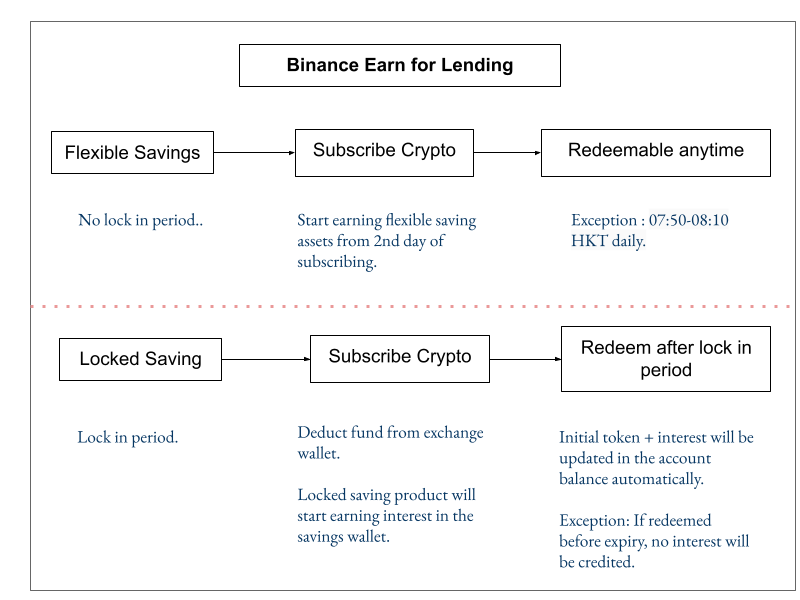

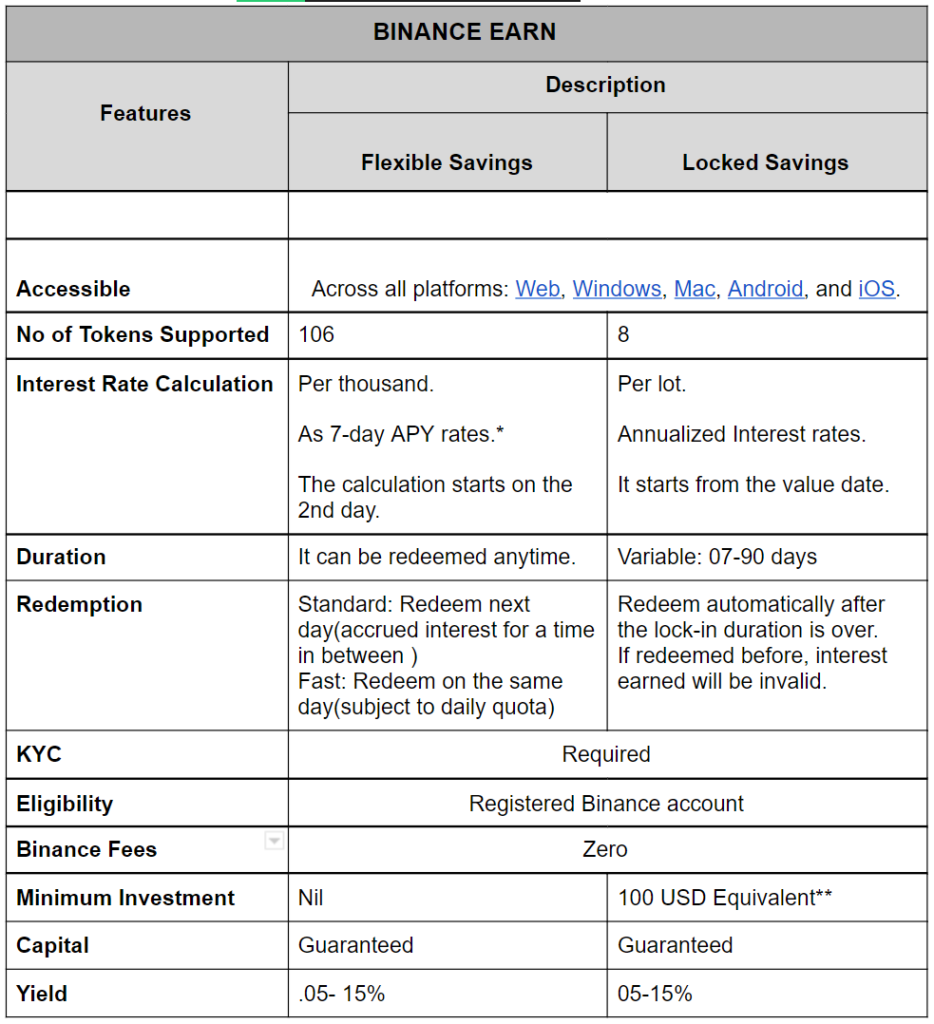

2. Binance Lending

Binance is one of the largest crypto exchange platforms globally. To learn more, read Binance Review.

- Binance Earn is the product for the investment of crypto assets and providing multiple services to earn a passive income.

- Crypto Loans is the product where you can borrow loans for trading or staking.

Binance Crypto Lending

It has two ways of earning interest on crypto assets.

- Flexible Savings

- Locked Savings

* The Annual Percentage Yield is calculated yearly; they look at the last 7 days to calculate approximately how much growth you can expect in a year.

** As of latest. It can, change in the future.

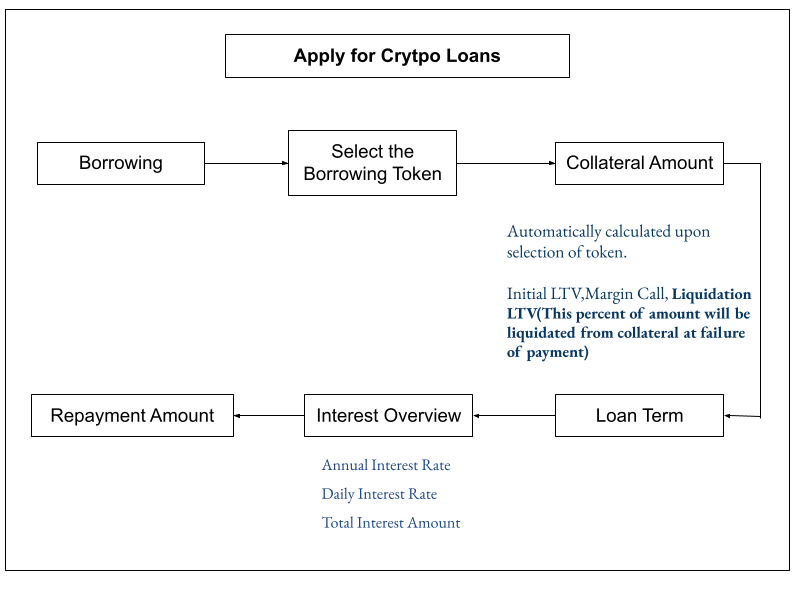

Crypto Loans

Borrowing on Binance happens through Crypto Loans.

| Features | Description |

|---|---|

| Accessible | Across all platforms: Web, Windows, Mac, Android, and iOS. |

| Tokens Supported | All popular tokens. |

| Interest Rate Calculation | Hourly calculation Rate is determined by the time a loan is made. Variable rate depending on crypto tokens. |

| Duration | 07,14,30,90,180 days available |

| Initial LTV | 65% (BTC) It is different for different tokens. |

| Payment | Need to be completed before the due date. |

| Penalty for Overdue | 07-14 days: Overdue duration 72 hours 30,90,180 days: Overdue duration 168 hours Interest charged 3x hourly interest. |

| Failure of repayment | Liquidation of the collateral to cover the loan. |

| Binance KYC | Required. |

| Eligibility | Registered User of Binance. |

| Binance Liquidation Fees | 2% of the total borrowed amount if liquidation happens. |

| Minimum and Maximum Amount | Variable |

2. YouHodler

Youhodler is a FinTech platform that provides crypto lending and exchange services. To learn more, read the YouHodler review.

| Features | Description |

|---|---|

| Accessible | Across Web and mobile platforms(iOS and Android). |

| YouHodler Security | CCSS Compliant 3FA supported. |

| YouHodler Insurance | ~ $150 million |

| Tokens Supported | Major tokens are supported, and more token support is underway. |

| YouHodler Interest Rate | Interest Rates are variable with each asset.It is compounding interest. |

| Collateral Accepted | Top 20 coins |

| YouHodler Minimum Deposit | $100 |

| Maximum Amount for Interest generation | $100k worth of crypto in your portfolio. |

| Interest Payout | In terms of assets deposited. |

| Tokens for Borrowing | USD or Stablecoins (USDC, GUSD, PAX) |

| Borrow Interest Rates | 4.5% – 9.75%, depending on LTV. International rates are higher. |

| Loan Duration | 30,60,180 days. Loan Fee payment before the end of the duration will keep the loan open. |

| YouHodler LTV | 90% – 30 Days 70% – 60 Days 50% – 180 Days |

| Interest Payment | Crypto, Bank Wire, Credit Card, From your wallet, Close now feature. |

| Liquidation of Collateral | 80% or above this, collateral will be liquidated. |

| Minimum Loan | $100 |

| YouHodler KYC | Required. |

Note: YouHodler has a service charge for many of its services.

3. CoinRabbit

CoinRabbit is an instant lending and borrowing platform with hassle-free steps. Further, it is a centralized platform and lets users take loans for an unlimited period. It has several advantages, including:

- low minimum loan amounts

- No boundaries on the maximum loan amount

- No monthly payments

- Instant lending service without any credit checks

To get detailed information, read our CoinRabbit Review

| Features | Description |

|---|---|

| Accessible | Only web platform |

| CoinRabbit security | Funds are secured with the help of the ChangeNow crypto exchange. |

| Tokens supported for loan | USDT, USDC |

| Collateral | BTC, ETH, BCH, FIRO, NANO, DOGE, XRP, DGB, XMR, and 13 Ethereum Token |

| Minimum Loan Rate | Only 5% |

| Minimum Loan Amount | 95 USDT |

| Maximum Loan Amount | 9999999 USDT |

| Minimum Lending Amount | $100 |

| Maximum Lending Amount | $100,000 |

| KYC | No |

| Earn Interest | 10% APY |

| Terms for Earning Interest | Unlimited |

| Loan Extending Capability | Available |

| Withdrawal Lending Amount | Partially or Full |

| Multiple Deposits | Yes |

| Deposit and Withdrawal Fees | None |

4. Xapo Bank’s Bitcoin-Backed Loans

In the growing world of crypto lending, Bitcoin-backed loans offer a smart way for investors to unlock liquidity without selling their assets. If you need access to cash but want to keep your BTC exposure, Xapo Bank provides a regulated and secure solution.

What Are Bitcoin-Backed Loans?

Bitcoin-backed loans allow you to borrow money using your Bitcoin as collateral. Instead of selling your BTC, you lock it as collateral and receive cash while maintaining ownership and avoiding potential tax events.

Use Code CPD-FQK-UCF to get a 1-1 Account manager.

Xapo Bank: Regulated Crypto Lending You Can Trust

Xapo Bank is a licensed private bank, regulated Virtual Asset Service Provider (VASP), and licensed money lender. Through its lending division, Xapo Credit Limited, it offers Bitcoin-backed loans with clear terms and fast access to funds.

Loan Amounts

Borrow up to $1,000,000 USD based on your Bitcoin holdings and account history.

Loan-to-Value (LTV)

Conservative LTV ratios between 20% and 40%, reducing risk of liquidation.

Flexible Terms

Loan durations range from 1 to 12 months, allowing you to choose a repayment schedule that fits your financial strategy.

Interest Rates

Competitive annual rates starting around 10%.

No Hidden Fees

No setup charges, and no penalties for early repayment—only the agreed interest.

Secure Custody

Your BTC is stored securely and is never lent out or rehypothecated.

Instant Loan Disbursement

Once approved, funds are instantly credited to your Xapo Bank account.

Easy Access to Funds

Spend or transfer your loan via:

- Bank transfer (USD, EUR, GBP)

- Crypto transfer (BTC, USDT, USDC)

- Lightning Network or UMA

- Xapo debit card

Why Choose Xapo Bank?

Xapo offers a regulated, secure, and efficient way to access fiat liquidity without giving up your Bitcoin. With flexible terms, competitive rates, and no unnecessary fees, it stands out as a strong choice for long-term Bitcoin holders seeking short-term cash.

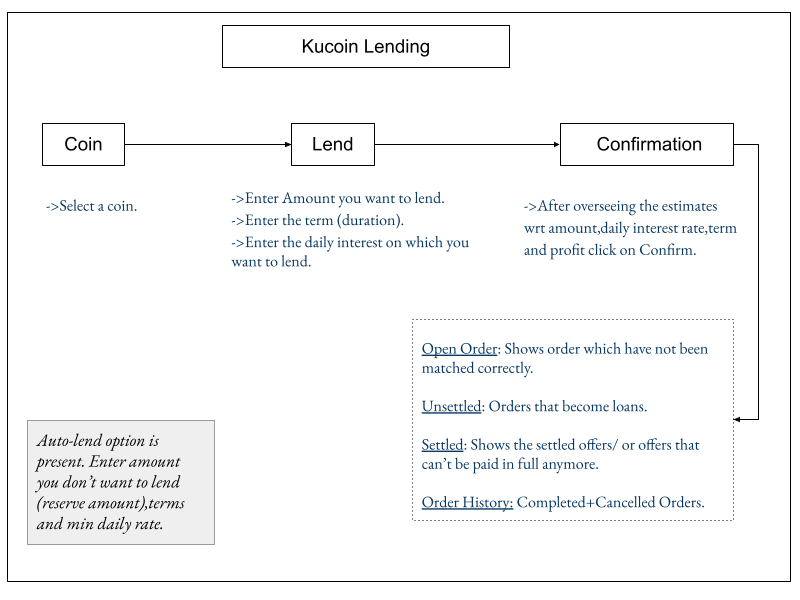

5. Kucoin Lending

Kucoin is a global cryptocurrency exchange established in 2017. Kucoin Lending provides an easy-to-use platform for lending and borrowing crypto assets and invites new investors to lend their assets in a low-risk environment. To learn more, read Kucoin Review.

KuCoin Crypto Lending

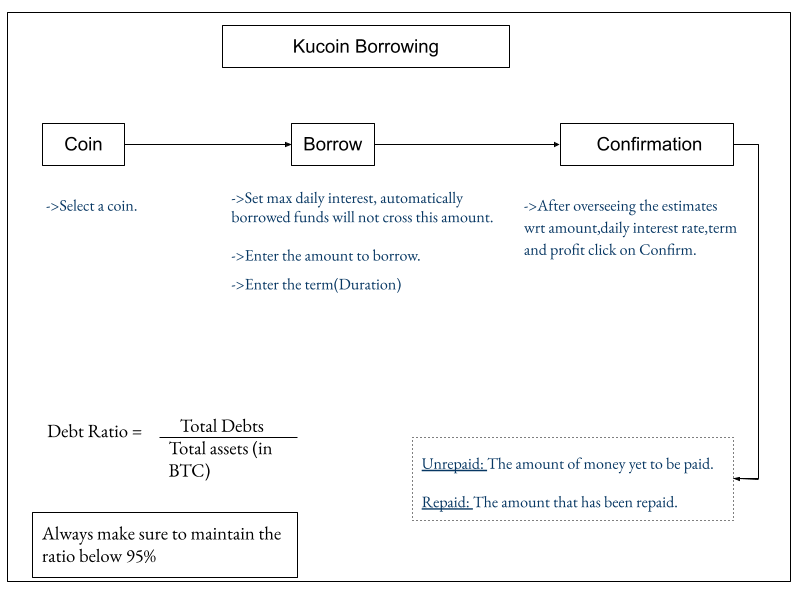

Kucoin Borrowing Process

| Features | Description |

|---|---|

| Accessible | Across all platforms: Web, Android, and iOS. |

| Tokens Supported | All popular tokens. |

| KuCoin Interest Rate | 0 – 0.2% |

| Duration | 07,14,28 days |

| Order when borrowing | FOK: Executed immediately and completely or not at all. IOC: Executed all or part immediately, and any unfilled portion will be canceled. |

| KuCoin Borrow Limit | You can borrow up to 9 times the principal in the margin account. |

| Payment | Need to be completed before the due date. |

| Penalty for Overdue | If the Debt Ratio is >95%, System sends a liquidation alert. If the Debt Ratio touches 97%, the system will automatically liquidate the collateral. |

| Automatically Renewed Rule | Triggers itself on the Borrower’s side due to insufficient funds to pay off a loan The system borrows assets = remaining debt principal+interest. Fail: It will fail if the debt ratio is greater than 96%.or the token has been delisted from the market. |

| KuCoin KYC | Not Required. |

| Kucoin Fees | 5% of accrued interest as fees.10% as an insurance fund. |

Note:

- If there is a failure in auto-renewal, the system will start to partially liquidate the coin of the highest value estimated in BTC until it repays off the debt.

- When a borrower’s debt crosses the 100% mark, all withdrawal and trading activities of that account are suspended.

6. Crypto.com

Crypto.com is a crypto application that provides products savvy to the field of cryptocurrency. You can buy/ sell or earn/ borrow, opt for a wallet facility, and trade in the native exchange. To learn more, read Crypto.com Review.

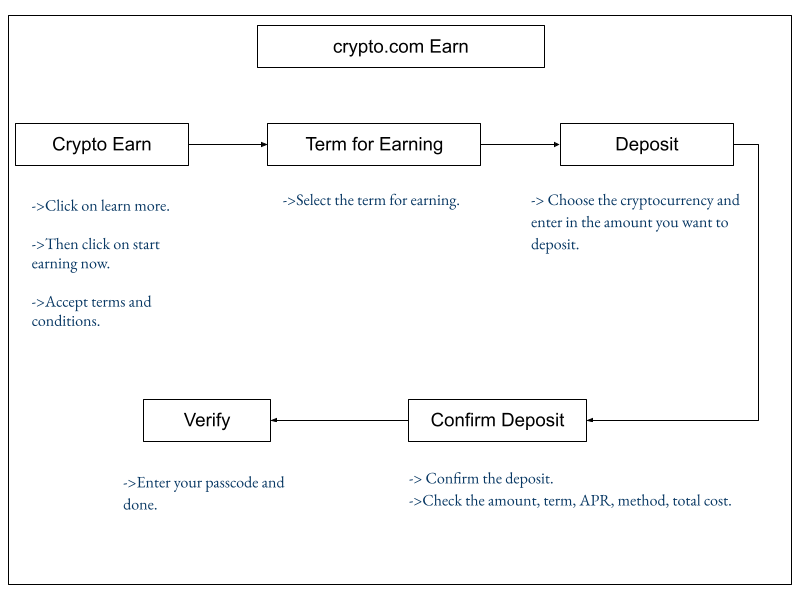

Crypto.com Lending

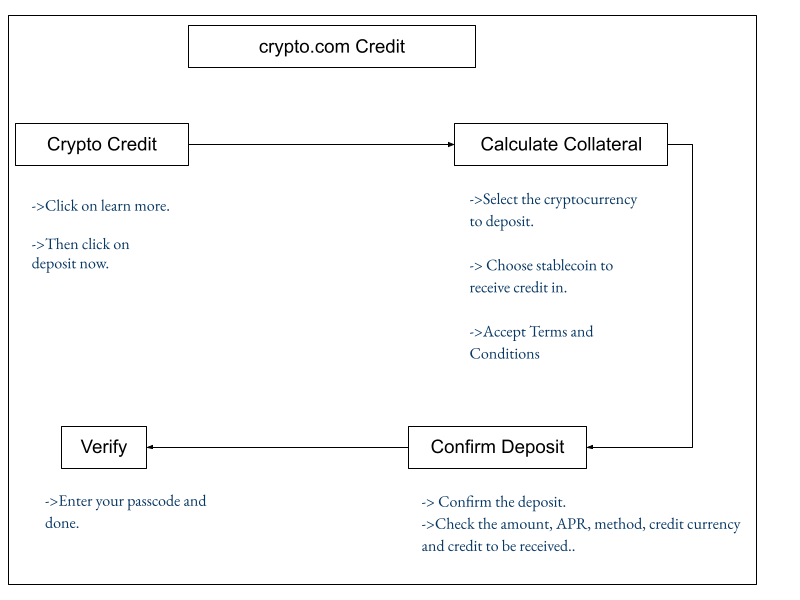

Crypto.com Credit Process

| Features | Description |

|---|---|

| Accessible | Across mobile platforms (iOS and Android). |

| Crypto.com Security | Multi-Factor Authentication. Whistlisting is mandatory. ISO/ IEC 27701:2019, CCSS Level 3, ISO/ IEC, 27701:2013, PCIDSS v3.2.1 Level 1 |

| Crypto.com Insurance | Holds cryptocurrency insurance of about $360M |

| Tokens Supported | Major tokens are supported everywhere. However, some tokens have restrictions in certain areas. |

| Eligibility for Earn | All users except citizens and residents of Hong Kong SAR, Switzerland, or Malta. |

| Holding Term for Crypto Earn | Three options: Flexible, 1 month, 3 months. |

| Interest Earn | After the deposit, interest starts accruing immediately except for flexible terms. |

| Repayment Deadline | 12 months from the start of the credit term. |

| Borrow Tokens | TUSD, PAX, USDC or USDT |

| Collateral Token | Multiple cryptos are supported. |

| Eligibility for Crypto Credit | All approved users except for citizens and residents of France, Germany, Hong Kong SAR, Malta, Singapore, Switzerland, United Kingdom, or the United States of America. |

| Collateral Health | Denotes the risk of the collateral getting liquidated. |

| Liquidation of Collateral | Collateral Health is critical, and LTV goes beyond 85% of the threshold. |

| Minimum Loan | 100 USD equivalent stablecoin. |

| Maximum Loan | 1,000,000 USD equivalent stablecoin. |

| Crypto.com KYC | Required. |

| Crypto.com Fees | No fees. |

Note:

- Crypto.com also provides Crypto.com lending, which is different from crypto credit as lending is supported on the exchange while credit is supported on the mobile app.

- More or less, the dynamics are the same except for multiple loans supported on Crypto Lending and the provision of taking out crypto loans in BTC.

7. Figure – Crypto Backed Loans

Unlock Cash Without Selling Your Crypto: Borrow cash using your Bitcoin (BTC) or Ethereum (ETH) as collateral without having to sell your assets.

Flexible Borrowing Options: Access up to 75% of your crypto’s value with fixed interest rates starting at 12.5% (APR: 12.5%-16.73%). Deferred interest payments are also available.

Loan Amount and Eligibility:

- Minimum loan amount of $5,000 (no minimum for international borrowers).

- Eligible collateral: BTC or ETH.

- Disbursement options: USD or USDC.

Loan-to-Value (LTV) Ratio:

- Max initial LTV: 75%

- Max LTV: 90%

Loan Term and Fees:

- Term: 3 months

- No prepayment fees, allowing flexibility in repayment.

No Credit Score Needed: Your eligibility is based on your crypto collateral, not your traditional credit score. A soft credit pull ensures you’re in good standing with other lenders.

Fast and Simple Process:

- Create your account.

- Deposit your crypto as collateral.

- Get cash instantly, directly to your bank account.

Flexible Payment Terms: Choose between interest-only payments or deferred interest until maturity.

No Impact on Credit Score: Borrow confidently without worrying about your credit report.

Nationwide Availability: Available in most states and internationally through Figure Markets Credit LLC.

Trusted and Proven: Figure has originated over $7B in loans, including crypto-backed loans, without losing coin assets or pausing withdrawals.

8. AAVE

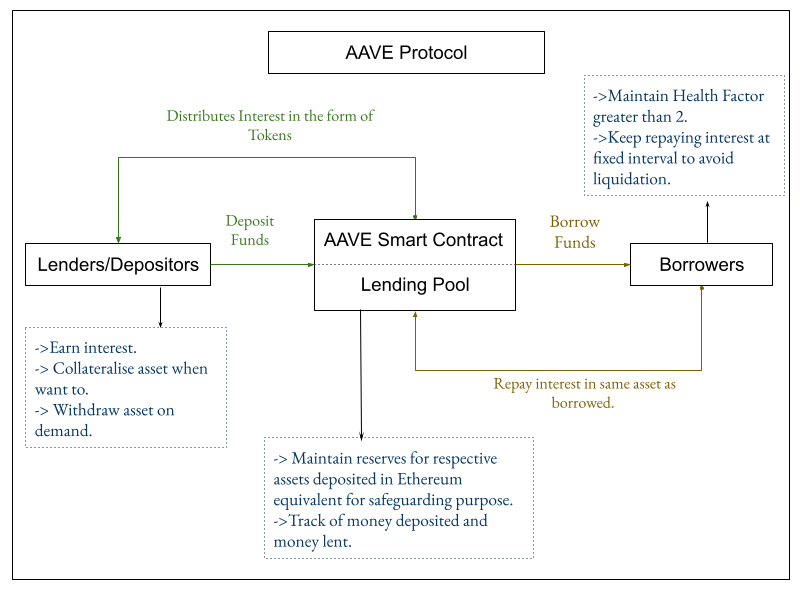

Aave is an open-source market protocol for lending and borrowing which is decentralized and non-custodial.

The protocol operates as a set of multiple smart contracts in place, having the following entities in general.

- Lenders: Provide liquidity to the pool by depositing crypto assets.

- Borrowers: Borrow the funds from the pool and pay the interest incurred.

- Interest Rate: Decided algorithmically, the lesser the funds in the pool, the higher the interest rate for the borrower.

- Reserve: Takes the deposited crypto assets and stores them as an Ethereum equivalent as total liquidity. This is a preventive measure so that the lender can always withdraw assets at any time.

The loans are not matched per lender or borrower; rather, it depends on the funds available in the pool.

Moreover, since smart contracts are coded contracts, anyone can buy the collateralized asset in case of failure of repayment at a discounted price.

AAVE Protocol: An Overview

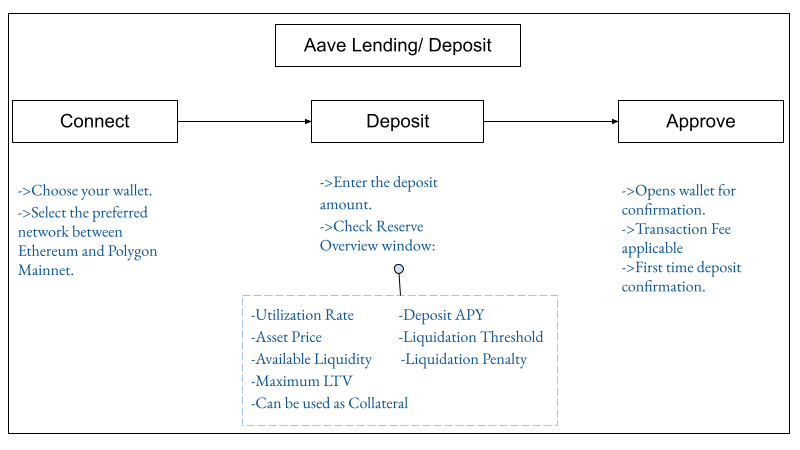

Aave Crypto Lending

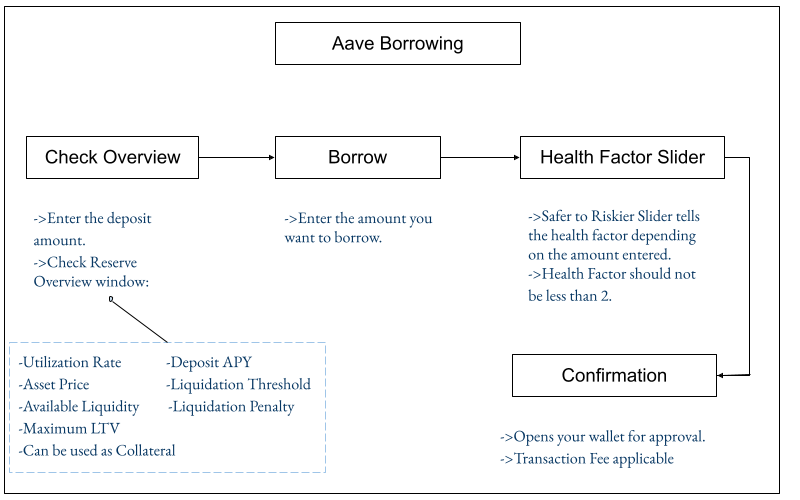

Aave Borrowing

| Features | Description |

|---|---|

| Accessible | Web Application |

| AAVE Security | Security Audits are held by 3rd Party auditors and reports made public. Funds are stored on non-custodial smart-contract on Ethereum Blockchain. Bug Bounty offers great incentives. |

| Tokens Supported | Ethereum based tokens are supported, including stablecoins. |

| AAVE Markets | Aave V1 Market, Aave V2 Market, AMM Market, Aave Polygon Market. Each market has features with different advantages. |

| AAVE Token | ERC-20 compatible token. Taken as 1:1 ratio with the underlying asset which is deposited. Snapshot feature to support the gas-less transactions and one transaction approval/ transfer. |

| Duration/ Lock-in Period | No lock-in period. |

| Interest Earned Availability | Tokens are distributed to the holders by increasing their wallet balance. |

| Borrowing Rates | Stable rates: The rates do not change for the short term but may get rebalanced as per market change in the long term. Variable Rates: Changing rates are lower than stable rates but can change with factors like deposit, withdrawal, repayments, or liquidation. |

| Debt Tokens | Interest accruing tokens. For stable rates: Stable debt tokens.For variable rates: Variable debt tokens. |

| Minimum or Maximum Deposit | No limit on either. However, small deposits may incur a transaction fee that could be higher than the expected earnings. |

| Risks involved. | Smart contract risks such as code bugs and liquidation risks. |

| AAVE Transaction Fees | As per Ethereum, Blockchain transactions depending on network status and transaction complexity. |

| Liquidation Condition | When the Health Factor goes below 1, the loan can be liquidated. |

| AAVE Flash Loans and interest | Flash loans are possible with depositors getting a share of 0.9% of the flash loan volume. |

| KYC | Not required. |

| AAVE Governance | Improvements and policy changes etc., related to risk parameters are discussed and voted upon by the holder holding the AAVE token. |

Note: AAVE is a protocol-based crypto lending platform. It has many native terminologies that one must try to understand before jumping directly into lending or borrowing.

Best Crypto Lending Platforms: Conclusion

There is a huge growth in options available for cryptocurrency services. Do Your Own Research (DYOR) stands true when opting out for a particular platform or service. Therefore, it is necessary to understand how you can earn passive income on your assets. Hence, you can go with Nexo if you’re looking for high interest rates and security.

Moreover, if you don’t want to withdraw your funds from your trading account, then Binance or KuCoin can be your go-to platforms. In addition, if you wanna do a complete deep dive in DeFi, the head for all the vast features of AAVE.

Frequently Asked Questions

What is the crypto lending price?

Crypto Lending price is associated with many fees such as origination, network, transaction, etc. Keep in mind that the platform may not charge for the service, but withdrawing/depositing fees is still applicable.

Is KYC required for all lending platforms?

No, KYC is not required for decentralized platforms.