In this article, we will review CoinTracking, which enables you to examine your trades and helps you in generating real-time tax reports. It calculated your coins’ overall value, realized and unrealized gains, profits, and losses, and generate tax reports.

Whether you have just started investing in cryptocurrencies or have been trading like a pro for a long time, CoinTracking helps you track all your transactions in real-time.

Earlier, crypto traders had to use custom-made spreadsheets to track their transactions if they wished to keep up with their taxes. This was before CoinTracking went online in 2013.

They minimize the use of paperwork burden by using automation.

The tax software automatically downloads transactions of traders from their respective exchanges. Then it generates tax reports which are easy to read and concise that explain how much is owed.

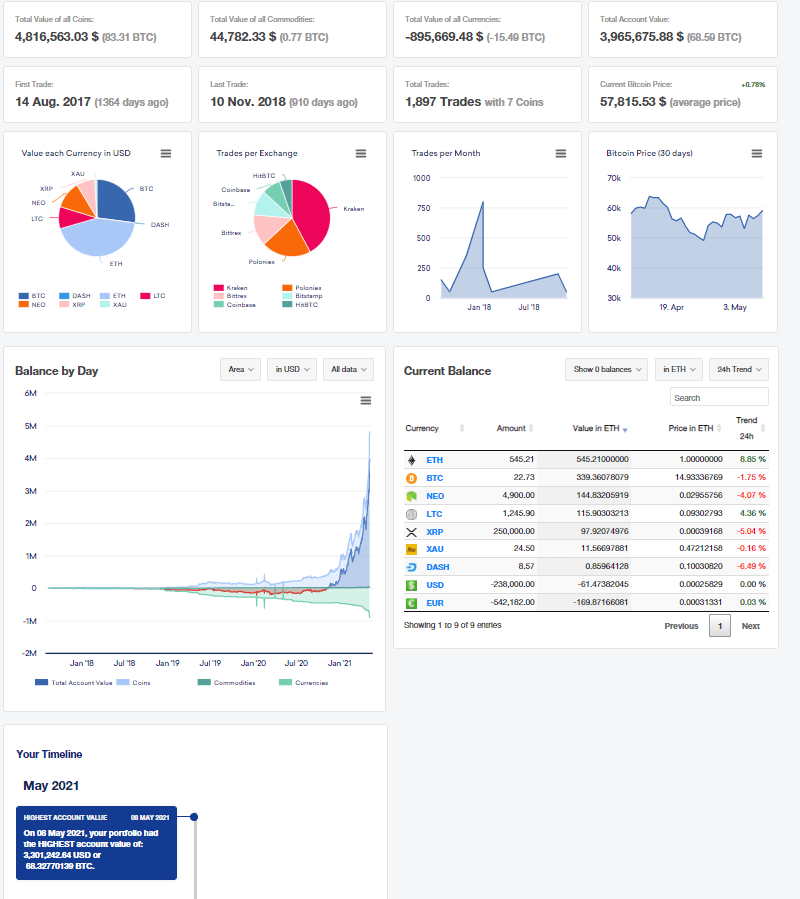

Another key use case for the software is Portfolio Management. Professional traders who use numerous crypto exchanges rely on CoinTracking to visualize their funds’ status across all their accounts. Also, tax professionals and fund managers use it to set up profiles for each of their clients.

CoinTracking Review: Summary

- CoinTracking is a cryptocurrency tracking and tax reporting software.

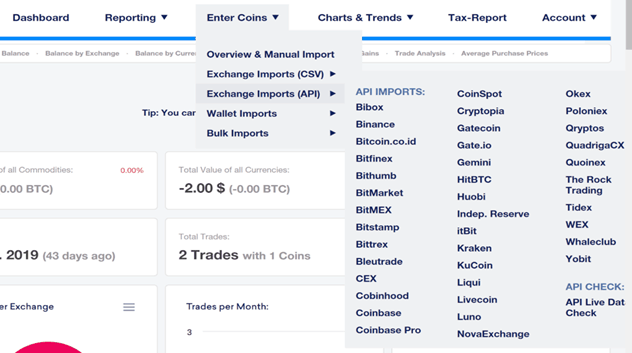

- You can import trades from more than seventy-five exchanges as CSV uploads or API transfers.

- CoinTracking supports more than 100 countries.

- They offer twenty-five customizable crypto reports along with interactive charts for trades and coins.

- You can also seek professional help whenever you need help with a complex tax issue or simply wish to have an expert check your tax report before its submission to the tax office.

- CoinTracking Corporate offers a unified interface for crypto companies dealing with multiple exchanges. It eliminates the inconvenience of switching between different portfolios of cryptocurrency.

- They provide complete data and API encryption along with two-factor authentication. The data is stored securely on their servers.

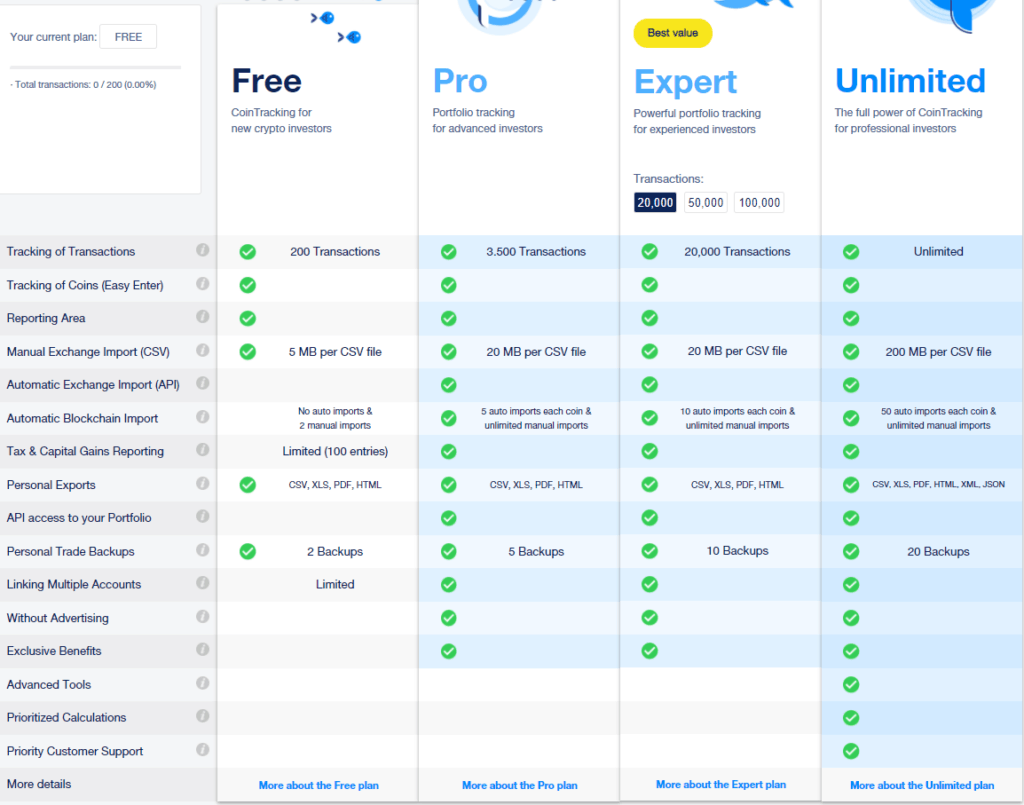

- They offer four plans – Free, Pro, Expert, and Unlimited and accept nine payment methods.

- CoinTracking application is available in both Android and iOS and supports multiple languages.

- They also provide extensive customer support.

CoinTracking Review: Features

1. Trade Imports

CoinTracking allows you to import your data from more than seventy-five exchanges and more than twenty wallets. They also provide legacy support for closed exchanges.

The two primary methods you can use to copy data from your cryptocurrency exchange account to the platform are CSV uploads and API transfers.

The Free plan comprises manual CSV uploads, whereas all upgraded users can connect their exchanges through API. This way, their data updates automatically every day.

CoinTracking enables you to export every report into formats like PDF, CSV, Excel, and more. You can also download all charts as SVG, PNG, PDF, or JPG. They provide many tax exports like TaxACT, WISO, Form 8949, Drake, and TurboTax.

Additionally, Instead of linking an exchange account, you can import data directly from your cryptocurrency wallet.

2. Generate Tax Reports

It generates tax reports for more than 100 countries. You can also obtain capital gains, income mining, etc. Along with this, it also offers export for CPS and the tax office.

Several cryptocurrency traders can easily use CoinTracking to do their taxes. This is because the interface is effortless to understand, even if you are not a professional accountant.

Since 2013, they have supported the cryptocurrency community by encouraging beginners to create tax reports for free. If someone has made 100 or fewer trades during the entire year, he/she can create as many tax reports as they like.

Since there is not any particular limit to the number of reports you can make, it concludes that you can recalculate your crypto taxes as many times as needed. This allows you to experiment with our software and learn how it works.

You can do various other things, such as trying several different accounting methods and adding additional data to your tax report. If any sort of mistake occurs, you can simply restore the data from a backup.

3. Personal Analysis

As you obtain trading experience with cryptocurrency, you would notice yourself using three or more crypto exchanges. The newly released coins generally appear on smaller exchanges first before the larger ones list them. The more significant number of exchanges you use, the more work you need to acquire the information required to file your taxes correctly.

CoinTracking streamlines all this and helps you save your entire trading data in one place. There are 25 customizable crypto reports along with interactive charts for trades and coins. You can also get profit/loss and audit reports along with realized as well as unrealized gains.

4. Coin Charts and Trends

CoinTracking includes chart history for more than 10,298 coins. It always offers the latest prices for all coins along with top coins by trades and by volume. You can obtain coin trends statistics and analysis.

They allow you to identify all the transactions that you require to annotate quickly. You can use filters in determining all of your mining income deposits. For example, once all other transactions are filtered out, you can label the remaining transactions appropriately.

5. Professional Help

A professional team is there to give you the assistance you need whenever you need help with a complex tax issue or simply wish to have an expert check your tax report before its submission to the tax office. You can share your data with crypto tax advisors and obtain tax reviews from the full-service team.

Since all the accountants we work with have adequate experience operating with our software, they can also help you import your data from exchanges and other such technical tasks.

You can share your account with tax professionals who subscribed to CoinTracking Corporate with the help of a few clicks. This will save you and your accountant significant time while transferring data.

Apart from tax professionals, there are various other companies, like fund managers, with whom you can share your account for a finer collaboration.

Our international crypto tax consultant database assists you in finding tax experts located around the world. This list is easy to navigate and links to tax laws in more than 75 different countries. This information is provided free of cost to anyone who needs it. You do not need to sign up for CoinTracking if looking up tax laws and accessing the database is all you need.

CoinTracking for Crypto Companies

To make life easier for businesses and firms involved in cryptocurrencies, our team has created CoinTracking Corporate.

With the help of CoinTracking Corporate, you can set up accounts for every customer of yours and manage their crypto tax data in a single interface that is relatively easy to use. Using this CoinTracking accounts for your employees can also be created and configured.

CoinTracking is the only software tool you require to expand your service menu and start serving cryptocurrency traders. Cryptocurrency CPAs prefer CoinTracking Corporate as it is effortless to use, is affordable to many, and can operate with all major cryptocurrency exchanges.

Alike CPAs, crypto fund managers often deal with multiple cryptocurrency clients at the same time. CoinTracking Corporate provides a unified interface that eliminates the inconvenience of switching between different portfolios of cryptocurrency.

The tax features assist in determining the consequences of tax of different types of trading strategies.

Various tax firms that specialize in cryptocurrency can benefit from CoinTracking. Any of the accounts that you obtain while buying CoinTracking Corporate can be assigned to individual employees. This enables your entire tax firm to share data safely, quickly, effectively, and efficiently.

How to use CoinTracking for taxes?

Here are the steps to use CoinTracking for taxes.

Total Time: 5 minutes

Account Creation

Once your account is created, you will automatically be enrolled in CoinTracking Free. After that, you need to put in a user name, password, and email address. The limit of CoinTracking Free is 200 transactions. You have the option to upgrade as per your requirement to Pro, Expert, or Unlimited for other advanced featured, including more API imports and transactions.

Import Your Transaction Data

The two ways of importing your data are: Manually via the CSV files or Automatically by using API synchronization. Refer to the Drop Down menus on the top of the CoinTracking website for further steps.

– CSV files. CSV stands for Comma Separated Values. A large number of crypto exchanges provide some type of CSV export option.

– API sync. Paid users can connect their exchanges to their CoinTracking account by setting up API connections for each of them. After linking, once a day, transaction data is synced automatically. Depending on the exchange, the process for creating an API link changes.

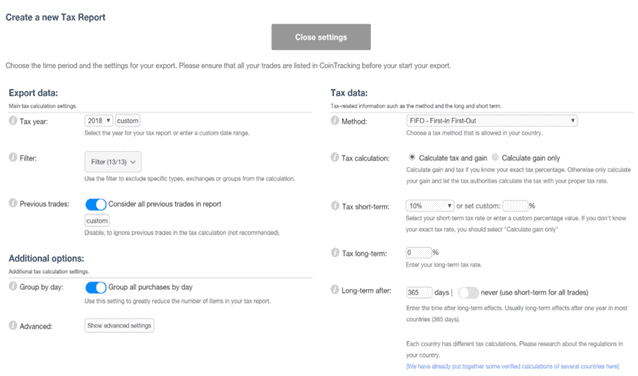

Create Your Tax Report

Once all your data is imported, you can create tax reports. Select the Tax Report and click the red Open Settings to create a new Tax Report button from the main menu. This will open the “Create a new Tax Report” page.

The field of Tax Year enables you to create tax reports for prior tax years as per your requirement. The Filter function is helpful in troubleshooting in case you get unexpected results as it allows you to filter out various types of transactions.

Using Advanced Settings, you can calculate margin trades and modify the way the transitions are grouped. You can also select from different cost basis accounting methods.

How to import a CSV file into CoinTracking?

This CSV import aims to import several transactions or edit your CoinTracking transactions locally and manually on your PC. If you choose to support your CoinTracking trades, you can opt for using the Trades Backup function because it is much faster.

Otherwise, you need to import the exported file into another CoinTracking account, both accounts must use the same language. To upload a CSV file into CoinTracking, you have to complete the following seven steps –

- Download the CSV file from the wallet or exchange.

- Open the CSV file using any spreadsheet editor, for instance, Google Sheets.

- Refer to the CoinTracker CSV format.

- Delete the columns that are no longer required by the format.

- Convert the remaining columns to the CoinTracker CSV format.

- Export the reformatted CSV file.

- Upload the reformatted CSV file to CoinTracker.

How to delete all holdings of CoinTracking?

You have the option to delete your trades on the Enter Coins page. Select a trade and then click on the Delete option. By doing so, you will remove this trade.

Multiple rows can be selected at once and across multiple pages using SHIFT + CLICK or CTRL + CLICK. Next to the Trade Table, there is an option of deleting all trades from an exchange in one go.

Here, you can also delete all your trades in a given period or remove your entire trades.

You can also delete an entire account in the right box on the Settings page. Click on Delete this Account to delete an account that includes all data and trades. You cannot recover the deleted accounts.

CoinTracking Review: Supported Exchanges and Wallets

CoinTracking allows you to copy your data from more than seventy-five exchanges and more than twenty wallets. They also provide legacy support for closed exchanges.

They support the following wallets –

CoinTracking Review: Security

The history of CoinTracking goes back to the year 2013 when Bitcoin was still trading for $100. This software is yet to be compromised in any way or hacked. You can register anonymously.

They provide complete data and API encryption along with two-factor authentication. You can create and restore trade backups without any requirement of accessing your exchanges.

They have developed secure transaction import processes for exchanges like Gate.io and itBit, which do not provide the ability to create read-only API keys to their users.

All the user statistics are calculated without using personal details. The data is stored securely on their servers.

CoinTracking Review: Pricing

CoinTracking offers four plans – Free, Pro, Expert, and Unlimited. A detailed comparison among the four plans is shown below.

| Plans | Pro | Expert | Unlimited |

|---|---|---|---|

| One Year | 12.99 USD /month | 19.99 USD /month | 69.99 USD /month |

| Two Years | 9.99 USD /month | 15.99 USD /month | 54.99 USD /month |

| Lifetime | 449.00 USD | 1099.00 USD | 6699.00 USD |

Accepted Payment Methods

- Bitcoin

- PayPal

- SEPA

- Crypto.com

- CoinPayments

- VISA

- MasterCard

- American Express

- GPay

CoinTracking Review: User Experience

CoinTracking application is available in both Android and iOS to help you manage your accounts on the go.

The website supports four different types of modes – Light, Dimmed, Dark, and Classic. Additionally, it supports ten different languages.

You can customize your dashboard according to the different templates.

CoinTracking Review: Customer Support

CoinTracking offers live chat support on their platform. You can also connect with them on Twitter.

To get started with their platform, you can go through their Youtube Channel. The FAQ section on their website has answers to the commonly asked questions by their users. You can create support tickets at the CoinTracking support desk and also track its status.

Additionally, they have communities on four platforms –

CoinTracking Review: Comparison with other products

One of CoinTracking biggest advantages over other crypto tax software is its reliability. Other software-based crypto tax products don’t receive regular updates and this is why they often generate errors or don’t work as expected.

Exchange compatibility is another strong point. Some cryptocurrency tax calculators don’t integrate with exchange APIs at all and those that do only support 10-15 exchanges. Currently, CoinTracking supports 36 exchange APIs.

CoinTracking’s new analytical features are a nice bonus as well. The IntoTheBlock-powered charts let you look for signs of altcoin scams when evaluating coins, while the Google sheets plugin lets CoinTracking users create their own custom charts inside of Google Sheets or Excel.

A crucial point when choosing software for cryptocurrency tracking and generating tax reports is its exchange compatibility.

A few crypto tax calculators do not integrate with exchange APIs, and those that do, not support more exchanges. Currently, the number of exchange APIs that CoinTracking supports is 36. The new analytical feature is a plus.

CoinTracking Review: Pros and Cons

Pros

- CoinTracking is one of the most reliable softwares for tracking and generating tax reports.

- Exchanges constantly add new features, modifying their fee structure and altering their APIs. CoinTracking always stays current and up to date regarding all the changes implemented by crypto exchanges.

- CoinTracking is the only crypto tax software that offers such distinguished Portfolio Management features.

- The exchange compatibility, ease of use, trading chart features, the performance of CoinTracking is unmatched.

- Another advantage is that for beginner crypto traders, CoinTracking comes with a free plan.

Cons

- You need a paid account for using the API import feature. This means that if you are using an exchange that doesn’t have a CSV export feature, say Bithumb, an upgrade is required for you to do your taxes.

CoinTracking Turbotax

CoinTracking has integrated with TurboTax to make your tax filing experience, including cryptocurrencies, seamless. You can file unlimited transactions. You can also check the steps in detail.

CoinTracking Review: Conclusion

If you use an exchange that has robust export features, you’ll be hard-pressed to find a better crypto tax calculator than CoinTracking. However, before you sign up, you should be aware of the fact that not all cryptocurrency exchanges have good data export features. Traders that use new or niche exchanges might run into frustrations. Some cryptocurrency exchanges don’t offer API services, for example. Others don’t offer any way to export data that’s more than 30 days old.

Frequently Asked Questions (FAQ)

Is CoinTracking safe?

Yes, CoinTracking is entirely safe. It went online in 2013 and has not been compromised in any way or hacked since then. The data is stored securely on their servers and provides complete data and API encryption along with two-factor authentication. Your details are not used for calculating user statistics.

How much does CoinTracking cost?

CoinTracking offers four plans – Free, Pro, Expert, and Unlimited. The number of transactions, CSV file upload size, number of personal trade backups, and automatic blockchain imports differ across all four plans.

![Profittradingapp For Binance Review [Important Read] 8 Profittrading App For Binance Review](https://coincodecap.com/wp-content/uploads/2021/11/Desktop-2021-11-28T193734.060-768x432.png)