The adoption and popularity of crypto have been on the rise, as evidenced by several reports. Hence it is essential to know the ways you can earn interest on your crypto holding. Celsius Network went bankrupt amid the present bear market and hence, in this article, we’ll talk about the top 4 Celsius alternatives.

Table of Contents

Summary (TL;DR)

| Nexo | YouHodler | Crypto.com | MyCointainer | |

|---|---|---|---|---|

| Interest Rates (APY) | 8% APY on BTC and up to 12% APY on Stablecoins | Up to 5.5% APY on BTC & ETH up to 12.3% APY on Stablecoins | 6.5% APY on BTC & up to 12% APY on Stablecoins | BTC will be added soon, ETH2 8%, up to 10% on stablecoins |

| Assets Supported | 18 | 22 | 70 | 144 |

| Min. Amount | No Minimum | US $100 | US $100 | 10 EUR |

| LTV ratio | 25%-50% | 90% | 50% | 25%-60% |

| Lock-in-Period | No | No | No | No |

Earn interest while HODLing

Recently investment product issuer 21Shares revealed its partnership with German online brokerage, Comdirect, allowing users to store physically-backed crypto exchange-traded products (ETPs) into their savings and retirement accounts. Moreover, Woori Financial Group is also said to be setting up a custody joint venture with South Korean Bitcoin exchange and blockchain service provider, Coinplug.

Although market volatility remains prevalent, cryptocurrencies seem to be gaining traction for a range of reasons.

Cryptocurrency relies on blockchain technology that allows for a decentralized financial system. This would mean that transactions and payments are likely to be more secure as financial institutions no longer govern them and are run by protocols. Furthermore, as the world adapts to be more digitally advanced, the adoption of digital currencies is timely and is said to be the future of finance.

While investing in cryptocurrency is indeed already a form of investment, there are other ways to not only alleviate the adverse effects of market decline but improve the productivity of crypto assets. One such method is crypto lending, where investors can lend out cryptocurrency and earn interest from it.

Also, read 9 Best Crypto Lending Platforms.

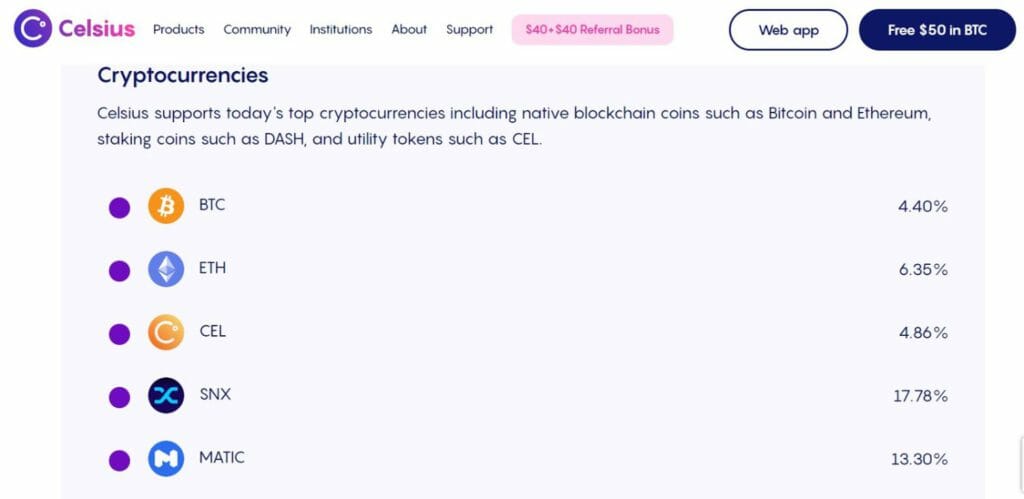

To date, many platforms offer this – and other beneficial – services that help individuals do more with their crypto assets. A platform to note is Celsius.

What is Celsius Network?

Celsius Network was founded in 2017 and utilizes blockchain technology to offer a range of products and services to replace the current traditional financial system. As such, crypto investors can earn interest by depositing their digital assets into the Celsius Wallet or borrowing fiat currency using their crypto as collateral at lower interest rates.

There are no withdrawal fees, lock-ups, and minimums required. The platform is also known to be working on a credit card that allows individuals to earn weekly rewards on crypto collateral.

However, buying crypto directly on Celsius Network may be expensive. In addition, the website does not offer a dedicated section with guides and resources for beginner investors who wish to learn more about crypto. Thus, individuals may want to consider other alternatives to Celsius.

MyCointainer: 1st Celsius Alternative

MyCointainer staking platform was launched in 2018 by Bartosz Pozniak. Headquartered and legally registered in Estonia, the service supports 144 assets and plans to add its own coin in H2 2022.

It is a no-frill cryptocurrency exchange with a range of features allowing users to earn cryptocurrency rewards in multiple ways: PoS, masternodes, cold staking, crypto cashback, airdrops, and giveaways. Users can pick a node and delegate their coins (no lock-in, your assets stay in your wallet) to earn up to 101% APY. Track your daily rewards in the MyCointainer app that is available for both iOS and Android.

The platform also offers a power subscription that can enable you to earn 100% of your rewards by not paying any subscription fees. The Power plan comes in three versions and also comes with various offers and VIP giveaways.

More information about APYs on MyCointainer’s crypto staking page!

| Pros | Cons |

| Rewards are generated daily | Reward and withdrawal fees |

| A licensed, secure platform | Not well-known yet |

| Fiat currency options | |

| Mobile apps available for both iOS and Android | |

| A no-frills, user-friendly platform |

Nexo: 2nd Celsius Alternative

Nexo is said to be one of the biggest crypto lending platforms globally. It was launched in 2017 and offers a multitude of products ranging from interest accounts where users can earn interest on their crypto or fiat assets deposited, to crypto loans and even the Nexo Card, a debit card that grants users access to the Crypto Credit Line that they can spend without selling their crypto. To learn more, read Nexo Card review.

Nexo supports 18 crypto assets and a slew of fiat currencies such as the USD. It also offers users up to 12% APY for those who choose to earn in Nexo tokens. Here are the effective interest rates for Nexo:

Nexo: Pros and Cons

| Pros | Cons |

|---|---|

| No withdrawal and transaction fees | High borrowing rates |

| Interest is paid daily | Insurance only applies to assets that are kept in cold Ledger Vault wallets |

| Comprehensive user interface | Not transparent with where they are operating out of |

Youhodler: 3rd Celsius Alternative

The Switzerland-based crypto lending platform was founded in 2017 and offered several financial services. It allows users to trade crypto and fiat currencies, invest in interest savings accounts, and take loans with minimal interest rates. To learn more, read the YouHodler review.

Users can earn up to 12.3% APY – which would be deposited weekly – on 22 supported currencies such as Bitcoin (BTC), Ethereum (ETH), Uniswap (UNI), and Tether (USDT), to name a few. The effective interest rates are as follows:

Moreover, Youhodler’s mobile application offers a detailed guide on crypto conversion to allow individuals to exchange funds quickly and easily. The resource dashboard has all the information that users need to know, from the basics of crypto exchange to the platform’s advanced tools. Plus, it even has a blog section where users can read up on the latest crypto news and other website-related updates.

YouHodler: Pros and Cons

| Pros | Cons |

|---|---|

| High-interest rates | High fees and interest rates on long-term loans |

| Fiat currency options | The platform is not available in China and the U.S. |

| Availability of iOS and Android mobile applications | Lack of insured custodian for user funds |

Crypto.com: 4th Celsius Alternative

Headquartered in Hong Kong and founded in 2016, Crypto.com allows individuals to buy, sell, trade, and spend cryptocurrencies. Users can purchase over 100 cryptocurrencies, manage their Crypto.com Visa Card, and make crypto payments quickly.

Additionally, users can lend out their crypto assets to earn up to 12% APY on their crypto assets passively and easily convert fiat currency with minimum fees. However, it is essential to note that less than 60 currencies are available in the U.S., and only 22 are available in every state. To learn more, read the Crypto.com review.

The effective interest rates are as follows:

The upside: Its DeFi Wallet is non-custodial so that users can have complete control of their private keys.

Also, read A Review of Crypto.com NFT Platform.

Crypto.com: Pros and Cons

| Pros | Cons |

|---|---|

| High-interest rates | Only 22 currencies are available outside of the U.S. |

| Offers fiat conversion with minimum fees | No desktop account access |

| Non-custodial DeFi wallet | Lack of transparency on where their funds come from |

Celsius Alternatives: Conclusion

With cryptocurrency gaining momentum in the current financial space, it is worth considering these platforms to boost the productivity of crypto assets. While Celsius Network is a great, user-friendly platform to use, other alternatives such as Hodlnaut, Nexo, BlockFi, Youhodler, and Crypto.com can help investors do more with their cryptocurrencies.