Opinion is rapidly establishing itself as a leading macro prediction exchange, with on-chain data showing over $5.5 million in cumulative fees, rising open interest nearing $72 million, and sustained growth in trading volume, liquidity, and active traders—signalling strong adoption of a decentralized economic forecasting market. In this article, we will explore Opinion Review.

Table of Contents

What Is Opinion?

- Opinion is building the “People’s Terminal for Global Economic Trading,” a next-generation prediction exchange that allows users to trade macroeconomic data, policy outcomes, and global signals directly, without relying on indirect proxy assets or expensive institutional platforms.

- The platform transforms economic beliefs into tradable markets, allowing users to express views on inflation, interest rates, employment data, and policy decisions as standardized financial instruments rather than speculative proxies like equities, crypto, or commodities.

- Opinion eliminates cross-market friction by unifying liquidity across prediction markets, enabling cleaner price discovery and reducing inefficiencies caused by fragmented liquidity pools that plague traditional and decentralized financial markets.

- By combining AI oracles, on-chain infrastructure, and DeFi composability, Opinion enables retail users, institutions, and global decision-makers to act as market economists, trading macro insights with clarity, transparency, and precision.

- Opinion represents the emergence of economic risk as a standardized asset class, bridging traditional macro trading instruments with permissionless access, creating a new financial layer where information itself becomes directly tradeable.

Opinion Review: Features and Products

- Opinion.trade (Prediction Exchange):

The core product is a live prediction exchange where users can create, trade, and resolve real-world economic markets, with prices representing the collective probability of outcomes such as rate decisions, CPI releases, or policy changes. - Opinion AI (Decentralized AI Oracle):

Opinion AI is a multi-agent decentralized oracle capable of resolving complex and unstructured data. It not only resolves markets but also assists users in creating permissionless markets by generating objective, verifiable resolution rules. - Opinion Metapool (Unified Liquidity):

The Metapool ensures deep, cross-market liquidity and resolution trust, enabling smoother execution and tighter spreads while reducing fragmentation across different prediction venues and markets. - Opinion Protocol (Universal Token Standard):

A universal token standard allows prediction markets to interoperate across platforms, making Opinion markets composable with DeFi protocols and enabling prediction assets to be reused across the broader financial ecosystem. - Integrated Market Analytics:

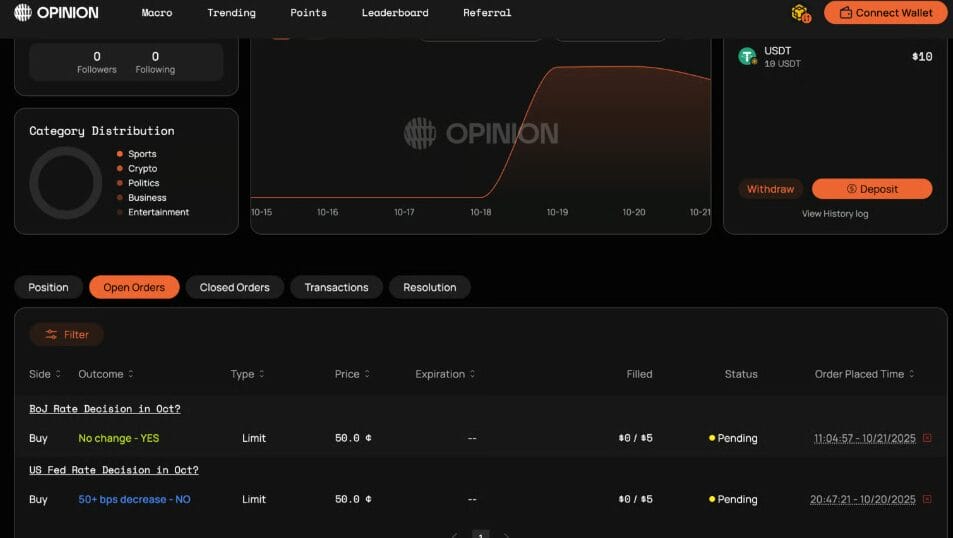

Opinion provides real-time graphs, market rules, probability distributions, and price history, helping traders analyze economic signals intuitively without requiring institutional data terminals or advanced financial tooling. - Order Book–Based Trading:

Markets use a transparent order book model with limit and market orders, allowing traders to provide liquidity, control execution prices, and engage in professional-grade trading strategies.

Opinion Review: Fees

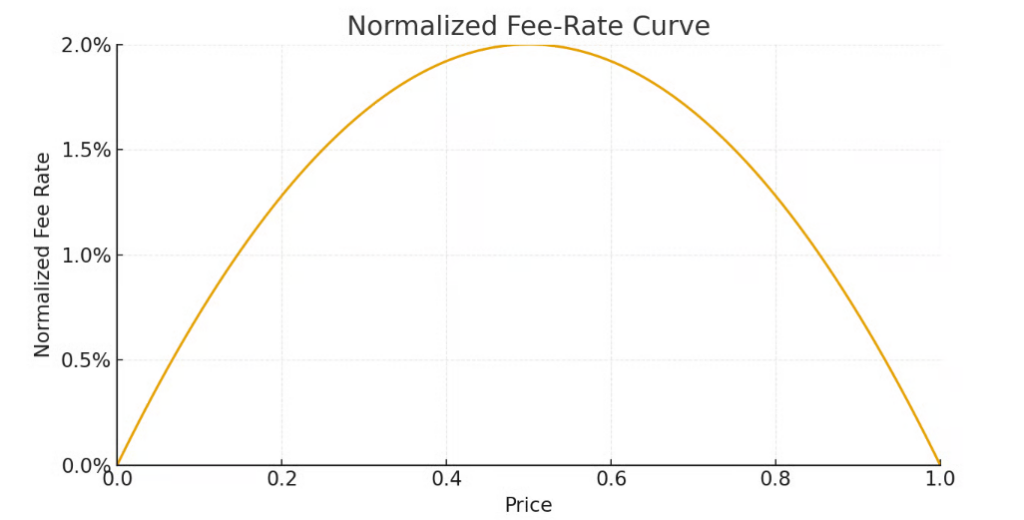

- Opinion’s fee model is designed as a market-shaping mechanism rather than a simple cost, encouraging conviction-based trading, reducing noise, and supporting accurate price discovery across prediction markets.

- Only takers pay trading fees, while makers trade fee-free, meaning users placing limit orders that add liquidity to the order book generally pay zero fees, incentivizing healthy liquidity provision.

- Fees range from 0% to 2% depending on market uncertainty, with higher fees applied when probabilities approach 50% and lower fees when outcomes become more certain, aligning costs with informational risk.

- Discounts can stack up to 100% fee reduction, although a minimum fee of $0.50 applies, ensuring fairness while still heavily rewarding active, informed traders over time.

- Fees are denominated in the settlement asset (e.g., USDT), and Opinion covers on-chain gas costs for trade matching and settlement, reducing hidden costs and improving capital efficiency for users.

Opinion Review: Mobile App

- Opinion.trade is fully accessible through mobile-compatible Web3 wallets, allowing users to trade seamlessly via mobile browsers without sacrificing functionality or security.

- The platform supports major wallets including Binance Wallet, OKX Wallet, MetaMask, Backpack, and Coinbase Wallet, ensuring broad compatibility and easy onboarding for both crypto-native and newer users.

- Mobile users can browse markets, place limit or market orders, monitor positions, and manage open orders, making Opinion suitable for active traders who require flexibility and real-time access.

- Wallet-based authentication removes the need for traditional account credentials, improving security while enabling fast interaction across devices without centralized custody of funds.

- Mobile trading maintains full access to analytics, P&L tracking, and order management, ensuring that usability and performance are not compromised outside desktop environments.

Security

- Opinion is built on a non-custodial, on-chain architecture, meaning users retain full control of their assets through their wallets, eliminating centralized custody risks common in traditional exchanges.

- Opinion AI serves as the primary oracle for market resolution, applying decentralized, multi-agent verification to resolve complex and unstructured data transparently and objectively.

- Market-specific resolution rules are clearly defined and publicly visible, reducing ambiguity and dispute risk while ensuring participants understand exactly how outcomes will be determined.

- On-chain settlement ensures transparency and auditability, allowing all trades, resolutions, and payouts to be verified directly on the blockchain without reliance on opaque intermediaries.

- By decentralizing both trading and resolution, Opinion minimizes single points of failure and aligns security incentives across participants, infrastructure, and oracle mechanisms.

User Interface (UI) and User Experience (UX)

- Opinion’s interface is designed to make complex macro trading intuitive, presenting probabilities, charts, and outcomes in a clean, minimal layout suitable for both experienced traders and newcomers.

- Market pages clearly display graphs, rules, order books, and odds, enabling users to evaluate opportunities quickly without navigating excessive menus or relying on external data sources.

- The Buy panel simplifies trade execution, allowing users to select outcomes, set order types, input amounts, and confirm trades efficiently, even when dealing with sophisticated prediction strategies.

- Order management is centralized through “My Portfolio,” Open Orders, and P&L dashboards, giving users a holistic view of positions, pending orders, and performance across all markets.

- Real-time feedback and transparent execution flows improve confidence, particularly in time-sensitive macro events where traders must react quickly to shifting market sentiment.

Opinion Review: Affiliate, Referrals, and Rewards

- Opinion’s Referral Program incentivizes community-driven growth, allowing users to generate unique referral codes and invite new participants to trade on Opinion.

- Referred users receive trading fee discounts immediately after binding a referral code, reducing entry friction while encouraging active participation from the start.

- Referrers earn incentives equivalent to 5% of the invitee’s paid trading fees, aligning long-term rewards with the trading activity of onboarded users.

- Referral codes become available once a user reaches $1,000 in trading volume, ensuring that referrers are active participants with meaningful platform engagement.

- Additional incentive boosts, including potential points or future rewards, may apply to both referrers and invitees as the ecosystem evolves.

Point System (PTS) and Rewards

- The Opinion Point System (PTS) rewards users for meaningful market contributions, including liquidity provision, informed trading, and long-term position holding.

- Points reflect how users and the platform grow together, influencing future incentive distributions and rewarding behaviors that improve price discovery and market efficiency.

- Weekly point allocations are distributed from a fixed pool, with early participants benefiting from higher multipliers as the platform scales.

- Users qualify for PTS after reaching $200 in total trading volume, ensuring baseline participation while keeping entry thresholds accessible.

- Points are earned through limit orders, trading activity, and holding positions, with higher rewards given for actions that enhance liquidity, accuracy, and market stability.

- Designated markets and early liquidity provision may receive higher multipliers, rewarding users who support new or strategically important markets.

Opinion Review: Conclusion

On-chain analytics strongly validate Opinion.trade’s emergence as a scalable macroeconomic prediction marketplace. The platform has generated over $5.5 million in cumulative fees, demonstrating consistent trader demand and a willingness to pay for reliable price discovery. Trading activity continues to grow, with cumulative volume reaching hundreds of millions of dollars, alongside frequent daily spikes during major macroeconomic events. Capital commitment remains strong, reflected in open interest nearing $72 million, signaling sustained conviction rather than short-term speculation. Additionally, more than $31 million in liquidity is deployed across trader wallets, supporting efficient execution and tighter spreads. Growth in active, retained, and new traders further confirms durable adoption, positioning Opinion.trade as a credible, high-liquidity venue for decentralized economic risk trading.

Can markets be created by anyone?

Yes. Opinion supports permissionless market creation, with Opinion AI assisting users in defining objective resolution rules and verifying whether a proposed market meets resolvability standards

What happens if a market outcome is disputed?

Does Opinion.trade require KYC?

Opinion.trade is wallet-based and non-custodial, meaning users typically do not need to complete traditional KYC, though access may vary depending on jurisdiction or wallet provider policies.