On-chain indicators help us find what is happening on the blockchain. Further, it helps us better understand the investor sentiment and increases our chances for Bitcoin price prediction. Further, since blockchain technology has excellent transparency, it allows anybody to evaluate and verify on-chain data. As a result, analyzing cryptocurrency markets may appear more accessible than traditional markets. These indicators provide additional insight into the present and future pricing patterns.

Table of Contents

Summary (TL;DR)

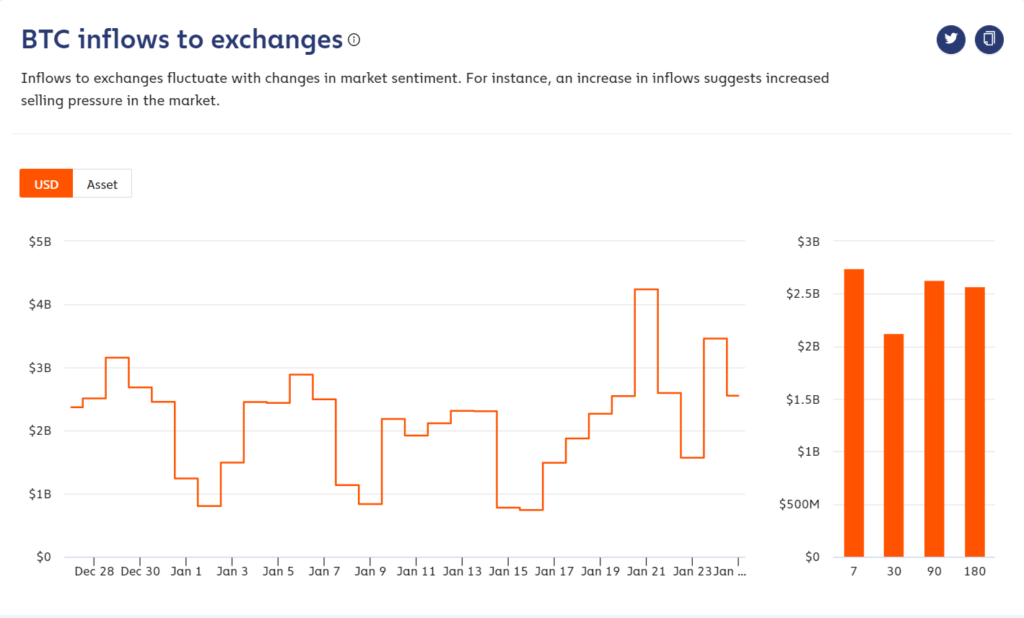

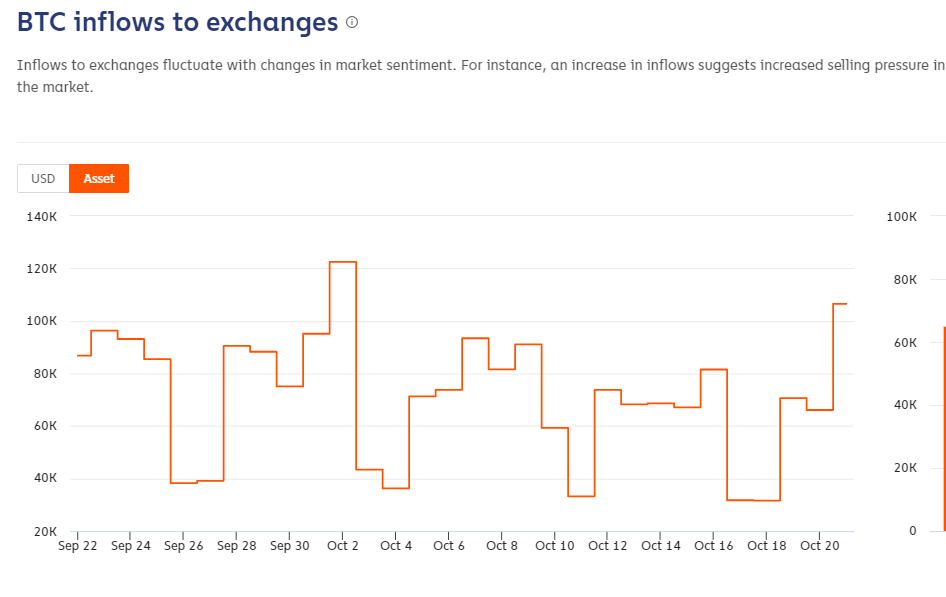

- When looking into exchange inflows, a rise in inflows could indicate that investors need to become cautious of where the market and their cryptocurrency are heading.

- An increase in the number of illiquid entities indicates strong holding sentiment and is a positive indication about the cryptocurrency, in this case, Bitcoin.

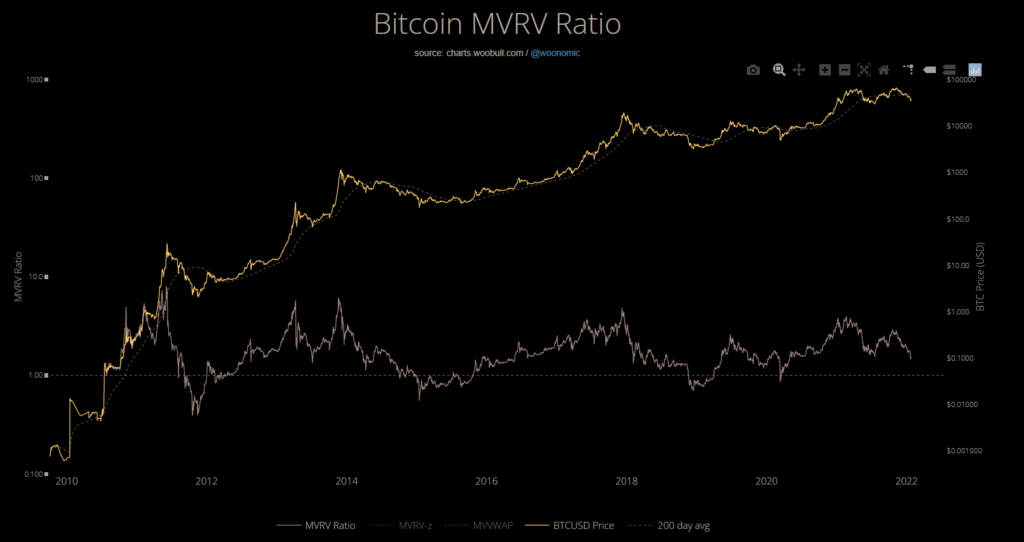

- MVRV is determined by dividing the market capitalization of Bitcoin by its realized capitalization.

- SOPR numbers more significant than one indicate that Bitcoins transferred that day are selling at a profit on average, and vice versa for SOPR values less than one.

- Google search activity for the term “Bitcoin” increased with Bitcoin prices. Although Google Trends is not an on-chain indicator, it’s reliable.

Best Free On-chain Indicators

Here’s an on-chain Indicator by IntoTheBlock:

Exchange Inflows

It can be understood as the quantity of cryptocurrency that has been placed into the exchange wallets. Investors often move coins from their wallets to exchanges when they wish to sell their holdings and take direct custody of their assets with an optimistic opinion on the cryptocurrency. Therefore, a rise in inflows into a rising market could indicate that investors need to become cautious of where the market and their cryptocurrency are heading.

Liquidity

The ease with which crypto may be converted into monetary terms without influencing its market price is liquidity. An illiquid entity hoards coins and harms market selling pressure. Analyzing blockchain transaction patterns to determine which addresses are controlled by an individual or company provides a fact-based inference. The data more accurately reflects actual holdings and transfers between people and businesses, reducing the irrelevant information.

Thus, a persistent increase in the number of illiquid entities indicates strong holding sentiment and is a positive indication about the cryptocurrency, in this case, Bitcoin. The best sources offering data for liquidations are Bybt and CryptoQuant.

Market Value to Realized Value

MVRV has traditionally been one of the most dependable on-chain predictors of Bitcoin market. It is determined by dividing the market capitalization of Bitcoin by its realized capitalization. In other words, realized capitalization is computed by pricing each unit of Bitcoin at the price at which it was last traded on-chain. The most significant conclusion is that the rare occasions when MVRV has fallen below one have historically been some of the finest opportunities to buy Bitcoin.

Trade Intensity Metric

It indicates the number of investors looking to buy Bitcoins. An increase in trade intensity indicates that buyers outnumber sellers and indicates widespread uptake in the trend. Investors should keep a watch on the demand side to identify the influence of exchange inflows on the supply side. Glassnode publishes a free weekly On-Chain newsletter every week that one might find helpful.

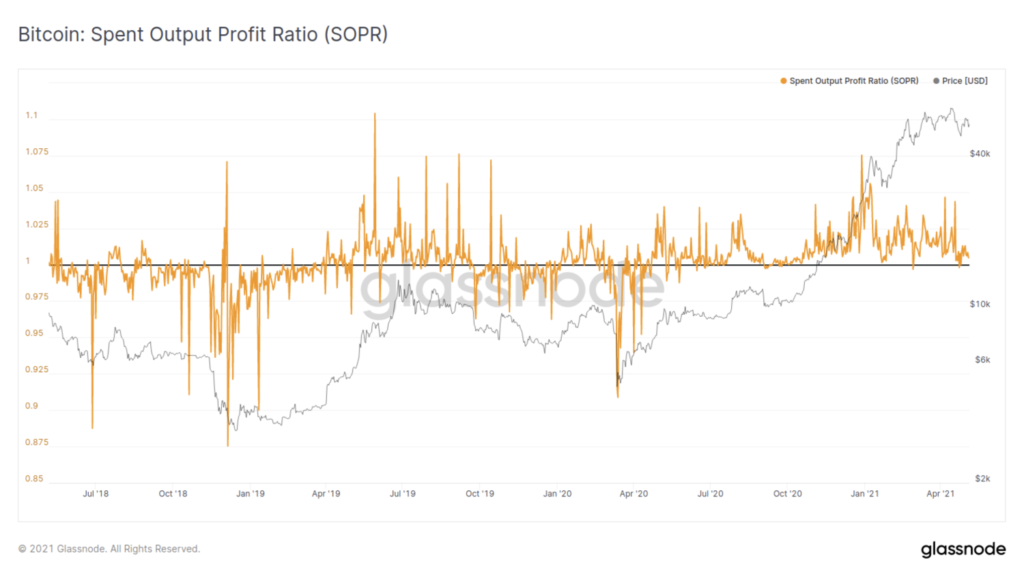

Spent Output Profit Ratio SOPR

The Spent Output Profit Ratio (SOPR) is valuable in all market situations since it captures the entire profit and loss on a given day. SOPR numbers more significant than one indicate that coins transferred that day are selling at a profit on average, and vice versa for SOPR values less than one.

We see higher SOPR trends, which generally indicates a positive price increase. When more coins are liquified, it raises the interest in the local or macro markets. On the other hand, with lower SOPR rates, investors holding coins slow down their spending, indicating that the current prices are not expensive. This has grave implications on the market.

Also read, Best Paid And FREE Crypto Trading Bots

Monitoring Interexchange Flows

Investors can acquire cryptocurrencies like Wrapped Bitcoin with fiat currencies such as the US dollar or dollar-backed stable coins. Keeping track of net flows between these two types of exchanges allows investors to assess whether the market is driven by fiat purchasers (such as institutions) or Tether.

Net movement from crypto-to-fiat exchanges to crypto-to-crypto exchanges implies that stable coin traders dominate the market. In this case, an increase in stable coin issuance may be viewed as a leading signal of an approaching price boom.

Also read, Best P2P Crypto Exchanges in India

Google Search Interest (not an on-chain indicator)

Bitcoin had a record-breaking year in 2021, smashing it’s previous all-time high and adding over $545 billion to its market value. To no one’s surprise, Google search activity for the term “Bitcoin” increased along with Bitcoin.

Thus, Google Trends is not an on-chain indicator, but it’s reliable. With crypto-assets achieving new market price highs—the whole crypto market capitalization achieved a record $3 trillion after recrossing $1 trillion in January and $2 trillion in the middle of the year—the total crypto market capitalization reached a record $3 trillion.

Also read, 9 Best Crypto to Buy in 2022

Free On-chain Indicators: Conclusion

As the crypto economy matures, demand for more in-depth on-chain analytics is bound to go up. Extensive effort has to be put in using on-chain data to go from basic blockchain notions like an address to a more critical concept like the exchange inflows. The user gets a valuable data set to act and make judgments.

Frequently Asked Questions

Q1. Why is Bitcoin prediction important?

A1. Bitcoin prediction is essential as it gives the investors an idea of the purchasing power and mindset of the consumers and how the market trends will rise and fall in the future and make their decisions accordingly.

Q2. Are Google Searches on-chain indicators for Bitcoin Price prediction?

A2. No, Google Searches are not on-chain indicators for Bitcoin Price Prediction, but the data received from them is reliable as every time there was a surge in searches, there was a consequent rise in Bitcoin prices.

Also read,