Having reviewed many crypto exchanges in the past, particularly that of the USA. Today, we put forward a comprehensive list of the top five crypto exchanges in the USA.

Analyzing supported currencies, liquidity, security, support, fees, and trading pair is a part of finding the best crypto exchange, so let’s get started.

| Exchange | Coinbase | Uphold | Cex.io | Gemini | Binance.US |

|---|---|---|---|---|---|

| Supported Crypto Assets | 45+ | 250+ | 31 | 26+ | 200+ |

| Fees | 0.5% | Depends on the type of transaction and payment method used. | 0.25%/ 0.16% | 0.5% | 0.1% |

| USP | High Liquidity; Secure | Wide range of crypto assets; high security | Apt for beginners; support credit cards | OTC Desk; Competitive Fees; available in all the states of USA | A wide range of Crypto assets and services/ features |

| Insured | Yes | Yes | No | Yes | Yes |

| Website | Coinbase | Uphold | Cex.io | Gemini | Binance.US |

Table of Contents

Summary (TL; DR)

- Firstly, Coinbase is one of the biggest platforms in the world. Furthermore, it allows its users to invest, trade, and stake crypto. In addition, it also extends a dedicated Coinbase wallet and card.

- Secondly, Uphold is a multi-currency investment provider founded by serial entrepreneur Halsey Minor. The platform enables businesses and individuals to invest and exchange a wide variety of assets, including cryptocurrencies, national currencies, precious metals and US equities.

- Cex.io is a multifunctional portal for trading, margin trading, leveraged trading, and staking services. However, it charges a deposit fee of up to 2.99% using VISA/ MasterCard.

- Further, Gemini is the most secure crypto exchange operational in all 50 states of the USA. However, the fee is high. Therefore, it is advisable to use the extended version – ActiveTrader. Also, it offers a dedicated Gemini stable coin and a mobile app.

- Lastly, Binance.US has a separate utility token that gives many benefits to traders. Furthermore, it has a wallet, mobile app, and visa card facility. However, the trading fee is high for debit card users.

- Apart from this, Coinbase, Gemini, and Binance provide crypto insurance to their users.

Five best Crypto exchanges in the USA

Out of many crypto exchanges, we have narrowed them down to the best five. We will be discussing their features and Pros & Cons briefly.

1st Best Crypto Exchange in USA: Coinbase

What is Coinbase?

Coinbase is the most prominent and established cryptocurrency exchange, supporting all the U.S. states except Hawaii. Furthermore, it operates in 100 countries with 30 million traders, offering a crypto trade platform for 50+ coins. For more in-depth information about Coinbase, read the Coinbase review.

Features

In addition, it extends various services such as:

- Cryptocurrency Investing

- An advanced Trading Platform

- Coinbase Staking

- Custodial Accounts

- Coinbase Crypto card

- The U.S. Dollar Stable Coin

It is a perfect option for novice traders as it has a learning program and is an easy-to-sign-up and trade platform. Also, it has a user-friendly and straightforward interface. Moreover, it pulls a massive trade volume as it is highly liquid and easy to use. The Coinbase app is available on both android and iOS.

Coinbase Fees Structure

It has a complex and expensive fee structure. It imposes a transaction fee of 1.49% for standard and 3.99% for credit card purchases. Furthermore, it also charges a flat fee for transactions below $200, or a certain percentage depending upon the crypto used.

However, you can switch to Coinbase Pro that extends an advanced and robust trade experience. It imposes low fees and might be complex for a new trader.

To learn more, read Coinbase Fees: Cheapest Exchange in the USA?

Coinbase: Pros & Cons

| PROS | CONS |

|---|---|

| Simple User interface | High transaction fee |

| Very High Liquidity | No control over wallet fees |

| Extensive selection of cryptocurrencies | Difficult to understand the fee structure |

| Convenient and user friendly | Poor customer support |

| Secure, regulated and licensed |

2nd Best Crypto Exchange in USA: Uphold

What is Uphold?

Uphold is a multi-asset digital money platform that provides global financial services. Uphold’s one-of-a-kind ‘Anything-to-Anything’ trading experience allows clients to trade directly between asset classes with embedded payments, paving the way for a future in which everyone has access to financial services. Furthermore, it is founded on a foundation of proprietary technologies and e-money apps, and it anticipates a future in which people and businesses all over the world have access to safe, transparent, fair, and inexpensive financial services.

Furthermore, Uphold provides frictionless foreign exchange and cross-border remittance for members in 184+ countries and 200+ currencies (conventional and crypto). Uphold has powered over $4 billion in transactions since it began in 2015.

Uphold Features

- Uphold supports a wide range of cryptocurrencies, including popular ones like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), as well as less common altcoins.

- Uphold provides a mobile application for both Android and iOS users, allowing them to manage their cryptocurrency assets and perform transactions on the go.

- One of the best features of Uphold is that the platform is always 100% reserved. This means that they never lend out your money, so you’ll always have it available to withdraw.

- Uphold is committed to compliance as a FinCEN Registered Money Services Business (MSB) in the United States and an EMD Agent of an Electronic Money Issuer authorized by the FCA in the United Kingdom.

- One of Uphold’s key features is their ‘anything to anything’ asset conversion service. This means that you won’t have to make several transfers in order to invest in cryptocurrencies or fiat currencies. You can exchange assets directly with a bank account, cryptocurrency network, precious metals, US equities, or debit/credit card depending on your area.

- Uphold has also announced the launch of a new crypto-linked debit card for customers in the United Kingdom offering them reward rates of up to 4% in the $XRP digital currency.

- Users can use uphold staking to put their money to work and earn interest. With high-interest rates available for a variety of crypto coins, staking your crypto with Uphold can earn you some significant rewards.

Uphold Fee Structure

When you deposit or withdraw money from a bank, Uphold does not charge you any fees. They also do not charge fees if you deposit via a cryptocurrency network.

When you trade, deposit with a card, wire transfer, or withdraw funds to a crypto network, the platform charges fees. It is determined by factors such as where you live and the payment method you choose.

Fees are classified into the following categories.

- Deposit fees apply when you use a debit or credit card to make a deposit. When you deposit from your bank, they do not impose a fee (save for wire transfers under $5,000 in the United States).

- Uphold fee – Uphold charges a withdrawal fee on specific crypto networks when legal, compliance, and regulatory challenges necessitate the use of a more stringent control system.

- Network fees are paid to miners and validators who process transactions on the network. Multiple transactions are grouped together in “batches” by Uphold. The network fees paid by customers in a batch may be slightly more or lower than the total fees paid by Uphold. Uphold charges a fixed network fee for specific assets.

- Transaction fees are a set cost for trades of less than $500.

To know more, check out the Uphold Fee Table.

Uphold Pros & Cons

| PROS | CONS |

|---|---|

| You can get 4% cashback if you spend crypto and 2% in case of national currencies. | There is no live chat system. |

| The platform is 100% reserved. | |

| They are PCI/DSS verified. | |

| |

Also, you may be interested in reading:

3rd Best Crypto Exchange in USA: CEX.io

What is CEX.io?

CEX.io is a multifunctional exchange platform relied upon by 3 million people. Furthermore, it stands out as a one-stop shop for all crypto-related activities. It extends many crypto products, features, and tools to allow individuals quick and easy access to cryptocurrency assets. To know more, read our CEX.io review.

Also, read CEX.IO Staking – The Best Way to Earn Passive Income?

Features

- Brokerage Service provides a crypto buying (via card/ wire transfer) platform. {preferable for novice traders}

- Moreover, CEX.io trading services present an advanced platform with exceptional features and decent liquidity. It enables cross-platform trading and gives advanced reporting. {suitable for advanced traders}

- Further, it offers an advanced platform for margin trading, CEX Broker, and supports trading via CFDs. Users can trade with up to 100x leverage which is extremely risky.

- Lastly, the team also has a staking service for various cryptos.

The CEX.io trading platform is apt for beginners and pro traders. It is a regulated exchange with a comprehensive customer support base. Moreover, it is registered with FINCEN and is completely secure and therefore trusted by millions of traders.

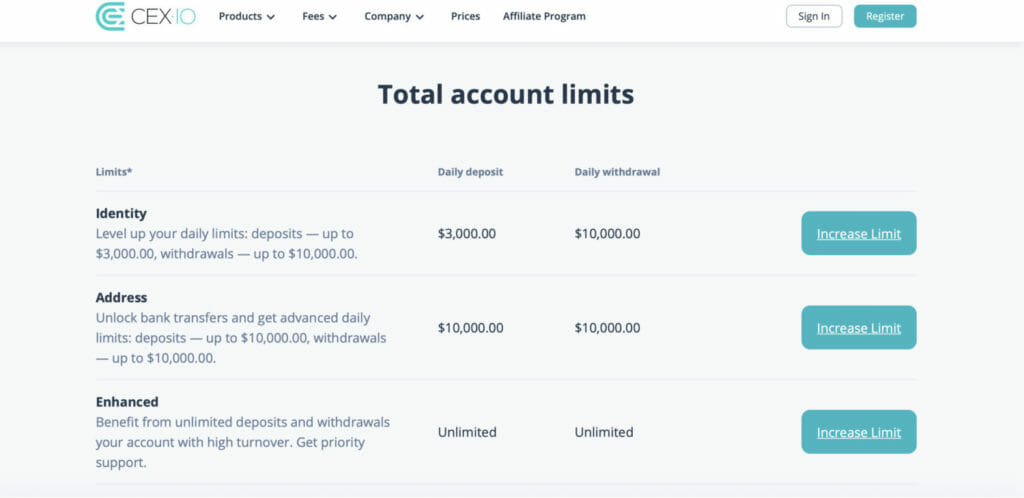

However, there is a transaction limit. For instance, verified accounts’ purchasing limit is up to $1000 worth of Bitcoin per day only.

Also, users can upgrade their tier to increase the transaction limit and features provided.

CEX.io Fees Structure:

- The trading fee for takers is 0.10%-0.25% and makers 0.00%-0.16%.

- Further, the deposit fee is relative to fiat currency and payment method. For example, VISA and MasterCard for the USD charge 2.99%, while Skrill charges 3.99%. Whereas, a transaction using ACH and bank transfer is free.

- Though, the withdrawal fee varies upon withdrawal method. A VISA Card costs 3% + $1.20, Mastercard costs 1.8% + $1.20. Skrill takes up 1%, Bank transfers 0.3% + $25 and ACH/SEPA/ faster payments are free.

To get in-depth knowledge about this exchange, read CEX.IO Review – Is it Legit or Scam?

CEX.io: Pros & Cons

| PROS | CONS |

|---|---|

| Facilitates buying bitcoins with a credit card | Less coin/ cryptocurrency options |

| Fiat-to-crypto and crypto-to-crypto purchases | A high brokerage services fee |

| Suitable for amateurs as well as veterans | Transaction limits for Basic account holders |

| 24/ 7 Quick and reliable customer support |

4th Best Crypto Exchange in USA: Gemini

What is Gemini?

Firstly, Gemini Crypto Exchange is a New York-based most secure crypto exchange known for compliance with USA laws and regulations. It is operational in all 50 states of the USA. It extends a wide variety of financial products and services.

Furthermore, it has an ‘automatic buy’ feature, which allows the users to schedule purchases every day, week, or as often as desired, making dollar-cost averaging much easier. It also has an extension to the existing website- ActiveTrader. In addition, it has more sophisticated features and tools. To know more, read our Gemini review.

Also, read Gemini vs BlockFi – How to Earn more Interest Rates?

Features

- Gemini Clearing Portal: A default platform streamlines trading with an easy to use interface.

- Gemini Custody: Custodial service regulated as a New York trust company with insurance up to $200 million.

- Clearing: Is an OTC desk for crypto trading.

- Gemini Pay: A service that empowers users to spend their crypto for retail purchases in up to 30,000 stores in the USA.

- Gemini Earn: For earning interest on the unused crypto balance on the platform. The interest is up to 7.4% on various tokens. {3.05% on Bitcoin}

- Crypto App: It provides an application for trading on android and iOS operating devices.

- Gemini Dollar: Has a stable coin that is functional for all transactions.

- Nifty Marketplace: Offers a platform for the purchase & sale of digital art and collectibles.

The most prominent advantage of Gemini is the ability to trade in real dollars. Gemini offers more than 45 coins & tokens for trading with 19 trading pairs. Users can deposit without KYC but can not withdraw without KYC. It is suitable for peer-to-peer and crypto-to-crypto trading and caters to both beginners and experienced traders.

Gemini is easy to use with a quick setup and convenient interface. The platform’s customer support is impressive with the column of in-depth FAQs available on the website. Also, the email provided is prompt and beneficial.

Also, read Gemini vs Coinbase | Which is the Best USA Crypto Exchange?

Gemini Crypto Fee Structure

Gemini charges a low fee. However, it might be expensive for small traders.

- Firstly, Gemini imposes a convenience and transaction fee. Therefore, the convenience fee is 0.5% included in the quoted price of crypto. But, the transaction fee varies from currency to currency and volume to volume. Thus, It ranges from $0.99 for transactions lesser than $10 to 1.49% for transactions greater than $200.

- Deposit via ACH, Wire Transfer or external accounts is free. However, a debit card pulls 3.49% of deposit fees.

- Withdrawals hold no fees on the platform.

Though fees on ActiveTrader are better in comparison. Check the detailed fee structure here.

Gemini: Pros and Cons

| PROS | CONS |

|---|---|

| Wide variety of services | Relatively high fees |

| Secure and insured | Few payment methods |

| Intuitive to use | Some popular cryptocurrencies are not on the platform {such as Cardano, Ripple, and Stellar Lumens} |

| Highly-rated mobile app | |

| Earn interest on cryptocurrency balances | |

| Available in all U.S. states. | |

| ActiveTrader™ offering professional-level trading features |

5th Best Crypto Exchange in USA: Binance.US

What is Binance.US?

Binance is the leading crypto exchange with over 200 crypto assets supported. Therefore, it is apt for novice or veteran traders. Binance.US is fit for USA traders as it complies with US trade regulations. Specifically, it is the largest exchange platform by trading volume. As a result, trading on Binance is fully secure through 2-FA and anti-phishing measures. It offers a wide array of services and features.

Features

- Binance Exchange: It is a trading platform categorized into primary, classic, and professional.

- Binance reward: Binance offers its users a reward for depositing and staking cryptos. It also gives loans secured by crypto assets.

- Spot Trading: Binance allows users spot trading. Moreover, users can also do margin and futures trading.

- OTC: Binance enables bulk purchase & sale of crypto with better pricing. However, users need to complete KYC verification for trading on the OTC portal.

- Leveraged Tokens: Binance extends derivatives that provide UP & DOWN contracts betting on some crypto prices.

- Binance App: It extends a mobile application for trade on the go for android and iOS devices.

- Binance Wallet: Extends a wallet to hold crypto and fiat currencies.

Further, Binance Futures Platform supports crypto trading through derivatives. Furthermore, the portal enables leveraged trading up to 125X.

Binance provides its users three chart forms- Original, TradingView, and Depth.

Traders can purchase crypto via bank deposits, credit/ debit card, bank transfer, and third-party payment {Banxa & Simplex}. Moreover, Binance allows trade with the broadest range of cryptos available today.

Binance Fees Structure:

It has a tier-based fee arrangement based upon 30-day trading volume or 24-hour Binance Coin Holdings.

- Binance Trading Fees: It varies from tier to tier. It ranges from 0.1% for taker and maker to 0.02%/ 0.04% for maker and taker.

- Margin Borrow Interest Rates: It varies upon tier and the crypto assets involved. It ranges from 0.016% to 0.022%.

- Withdrawal Fees: There are no withdrawal fees. But, the minimum withdrawal limit varies from crypto to crypto.

- Spot Trading Fee: The spot trading fee is 0.1%.

Binance allows an instant buy/ sell option that pulls a 0.5% fee. Also, a Debit card attracts a 4.5% fee. Therefore, users are entitled to an additional 25% discount if they pay the trading fees using Binance Coin.

Binance.US: Pros and Cons

| PROS | CONS |

|---|---|

| A user-friendly platform | High Trading Fee for Debit card Users |

| A wide array of cryptos in the market | Not available in seven US states |

| A comprehensive range of crypto pairings to trade | Fewer crypto-to-crypto currency pairs in the US portal |

| High trading volume | |

| High liquidity | |

| Deposit and withdrawals via crypto and fiat money | |

| Stake cryptos | |

| Mobile Compatible: Android and IOS | |

| Low Trading Fees |

Best Crypto Exchange in USA: Conclusion

All the five crypto exchanges mentioned above cater to varied trader wants. Coinbase is the leading portal for high liquidity and faster trade, qualifying as a secure and trustworthy portal. Whereas, Cex.io is apt for beginners and experienced traders with a user-friendly interface and support of credit cards.

Gemini qualifies as the most secure crypto exchange with a variety of services at its disposal. It is apt for seasonal traders as well as it offers interest on the crypto balance. Hence, Binance is prevalent for diverse crypto assets and services/ features extended with high trading volume and liquidity. Lastly, all these exchanges are beneficial in one way or another. Choose a platform to suit your needs.

Frequently Asked Questions

How to withdraw money Out of Coinbase?

Users can withdraw money from Coinbase with the following options:

Bank account

PayPal account

A cryptocurrency wallet (for cryptocurrencies)

Users can not withdraw fiat currencies with credit/debit cards.

Can users store Bitcoins on Coinbase?

Yes, Users can keep Bitcoins on Coinbase, but it is not advisable. It is best to keep Bitcoins in a non-custodial wallet.

Is Cex.io a wallet?

CEX.IO gives its users an online Bitcoin wallet as they sign-up for an account. A website that stores bitcoins in the cloud serves as an online wallet. However, storing all the crypto assets in a third-party wallet is advisable as platforms and exchanges are prone to hacking.

Are the fees high on Gemini Exchange?

Trading fees are high on Gemini compared to other popular crypto exchanges. This is because it includes a 0.50% convenience fee on all trades on top of regular trading fees. On the other hand, deposit and withdrawal fees are cheap on Gemini.

Is Binance banning USA customers?

Binance does not comply with any regulations. Hence, It was inaccessible for USA traders. However, Binance.US complies with US Trade Regulations and allows US Traders to trade on the portal.

What is the qualification for a user to borrow on Binance Loan?

A registered user of Binance is qualified to borrow on Binance Loan.