Coinbase announced the launch of a Visa debit card program in October 2020. It was first made available to European residents and later was launched in the United States as well. Today, we will review the Coinbase card.

Table of contents

- What is Coinbase?

- What is a Coinbase Card?

- Summary (TL;DR)

- Why Choose Coinbase Card?

- Is Coinbase Card for me?

- Coinbase Card Review: Eligibility

- How to get started with Coinbase Card?

- Coinbase Card Review: Features

- Coinbase Card Review: Spending Limits

- Coinbase Card Fees

- Coinbase Card Review: Supported Cryptocurrencies

- Coinbase Card Review: Supported Countries

- Coinbase Card Review: Customer Service

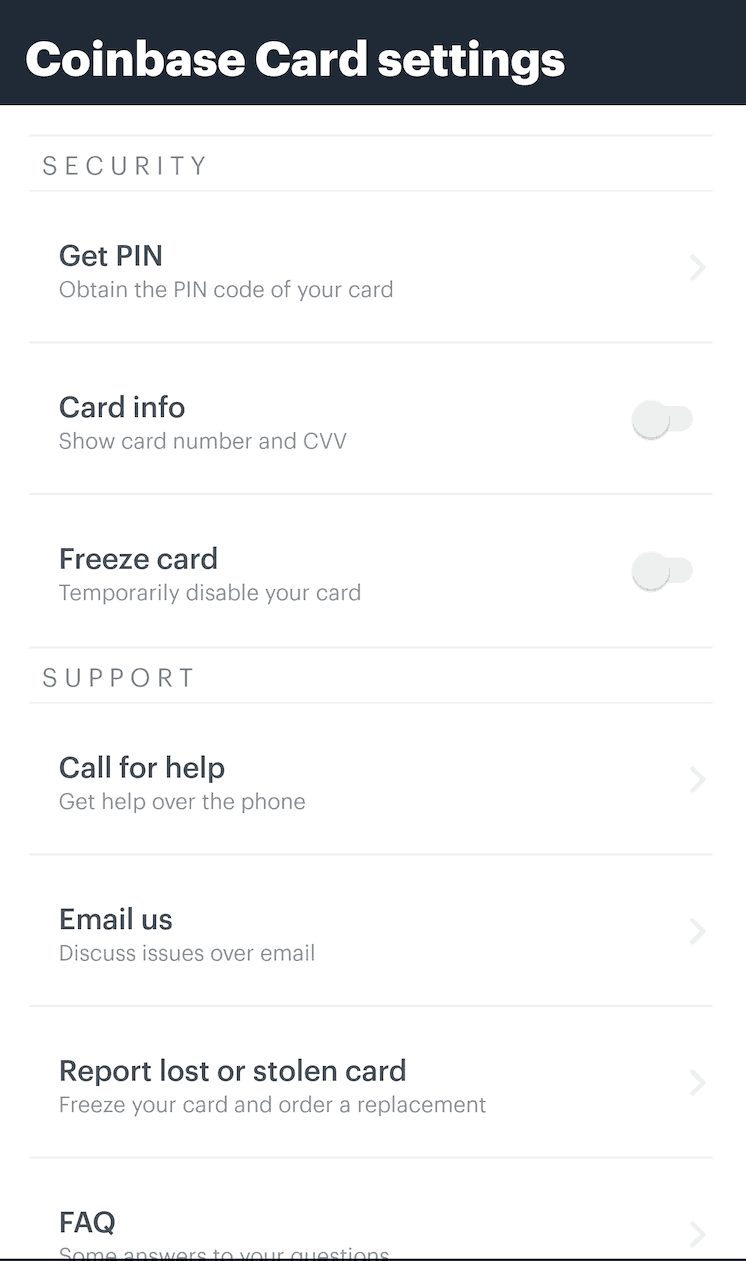

- Coinbase Card Review: Security

- Coinbase Card Mobile App

- Coinbase Card Review: Pros and Cons

- Coinbase Card Review: Conclusion

- Frequently Asked Questions (FAQs)

What is Coinbase?

Coinbase Global Inc., or Coinbase, is the most reputable and leading cryptocurrency exchange platform. Brian Armstrong and Fred Ehrsam founded this American company in 2012.

It claims of having more than 56 million verified users and 1,200 plus employees. It has 7,000 institutions and 115,000 ecosystem partners in around 100 countries. Coinbase’s quarterly volume trade is $335B, and the assets on the platform are $223B.

You can buy, sell, and withdraw cryptocurrencies effortlessly with Coinbase. It also provides you with vault protection to store your funds in a vault.

They are accessible, transparent, and have become the most trusted of all the exchange platforms.

What is a Coinbase Card?

Coinbase announced their Visa debit card on 11 April 2019. It empowers you to spend your cryptos anywhere without having to keep a fiat currency balance in your Coinbase account. It converts the crypto to fiat on-demand in a flash. This is exceptional because not many cryptocurrency companies let you do that.

MetaBank issued the Coinbase Card with N.A., Member FDIC, and is under Visa USA license, and Marqueta powered it. Paysafe Financial Services Limited, on the other hand, issues Coinbase cards in Europe.

They have issued a virtual card, but you still will need the physical plastic debit card to use the app.

The card is an additional feature conjoined with Coinbase rather than a standalone project. You know you’re working with a reputable company when you are using the Coinbase card. You won’t have to worry about staking proprietary tokens and fear losing potential money.

The team claims Coinbase’s Card to be the easiest and quickest tool to help you spend your crypto worldwide. They aim to make it a real-world application, to create seamless ways to spend their cryptos in real-time.

It’s never been so effortless and swift to use your cryptocurrencies instantaneously. You can buy a cup of coffee with cryptos just like you would have with fiat money.

Summary (TL;DR)

You will get access to the most convenient way to use your cryptos if you apply for the Coinbase card.

The Coinbase team says that they strive to provide better financial services to everyone around the world. Their launch of this debit card is yet another move in their direction to achieve worldwide economic freedom.

- You can instantly pay everywhere as Visa is accepted.

- Coinbase converts your crypto to fiat in no time.

- You can pay with and switch between any supported currencies.

- U.S. customers can earn up to 4% crypto rewards on every purchase.

- Having a verified Coinbase account is mandatory before applying for the card.

- Coinbase doesn’t charge any application fee, and there is no credit check to receive the Coinbase card.

- There is no monthly fee and no minimum deposit amount.

- No transaction fees will be applied if you use USD Coin(USDC).

- Coinbase Card provides a free ATM withdrawal limit of up to £ 200 per month.

- It Supports 9 of the most important cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and others.

- It is available in the U.S. and across 30 countries in Europe.

- It Uses bank-level AES-256 encryption.

- It provides the facility to lock your account and report if stolen or lost.

- A mobile app is available on Android and iOS for the Coinbase Card.

Why Choose Coinbase Card?

Coinbase’s competitors might offer lower fees on their card but they don’t provide service as smooth as Coinbase. Even if the competitive price might be bothering you, you should take note of the fact that, unlike others, Coinbase doesn’t impose tight restrictions and regulations on its users. Coinbase card’s uncomplicated features prove to be quite convenient. Also, Coinbase takes its privacy policy seriously and hence proves itself in the security region/section.

Is Coinbase Card for me?

The Coinbase debit card is best for people who wish to have quick and easy access to their cryptocurrencies. It’s a simple, straightforward card that converts your cryptos to fiat in no time. U.S. customers can also benefit from crypto rewards.

Note: If you are one of those people in the crypto industry who keep a diversified portfolio of all the different coins, then you might find Coinbase a little lacking.

Coinbase Card Review: Eligibility

Since your Coinbase card pulls funds directly from your Coinbase account, you must first have a verified Coinbase account and must have passed the Level 2 verification.

Once you have a verified account, you must fund it with at least £5 of cryptocurrency.

You can fund in any of these currencies- Bitcoin (BTC), Litecoin (LTC), Ethereum (ETH), or any other supported cryptocurrency (mentioned later).

Also, if you are from the U.S., you would only be eligible if you live outside of Hawaii.

How to get started with Coinbase Card?

You must have a verified Coinbase account and meet the criteria mentioned earlier before deciding to apply for the Coinbase debit card.

How to apply and verify cards on Coinbase?

You can apply for the card through the main website or via the mobile app to get started. If you decide to use the app, then these are the steps you will have to follow:

- Download the mobile app.

- Verify your mobile number on the app and connect the app to your verified Coinbase account.

- Select ‘Apply Now’ under the Coinbase Card on your ‘Home’ page and follow the prompts to sign up.

That’s it. Now download the app and apply for your card.

How to set up the Coinbase card?

- You will get the physical card within 7 to 10 business days of placing the order.

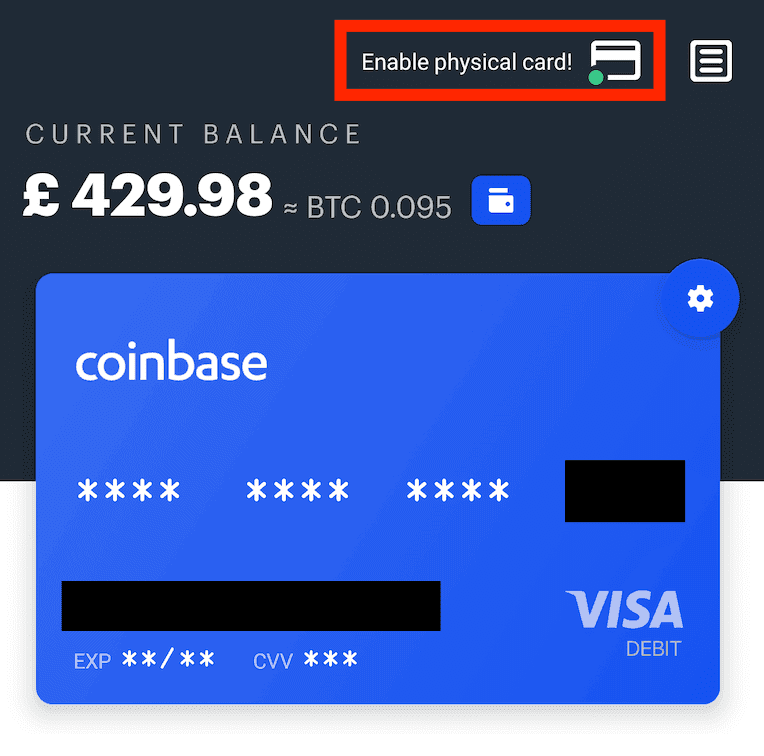

- Once the card arrives, you will have to load up the Coinbase Card app and click on ‘Enable physical card!’ at the top.

The enable physical card option is shown in the picture above

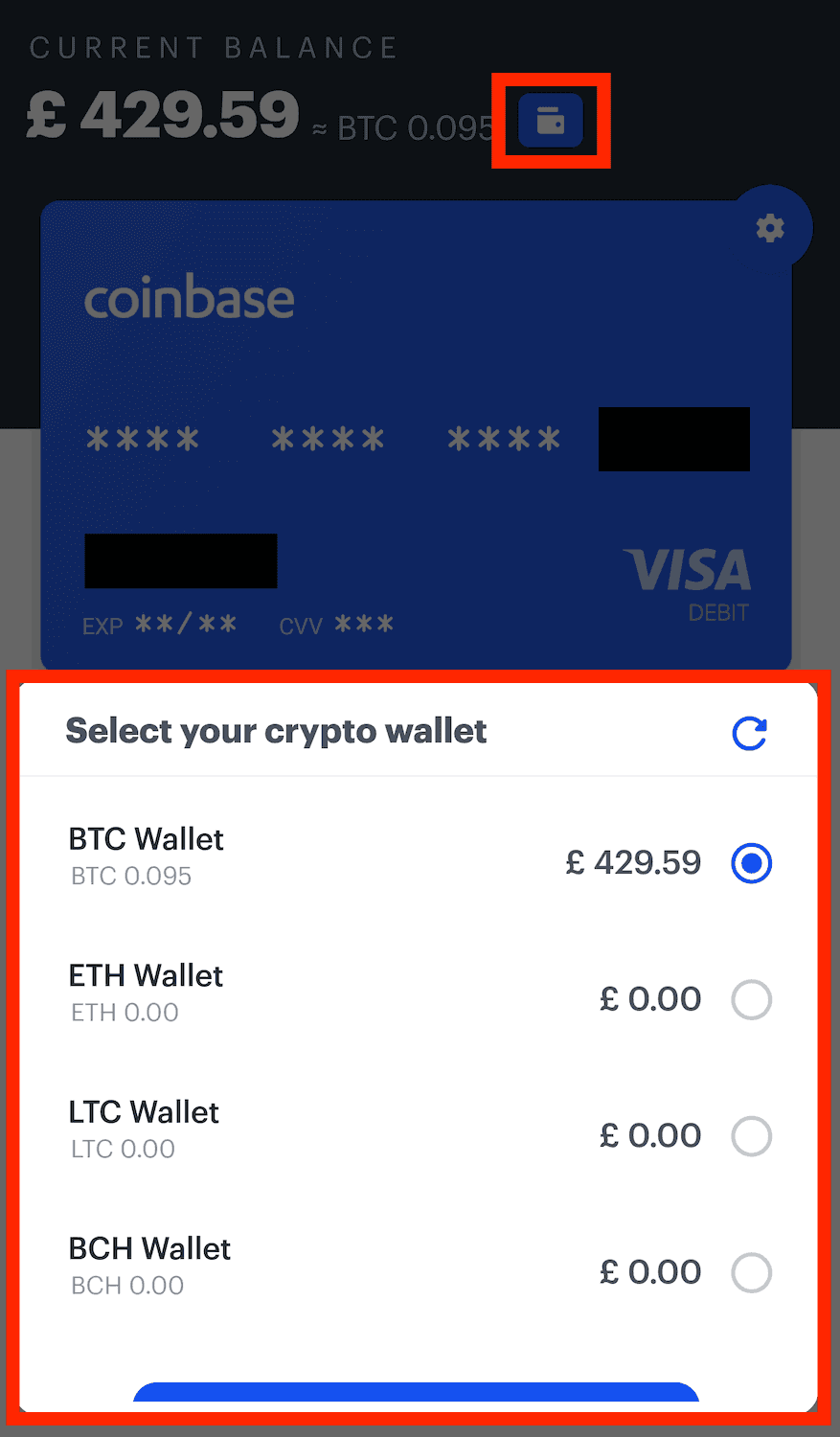

If you wish to change the cryptocurrency type (which will be converted to cash on every purchase), you can easily do that. Just tap on the highlighted symbol under the ‘Current Balance’ tag in the app and choose the preferred cryptocurrency wallet.

Once you start purchasing, you will get a push notification on your phone, which will show a summary of the purchase.

How to fund the Coinbase card?

Link your card directly to your Coinbase account. So you should fund your Coinbase account with cryptos that, in turn, will ensure your card remains funded.

Coinbase Card Review: Features

We have mentioned all the features and services Coinbase has to offer to you through its card.

- You can instantly pay, wherever Visa is accepted. Visa is the most widely accepted card worldwide makes Coinbase Card even more convenient to use.

- While using the card, you get the option to pay with contactless, with PIN, or you can withdraw from the ATM.

- Coinbase converts your crypto to fiat in no time. Before any purchase or ATM withdrawal, Coinbase draws and converts funds directly from your Coinbase account. You won’t even have to wait, and it’s that instant.

- You can gain up to 4% back in Stellar Lumens (XLM) or 1% back in Bitcoin (BTC) by using cryptocurrency through daily spending. However, this is only applicable to U.S. cardholders. The more you use your Coinbase Card, the more rewards you will accumulate in due course.

- Coinbase enables you to switch between two offers from the app so that you can accumulate both the XLM and BTC rewards at your convenience.

- You can pay with and switch between any supported currencies.

- Coinbase Card available in the U.S. and across 30 countries of Europe, including the U.K.

- You will receive push notifications after every purchase and action made on your account.

- Coinbase sends you a spending summary and receipts every time you make a purchase.

- Coinbase lets you track your transactions easily on their mobile app.

- Verification of your Coinbase account is mandatory, and Coinbase offers Two-factor authentication.

- It offers SSL protection alongside bank-level AES-256 encryption.

- Coinbase gives you the option to freeze your account when you feel the need to instantly.

- You won’t have to pay an issuance fee, unlike in Europe, where it is £4.95.

- Coinbase doesn’t charge any application fee, and there is no credit check to receive the Coinbase card.

- There is no monthly fee and no minimum deposit amount.

- No transaction fees will be applied if you use USD Coin(USDC).

- If you ever refund your purchase, Coinbase gives you a refund directly on your cryptocurrency balance calculated concerning the fiat-to-crypto exchange rate at the time of refund execution.

- To let you see your card details on the mobile app, Coinbase doesn’t ask for a PIN code but instead asks for a fingerprint scan.

- Regardless of which crypto wallet you’re using, Coinbase gives you the option to select a preferred reward offer (BTS OR XLM) to be applied to every purchase of yours. You will receive the reward within 1 to 5 days of the transaction.

- A mobile app is available on Android and iOS for the Coinbase Card.

We will discuss the fee structure, spending, withdrawal limits, and supported currencies in detail in the article.

Coinbase Card Review: Spending Limits

The daily spending limit imposed by Coinbase is £10,000 / €10,000. Whereas the Coinbase debit card limit for monthly purchase £20,000 / €20,000 and the yearly purchase limit is £100,000 / €100,000. There is also a daily ATM withdrawal limit of £500 / €500. The company also enables you to contact them via email, [email protected], if you wish to alter your daily spending limit.

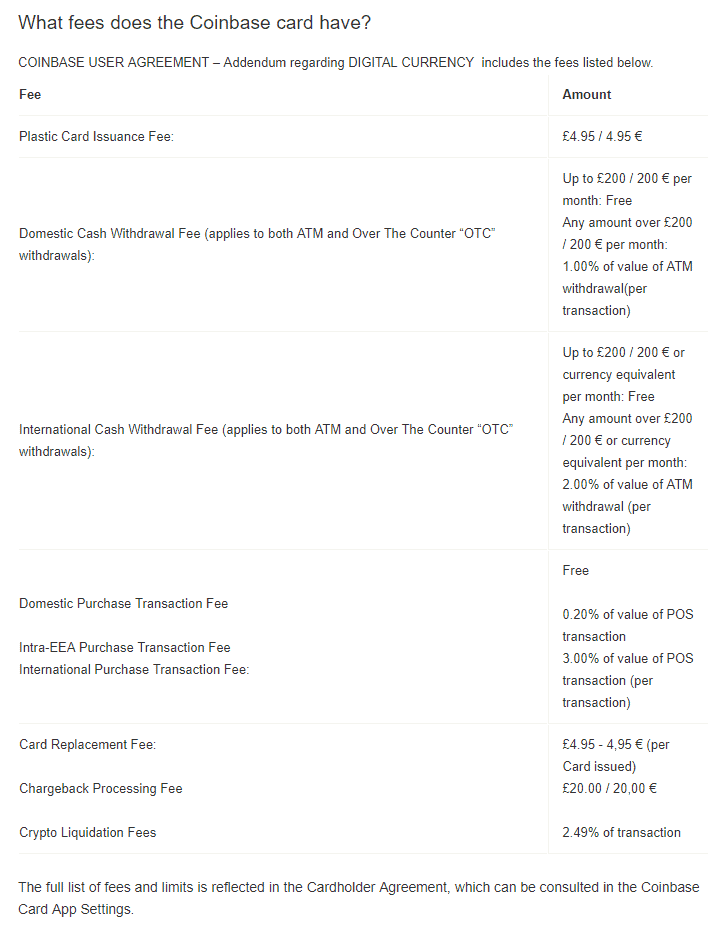

Coinbase Card Fees

If you immensely detest high fees, this Coinbase card might put you off. Even though their liquidation fee is high, their service is like none other. Rival crypto companies might impose lower costs but will place tight restrictions and requirements.

What is the purchase fee of a Coinbase card?

- If you are a U.K. cardholder and make a purchase you will not be charged any fee.

- Within a European Economic Area (EEA) outside of the U.K., the cost would be 0.20%.

- Outside of the U.K. or the EEA, the spending fee would be 3%.

What is the Conversion fee charged by Coinbase?

In addition to the purchase fee, Coinbase charges a conversion fee too. Coinbase automatically converts your cryptocurrency to the form of payment acceptable to the merchant for every purchase you make. But for doing so, it imposes a crypto liquidation fee of 2.49%. Although, they won’t charge you any such payment if you pay using USDC.

Does Coinbase charge any monthly & issuance fee?

On a brighter note, Coinbase doesn’t charge any monthly fee. Also, all the users aren’t charged any issuance fee except for the U.K. cardholders. The U.K. cardholders will have to pay £4.95 as an issuance fee.

What is the ATM withdrawal fee?

The Domestic ATM withdrawal fee is free up to £200 per month. If amounts go beyond the limit, then they would charge a 1% fee.

The International ATM withdrawal fee is free up to £200 per month. If amounts go beyond the limit, then they would charge a 2% fee.

What is the chargeback fee?

If you wish to process a chargeback, then you will have to pay a fee of £20 ($26.20), which is indeed quite expensive.

Coinbase Card Review: Supported Cryptocurrencies

Coinbase Card supports 9 of the important cryptocurrencies – Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Ripple (XRP), Basic Attention Token (BAT), Augur (REP), 0x (ZRX), Stellar (XLM), and all ERC-20 tokens, which include USDC and DAI.

Coinbase Card Review: Supported Countries

Coinbase Card is available in about 30 countries, namely Austria, Belgium, Bulgaria, Croatia, Cyprus, Denmark, Estonia, Finland, France, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, and the U.K. In 2021, it was made available in the U.S. too.

Coinbase Card Review: Customer Service

You get the facility to contact Coinbase’s customer service by email, phone, or directly via the Coinbase card mobile app. If you need quick support, you should avail the email support or use the app’s messaging center.

If due to some reason you have to disable or re-enable your account, automated phone support will offer help. But anything more than that requires you to use the email support service.

Currently, the company doesn’t provide customer service through live chats. While this may put off some people, the company seems to give pretty adequate aid via their email service.

To keep up with the updates you can follow their Twitter account, @CoinbaseCard, or can learn more by visiting coinbase.com/card.

Coinbase Card Review: Security

Coinbase is primarily known for its security. It is a reputable company that diligently follows the security acts in its privacy policy, General Data Protection Regulation, and Data Protection Act.

Coinbase uses bank-level AES-256 encryption on their servers to store your passwords and OAuth tokens. You can hold a large chunk of your funds in offline wallets. Additionally, to prevent third parties from monitoring your funds and account, all the traffic goes over SSL protection. You can secure your Coinbase card with a PIN just like any other Visa debit card, and you anytime change the PIN online. Coinbase background checks all its employees to the extent the law allows. Furthermore, employee access at Coinbase is heavily restricted.

You can also report a chargeback by contacting the company at [email protected]. You can also click on ‘Call Support’ under Card Settings from the app to call your local support number.

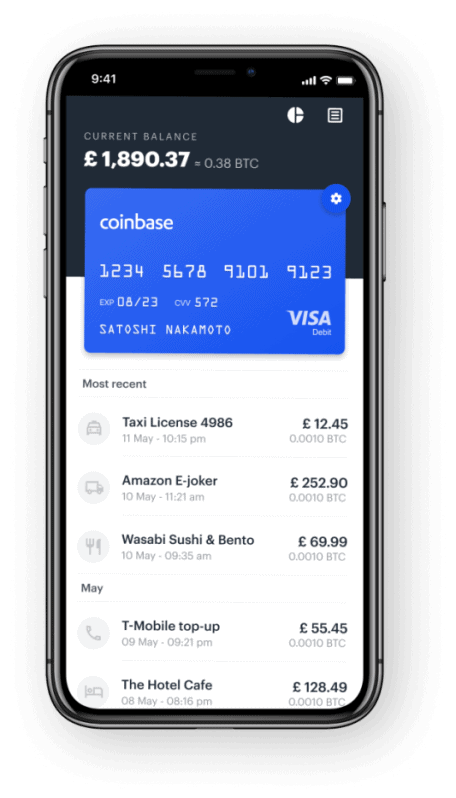

Coinbase Card Mobile App

Coinbase provides you with the facility of the mobile card app, which is available on Android and iOS. The mobile app has features that let you switch between cryptos, track transactions, and view spending summaries. If you lose your card, then through the app, you can report it as stolen or lost. The app is user-friendly and easy to use. You won’t have to enter a PIN code to view your card details. Instead, you will have to scan your fingerprint to access the app and the card details. Coinbase lives up to its expectations with its simple and straightforward service.

Coinbase Card Review: Pros and Cons

Even though the Coinbase card is the most convenient and secure debit card out of all, it still has its downsides. You should give the table a quick read below, in which we have summarized the card’s perks and shortcomings.

| Pros | Cons |

|---|---|

| The most trusted company in the industry | More expensive than others |

| Automatic crypto to fiat conversion | Extremely few rewards offer on every purchase |

| Supports 9 of the most important cryptocurrencies | High conversion fee of 2.49% |

| Crypto reward offers of up to 4% for US customers | Verified Coinbase account required |

| ATM withdrawal free up to £200 per month | No live chat support system |

| Pay with contactless, PIN or withdraw from ATM | |

| Bank-level encryption provided | |

| Extremely simple User Interface | |

| Card Mobile app available on both android and ios |

Coinbase Card Review: Conclusion

If you search for an unproblematic and easy-to-use way to spend your cryptocurrencies, then Coinbase’s Visa card should be your go-to debit card. Coinbase has a reputation for being one of the most secure and trustworthy crypto exchange companies.

One should also note that Coinbase has grown its user base from 2 milion in the first two years to a 56 million in the current time, all because of its consistent, excellent performance.

Its extremely simple User Interface makes it even more convenient. They don’t provide support through live chat but do respond to emails.

Coinbase card might preferably not be for someone looking to establish a diversified portfolio of all the different coins. It is more for someone who wishes to use their crypto anywhere and anytime instantly. If you desire quick conversion of your cryptos to fiat, easy spending of your currency worldwide, and secure transactions, then you shouldn’t hesitate to apply for the card.

Moreover, they offer crypto rewards of up to 4% to U.S. cardholders. It is indeed a bit pricey but worth the service. Coinbase supports all the essential and potential cryptocurrencies and also facilitates you to switch between them anytime. The Coinbase card is so easy to use that you can be a beginner and still reaps all the benefits. Coinbase card is undoubtedly the most convenient product out there in the cryptocurrency exchange industry.

Frequently Asked Questions (FAQs)

Will I have to order a physical Coinbase Card to be able to use the virtual card?

Yes. Unless you order a physical card, Coinbase won’t issue you the virtual card details.

How does the Coinbase card work?

You can directly link the VISA debit card to your verified Coinbase account. It enables you to spend the stored cryptocurrencies in your account. There is no requirement to keep your balance in EUR or GBP.

Where can I use my Coinbase card?

Since it is a VISA card, you can use it everywhere Visa is accepted. And not to mention VISA is the most widely accepted card worldwide.

What if my Coinbase debit card is lost or stolen?

If your card ever gets stolen or lost, you can immediately lock it using the main website. After doing so, you must report it as lost or stolen by following the given steps:

– Sign in to your Coinbase account

– Click on Coinbase Card

– In the top right, Click on manage card

– Report your card as stolen or lost

– Carry out the prompts that will follow

Coinbase will deactivate your account and will issue a new card within 7 to 10 days, and that too free of cost.