When I started to develop my passion for blockchain technology I did not understand most of the terms used in the space. I remember nodding my head multiple times at conversation even though I did not understand a single word. Over time, I increased my blockchain vocabulary and by now I can proudly say that I understand nearly every term.

I believe that blockchain technology will change our lives to an even greater impact as the internet did. I want to raise awareness and draw interest so that more people become aware of its full potential. This article should support everybody who wants to increase his blockchain vocabulary and explain core concepts in an easy language.

I hope you enjoy reading it.

Table of Contents

Altcoin

Altcoin is the abbreviation for “alternative coin” or “alternative to Bitcoin”. An Altcoin is every cryptocurrency that is not Bitcoin.

According to CoinMarketCap, the current number of Altcoins is around 5609. The first Altcoin was Namecoin, which was established in April 2011.

Early Altcoins were based on the Bitcoin protocol but tried to offer an improved version of the first cryptocurrency.

Later, Altcoin projects focused on completely different use cases from Bitcoin, such as Ethereum in 2014.

From a market perspective, Bitcoin still dominates all other cryptocurrencies with a market cap dominance of 64.6%. Therefore, 64.6% of all money invested in cryptocurrencies is invested in Bitcoin (as of June 2020).

Bitcoin

Bitcoin is the first and most prominent cryptocurrency in the world. It was created by a person or most probably by a group that used the pseudonym Satoshi Nakamoto.

Bitcoin was first mentioned in its famous whitepaper “Bitcoin: A Peer-to-Peer Electronic Cash System” that was published at the end of 2008.

In the wake of the financial crisis in 2008 that exposed several weaknesses and inefficiencies of the current financial system, Bitcoin promised a solution for an alternate monetary system.

From a technical perspective, Bitcoin solved the double-spending problem without the need to have a centralized party.

Bitcoin aims to become an alternative to the current financial system by switching from powerful centralized intermediaries to a peer-to-peer economy.

Although initially designed to become an alternative to fiat money. However, it is currently more seen and used as digital gold due to its finite supply, limitation in transaction time, and its use as a speculative investment with high volatility.

Bitcoin further invented the Blockchain. There is no mention of “Blockchain” in the original whitepaper because the data structure did not exist beforehand.

So one can say Bitcoin was the first use case, but also the creator of blockchain technology.

Crypto

In general the abbreviation for cryptography, in the context of blockchain used for cryptocurrency or digital currency.

A digital currency that issued and maintained using a distributed ledger protocol (blockchain) and uses cryptography to securely record, store, and verify transactions.

Cryptocurrencies are differently defined, for example, some hardcore crypto proponents do not see XRP as a true cryptocurrency.

Because XRP’s supply is controlled by a central entity even though it is based on blockchain technology.

The first cryptocurrency was Bitcoin in 2008/2009. Although there were previous attempts to create digital money.

However, Bitcoin was the first to solve the double-spending problem, without a need for a central authority.

Contrary to fiat currencies crypto is not issued by a government or central bank.

Also Read: Who creates all the money in the world?

Everybody can create their cryptocurrency either by creating their own blockchain protocol or build it up on top of an existing one.

Cryptocurrencies are very controversial since they are used as speculative assets. While they solve many problems of our out-of-date financial system, they also bear risks to the global economy since many of them cannot be controlled.

DLT

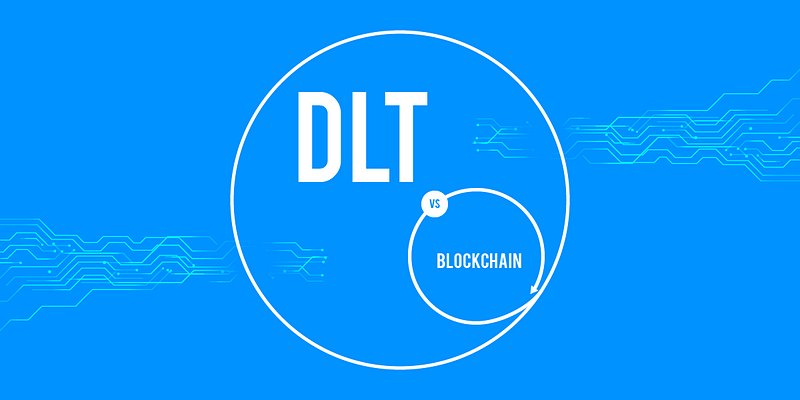

Stands for Distributed Ledger Technology (DLT). Often the term DLT is used as a synonym for blockchain which is not entirely correct.

DLT is the parent technologies of blockchain. To make their relationship clear:

Every blockchain is a DLT but not every DLT is a blockchain.

Tweet

A blockchain is a specific type of DLT like Coca Cola is a specific type of beverage. What they both share in common is that they are distributed networks with no central data storage.

Many institutional companies prefer using the term DLT instead of blockchain and digital assets instead of crypto to avoid the bias of traditional finance investors.

There are other forms of DLT which are no blockchains such as distributed ledgers for example

Exchange

An exchange is a platform that matches cryptocurrency sellers and buyers while charging a fee for connecting them.

In the very early days of crypto, there were no exchanges, and people had to meet in coffee shops to exchange their cryptocurrencies.

Nowadays, there are thousands of exchanges such as Bitstamp, Binance, and Coinbase. While in the early days crypto exchanges only offered to buy or sell cryptos they now offer a wide variety of services such as lending or staking.

It is recommended, to research the crypto exchanges before buying crypto to compare fee rates and coins listed.

Although there are 5609 different cryptocurrencies on the market, there is no exchange that offers them all.

So first, check if an exchange has the coins listed you want to purchase. A new trend is the development of DEX which stands for decentralized exchange.

These are crypto exchanges that are built on top of a blockchain making them decentralized by nature which increases the level of security and lowers fee rates.

Fiat

In the context of cryptocurrencies, fiat money is often seen as the counterparty.

Fiat currencies are issued by governments or to be more precise, by central and private banks.

Also Read: Who creates all the money in the world?

They are not backed by an asset such as gold or silver, which was the fact in the past when commodity money was dominant.

Since 1971 when the US decided to decouple the US Dollar with gold, fiat has become the dominant currency type.

All globally dominant currencies are fiat such as the Dollar, Euro, Pound, etc.

Ironically, cryptocurrency projects are criticized by fiat holders to have no asset backing them.

Although this also counts for fiat as it is not backed by an asset but trust in the system which is the same for cryptocurrencies. Interestingly fiat means in Latin “let it be done”.

Genesis Block

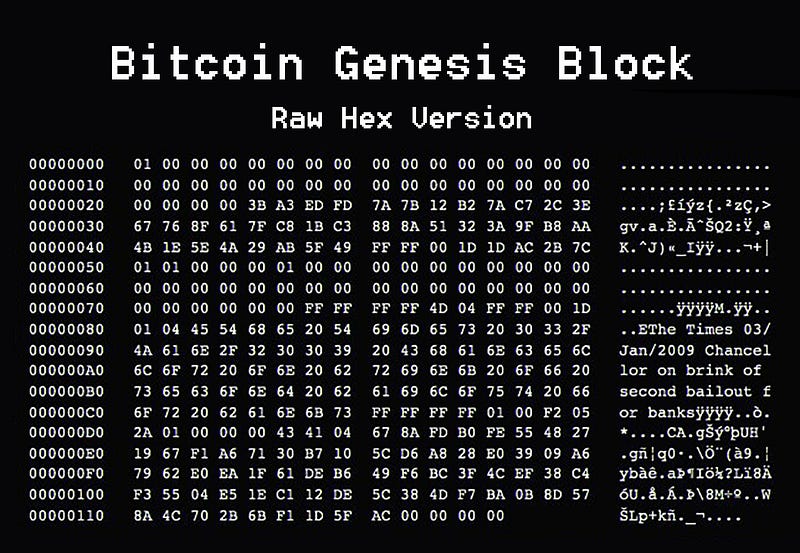

A Genesis Block is the first block of a blockchain protocol. It is a very special block because contrary to all other blocks in a blockchain it has no previous block. Therefore it is also called Block 0 or genesis block.

This is special as blockchain’s high security and immutability comes from the connection of the blocks.

Every block contains the hash of the previous one making changes in the data easily detectable as it is fully traceable, and all transactions can be looked up.

Due to its nature, it is in most cases, directly hardcoded into the blockchain protocol. The first Genesis Block in history was created in 2009 for the Bitcoin protocol.

As public blockchains are fully transparent everybody using a blockchain explorer can access every block and its information from the latest back to the Genesis Block.

HODL

A slang word in the crypto community with a very funny backstory.

In 2013 when the Bitcoin price had a massive 39% decrease, an obviously drunk member of the Bitcoin Talk forum posted the sentence “WHY AM I HODLING” while meaning “Why am I holding”, meaning not willing to sell his Bitcoins despite the decrease in value.

Although it was clear that it was a typo, the crypto community adopted the term. It is used for people who are invested into cryptocurrencies for the long-term mostly several years contrary to day traders and therefore called HODLERS.

ICO

ICO is the abbreviation for Initial Coin Offering, which represents the blockchain equivalent to an Initial Public Offering.

It is mostly used to collect funding for a project by selling the tokens, which guarantees a certain value or right in the project, in exchange for fiat money or other cryptocurrencies.

Especially in 2017 when Bitcoin price increased extremely, many ICOs were conducted. Due to a lack of regulations and of investor knowledge many ICOs were scams, that created a stigma of frauds to blockchain and crypto.

Also Read: Analyzing Cryptocurrencies Github Activity

JOMO

Is the abbreviation for “joy of missing out”. It is the opposite of the better known FOMO abbreviation which stands for “fear of missing out”.

FOMO describes in the context of crypto panic buying or selling of cryptocurrencies based on short term market volatility.

Typically “JOMO” is attributed to traders who are “Hodlers”, which invest with a long-term horizon and do not become panicked.

Those traders believe in the future potential of cryptocurrencies beyond being just a speculative asset in the short-term. Also, many of those traders have spent enough time in the crypto space to react more calmly to the high price volatility of cryptos compared to newbies.

KYC

KYC is the abbreviation for “Know Your Customer”. Everybody who has registered to a crypto exchange should (hopefully) be familiar with this process.

KYC is very important for companies that deal with cryptocurrencies like exchanges. As the name implies, companies who offer crypto services must know who their customers are to prevent illicit activities such as money laundering, terrorist financing, or buying illegal goods on the dark web.

It is vital for the crypto world to prevent bad publicity of crypto being misused for illicit activities. Luckily, nowadays regulation in most jurisdictions requires KYC for exchanges to be allowed to be operational and otherwise will be shot down.

Although annoying for users to provide the necessary information such as proof of identity, address, etc.

Libra

Facebook`s controversial digital currency project, that aims to create a cross-platform currency for Facebook`s services such as WhatsApp and Instagram.

A consortium named the Libra Association will manage the project, that has been registered in Geneva, Switzerland.

Due to the possible impact on the global financial system, being “too big to fail” and Facebook acting as a global central bank, many governments especially the US are very critical towards the project.

Due to this fact, Facebook changed its approach, and Libra will be more a digital dollar as we know from PayPal rather than a centralized cryptocurrency backed by a basket of different assets.

It is planned to be launched in 2020 but due to setbacks such as the leaving of some of the initial founding members like eBay, MasterCard, and PayPal a later date is more likely.

In the crypto world, the project is seen very controversial. Because, it is opposed to the original idea of Bitcoin, which is to avoid a central party managing a currency. However, on the other hand, Facebook`s services like WhatsApp and Instagram together have over two billion users; which could lead to crypto into mainstream adoption if Libra launches.

Although after the change of approach, some experts argue if Libra can still be seen as a cryptocurrency.

Mining

In the context of Proof-of-Work blockchains, mining is the process of collecting transactions and validating them from the nodes and adding them to a new block.

If the block is successfully added to the blockchain the miner will be rewarded with the blockchains native currency for his work.

In the case of Bitcoin, the miners who solve a “mathematical quiz” first can mine the next block and is rewarded.

This is done to incentivize individuals or companies to participate in the consensus creation process of blockchains as mining involves costs in hardware and electricity.

Everybody can be a miner however nowadays in the dominant Proof-of-Work blockchains such as Bitcoin’s, it is only profitable if you have enough computing power. Otherwise one will not be able to compete with large mining pools that have enormous amounts of computing power.

Since increased computing power increases the chance of successfully mining the next block and be rewarded Proof-of-Work blockchains are criticized as being to energy incentive as large mining facilities consume a large amount of electricity.

This is also a reason why several blockchain protocols such as Ethereum are switching to the Proof-of-Stake consensus models.

Also Read: How Bitcoin Mining Work?

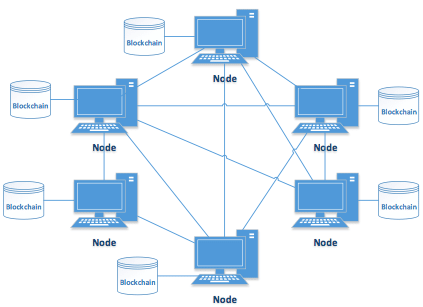

Node

Contrary to a central database where all the data is stored on one server. A blockchain is decentralized which means that the data stored on a blockchain is stored on multiple servers at the same time so there is no single point of failure.

Each of these servers stores a copy or part of a copy of the blockchain data and is called a blockchain node.

There are different types of nodes but in general, they have two major functions. The first is to store a copy of the entire blockchain protocol or a part of it.

Second, nodes act as validators to verify transactions according to a blockchain`s consensus model. Therefore, nodes have an important function to enforce the consensus rules of a blockchain network to agree on the order of transactions.

In the case of Bitcoin, there are for example archival nodes who store a copy of the transactions but do not contribute to the mining.

The more nodes a blockchain protocol has, the higher is the network`s security level, as it becomes harder for malicious actors to change the data stored.

To change the data stored in a blockchain network one must control >50% of all validating nodes’ hashing power at the same time.

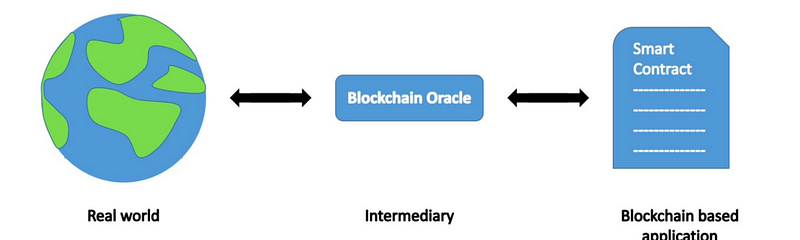

Oracle

In the context of blockchain technology, an oracle is a device outside of the blockchain, which provides input information for Persistent Scripts (Smart Contracts).

Persistent Scripts work with If…/Then…/Else… statements. Let’s say there is a Persistent Scripts which automatically activates the sprinklers on a farm if the temperature rises above 20-degrees. In this example, a thermometer with a chip connected to the blockchain would be an oracle.

Oracles are very important because Persistent Scripts automatically execute its pre-defined tasks if the conditions are given.

But if the input information is wrong, Persistent Scripts can be misused. Therefore, oracles are a vital part of Persistent Scripts but also one of their vulnerabilities. This is a general problem in technology to connect the digital with the physical world.

Persistent Script

Also known under the name Smart Contracts. These are programs that run on a blockchain. Most Persistent Scripts are programmed on the Ethereum blockchain using its programming language Solidity.

Persistent Scripts are based on simple conditions that, if a certain pre-defined event happens, then a task is automatically executed, else not when initialized by a user or key.

Conditional programs already existed before the emergence of blockchain but because blockchain is very secure and tamperproof, persistent scripts are nearly impossible to shut down.

I prefer the term persistent scripts since the term smart contracts can be confusing as there is no AI involved (not really smart) and they do not have to represent contracts per se, therefore, giving a limited perception to newbies.

Quorum

Quorum is a blockchain network developed by J. P. Morgan. It is based on the Ethereum protocol and is the “enterprise-focused version of Ethereum“, according to its website.

It is an open-source blockchain platform that aims to connect the benefits of the Ethereum protocol and community with the needs of enterprises.

As a permissioned blockchain solution, it allows private transactions, and only approved and known individuals or organizations can participate.

Contrary to most blockchain protocols that use either Proof-of-Work or Proof-of-Stake as their consensus mechanism Quorum uses a raft-based Consensus and Istanbul Byzantine Fault Tolerance.

This allows the protocol to have faster block-times, transaction finality, and on-demand block creation.

While some crypto proponents criticize the project since it is from J.P. Morgan, a traditional player in the financial industry, others see it as a good development that institutional players are developing blockchain solutions increasing adoption similar to Facebook’s Libra project.

Reward

Is the financial incentive to participate in the consensus creation process of a blockchain protocol. Most blockchain protocols are owned by nobody (so-called public blockchains), which bears the question of who maintains the network and provides the necessary hardware.

Also Read: Permissionless Blockchain vs Permissioned Blockchain

Since there are no companies behind protocols such as Bitcoin the system is designed in a way that if you participate in the consensus process you can get rewarded with the protocol`s native currency.

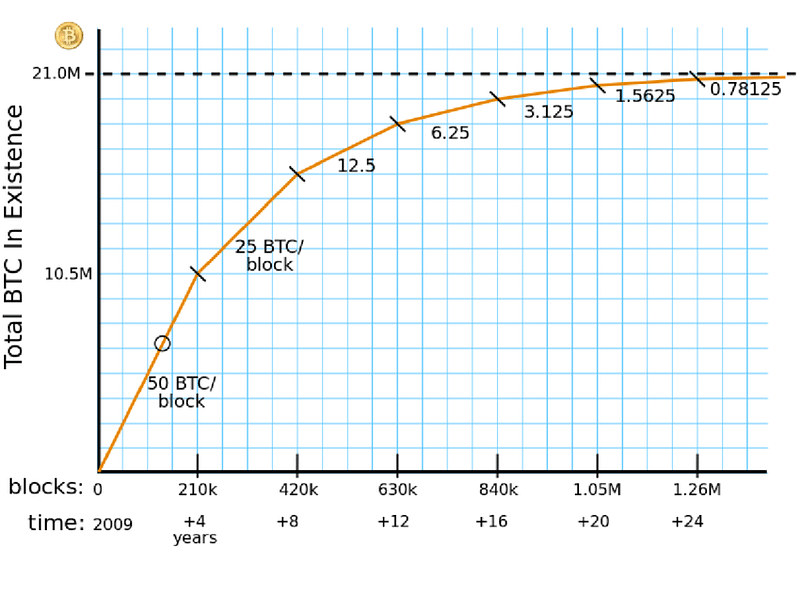

In the case of Bitcoin, the miner who solves a “mathematical quiz” first can mine the next block and is rewarded with BTC (currently 6.25 BTC per block).

This incentivizes people to provide hardware and pay for electricity to maintain and grow the network.

Block rewards are not fixed but subject to change for example in the case of Bitcoin the block reward is halved every 210k block as you can see in the graph above due to its deflationary nature.

Satoshi Nakamoto

The infamous creator(s) of blockchain and the first and most dominant cryptocurrency in the world Bitcoin.

Satoshi Nakamoto is the name that is given as the author of the Bitcoin whitepaper. It is a pseudonym since this person does not exist under this name and many experts believe that there is most probably a group behind the Bitcoin development than just one individual.

Satoshi solved the double-spending problem of digital coins as it is much easier to copy digital money compared to physical. With a high probability, we will never know who Satoshi Nakamoto is since he is most probably an idealist, afraid of governmental prosecution.

Interestingly based on chain-analysis, experts are quite sure that Satoshi never spent his coins proofing the point he did not create Bitcoin for his own wealth.

Also Read: A Candid Explanation of Bitcoin

Tokenization

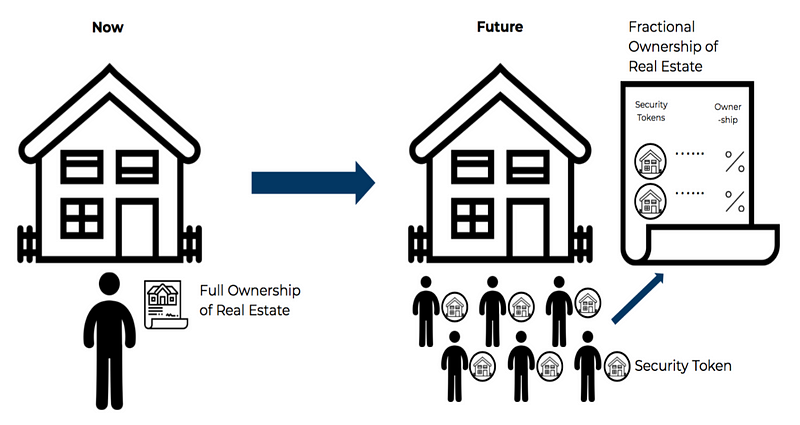

Is the process of creating a digital representation of tangible (real estate, gold) or intangible (cryptocurrencies, carbon credits) assets on a blockchain.

The tokenization of assets opens many possibilities such as fractional ownership. For example, a real estate worth one million USD can be digitally represented in one million tokens so each token is $1.

This lowers the minimum capital requirements for many expensive asset classes such as art, collectibles and allows a crowdfunding style of investment making illiquid assets liquid.

Also, the change of ownership is settled nearly instantly and cheap compared to traditional means, and transparency of ownership is high as every transaction is saved immutable on the blockchain protocol.

Also Read: The Rise of Individual Securitization and Human Tokenization

Unbanked

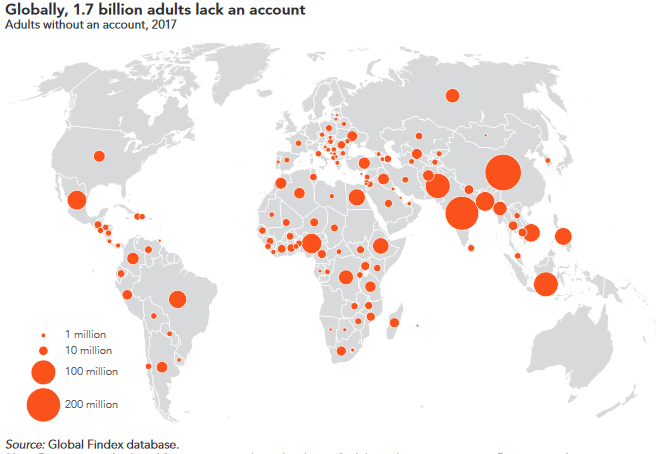

Although it is very normal for people in the first world to have a bank account it is sadly not a reality for over 1.7 billion people worldwide.

Due to various reasons such as high fees, lack of trust, or missing infrastructure many people worldwide do not have access to banks and financial products. These people are called the unbanked who are primarily situated in developing regions such as Africa and Southeast Asia.

Many blockchain experts say that while the internet gave everybody accesses to information, blockchain will give everybody access to the value.

Currently, many blockchain projects focus on unbanked as a target group. This is a very promising use case as having a phone with an internet connection is enough to use blockchain applications.

Vitalik Buterin

Vitalik Buterin is the co-founder of Ethereum the second-biggest cryptocurrency by market cap. In 2014, at age 19 he developed the blockchain protocol.

Ethereum symbolized the second generation of blockchains after Bitcoin that allows persistent script programming. Vitalik realized the potential of the underlying blockchain technology for various applications besides digital money and created Ethereum as a world computer that is turning complete.

This means everything can be programmed on top of the Ethereum blockchain from decentralized applications (DApps) to entire organizations (DAOs).

Due to the underlying blockchain, all applications built on top of Ethereum profit from its nature as being tamper-proof, immutable, and nearly impossible to shut down as there is no central server.

Wallet

In the context of blockchain, a crypto wallet is a tool that allows us to send, receive, and store cryptocurrencies and tokens.

It is a common misconception that the coins are stored on the wallet itself. This is wrong, the cryptos are always on the blockchain but the access to them (private key) is stored on the wallet.

Generally, there are three types of wallets in the crypto world: software, hardware, and paper wallets.

Also Read: Different Types of Crypto Wallets

Software wallets are the most convenient wallets. However, have a higher risk to be hacked since they are connected to the internet and exposed to hackers e.g. having your cryptos on the exchange.

Hardware wallets and paper wallets are less convenient to use but have a higher level of security. Since these wallets are not permanently connected to the internet as in the case of hardware wallets like a Nano Ledger or not at all in the case of a paper wallet where your private key is printed on a piece of paper.

Wallets are generally differentiated in two groups hot and cold wallets referring to their connectivity to the internet. While a software wallet is a hot wallet, hardware and paper wallets are examples of cold wallets as they are disconnected from the internet.

XRP

XRP is the native cryptocurrency of the XRP Ledger, a blockchain protocol developed by the company Ripple.

The two terms XRP and Ripple are often used synonymously in the crypto community although this is not correct.

Ripple is a privately held company while XRP is the native currency that runs on top of the XRP Ledger.

By market cap, XRP is the fourth-largest cryptocurrency in the world after Bitcoin and Ethereum.

Its main use case is global interbank settlements. The company aims to make them more effective by leveraging blockchain technology which allows them to settle transactions in 3–5 seconds according to their website. The XRP ledger is attempting to replace /compete with the SWIFT network which is the current method for interbank transactions.

Editor’s Note: Do not buy XRP, we don’t think it has any value.

Yield Farming

Yield Farming is the latest edition in the DeFi (Decentralized finance) ecosystem. There are several projects which are providing free tokens to people to provide liquidity to their protocol. Some of these projects are Compound and Balance for example.

For example, the Compound protocol created a COMP governance token. Currently, COMP is being airdropped to people who are borrowing and lending using the Compound protocol.

Zcash

The most famous privacy cryptocurrencies besides Monero. Zcash was launched in 2016 by Zooko Wilcox-O’Hearn and focuses on private transactions.

Similar to Bitcoin its maximum supply is 21 million coins. Although it is a common misconception that all cryptocurrencies are anonymous but this is not the case in reality.

The most prominent blockchain protocols such as Bitcoin and Ethereum are public. Every transaction can be seen by everybody, saved forever, and can be accessed by a blockchain explorer such as Etherscan.

Although transparency is seen by many as an advantage of cryptocurrencies, there are also downsides if there is zero privacy.

Zcash uses a technology called zk-SNARKs to make crypto transactions private. Although being criticized for largely being used by criminals a recent study proofed this allegation wrong.