The term DeFi, short for decentralized finance) has been circulating in the financial world in the past few years, and it’s not without reasons. The emerging movement promises to revolutionize the traditional finance (TradFi) sector, and it’s increasing in demand due to the pressure for a more transparent, democratic, and efficient financial system.

Table of Contents

What is DeFi?

DeFi is a term that describes a technology where different financial products and services are conducted on the blockchain network without middlemen or intermediaries. With DeFi, it’s open to all, and you can earn interest, borrow and lend, buy insurance, and trade derivatives without the hassle of paperwork. Furthermore, the technology eliminates the high fees traditional finance (TradFi) institutions like banks charge for using their services. Unlike banks, no centralized authorities can get in the way of your financial transactions, allowing one user to transact directly with another user through the internet. DeFi is gaining popularity as an alternative to TradFi because of its increased transparency, speed, and affordability.

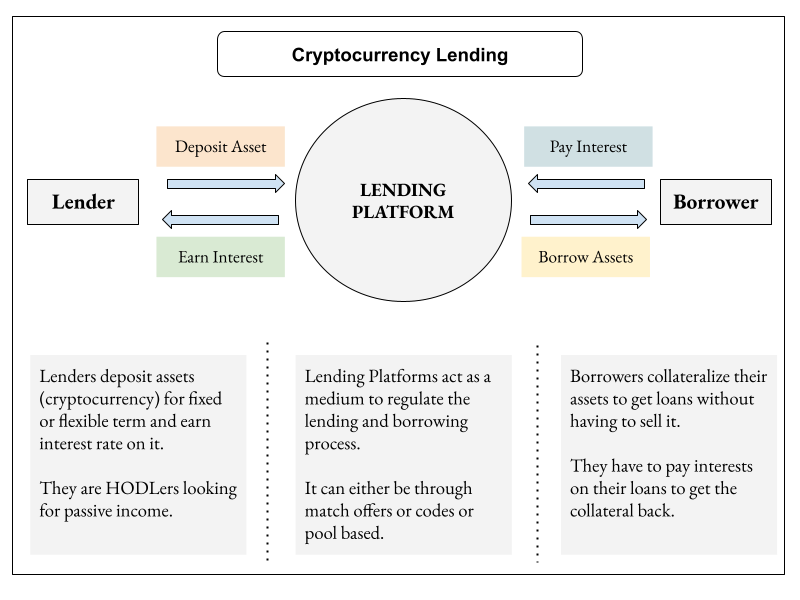

DeFi lending is one of the financial services enabled through the decentralized ecosystem. While in TradFi, the entire lending process is monitored by a centralized authority, in DeFi, it is handled by peer-to-peer applications called dApps. Like TradFi lending, DeFi lending allows crypto holders to deposit funds into a savings account and receive interest payments.

How does it work?

DeFi works by utilizing smart contracts run on the blockchain. Transactions are handled by decentralized applications known as dApps and run mainly in the Ethereum blockchain. A blockchain is a distributed ledger or database that is secure and shared among different computer networks called nodes. Transactions are recorded as “blocks” on the blockchain and then verified by other users. Once the verification is completed, the block is closed. Then, another block is created and chained with information from the previous block, thus the name blockchain.

With DeFi, users take full custody of their funds utilizing a secure digital wallet. A set of conditions are agreed upon initiating a transaction between two users using the digital wallet. Once the smart contract is set up, it cannot be changed or rerouted to a different account. Moreover, being open-source, DeFi protocols and applications are accessible by anyone.

DeFi lending allows crypto investors to generate more yield on their assets. Users can earn interest on their crypto by lending funds to other parties, mainly through lending pools. Regarding TradFi, banks provide loans to individuals based on their credit scores and are not always accessible to anyone. In DeFi, anyone can become a lender without a creditworthiness score as the determinant.

In TradFi, a borrower typically needs to provide collateral when borrowing from banks. For example, suppose the borrower takes out a home equity loan. In that case, the home is the collateral and failing to repay the loan may lead to losing the home to foreclosure. With DeFi lending, a smart contract allows users to pool their funds and lend them to borrowers based on the rules written in the smart contract. Depending on the different types of DeFi projects where the pool is based, there might be various ways to distribute interest to each lender or investor.

The way the collateral works in DeFi is relatively straightforward. A borrower generally needs to offer more valuable collateral than the loan amount. Furthermore, the collateral can be in different cryptocurrencies. As a reference, MakerDAO allows users to borrow Dai (a stablecoin cryptocurrency on the Ethereum blockchain maintained and regulated by MakerDAO) up to 66% of their collateral’s value or 150% collateralization ratio.

Benefits of DeFi lending

Generally, DeFi lending and borrowing offers more transparency, efficiency, and access than TradFi lending. Furthermore, DeFi proposed various compelling benefits that are arguably superior to what TradFi can offer:

Increased speed

Forget waiting for loan paperwork to be approved with TradFi lending; with DeFi’s smart contract; users can simply connect their digital wallet with the project’s site and request to make a loan. Because there are no intermediaries, the loan approval process becomes streamlined.

Inclusive and permissionless

Anyone with internet access and a digital crypto wallet can access financial services that DeFi offers, including lending. Therefore, there is no need to wait for centralised authorisation for loan approval or pay the high fees that TradFi institutions often charge. Moreover, there are no intermediaries in DeFi, and all transactions are done via peer-to-peer according to the smart contracts.

Transparent and accessible

Most DeFi projects are open source which means they are available for anyone on the internet to view, audit and build on. DeFi creators can connect multiple dApps to create various financial products without needing permission from a government or authoritative body.

Self-custody

Contrary to the TradFi where assets and personal data are managed by centralised authority, the use of digital wallets, for example Metamask or Trust Wallet, allows DeFi users to keep custody of their own crypto assets and data.

Risks of DeFi lending

Since DeFi applications are software that utilises the internet with little to no human supervision, there are few risks associated. The first risk is the coding errors or “bugs” to which all software is exposed. The bugs may cause the protocols to malfunction and cause errors or delays in the transactions. Secondly, security vulnerabilities in DeFi are common, especially considering the large number of financial assets going through the network, which makes it prone for hackers to steal the assets.

Mistakes are irreversible

Most DeFi projects are made of complex smart contracts automatically executed on the blockchain. Smart contracts may come with risks because if a mistake is made, for example, transferring funds to the wrong network or address, the action is irreversible and will cause lost of funds. Contrary to DeFi, TradFi institutions like banks and other centralised finance could trace back financial transactions and retrieve lost funds.

Volatile price swings

When dealing with DeFi lending, one of the downfalls is the price swings. If the price of the collateral drops below the price of the loan, there is a risk of liquidation. For instance, with MakerDAO, if the borrower requested a loan of 1000 Dai, then the minimum collateral for the loan would be $1500 in ETH. If the collateral drops below the $1500 ETH value, there would be a 13% penalty and liquidation.

DeFi scams

Another risk of DeFi lending that users need to be aware of is a type of exit scam known as “DeFi rug pull” that is, unfortunately, growing in volume. Because DeFi doesn’t have the central governance structure and regulations that TradFi provides, users need to rely solely on their trust and individual due diligence in the DeFi projects or platforms from which they borrow, lend and buy tokens.

DeFi rug pull is when developers of the DeFi project create a new token and pair it to a leading cryptocurrency such as ETH to pump up the price and set up a liquidity pool only to drain as much value out of them as possible before abandoning them. An infamous example of DeFi rug pull is when SushiSwap’s maker Chef Nomi raised over a billion dollars in collateral before suddenly liquidating his SUSHI tokens, causing the price of the tokens to fall near zero in 2020.

Examples of DeFi lending platforms:

Maker DAO

Maker DAO (decentralized autonomous organization) is the DeFi protocol behind the stablecoin DAI, a cryptocurrency that maintains a 1:1 peg to the US dollar. The idea for the project started through the Maker Foundation in 2014 by Rune Christensen and it is considered one of the pioneers of DeFi movement. Users can trade tokens, borrow Dai, and earn savings using Oasis Borrow which is the interface to the Maker protocol. Through the platform, users can borrow Dai by providing any supported collaterals such as ETH, WBTC, MATIC, and many others. Some of the benefits of borrowing using Oasis Borrow is that it’s completely free of charge, no repayment schedules or minimum payment, and no credit history requirements.

Compound

Compound is another DeFi project that allows its users to lend and borrow cryptocurrencies as well as take part in its governance process with its native COMP token. Backed by venture capital firms Andreessen Horowitz and Bain Capital Ventures, and Paradigm Capital, Compound lets users earn interest on their crypto assets, and the platform currently managing $3.4 billion of assets across 18 cryptocurrencies as of July 2022. One thing that’s unique with Compound is that it rewards lenders with COMP tokens based on

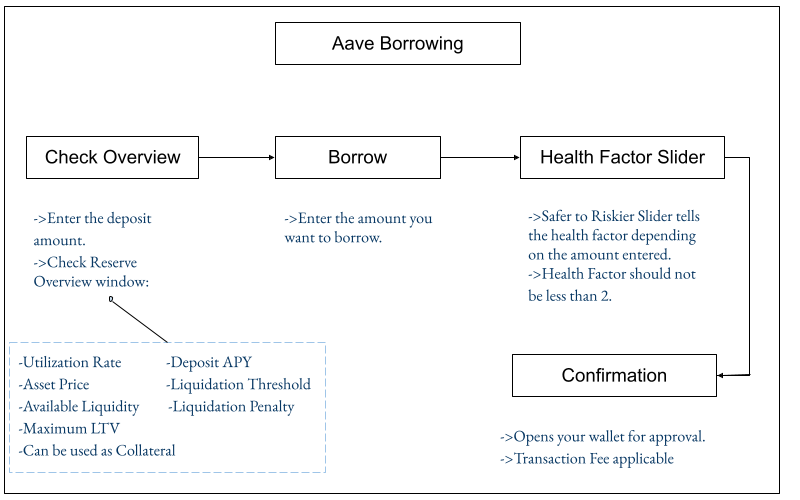

Aave

Similar to Maker and Compound, Aave is a DeFi protocol that allows users to lend, borrow and earn interest on different types of crypto assets. Currently, there are 30 lending pools for crypto assets such as Tether, Dai, and USD Coin. Originally built on on the Ethereum network (like most DeFi projects), Aave has now include other network chains such as Avalanche, Fantom, and Harmony to process transactions. Aave stands out among competitors with its features such as Flash Loans where certain loans can be issued and settled almost instantly without any upfront collateral.

Alternative to DeFi lending: CeFi lending

Blockchain technology’s growth allowed crypto verticals such as DeFi to emerge. It sprouted many others, such as centralized finance (CeFi) borrowing and lending platforms, to surface. Because DeFi is a relatively new technology and comes with a set of risks some are associated with technical malfunctions, CeFi came with the idea to create the same crypto asset yielding benefits as such with DeFi but with a centralized authority such as a group of people (mainly behind a company) to manage the assets and execute the services. Some of the major CeFi platforms are known for their intuitive user interface and convenient user experiences that are humane and personal. Furthermore, CeFi platforms are equipped to offer other financial services such as fiat to crypto conversions and cross-chain exchange.

Some of the most notable CeFi platforms are:

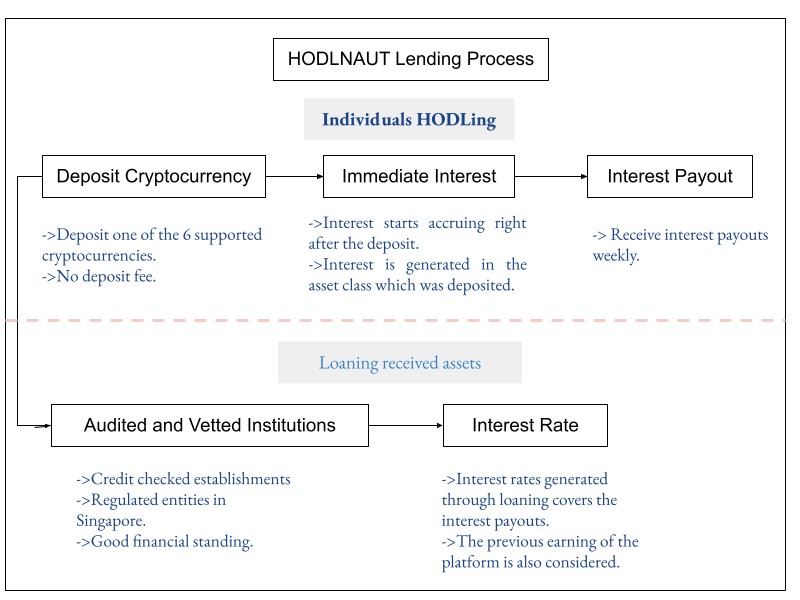

Hodlnaut

Hailing from Singapore, Hodlnaut prides itself on attractive interest rates and unique features such as preferred interest rates and token swap, to name a few. Started in 2019 by bitcoin maximalists Juntao Zhu and Simon Lee, Hodlnaut currently offers up to 7.25% APY through its crypto interest account. One of the advantages of Hodlnaut is that there are no lock-in periods or minimum deposits, and users can withdraw their funds at any time. Furthermore, the company is well known for its stellar customer support, with 4.8 ratings on Trustpilot.

YouHodler

YouHodler is another CeFi platform that provides various services such as crypto-backed lending with fiat currency, crypto-to-fiat and crypto-to-crypto conversions, and crypto savings account. Based in the Switzerland,

YouHodler allows users to earn up to 11.28% APY on crypto assets such as BTC, PAXG, and USDC. It is also convenient for those who are just starting to learn about cryptocurrency because the platform allows fiat currency deposits. However, to withdraw there are fees to withdraw fiat currencies with bank wire transfer fee for USD (SWIFT) at 1.5% and a minimum of $70.

BlockFi

BlockFi is considered one of the earliest and most prominent CeFi platforms in the industry with its 1 million users enjoying a range of innovative products such as crypto credit cards, interest accounts, and crypto trading. Founded in New York in 2017 by Zac Prince and Flori Marquez, BlockFi is known for its savings account’s attractive interest rates and low-interest rates on loans. However, it’s good to note that BlockFi doesn’t allow withdrawals on some of the cryptocurrencies it offers such as DOGE, ALGO, and BCH. Furthermore, although the company is based in the US, the BlockFi Interest Account product is not available for US investors due to legal challenges.

In Conclusion

Despite the volatility of cryptocurrency markets and increasing challenges in regulations, scalability, and security, DeFi lending has the potential to become the future of finance. The movement will continue to attract new investors due to its inclusive and open applications. DeFi has the premise to offer massive gains in the investors’ portfolios, but it also comes with high risk. Hence, performing due diligence is essential when considering borrowing and lending through a DeFi project. However, with more than 1 billion unbanked adults in the world due to the shortfalls, all eyes are on DeFi to see whether it can become the solution to TradFi problems.