The value of cryptocurrencies and security tokens can be heavily dependent on several market factors, including supply and demand of cryptocurrencies, the volume of trade and transactions, as well as extrinsic shocks such as positive or negative news.

For any trader or investors who have holdings, interest, or trades in such crypto, it will, therefore, be important to be mindful of any factors that can significantly impact the price of the digital asset, in order to have the right insights and make correct decisions on their transactions.

One event that smart traders and investors watch out for are crypto selloffs — this is an event wherein there is massive selling or “dumping” of tokens or digital assets. It’s similar to the dumping of stocks or other securities, wherein there is a massive amount of transactions leading to an excess supply of that security, and thus a big drop in its price or value.

Checkout Portfolio Manager Apps on CoinCodeCap.

When large amounts of crypto are deposited to exchanges, it can usually mean that someone or a group of people are preparing to sell. That means an impact on the price if the amount is large enough relative to the cryptocurrency’s market capitalization.

A crypto selloff will therefore also depress the value of a digital asset, which can significantly impact one’s portfolio if the underlying shock turns out to have a long-term effect on the market. However, such a fall in prices can also be a good opportunity for traders to pick up the crypto if there are indications that prices will eventually rise to pre-selloff levels.

Here are some ways to predict such an event

Activity by big players and “hidden hands”

The so-called “whales” have a huge influence on cryptocurrency markets because of their significant holdings. These individuals or entities even have the ability to influence the price of a digital asset with massive volumes of transactions — something that is said to have influenced how Bitcoin reached its peak price in late 2017.

During that time, for instance, there was reportedly a bot pumping up the value of Bitcoin by flooding the markets with the stablecoin Tether. Much of the impact here can be analyzed through hindsight, but the ability to monitor the sources and volume of transactions beforehand would have been helpful in predicting an eventual bubble-type drop in the value of Bitcoin toward early 2018.

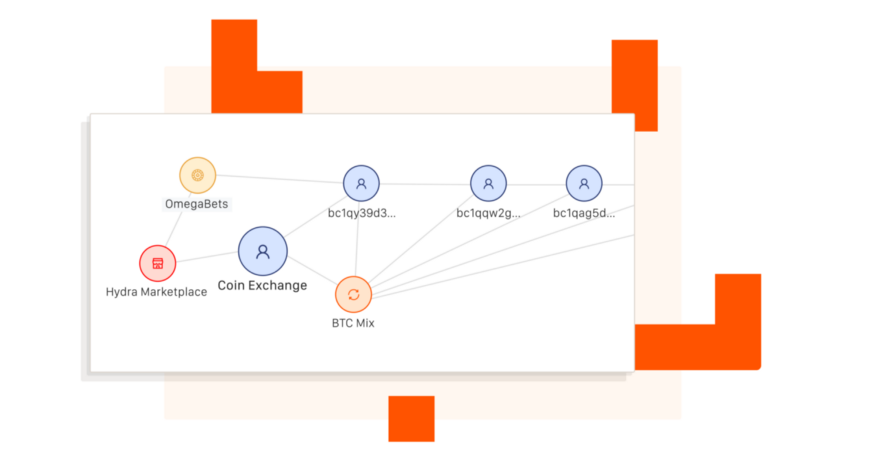

Hence being able to monitor these whale addresses are one method to staying ahead of the market, and also be the first to know that a whale has moved a substantial amount of crypto to external exchanges. Using instant wallet tracking services, users can easily monitor whale addresses and be notified in real-time when such whale transactions occur.

Impending news of regulation

Regulation, per se, is not necessarily negative toward cryptocurrency and token markets. However, some regulations might have a negative impact, such as when certain jurisdictions ban the use of some types of digital assets, security, or technology. These external events can then influence crypto holders to sell in large quantities.

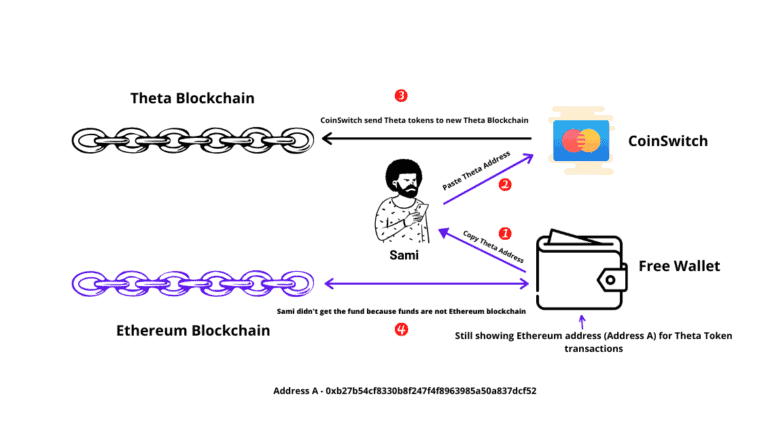

Wallet monitoring can also help these holders to be better prepared for such extrinsic shocks. For example, you can put an exchange address under monitoring for incoming deposits of certain crypto. To customize and automate reactions, you can set specific threshold prices that you think can trigger market prices to change. By knowing that a deposit is taking place on the exchange before it impacts the price, you can act accordingly.

Significant security events

Cryptocurrency platforms have been the subject of attacks and schemes that have led to theft or loss of digital assets. Scammers liquidating their assets can trigger a selloff, thus heavily impacting the value of the tokens.

As cryptocurrency hacks across exchanges, wallets and other crypto service providers occur time after time, the importance of monitoring crypto assets with smart, real-time and customizable blockchain security solutions cannot be undermined.

The importance of monitoring

These are only a few examples of how market forces and external activities can lead to a cryptocurrency selloff. For a trader, investor, or holder of crypto assets, it will therefore be critical to have the ability to monitor transactions, movements, or trends, even before any activity is executed or confirmed.

Some of the most promising wallet monitoring services:

- CoinTracker. Tax and portfolio manager for cryptocurrency. Users from 146 countries have synced their crypto wallets to monitor their portfolios.

- Chainalysis. Provides blockchain data and analysis to government agencies, exchanges, and financial institutions across 40 countries.

- PARSIQ. Automates the blockchain analytics and monitoring process, providing customizable workflows with real-time intelligence.

Attribution

This article is written by Anastasia Shcherbina. She holds MS in Digital Marketing.