Grid Trading bots work by the simple strategy of buy low and sell high. However, these bots places buy/ sell orders within a specified upper and lower limit. Furthermore, if the asset’s price jumps below the specified limits, it does not execute any more buy orders.

Top GRID Trading Bots: Briefly

| Bots | Features | Mobile App | Cheapest Plan | Standout Feature |

| Pionex | GRID Trading Bot | Android & IOS | Free | Spot-Futures Arbitrage Bot |

| 3Commas | MarketPlace for Trading Bots | Android & IOS | $14.5/Month | Options Bot |

| BingX | Trading Exchange and Bots | Android & IOS | Free | Beginner Friendly |

| Bitsgap | Combo Bot | Android & IOS | $19/Month | Futures Trading Bot |

| Quadency | Market Maker | Android & IOS | $49/Month | Portfolio Rebalance |

| KuCoin | GRID Trading Bot | Android & IOS | Free | In-built with KuCoin Exchange |

Grid Trading Bots: Summary

- Grid Trading helps you to make profits by buying and selling orders at predefined price intervals. It allows you to take advantage of fluctuating market prices.

- Grid Trading bots allow you to automate Grid Trading Strategies.

- Top Five Grid Trading Bots are provided by – Pionex, Bitsgap, Quadency, 3Commas, and KuCoin.

- Pionex offers five free built-in trading bots.

- Bitsgap provides easy-to-use trading bots with optional features – stop-loss, Take Profit, and Trailing up.

- Quadency Grid Trading Bots are user-friendly. Additionally, they allow you to configure different conditions on when the bot should stop working.

- 3Commas Grid trading bot provides manual and AI modes to automate your crypto trading.

- KuCoin, the crypto exchange, provides four types of inbuilt Grid trading bots through its mobile app.

What is a Grid Trading?

Grid Trading allows you to buy and sell orders at predetermined price intervals. The range is divided into multiple levels forming a grid. You can select the number of levels according to your requirement.

The higher the number of levels, the more will be the trading frequency. This will also decrease the price difference between each level, i.e., the amount per grid, which reduces each order’s profit.

Therefore you have to choose whether you want a higher number of trades to be executed with less profit or fewer trades with higher profit.

The buy and sell orders are set below and above the current price. As soon as a sell order is executed, you can place a buy order at a level below it. Similarly, if a buy order is executed, you can place a sell order at a level above it.

Why use Grid Trading?

Grid Trading helps you make a profit from the ups and downs of an asset’s market price. They have proven to be one of the best trading strategies in a ranging sideways market.

Best Crypto Grid Trading Bots

1. Pionex

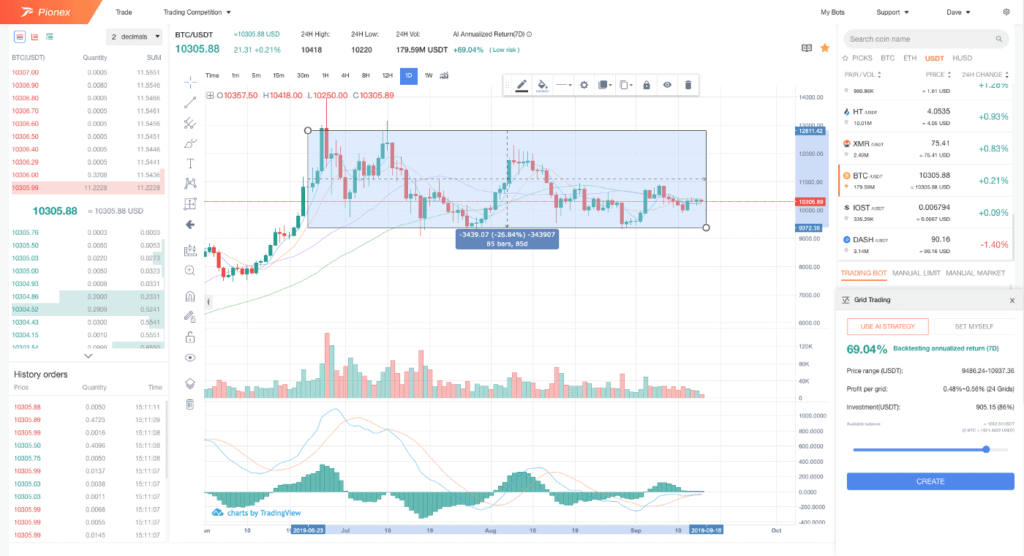

Pionex offers five free types of built-in grid trading bots with only a 0.05% trading fee. They are as follows –

Smart Grid Trading Bot

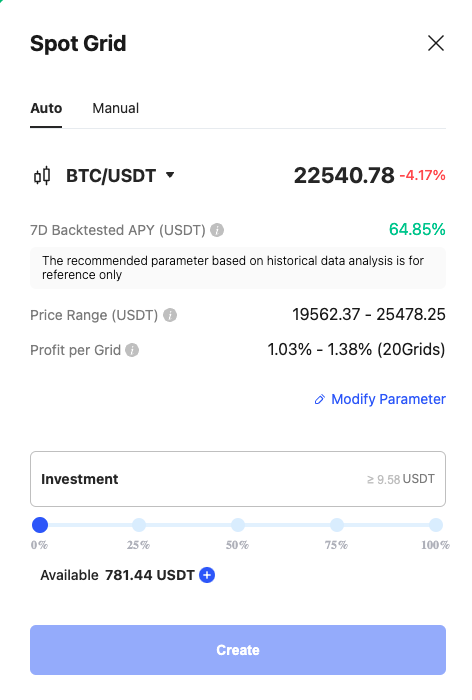

Pionex Grid Trading Bots allow you to automate grid trading strategies. You can set a price range and the number of grids. You have to select the percentage of funds you would like to allocate. They provide two types of Grid Trading Bot – “Use AI Strategy” and “Set Myself”.

- Use AI Strategy – The Pionex AI Advisor suggests a set of parameters calculated from backtesting the last seven days. The recommended price range and profit per grid is available for preview.

- Set Myself – You have to set parameters such as – Upper Limit Price, Lower Limit Price, Number of Grids, Amount per grid, and Stop-Loss price

Reverse Grid Bot

Pionex’s Reverse Grid Bots allow you to store your assets when the price drops. Then it sells your assigned assets at the current level and repurchases them when the price drops. If, according to your analysis, the price will drop, you should use Reverse Grid Bot

You have to configure parameters- Price range, the number of grids, grid spacing setting (Arithmetic / Geometric), and the percentage of funds. You can also set the optional features Trigger price, stop-loss price, and Close Bot.

They don’t have a SHORT feature. If you want to use the SHORT feature, you can use Leveraged Reverse bot or Margin Grid bot.

Infinity Grid Bot

Pionex’s Infinity Grid Bots are the premium version of Grid Trading Bot. They allow you to “buy low and sell high.” The total number of assets remains the same while the price is increasing. You can set the range using percentages. There is no upper limit. You have two options – “Use AI Strategy” and “Set Myself”.

- Use AI Strategy- It is similar to the option Grid Trading Bot with some differences. The parameters are calculated by backtesting the last 30 days’ data. The Profit per grid is fixed at 0.6%.

- Set Myself – You have to configure parameters such as Lower Limit Price and Profit per grid. The bot will stop trading if the price drops below the lower limit price.

Leveraged Grid Bot

Pionex’s Leveraged Grid Bot allows you to magnify your profit by leveraging your investment. Pionex combines the lending market to leverage the principal for a higher yield. Experienced traders use leveraged grid bots in up-trend market conditions

You must set parameters – lower limit, upper limit, grids, leverage, borrowable fund, daily interest, and estimated liquidation price.

The borrowable fund is the fund available in the pionex pool for traders. The daily interest is dynamic according to the available borrowable fund. If the number of users using leveraged grid bot increases, the interest rate will increase and vice versa. The leverage can be fixed to 1.2X, 1.5X, and 2X.

Margin Grid Bot

You can lock up your funds as collateral. Pionex combines the grid trading strategy and the lending market without using your collateral for trading. The collateral is also different from Leveraged GRID Bot.

Experienced traders use margin Grid Bots to make a profit without risking their long-term holding position. They are also used by traders who try to shorten or long the market.

You must set the lower and upper limit, leverage, grids, borrowable fund, daily interest, and estimated liquidation price. They provide four leverage options – 0.2X, 0.5X,1X, and 2X. The daily interest and the borrowable fund are similar to Leveraged Trading Bot.

2. 3Commas Grid Bot

The 3Commas Grid bot trading strategy is perfect for beginner and professional traders.

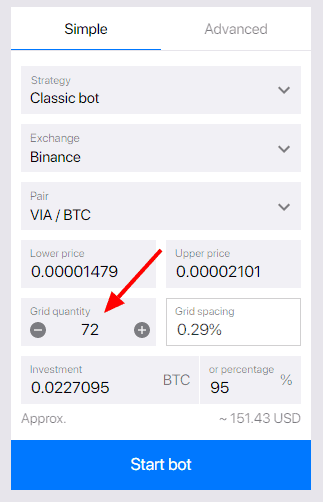

The simple interface of 3Commas allows you to connect an exchange and choose the bot mode to automate your trades. Furthermore, the platform provides two primary GRID bot modes: AI and Manual.

- Manual Mode: The manual mode at 3Commas provides complete control over the Grid bot. Furthermore, once you connect your exchange, you can enter the upper and lower limits, Grid quantity, quantity per grid, and investment amount. The bot then starts running and taking returns on your behalf.

- AI Mode: The AI mode at 3Commas prevents you from all the complexities of deciding the upper and lower limits of the grid. Furthermore, the AI gives you an estimated return per grid within the chosen range. All you have to do is connect your exchange and provide funds to the bot.

The platform charges zero trading fees from its users. That is, you can open and close trading positions without any charges. However, you have only to pay when you generate profit on the platform, and 10% of your total profit earned is charged as fees.

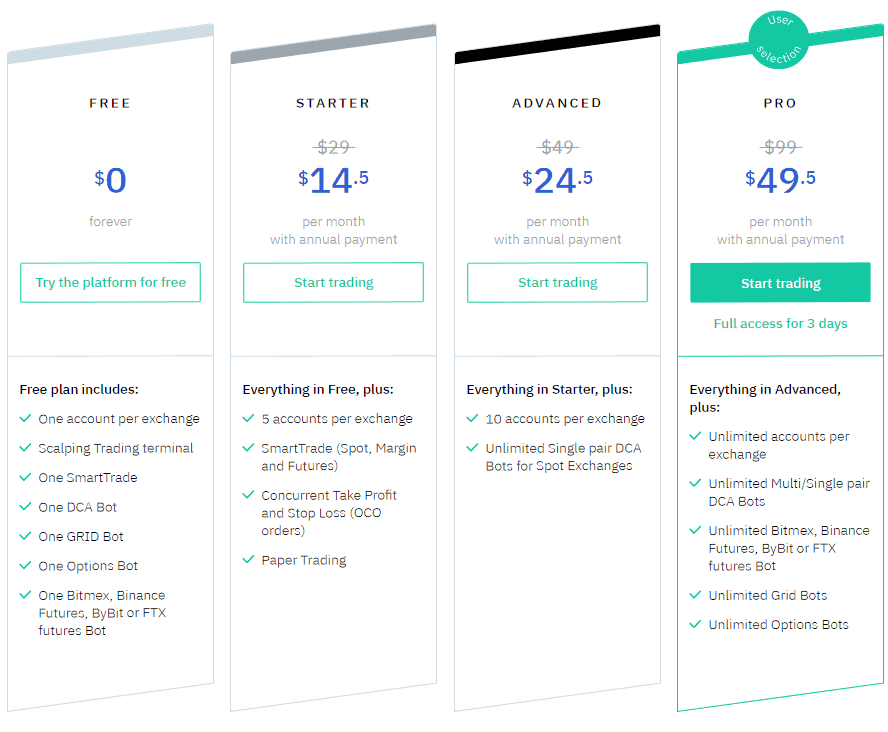

3Commas Pricing

3. BingX

Recently a lot of exchanges have started introducing Grid trading recently. BingX is one of them. It started as a crypto trading exchange, then BingX introduced copy trading. Recently they have introduced Grid trading.

It is very easy to configure. First, you need to sign up.

Once you have signed up use the button above and press on create button to create a new Grid trading bot.

You can use both Auto or Manual mode. In manual mode, you can change parameters such as number of Grids, Daily low and high, and investment.

There is no fee to use BingX grid bot; it’s similar to Pionex.

4. Bitsgap

Bitsgap offers one of the best Binance grid trading bots. They allow you to set grid quantity, exchange, price, lower and upper price limit, and the percentage of funds you would like to allocate.

They also provide optional features – stop-loss, Take profit, and trailing up. Bitsgap calculates the profit per grid by subtracting the price percentage per grid by the trading fee percentage for both buying and selling.

For example, the grid spacing is 0.5%, and the trading fee is 0.1%. Then 0.2% will be deducted as a trading fee for buying and selling.

Therefore, the profit percentage per grid is 0.3%. They allow you to set the grid quantity and spacing, directly affecting the profit. The profit per grid tells you the profit you can make when buying and selling between the two grids minus the trading fee.

The grid quantity can be anything between four and ninety-nine. Bitsgap recommends adjusting your profit per grid between 0.5% and 2%

The minimum investment needed to launch a bot depends on your set parameters. The minimum deposit is calculated based on Grid Quantity.

Bitsgap calculates the minimum order size and the minimum order increment. The minimum order size restricts the amount that bots per order can use. The minimum order increment defines by what value bots can increase the amount

For example, if your minimum order size is 10 USD and the minimum order increment is 2 USD. You can place orders for 10 USD, 12USD, and 14USD, but not for 8USD or 14.50USD.

The stop loss feature allows you to set the base currency when the price reaches the stop loss price condition.

They help you to limit your losses. If trailing up is disabled, the stop loss is permanent; else, it becomes dynamic. Additionally, you can switch on and off the stop loss in active bots.

You have to set the price at which stop-loss should be executed. When it gets triggered, all open bot orders are canceled automatically.

The bot sells the used base currency at the best available price via a market order. Additionally, Bitsgap removes the bot from active bots, and Bitsgap adds the data to the History tab.

Bitsgap Pricing

| Category | Price (USD) Monthly | Characteristics |

|---|---|---|

| Basic | $19 | -$25 monthly trading limit-Two active trading bots |

| Pro | $44 | -$100000 monthly trading limit- Five active trading bots- Arbitrage |

| Advance | $110 | Unlimited monthly trading Limit.- Fifteen active trading bots.- Arbitrage- Take Profit for bots. |

All three packages provide – Trading signals, Portfolio, Extended order types, and demo trading. Additionally, the Pro package offers priority support.

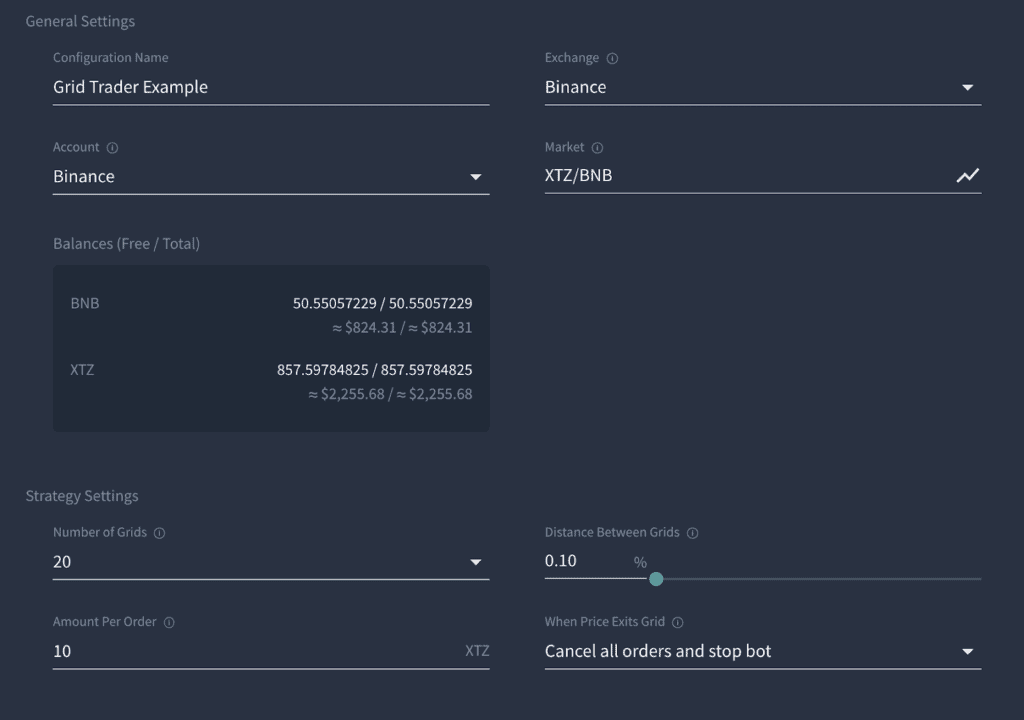

5. Quadency Grid Bot

Quadency offers grid trading bots to automate grid trading strategies

You have to configure the following parameters – the exchange, number of grids, the distance between the grids, amount per order, and the condition when the bot should stop working. The higher the number of grids, the higher the coverage, and more investment will be required. You have four options to choose from when the price exits the grid-

Recreate grid around exit price and continue trading

This cancels all open orders and closes open positions with a market order. You can use this option if you have sufficient balance and recreate the grid when the price exits the grid.

Cancel all options and stop the bot

This cancels all the remaining open orders and stops the bot. This does not close any open positions. A position is open if it satisfies any of the following conditions-

- The bot has bought quantity but has not sold the same amount.

- The bot has sold but not back-bought the same amount.

Cancel all orders, close all positions and stop the bot

This option closes all positions and cancels the remaining open orders.

Do nothing

In this option, the bot stops working after all orders are filled. After the price enters the grid, the bot resumes trading. If the price never enters the grid, the orders remain open until they get canceled manually.

Quadency Pricing

The platform charges zero trading fees from its users. That is, you can open and close trading positions without any charges. However, you have only to pay when you generate profit on the platform, and 10% of your total profit earned is charged as fees.

| Category | (USD) Monthly | (USD) Monthly | Characteristics |

|---|---|---|---|

| Lite | Free | Free | -Email- 10 backtests per day- One running live bot- Monthly trading limit is USD 50,000 |

| Pro | $39 | $49 | 100 backtests per day-Twenty running live bots- Monthly trading limit is USD 500,000- Email and Live chat |

| Advance | $79 | $99 | Unified rest and streaming API-Unlimited backtests- Unlimited live running bots-Unlimited monthly trading limit.- Email and Live chat-Strategy Coder |

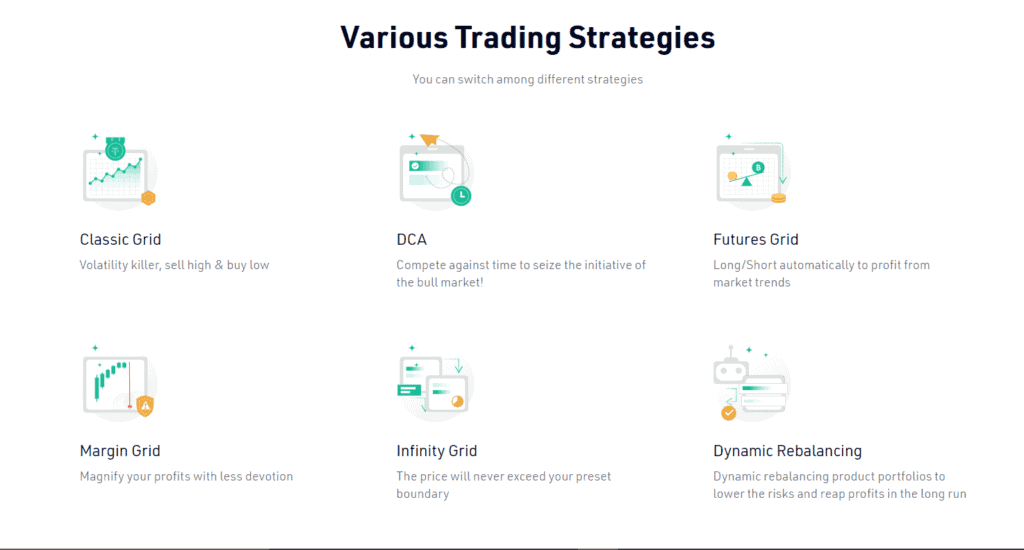

6. Kucoin Grid Bot

KuCoin is a popular cryptocurrency exchange that also has a crypto trading bot. However, KuCoin’s crypto trading bots are only accessible via the exchange’s mobile app. In addition, the platform has four different types of Grid bots. To learn more, read How to Use the KuCoin Bot in 2022?

- Classic Grid: The Classic GRID trading technique focuses on gaining from market volatility. In a specific price range, it buys cheap and sells high. On the other hand, the classic GRID only allows trading in the spot market.

- Futures Grid: The Futures grid is a more advanced variant of the traditional grid bot. On futures, it employs the buy short and sells high approach. However, because futures trading is based on leverage, this bot may expose you to liquidation risks in volatile markets. You can go with the Bitsgap Futures trading bot as an alternative.

- Margin Grid: The Margin grid trading bot at Kucoin uses a grid approach for margin trading. With little effort, you can leverage your cash and increase your income. You should not leverage significant positions because a margin grid bot trading might expose you to substantial risks similar to margin trading.

- Infinity Grid: The pricing on the infinite grid never exceeds the conditions or boundaries you define.

The inbuilt Kucoin bots are entirely free of charge for their users. You only need to sign-up to the platform and download its app to get started.

Grid Bots: Conclusion

In conclusion, Grid Trading bots allow you to automate your trading strategies and reduce manual work. They operate 24/7. The bots can be customized according to your requirement. After comparing the top five grid trading Bots of Pionex, Bitsgap, 3Commas, KuCoin, and Quandency, Pionex clearly outperforms.

Pionex offers five free built-in grid-trading bots with impressive features. Each of these bots is suited for different situations and is easy to use. On the other hand, Bitsgap offers beginner-friendly trading bots with additional features of stop-loss, Take-Profit, and Trailing-up

Quadency also provides user-friendly trading bots. They allow you to configure different conditions when the bot stops working. This helps you to have more control over your bots.

Furthermore, through its AI mode, the 3Commas Grid trading bot allows you to skip the hustle of deciding upper and lower limits. Finally, Kucoin’s inbuilt Grid bots come in many variations and are completely free of charge for traders using the platform.

Frequently asked questions

What is Grid Trading?

Grid Trading allows you to buy and sell orders at predetermined price intervals. The range is divided into multiple levels forming a grid. The buy and sell orders are set below and above the current price. As soon as a sell order is executed, you can place a buy order a level below it and vice versa.

Why should we use Grid Trading Bots?

Grid Trading Strategy requires continuous market monitoring. You have to take advantage of the market price fluctuations and buy and sell according. Grid Trading Bots automates the entire strategy keeping in mind your requirements. They reduce manual effort and return better profits.