Estimated reading time: 8 minutes

In this article, we will review Shrimpy, a crypto trading platform for your personal crypto investments. The application focuses on long-term strategy automation, portfolio tracking, and coping strategies from other traders in the social program.

Shrimpy Review: Summary

- Manage your crypto portfolio in a simple way

- Automate strategies over the long-term with trading bots

- Analyze your portfolio over time

- Copy other traders in the social trading program

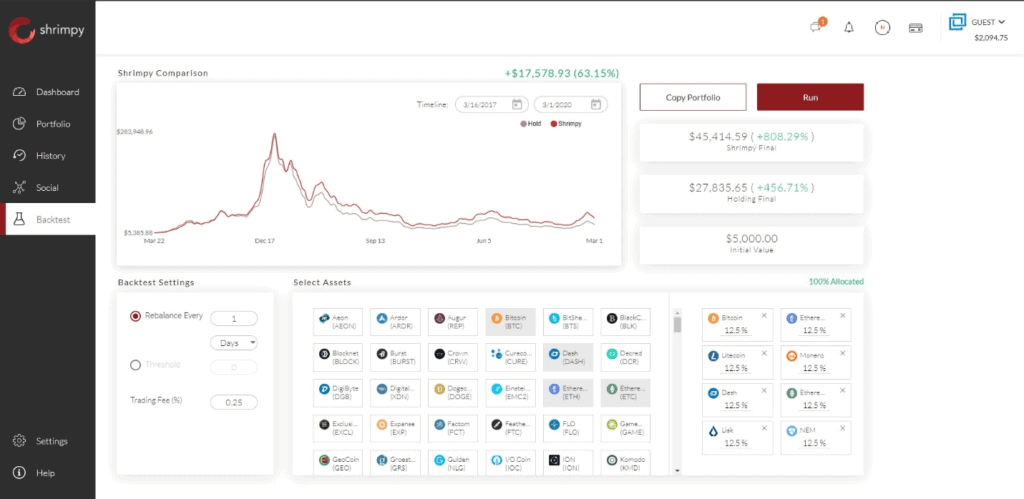

- Backtest strategies

- Develop new applications with the crypto APIs

- Collect historical and live market data from every major exchange

Shrimpy Review: Features

We could divide all the features into 3 parts: Management, Trading & Automation.

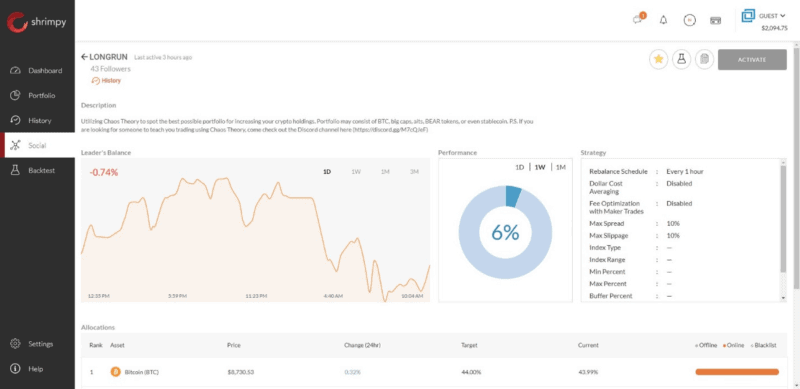

Social Portfolio Management

Social portfolio management is a concept that is being defined by Shrimpy. Unlike other trading platforms, Shrimpy allows crypto investors to leverage social portfolios to copy leading traders, discuss different strategies, and automate their portfolio.

It’s important to understand that Shrimpy is not designed for signals or indicators. Instead, it allows for long-term portfolio management through simple automation like rebalancing, dollar-cost averaging, and stop loss.

This provides a way for new investors to learn about cryptocurrency, interact with expert investors, and simplify their lives with social automation.

Automating a portfolio in the social program is as easy as selecting to “Activate” the leader. This will immediately begin copying the strategy of the leader and automating every update that is made by the leader.

[optin-monster-inline slug=”kypqbd8bxbsurarmqsxd”]Without any hesitation, Shrimpy will continue implementing the strategy.

If you aren’t interested in having a leader automate your strategy, that’s not a problem. You can still discuss with various leaders, copy a leader’s strategy into your automation tab (without activating it), and explore the assets that different leaders hold. It’s the perfect place to learn more about the cryptocurrency market.

Tracking your portfolio

Tracking your crypto portfolio starts on the dashboard. This is where you will see each of the assets you own on your exchange account. Shrimpy supports all major exchanges, so you can flip through each of your exchanges to see all your balances. It feels comfortable yet professional.

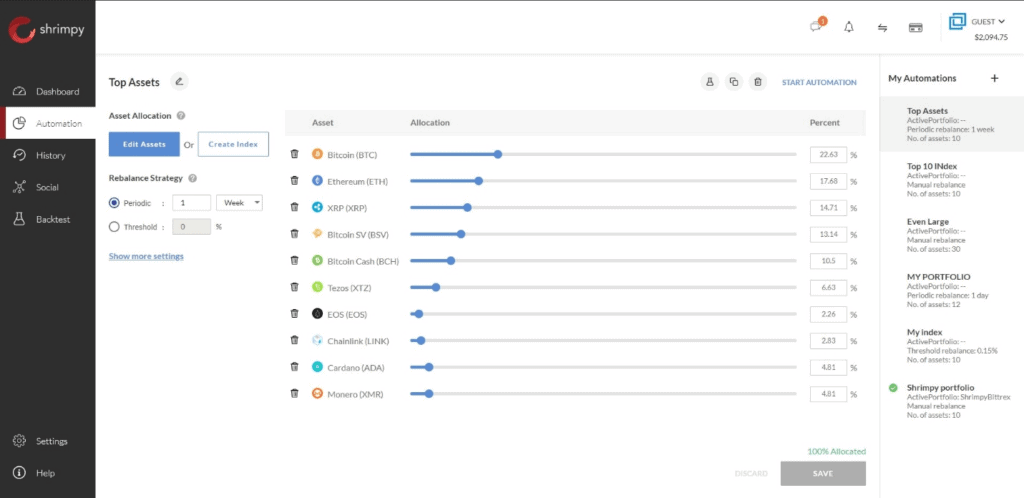

A dashboard to track your entire portfolio is convenient, but Shrimpy goes beyond simple tracking. On the dashboard, you can select to split up your funds into multiple portfolios. This provides a way for you to track, manage, and automate your funds through individual portfolios.

Each portfolio is treated as a separate set of funds in Shrimpy. This separation is not on your actual exchange account, so Shrimpy intelligently tracks the movement of your funds to keep them organized and separated.

While you automate your portfolio, different events will be populated in the “History” tab. These events will highlight different information about rebalances, trading events, and how your strategy has changed over time.

Trending

Uphold Card Review – Is it Legit or Scam?

Portfolio automation

Automating a portfolio is simple with Shrimpy. Unlike other trading bots that provide every possible indicator, signal, and statistic, Shrimpy eliminates this complexity by only focusing on the core long-term strategies that matter the most.

Shrimpy APIs for Crypto Trading

The portfolio management application is not everything offered by Shrimpy. They also support a developer API product that allows developers to build portfolio management applications, trading bots, and trackers easily.

With only a single API, developers can connect to every major exchange without writing any custom code for each exchange. It’s a developer’s fantasy, and Shrimpy pulled it off with exceptional taste.

Trading API

Shrimpy APIs allow developers to execute trades on all 16 exchanges supported by it. The APIs support limit orders, market orders, and smart order routing. Each of these orders are placed on exchanges with lightning speed and precision.

As developers scale their applications from 1 to 1 million users, the Shrimpy trading engine scales with them. That means developers never need to worry about scaling their infrastructure as they grow. Shrimpy will automatically take care of the process.

Developers can spend more time focused on their product and less time worrying about how they will be able to manage the growth.

Smart Order Routing

As mentioned, smart order routing is built into the Shrimpy APIs. This feature provides the easiest way for developers to start optimizing their trading without ever thinking about the complex logic that goes into smart order routing.

With smart order routing, developers can simply specify an asset they want to sell and an asset they want to buy. Within seconds, Shrimpy will evaluate every possible route and begin executing trades to get the best price. It’s a feature that every developer needs.

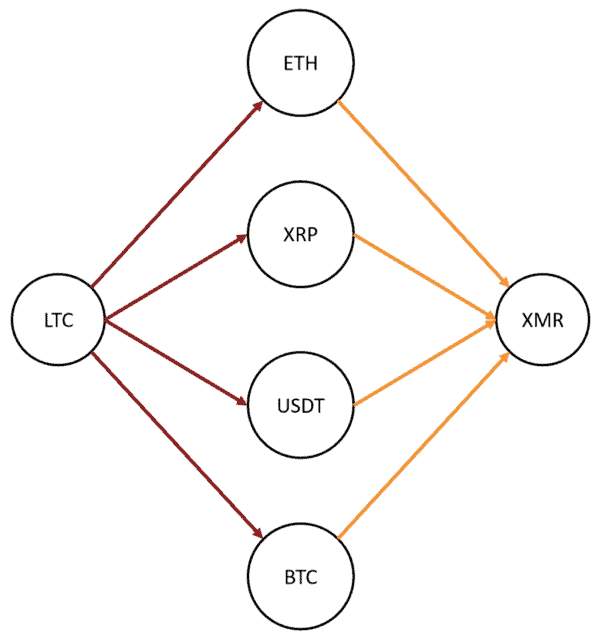

As an example, say you want to trade from LTC to XMR. On most exchanges, there will be multiple trading pairs that connect these two assets. You could use Ethereum, Ripple, Tether, or Bitcoin. Shrimpy automatically evaluates all of these trading pairs to find the best price during trading. Developers only need to specify where they want the funds to go.

Live Data API

Live data is the backbone of trading. Without live data, traders can’t make informed decisions on when to trade. To prevent traders from getting left in the dark, Shrimpy provides a variety of endpoints for developers to access the most up-to-date exchange market data.

With the APIs, live market data can be accessed either through the REST API endpoints or the WebSocket feeds. Both options provide benefits in different situations.

The live WebSockets are ideal for high-frequency trading. As the price on the exchange changes, updates will be sent through the WebSockets to keep traders up to date in real-time.

On the other hand, the REST API endpoints are ideal for infrequent trading or mobile applications. They provide an easy way to get a snapshot of the current order book without continuously getting updates in the future.

In addition to these endpoints, Shrimpy also supports live candlestick data, tick-by-tick trade data, and general price tickers.

Historical Data API

If you’ve ever tried to analyze a trading strategy, you know the importance of historical data. Thankfully, Shrimpy provides one of the most robust sets of historical data available in the market.

Going back as far as 2012, Shrimpy provides candlesticks, order book snapshots on a 1-minute interval, and tick-by-tick trade data.

The pricing plans for historical data are also straight forward. Several tiers can be accessed so you can collect anywhere from a few million data points to billions of data points.

These options are ideal for anyone from individual traders to institutions who need to process millions of trades to train complex AI trading solutions.

Supported Exchanges

Shrimpy currently supports the top 16 exchanges in the market. This list includes Binance, KuCoin, Bittrex, Coinbase Pro, Binance US, Bittrex Global, Kraken, Poloniex, Gemini, Bibox, BitMart, Huobi Global, HitBTC, OKEx, Bitstamp, and Bitfinex.

All these exchanges are available for both the social portfolio management application and the developer APIs.

Shrimpy Review: Partnerships

The Shrimpy team has been actively working with exchanges, data provides, tax services, and other trading services to bring significant value to the community.

At the time of writing, some of their partners include KuCoin, OKEx, HitBTC, Kaiko, CoinStats, CoinAPI, CoinTracker, Koinly, CryptoTrader.Tax, and BitMart, to name a few.

Shrimpy Review: Pricing

Currently, the social trading platform costs $19/mo. It gives you access to everything Shrimpy offers for portfolio management, social trading, backtesting, and automating your portfolio.

If you are developing an application using the developer APIs, the cost is far more flexible. The plans start at $14/mo, but increase as you need additional historical data or manage more users.

Outside of the subscription costs, Shrimpy does not charge any commissions on trades or any other hidden fees. Everything is included in the subscription cost.

Shrimpy review: Pros and Cons

Pros

- Focus on portfolio automation

- Best for beginners

- Intuitive Interface

- Create asset index

Cons

- No trading bot scripting support

- No mobile app

- Trading terminal is not supported

Shrimpy Review: Conclusion

Shrimpy currently supports two excellent services. One service is perfect for the cryptocurrency investor who wants a hands-off (yet engaging) experience when investing in the cryptocurrency market.

The other service is perfect for cryptocurrency developers who are trying to build scalable trading bots or services.

Together, both tools are the perfect match to facilitate the global adoption of cryptocurrency through conveniently connecting people to exchanges.

We think these are both essential services for the next wave of cryptocurrency adoption as we begin to see more and more retail investors enter the market.

We highly recommend everyone check out both applications and give them a try.

Let us know what you think about our Shrimpy review in the comment sections.

Frequently Asked Questions

u003cstrongu003eDoes Shrimpy have a mobile app?u003c/strongu003e

No, Shrimpy does not have a mobile app on Android or iOS. However, Shrimpy has a responsive website that you can use on a mobile browser.

u003cstrongu003eWhat is Shrimpy pricing?u003c/strongu003e

Shrimpy has a freemium plan which only includes portfolio tracking and its premium plans start from $19/mo.

u003cstrongu003eDo Shrimpy support backtesting?u003c/strongu003e

Yes, you can backtest your portfolio strategies for any exchange for more than 5 years. It has multiple configurations for its backtesting feature.

u003cstrongu003eDoes Shrimpy have APIs?u003c/strongu003e

Yes, Shrimpy provides APIs that allow developers to build portfolio management applications, trading bots, and trackers easily.

Shrimpy Alternatives

Pionex

Pionex provides tools for trading automation. There is no month on month fee on Pionex, they only charge the trading fee as it’s an exchange too. Try Pionex Leveraged Tokens to earn more with less money.

Quadency

Quadency, a crypto trading automation platform launched in 2018. It brings you a smarter way to trade, automate, and manage your crypto. It supports top exchanges: Binance, Kucoin, OKEx, Kraken, or Liquid.

CryptoHopper

Cryptohopper, an all-in-one trading platform designed to automate trades, copy experienced traders, set signals and alerts, and much more. While investors must pay to use Cryptohopper’s most advanced features, the platform does not demand a per-trade fee.

Related Article

![Profittradingapp For Binance Review [Important Read] 9 Profittrading App For Binance Review](https://coincodecap.com/wp-content/uploads/2021/11/Desktop-2021-11-28T193734.060-768x432.png)