Social trading has become a booming market in the investing world. Millions of investors are already participating in some form of social trading.

Throughout this article, we will compare two of the biggest names in crypto social trading: Shrimpy and eToro.

eToro was one of the first major players that pioneered the social trading scene when the social trading platform launched in 2007. Since launch, they have garnered attention from millions of investors. A major turning point for the platform came in 2014 when they launched support for cryptocurrencies.

Shrimpy is a new, but rapidly growing, social trading platform that focuses on cryptocurrency exchanges. Unlike eToro, Shrimpy does not custody assets, instead, Shrimpy connects directly with your crypto exchange account. By integrating with 16 different exchanges, Shrimpy has built a community of passionate traders.

Disclaimers

Shrimpy Went out of the business

eToro is a multi-asset investment platform. The value of your investmen ts may go up or down. Your capital is at risk.

What is Social Trading?

Social trading is a concept that comes in many different shapes and sizes. While some social trading strategies involve significant manual work, others can be fully automated.

Different Types of Social Trading

Single Groups

Signal groups typically aggregate on text chat channels where a group leader will send out messages or “Signals” that can be used by the followers of a channel to make trading decisions.

Copy Trading

Copy trading is a strategy for copying each individual trade that is executed by a leading trader. The copy trades are attempted at the same exact price as the leader.

Strategy Marketplace

Strategy marketplaces are places where traders can meet to buy or sell trading strategies. Think of it like Amazon for trading strategies. People can browse different strategies and purchase the ones that work best for their portfolio.

Copy Allocations

Copy allocations is a simple way for traders to share the percentage of each asset they hold in a portfolio and other people can automatically follow those allocation percentages. As the leading trader adjusts their allocations, it will automatically adjust the allocations of any followers.

Also Read: What is an Example of Social Trading?

Benefits of Social Trading

Social Leaders

Social leaders earn money for their services as a leader. Sometimes this is through subscriptions to signal groups, receiving payment from the social trading platform, or through charging performance fees.

Social Followers

Social followers will receive the same performance as the leaders in the trading group. That means if the leaders are experienced investors and outperform the market, each of the followers will benefit from the knowledge of the leader and also outperform the market.

RELATED RESOURCES

Best Paid And FREE Crypto Trading Bots In 2022

5 Best Crypto Trading Bots in Germany

3Commas vs Mudrex vs eToro [2021]

Different Types of Crypto Trading Bots

What is a Bitcoin Trading Bot? A Complete Guide 2021

Trading Features

In this article, we will focus our attention on those social trading strategies that allow the automatic execution of trades. Signal groups and strategy marketplaces are generally cumbersome to use, highly manual, and often outdated.

Automated trading requires a quality set of trading features that can be leveraged by both the social leaders and the social followers to successfully implement a strategy.

Shrimpy

Shrimpy provides a wide range of trading tools that are constantly expanding. After connecting a Shrimpy account to one or more cryptocurrency exchanges, traders can begin implementing a trading strategy.

Trading Tab

Social leaders that want to manually trade a portfolio can execute individual trades on the trading tab. On this tab, we can find options for both limit orders and smart market orders. These options provide the foundation for most manual trading strategies.

Whenever a social leader executes a trade using the trading tab, the changes are automatically sent to each and every follower to perform the same trades.

Automation Tab

Automations is a way for anyone using Shrimpy to automatically execute a trading strategy without requiring manual trades. Setting up a strategy on the automation tab is quick and easy. Within a few minutes, anyone can have a long-term portfolio strategy automating their funds.

Read Trades from Exchange

If none of the above options work for a leader, that’s okay. A social leader does not need to trade through Shrimpy in order to allow a group of followers to get the same portfolio changes. Shrimpy monitors each social leader’s exchange account and detects when trades are made automatically. Even if the trade was made using an entirely different trading bot or platform, Shrimpy will detect the changes and send the appropriate trades to followers.

eToro

eToro offers a limited selection of trading features for both social leaders and followers. Unlike many other trading platforms, eToro does not offer significant control over how a trade is executed.

Trade

A trade on eToro allows the trader to only enter the amount of the asset they would like to buy or sell. A trade does not offer any control over the price at which the asset is bought.

Order

An order on eToro presents the trader with an option to enter the price of the asset they want to purchase. Unfortunately, there is no way to view an order book, so it makes using the order option.

Social Features

Let’s be honest, if you’re going to call yourself a social trading platform, you better have social features. Ideally, each social feature would be carefully designed to enrich the experience of traders.

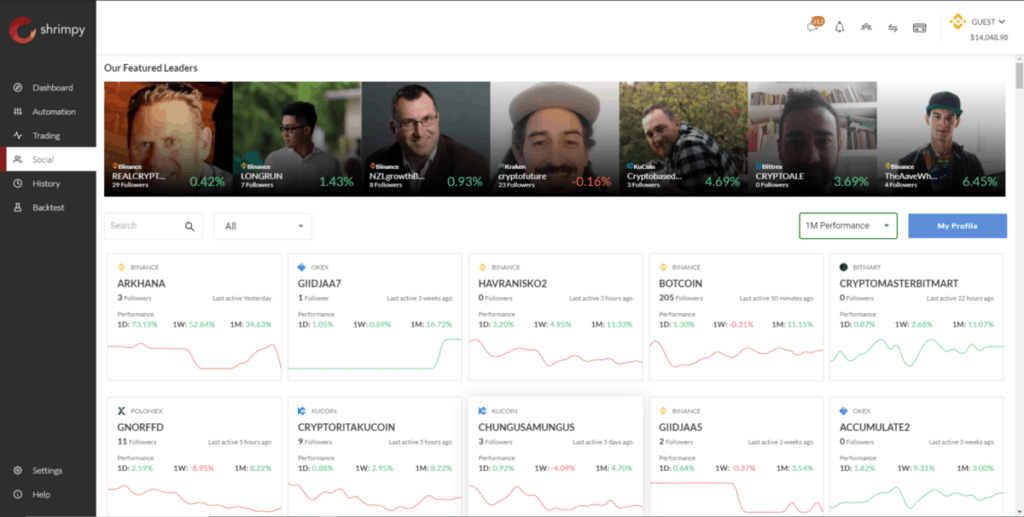

Shrimpy

Traders on Shrimpy receive access to multiple different outlets for connecting with other traders, engaging with portfolios, and learning about cryptocurrency.

Group Chat

Every social leader on the Shrimpy platform is provided with a group chat where they can communicate with followers, share ideas, and grow a community. The group chat is ideal as a central place for leaders to discuss with other traders on Shrimpy.

Leader Journals

Leaders can provide long-form content through the journal feature. The journal is a place where only the social leader can post content about their strategy, provide updates, and educate other traders. However, social followers can comment on these journal posts.

Group Links

Many social leaders engage with followers on a variety of platforms. For this reason, Shrimpy provides a convenient way for leaders to link to other social applications like Twitter, Telegram, and Discord.

eToro

Investors on eToro are more limited by the social features that have been made available.

Update Feed

eToro social leaders can keep followers updated by posting to a group feed. On each feed post, followers can comment and share insights that relate to the original post made by the leader.

Social Leaders

Social platforms generally require two sides — Individuals who want to be social leaders and those who want to be followers.

Social leaders are expected to educate followers on strategies, manage a portfolio of assets that can be followed by others, and consistently update the community.

Social followers will be looking for quality leaders that can be trusted to manage a group of passionate traders. Followers will be looking for consistent updates, frequent participation in discussions, and strong portfolio performance.

Shrimpy

Traders on Shrimpy receive access to multiple different outlets for connecting with other traders, engaging with portfolios, and learning about cryptocurrency.

Shrimpy has a wide range of leaders on the platform. Anyone from hyper-active fund managers to long-term investors.

Each leader has their own group management style, portfolio strategy, and philosophy. Browsing through the ranks of Shrimpy social leaders, we are greeted with hundreds of options for leaders we can follow.

Any leader can be selected, Favorited, and followed. These actions allow traders to either monitor the progress of a leader or fully automate a portfolio by following the leader.

Earning Money

Social leaders on Shrimpy can earn money by charging custom AUM (Assets Under Management) or Performance fees. As an example, a leader charging a 20% performance fee would earn 20% of the value that is earned by the group each month. If the group collectively earned $1,000,000 the leader would take away $200,000.

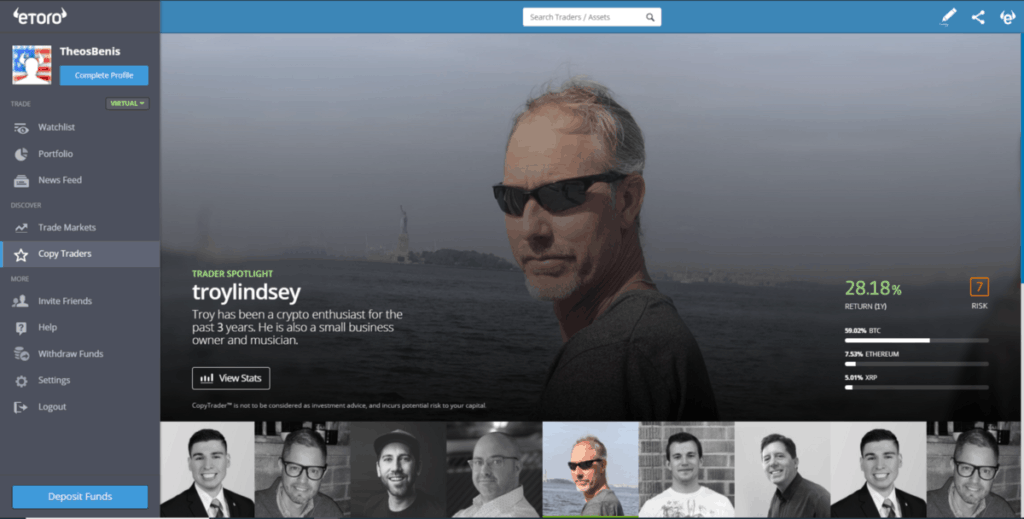

eToro

When it comes to leaders on eToro, we find that the platform caters towards a more passive crowd. That means we can expect less frequent trades, longer-term portfolio strategies, and fewer updates from many leaders.

Since eToro originally launched with stock trading, a significant number of leaders on the platform started out as stock traders.

Earning Money

eToro offers leaders the ability to get paid for yearly AUM. The max yearly AUM ranges from 2% to 2.5%. The payments for the yearly AUM get paid out monthly.

Crypto Availability

The availability of cryptocurrencies will have a direct impact on the potential performance that can be expected when trading.

In the cryptocurrency market, traders have generally realized that more assets is better. Exposure to new and exciting cryptos can provide a once in a lifetime opportunity to get in early.

Shrimpy

Shrimpy conveniently supports every asset that is available on the exchanges that are connected to Shrimpy. That means Shrimpy supports hundreds of large, mid, and small market cap assets. Anything from Bitcoin to Pundi X is supported by Shrimpy.

Every asset you could possibly want is supported by Shrimpy.

eToro

eToro supports 15 large market cap cryptocurrencies on the platform. The main assets being Bitcoin, Ethereum, Bitcoin Cash, Litecoin, XRP, Dash, EOS, and Tezos.

This limited selection of assets presents some concern for traders that are looking to execute strategies across a diverse portfolio of assets.

Fees

Nobody likes paying fees. However, both of these platforms need to make money somehow, so each has its own way for paying the bills.

The most common ways that trading platforms charge fees is though subscriptions or taking fees on trades that are executed.

Shrimpy

Shrimpy charges a single subscription fee for access to the entire platform. This fee gives traders access to all of the portfolio management features, automation options, social trading, backtesting, and APIs.

Shrimpy does not charge any trading fees.

Subscription Fee — Shrimpy charges a $13/mo fee (when paid annually) for access to the platform.

eToro

Unlike Shrimpy, eToro does not charge any subscription fees, however, they do charge trading fees.

Trading Fees — eToro charges a spread fee that ranges from 0.75% for Bitcoin to 5% for Tezos. A 5% fee on cryptocurrency trades is outrageously high. Typically, fees range from 0.075% to 0.25% in the crypto market. That means a single order to buy $1,000 in Tezos would cost $50.

Also Read: Best Crypto Trading Bots

Who should use Social trading?

Social trading is an ideal solution for traders that are just getting started with Social trading is an ideal solution for traders that are just getting started with trading cryptocurrency. Taking the first dive into the market can feel like jumping into the icy artic tundra.

Social leaders can help guide followers through the ins and outs of the market and explain common ways to construct a portfolio.

Community learning can be a powerful way to accelerate the spread of ideas and innovation in portfolio management.

Beyond the benefits of social trading for followers, social leaders will have benefits of their own. For example, social leaders can use social trading as a revenue stream that can grow significantly over time.

Any experienced trader who is looking to give back to the community, stay socially active, or earn money will find social trading as an exciting opportunity.

Frequently Asked Questions

Is social trading legit?

Yes, Social trading is legit and many platforms provide it. You can actually see each and every trade and other allocation details to verify everything.

Does social trading work?

Yes, it works, however you need to be active and re-evaluate the trading strategies you have implemented or your portfolio manager implemented.

Is social trading profitable?

It depends what type of trading strategies you have implemented. It same as asking if trading is profitable.

How to invest in social trading?

Just, sign up on any social trading platform and connect your exchange to start social trading.

Best Social Trading Platform

Shrimpy

Shrimpy is social portfolio management and crypto trading platform for your personal crypto investments. The application focuses on long-term strategy automation, portfolio tracking, and copying strategies from other traders in the social program.

Mudrex

While exchanges are busy spending time more on launching new tokens and assets only to increase their trading volume, platforms like Mudrex are actually working on the right problems and are making sure that traders actually end up making some money!

Botsfolio

Botsfolio automates your portfolio building and futures trading on your crypto assets without any technical or strategy setup.