Digitization is transformational

Digital transformation is disrupting the business model of every organization. It is enabling companies to scale to greater heights, maximize growth opportunities and build new, efficient business models.

70% of digital transformation failed due to common pitfalls such as poor cross-functional collaboration and a lack of accountability. To address existing pitfalls, the vision to build a fully connected technological ecosystem that is transparent,trust-able, and interoperable will allow organizations to future proof their businesses for the years to come.

Blockchain, without a question, is one of the most promising and transformational technologies that drives this vision. It disrupts the value chain and tears down boundaries to drive innovations beyond the imagination. Traditional businesses are facing threats from new blockchain start-ups and run the risk of an eventual displacement. This digital revolution brought forth by the blockchain has impacted every industry profoundly, including the precious metal industry.

The Value of Gold

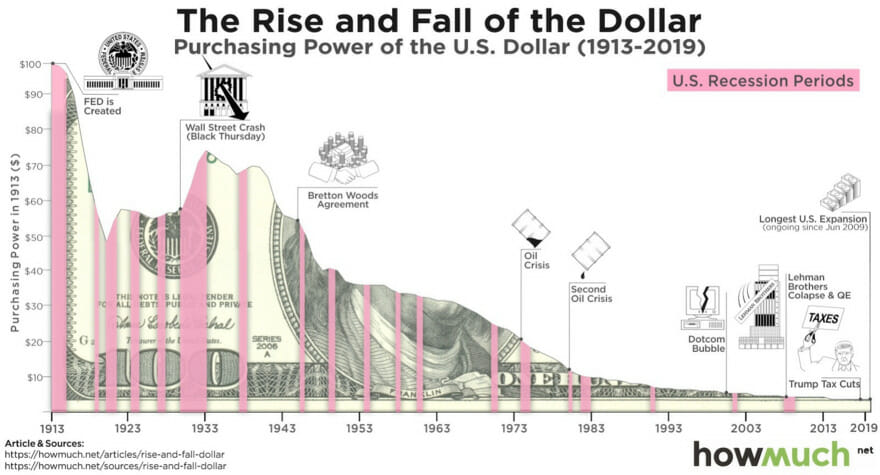

Gold has maintained its value and built its reputation as a ‘recession-proof” asset class that is largely uncorrelated with traditional market movements and economic fluctuations. This is due to the fact that currency devaluations will never apply to physical commodities like gold . Gold cannot be printed like money. Also, its value is not impacted by a government’s decision to change interest rates or to increase the circulation of a particular currency.

Gold is a strong contender to hedge against recession and other economic uncertainties. When most of the world was in lockdown, many turned to this safe-haven metal with investors hitting a record US$23 billion of exchange-traded funds that hold gold in the first quarter alone.

Most recently, the second-wave fears have once again pushed the gold price up, marking its highest peak in 8 years. Many have even speculated that gold will hit US$2000 in the coming year should the precious metal reenact its gains following the 2008 Global Financial Crisis.

Digitizing gold is like the future reaching out to the past. Reinvigorating the purpose of gold with a touch from modern technology. Gold is made divisible, portable and transferable on the blockchain. This innovation is an integration of physical and digital experience of gold as an investment instrument.

The Challenges of Digitizing Gold

Financial institutions and large corporations have spent an exorbitant amount of resources in digitization — but still face issues when it comes to cybersecurity. However, the emergence of blockchain technology solves existing issues and opens up a new avenue for gold to be placed on the digital realm. Having said so, there are challenges to bring gold to blockchain.

Challenge 1 — Verifying Authenticity of Gold Token

While every gold token minted on the blockchain is backed by its underlying gold asset, it is imperative to verify and certify the authenticity of the underlying gold asset. This sits at the centre of gold digitization. Traditional digital asset dealers and custodial services keep digital ownership, along with customer data, in centralised servers. Data can be altered or breached by bad actors internally or externally. This leads to scrutiny on data security and the infrastructure within centralised locations as we know.

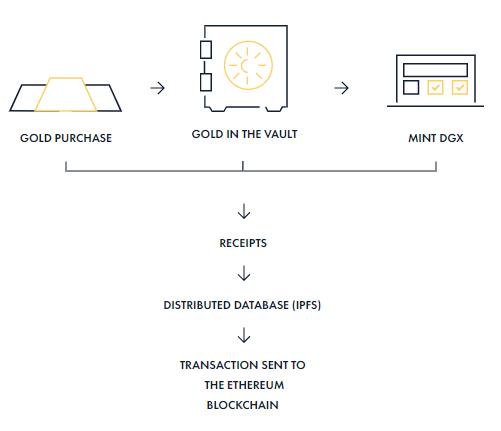

In addition to the possibility of the above malicious acts, digital assets on the blockchain may be duplicated or forged in error. The Proof of Provenance (PoP) protocol is the proprietary intellectual property by Digix to mitigate these problem problems. Coupling the Ethereum blockchain with the Interplanetary File System (IFPS), a protocol is created for a safer and more transparent model to record digital assets on the blockchain.

Every audit record and corresponding documentation confirming the authenticity of the gold bars are put into a Distributed Database (IPFS). These documents contain an IPFS reference to a signed paper documentation — the auditor’s Ethereum identity. The audit trails are then sent as transactions to the Ethereum blockchain.

Challenge 2 — Building Trust with Technology

Gold tokenization is a disruptive technology that encourages traditional businesses to innovate as we meet tomorrow’s unknown challenges. The heart of this successful digital transformation lays in articulating a clear digital visions that should revolve around any or all of the followings:

- Build higher level of customer trust in the new digital economy

- Support and establish new norms of ethical behaviour

- Respect for data and customer experience

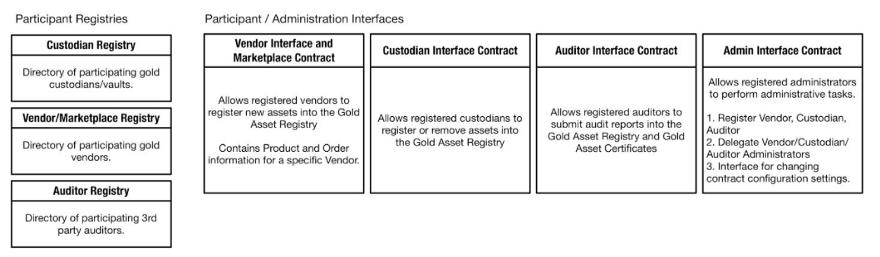

Digix’s PoP protocol consists of multiple independent participants, namely asset providing vendors, asset custodians and auditor-in-charge, acting together to prevent dishonest collusion. The Proof of Provenance protocol requires regular quarterly audits to be performed by a 3rd party auditor on the entire collection of gold assets held in the custodian vaults. The auditor-in-charge then submits a record on the gold registry contract for each and every underlying gold bar that has been audited. Digix works with an independent auditor ( inspectorate bureau veritas) to prevent bullion fraud.

To build a higher level of trust, anyone with access to the internet will be able to browse through the gold and verify the underlying gold bar via the asset explorer, through which the important information can be reviewed.

- Audit Documentation

- Chain of Custody Digital signatures (Vendors, Custodian and Auditor)

- Depository Receipt

- Gold Bar serial number

- Gold Purchase Receipt

- Inventory Receipt

- Time Stamp

Challenge 3 — Maintaining a Robust Market Depth and Liquidity of Gold-Backed Tokens

Liquidity is the ability to be traded on demand. High liquidity implies that many parties are trading the asset in significant sizes without large variances. Gold is a very liquid asset and the market liquidity is a market’s ability to purchase or sell an asset at stable prices.By tokenizing gold, gold tokens can be traded on secondary markets such as crypto exchanges. This further increases the liquidity, thus giving the traders more freedom to buy and sell.

With tokenization, greater value can be captured from the underlying asset and this improves the liquidity to vastly increase the volume of trades. Cryptocurrency market capitalization currently stands at $323bn USD. In comparison, the biggest and most accessible digital gold product, GLD Gold ETF, is trading at around $170 bn USD. That is of course in comparison to the entire universe of trading assets, from FX, fixed income, commodities to equities.

Improving the accessibility of Digix gold-backed token (DGX) is the first step to build out a liquid market. The horizontal expansion plan was to list DGX tokens across exchanges, thus allowing the tokens to be more accessible, cheaper, faster and easier to trade. DGX token is currently listed across 12 centralised and decentralised exchanges with the offer for traders to trade in fiat and/or cryptocurrency.

The second step to making the market a much more liquid one to trade on is to work in tandem with technology. The recent development of Decentralised Finance (Defi) and Decentralised Exchanges (DEX) presented new technologies to build a market with robust liquidity. Among the list of technologies, two technologies worth highlighting are:

Unlocking the Long-Term Value of Gold

In today’s financial markets and ever-changing digital landscape, liquidity and risk management is more difficult than ever. Gold-backed tokens offer gold buyers an alternative gold product to greater security and confidence for the future.

Gold digitization brings about new utilities that can be built upon the underlying gold assets. Developers can use Digix tokens for DApp to facilitate payment, borrowing and lending. Games can issue gold tokens that are backed by real-life gold. Investment grade gold tokens can be moved across borders in minutes. These are exciting times ahead as we stand at the forefront of many disruptive technologies that will disrupt the industry in time.

About Digix

Digix, incorporated in Singapore in 2014, is the blockchain company behind the world’s first gold-backed digital asset class. Digix uses blockchain to account for the authentication and provenance of 99.99% investment-grade gold bullions. Physical gold bars are registered on the blockchain, and every 1 gram of physical gold registered is pegged to 1 DGX token. The physical gold bars are kept in vaults located in Singapore and Canada.

Digix is also the first company globally to send a live transaction on the Ethereum network and a pioneer in Singapore’s blockchain ecosystem — becoming the first batch of Tribe Accelerator program, a Singapore government-backed blockchain accelerator. Digix recently won the 2020 S&P Global Platts: Precious Metals Industry Leadership Award and was a finalist in the 2016 Singapore MAS Fintech Awards.

![How To Buy Bitcoin On Wazirx? [ Also Works On Mobile ] 7 Buy Bitcoin On Wazirx](https://coincodecap.com/wp-content/uploads/2021/03/Buy-Bitcoin-on-WazirX-768x432.png)