In this comparison review, we will be evaluating the two biggest players in this rapidly emerging market; Shrimpy vs 3Commas.These two services operate under completely different philosophies. Yet, they have both managed to attract the attention of many of the same crypto traders.

Summary

| Features | Shrimpy | 3Commas |

|---|---|---|

| Portfolio Tracking | Enhanced Tracking | Limited Tracking |

| Portfolio Tracking | Portfolio Automation | Algorithm Trading Bots |

| Trading Terminal | Basic Features | Advanced Features |

| Trading Strategies | Social & Copy Trading | Trading Bot Marketplace |

| Pricing | Freemium Available | Starting Price $14.5 |

| Build For | Long Term Holders | Traders |

| Review | Shrimpy Review | 3commas Review |

Shrimpy vs 3Commas: Portfolio Tracking

Portfolio tracking is simply the ability to monitor a portfolio over time, observe trends, and make educated decisions about your assets.

Both Shrimpy and 3Commas provide ways to track a portfolio of crypto assets.

3Commas

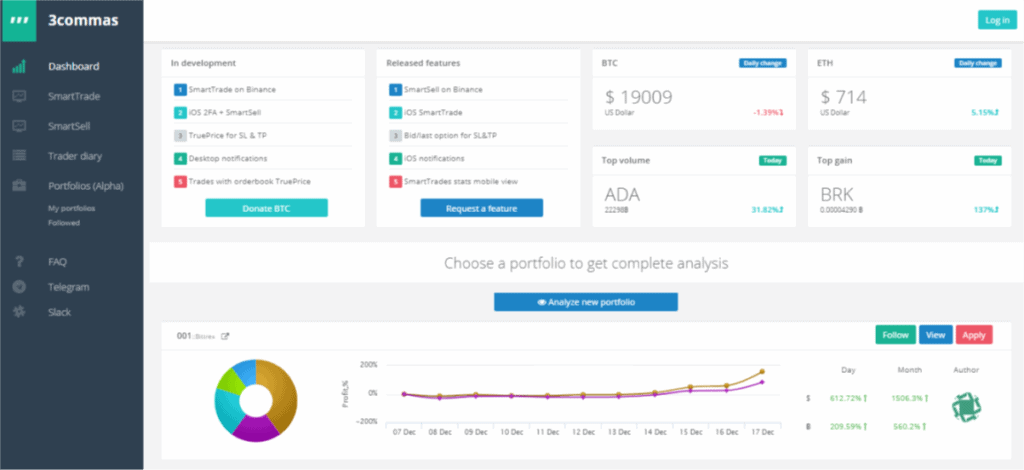

3Commas offers a limited selection of portfolio management options. At its core, 3Commas provides high-level performance metrics for portfolios. Simple stats such as monthly or daily performance can be found scattered throughout the UI.

Shrimpy

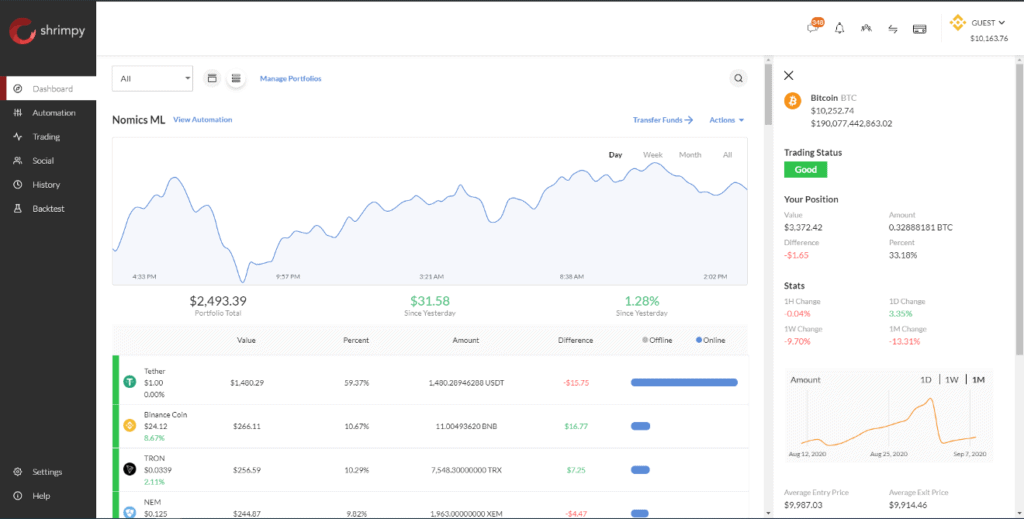

Shrimpy provides a well-organized dashboard that offers a total overview of a portfolio. This includes a breakdown of each asset that is contained in the portfolio, stats about each asset, and performance metrics for the portfolio over various time frames.

Shrimpy vs 3Commas: Trade Automation

Trade automation is one of the biggest differentiators between 3Commas and Shrimpy.

While 3Commas focuses on providing trading strategy automation, Shrimpy focuses on portfolio automation.

Essentially, you can think of 3Commas as a short-term trading platform and Shrimpy as a mid to long-term trade management solution.

3Commas

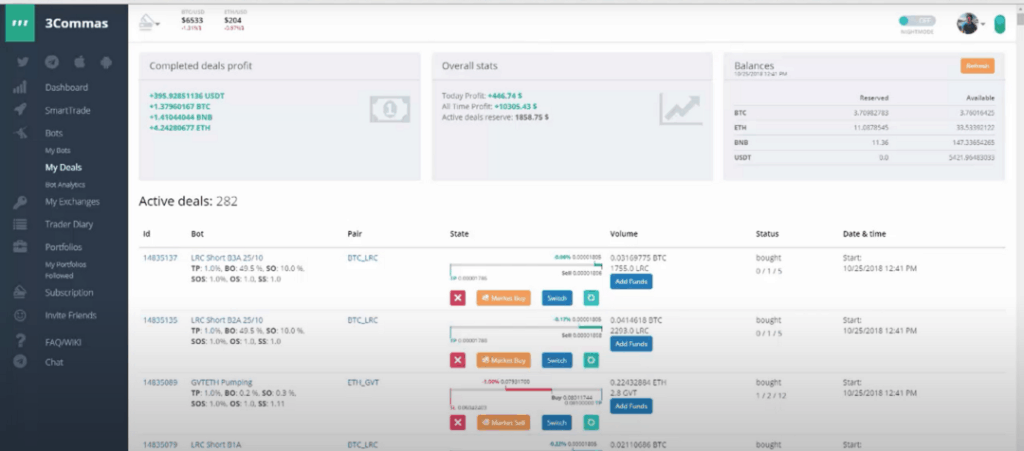

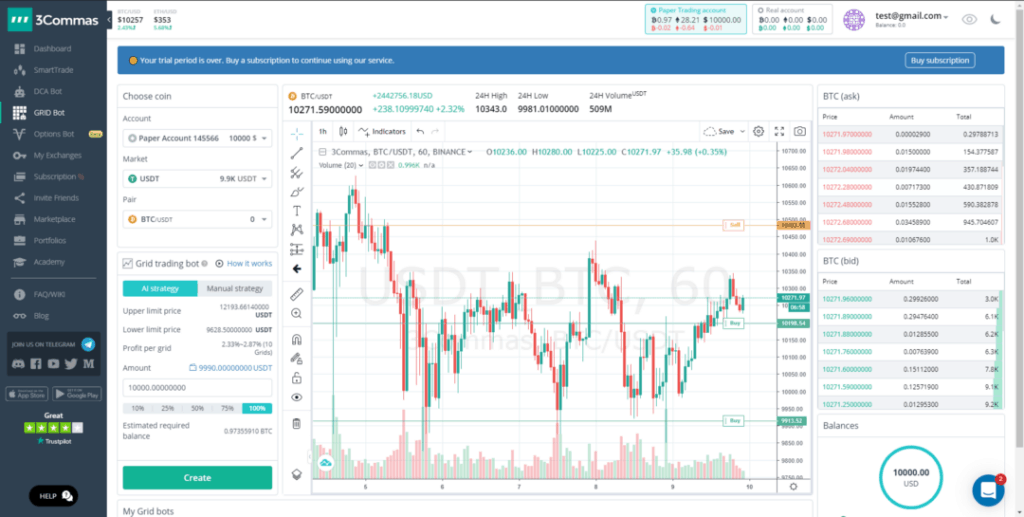

3Commas focuses on swing trading, day trading, signals, and algorithmic-based trading bots. Instead of trading a portfolio of assets, 3Commas will focus on trading across a single trading pair.

In the following image, we can see how each trading bot is configured to a trading pair. In addition to this configuration, there is an unlimited number of available options for how you can build a trading bot.

Shrimpy

Portfolio automation is the bread and butter of Shrimpy. No platform does it better. If you want to set up your investment for long-term success, look no further than Shrimpy.

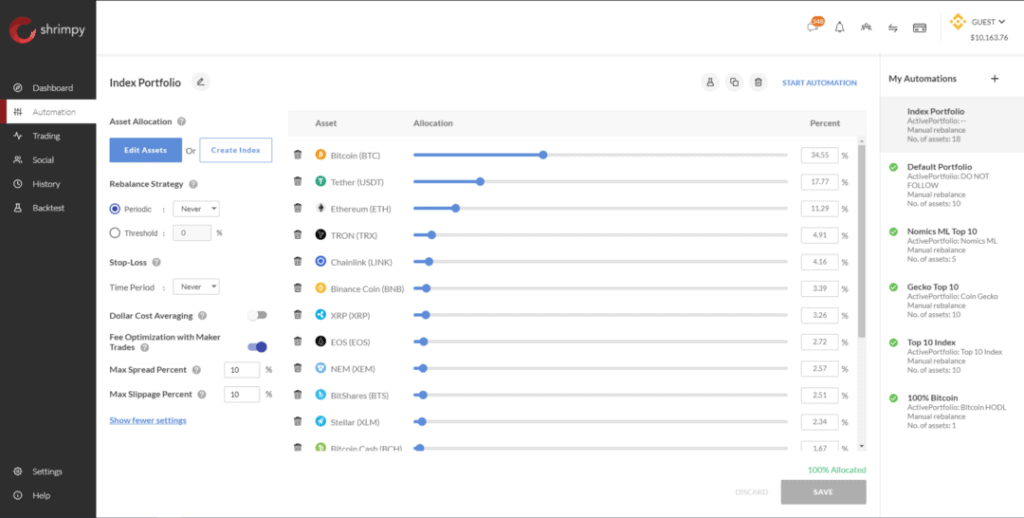

Selecting, modifying, and automating a portfolio is a breeze with Shrimpy. In figure 3 we can see how it’s possible to select a range of assets, configure rebalancing settings, enable dollar-cost averaging, and other convenient settings.

At any time, you can quickly remove an asset from your automation and Shrimpy will instantly sell your position and distribute the funds into your portfolio within seconds.

Customers can also execute a rebalance instantly using the “Actions” option on the dashboard. With a single click, Shrimpy will get to work buying and selling assets on the exchange to rebalance the portfolio. It only takes a few seconds to complete a process that would take hours to do manually.

Shrimpy vs 3Commas: Smart Trading Terminals

Smart trading terminals are an integral part of trading platforms. When complete automation isn’t possible for a strategy, then a trader can take the reigns and execute a strategy manually.

Continuing the trend, we quickly notice that even in their smart trading terminals, Shrimpy offers portfolio management functionality while 3Commas is focused on more technical aspects of trading.

3Commas

3Commas offers a wide range of technical indicators, controls, and smart trading features in its smart trading terminal.

The smart terminal provides a way for traders to manage their own order execution without relying on bots to automate the trades.

This resource is perfect for day traders or swing traders who want to maintain a manual strategy.

Shrimpy

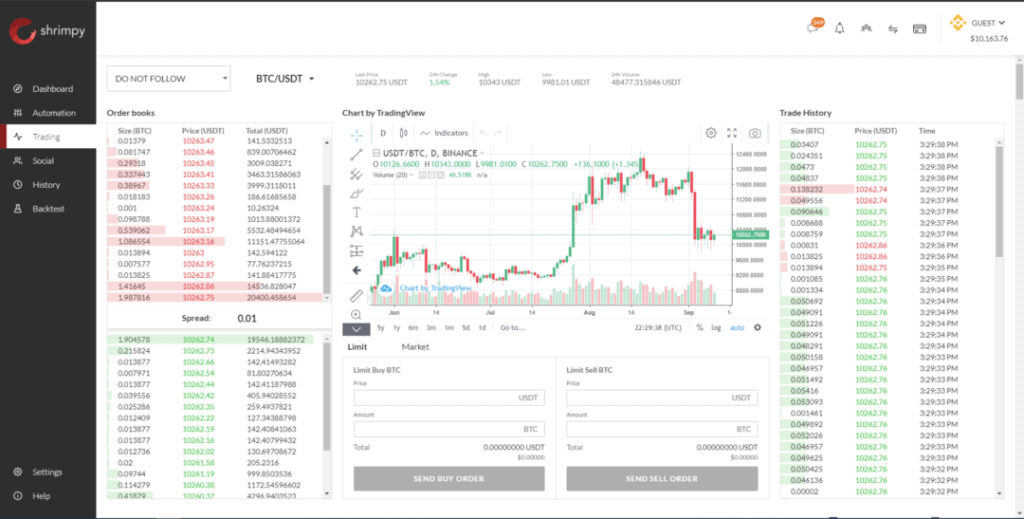

Shrimpy provides a number of key features in their smart trading terminal.

Beyond the charting and data capabilities, traders can execute limit orders and smart market orders.

Shrimpy vs 3Commas: Copy & Social Trading

Social trading is becoming a growing industry within cryptocurrency. Over the last few years, platforms have been working to find new ways to differentiate themselves from the competition by integrating social and copy trading experiences. Shrimpy and 3Commas are no different in this sense.

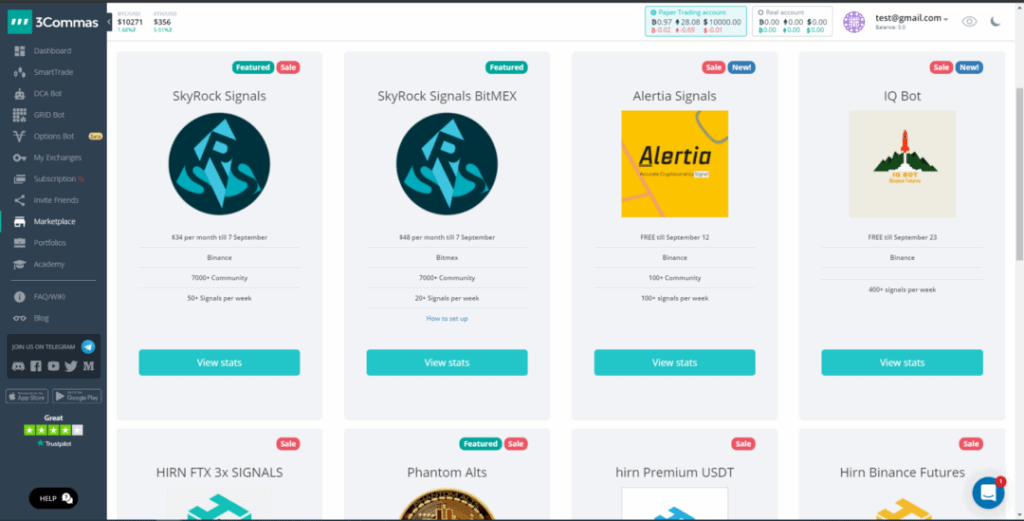

3Commas

3Commas has one of the largest marketplaces for trading signals. These signals can be attached to trading bots within the application to automatically trade based on the signal.

Shrimpy

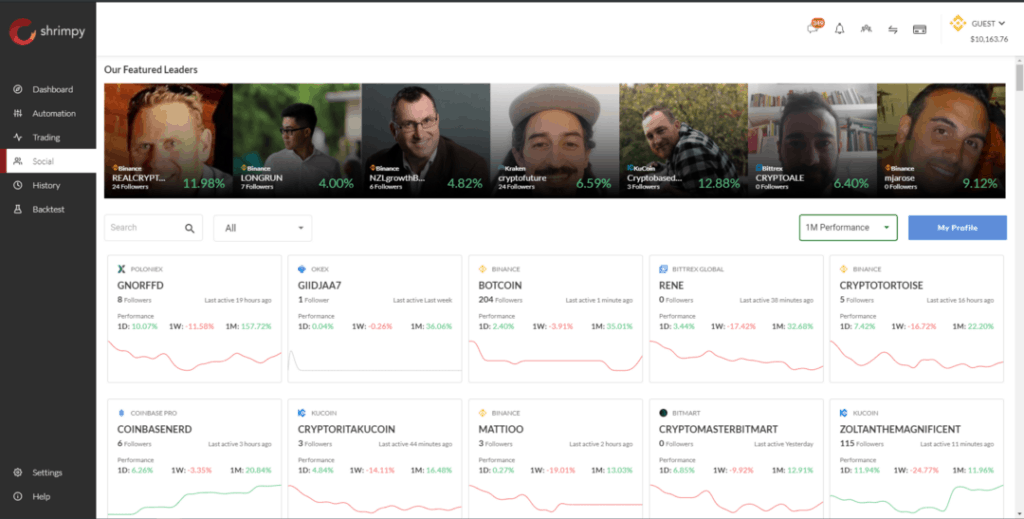

Shrimpy has developed one of the most complete social experiences for their trading community.

Unlike most other platforms that focus on signals, indicators, and other technical elements, Shrimpy has grown a community that focuses on the actual traders.

In Shrimpy, anyone is able to follow a social leader with all or a portion of their funds. As the leader updates their portfolio, the changes will instantly be sent to the followers to make the same changes.

At the end of the day, Shrimpy makes it easier than anyone to copy the trading strategies from the top crypto traders in the market.

Shrimpy vs 3Commas: Supported Exchanges

At the root of trading services like 3Commas and Shrimpy, investors must have the ability to connect to a range of top exchanges.

These top exchanges can provide the necessary liquidity for smooth trading experience.

3Commas

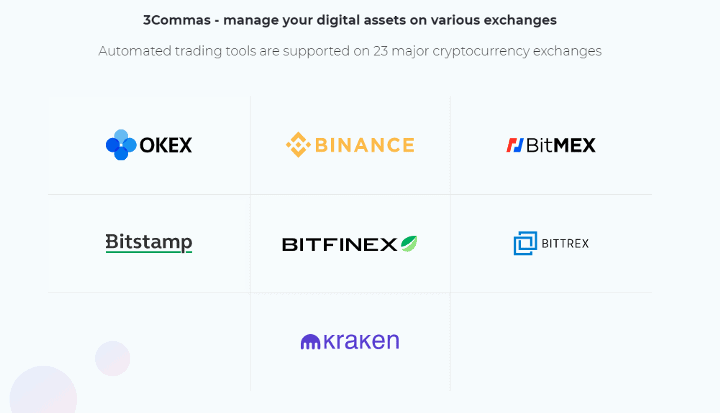

3Commas supports 23 different exchanges. Each of these exchanges can be connected to the platform for managing a diverse number of trading strategies.

Unfortunately, not all exchanges supported by 3Commas have the same features available inside the application. This can cause a significant level of confusion for new investors who are looking to automate their strategy across multiple exchanges.

Shrimpy

Shrimpy plugs into 16 different exchanges for immediate access. Customers can connect an unlimited number of exchange accounts to a single Shrimpy account. That means whether you have 31 Binance accounts or one of each exchange account, they can all be linked to Shrimpy.

The best part is every exchange has an identical set of features in Shrimpy. That means there is no confusion regarding what features will be available when linking a new exchange account.

Shrimpy vs 3Commas: Pricing

At the end of the day, the features and functionality of these platforms don’t matter if the price isn’t right. Both of these top platforms have established themselves as reasonably priced platforms for professionals.

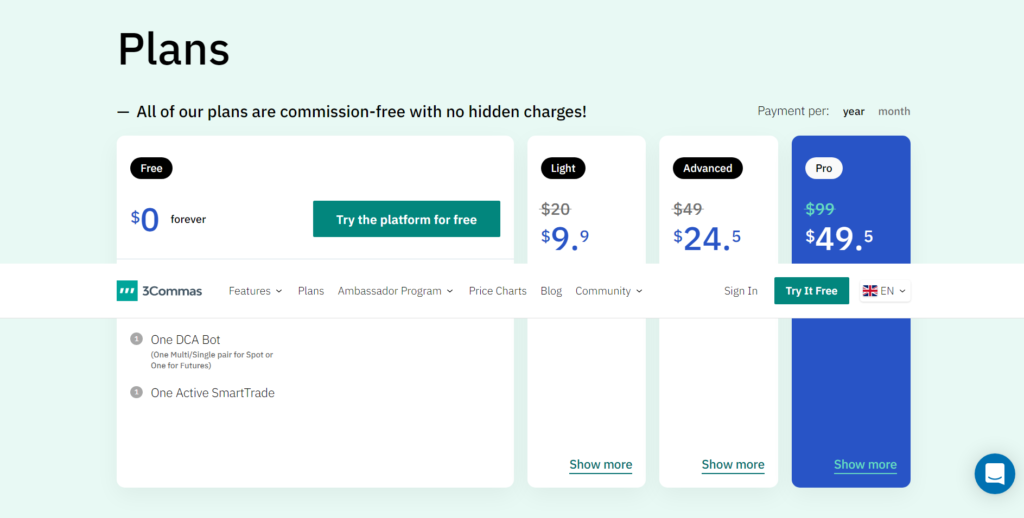

3Commas Pricing

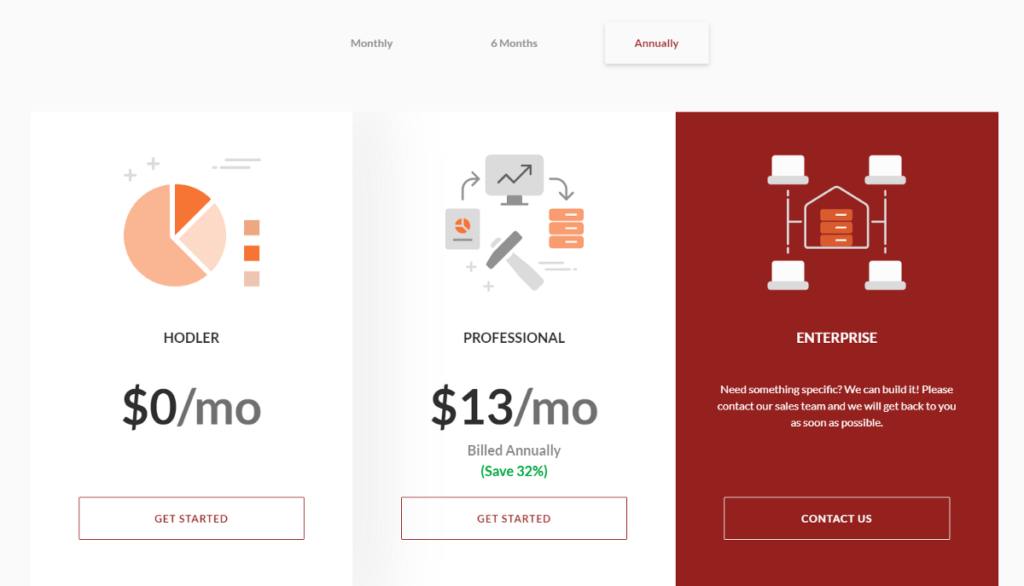

Shrimpy Pricing

The pricing plans for Shrimpy are extremely simple. There is essentially only one payment plan, which is a $13/mo option. This plan will give you access to 100% of the Shrimpy features, unlimited trading, unlimited social following, and so much more.

Anyone who is using Shrimpy will want to subscribe to the professional plan.

Shrimpy vs 3Commas: Conclusion

At the end of the day, these two platforms are very different. While Shrimpy focuses on portfolio management and providing a pleasant user experience, 3Commas is designed for the advanced trader who wants to implement complex strategies.

Although investors that are new to cryptocurrency would heavily benefit from the Shrimpy trading services, seasoned professionals may gravitate more towards the complexity provided by 3Commas.

We recommend trying out both of these platforms to find the one that works best for you. There is no perfect platform that will work for everyone.

Other Crypto Trading Bots

HaasOnline

HaasOnline is one of the oldest and most reputable automated trading companies in crypto. Their distinguished reputation comes from their trade automation software that has been executing trading strategies for crypto traders since 2014.

Bitsgap

Bitsgap, a one-stop crypto trading platform that caters for all your trading needs. It allows its users to bring all their crypto-exchange accounts under the same roof and trade from an integrated interface.

Quadency

Quadency, a crypto trading automation platform launched in 2018. It brings you a smarter way to trade and manage your crypto.