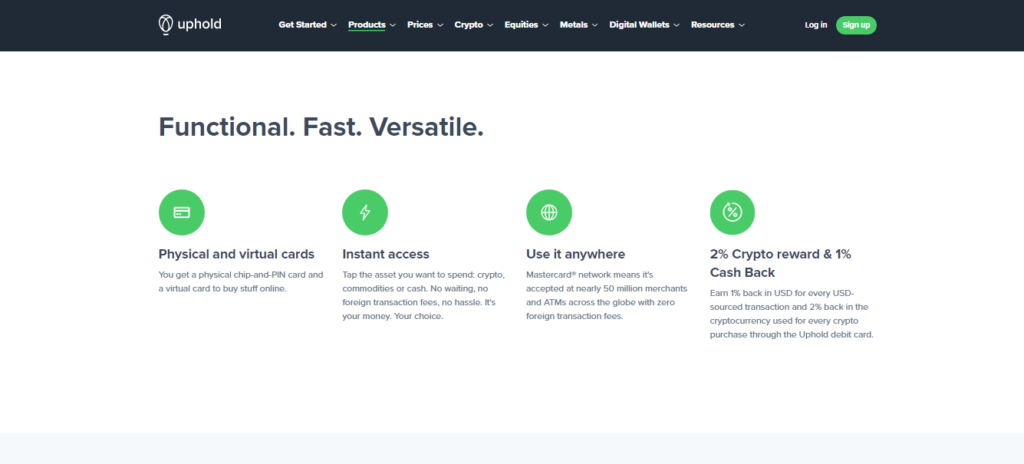

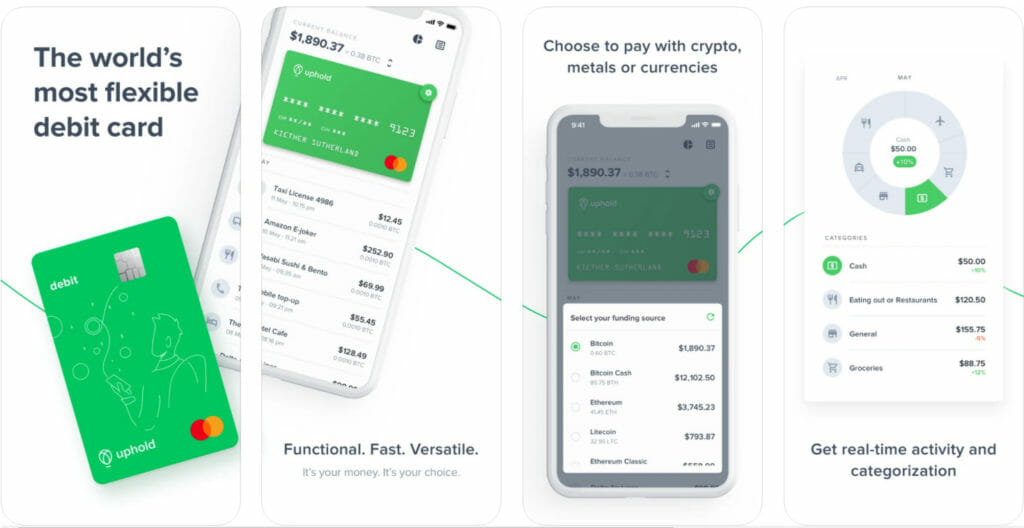

Looking for the best crypto card? Here’s one; Uphold card lets you pay for daily essentials directly using your crypto, metal, stocks, or currency. Further, it is backed by Mastercard, and hence globally accepted. However, this card is only for traders residing in the United States. This Uphold card review will come out to be an in-depth explanation of the crypto card, how you can use it to pay for groceries, and its charges.

Table of Contents

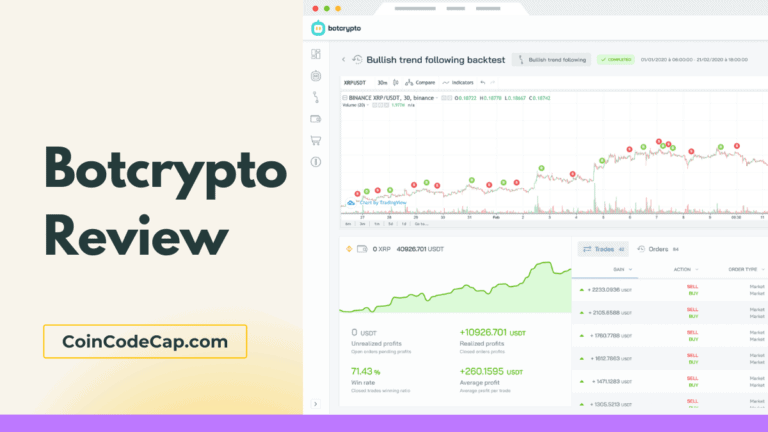

Summary (TL;DR)

- Uphold card enables traders to trade directly with the help of Mastercard.

- Uphold card is accepted by over 50 million merchants globally.

- Also, Uphold lets traders earn UPTO $5,000 cashback through both in-store and online payments.

- For traders who prefer crypto and fiat currency, the maximum payment ranges between $50 and $100.

- Cashback payments for the crypto asset and fiat currency transactions are calculated monthly and distributed within 90 days.

- The platform also offers an Uphold card mobile app (Android & iOS) that helps in the activation of the card and deposits or withdrawals.

- You need to pay a price of $9.95 to get the card.

- External wallet transfers are usable for the following crypto assets: BTC, LTC, ETH, BCH, BAT, LINK, DASH, ZRX, BTG, XRP, UPT, OMG, STORM, UPBTC, DAI, TUSD, USDC, USDT, UPUSD, and UPEUR.

What is Uphold Card?

Uphold card is an all-in-one flexible debit card that allows you to pay for groceries using crypto, metal, and stocks. Furthermore, the Uphold card permits the residents of the United States to make payments and trade through Mastercard. Besides, the Uphold Card is accepted by more than 50 million merchants and almost all ATMs worldwide. According to reports, U.K. users will soon be able to get their hands on the Uphold card.

Also, read Top 6 Bitcoin Credit Card | Best Crypto Debit Card

Uphold Card Review: Advantages and benefits

The Uphold Card permits users to earn UPTO $5,000 cashback each month on in-store and online purchases. The maximum monthly cashback is $100 for traders who spend crypto-assets and $50 for users who only spend fiat currencies.

Traders who process purchases with crypto assets will receive 2 per cent cashback. Payments are accepted in the same crypto-asset used to make the purchase. If collective crypto assets are used to make purchases, Uphold card will send separate cashback payments for each asset.

Users who purchase any supported fiat currency (EUR, GBP, USD, etc.) will receive 1% cashback in USD.

Cashback payouts for the crypto asset and fiat currency payments are calculated monthly and are distributed within 90 days. The cashback amount must be at least $1.00 for the user to receive proceeds. If the payout amount is less than $1.00, the amount carries over to the following month/months.

How to buy the Uphold Card?

Existing Uphold traders must request a card through the Uphold Card mobile app. The card application procedure works as mentioned below:

- Download the Uphold card mobile app and log in to your existing exchange account.

- Next, enter your details, i.e. first name, last name, government-issued I.D. number, email address, date of birth, and address.

- Thereafter, make sure to have an Uphold exchange account balance of at least $9.95 to pay the physical card issuance fee.

- Once approved, you should get your Uphold card through the mail within 5 to 7 business days.

Uphold Card Review: Fees

In the matter of the Uphold Mastercard card itself, there are only two types of fees to worry about. First, you’ll need to pay a price of $9.95 to get the card. Then, traders must pay this fee again when a user’s card is lost or stolen and needs to be replaced. The other cost comes into play when you’re at the ATM. If you’re withdrawing cash from an ATM with your Uphold Bitcoin debit card, then you’ll pay a flat fee of $2.50. Also, users should note that this fee rises to $3.50 for international ATM withdrawals.

On top of the fees associated with the Uphold Mastercard, you should also take a closer look at the prices involved in the base Uphold platform. The most notable fee here is the roughly 1% fee tied to exchanging bitcoin for U.S. dollars.

Uphold card Mobile App

The Uphold Card mobile application is used for card enrollment, card activation, fund deposits, and withdrawals. Further, the app is available on both Android and iOS.

Here are a few critical points about the mobile app:

Activation of card

Once your card arrives through the mail, activate it with the help of the Uphold Card mobile app. You will find a physical card and a letter that includes the card’s activation code in the package as well.

To activate the card through the Uphold Card mobile application, tap on “Activate physical card”. To start your card by phone, dial 1-855-568-8580 and press 1. Make sure to have your activation code by your side before dialling the number.

Deposits & Withdrawals: Fiat, Crypto, Metal, & Stocks

The Uphold Card is connected to the existing stability of your Uphold exchange account. The card permits you to make purchases directly using your available assets. In addition, you can deposit money from an external credit card or debit card, bank account, or crypto-asset wallet. Uphold assists diverse funds but only allows users to deposit and withdraw a small number of assets.

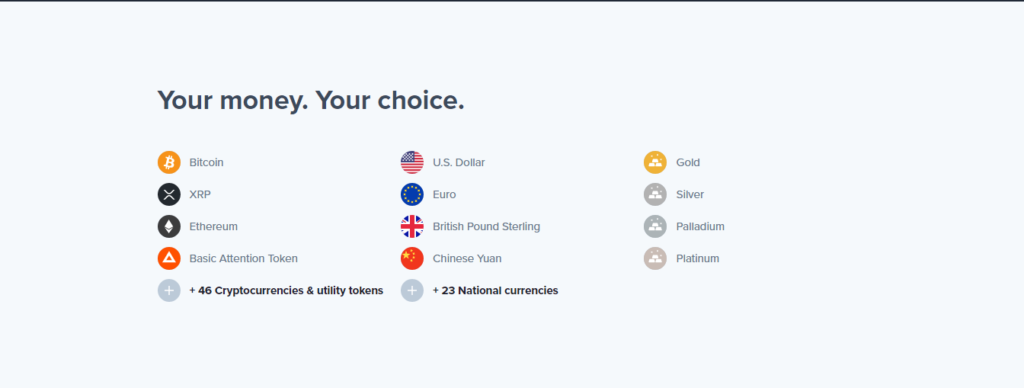

Bank transfers are feasible for fiat currencies, which include: PLN, USD, GPB, CAD, and EUR. Also, external wallet transfers are usable for the following crypto assets: BTC, LTC, ETH, BCH, etc. The fiat, crypto, and precious metal assets supported by the Uphold Card can only be spent or traded on the Uphold exchange.

How to use the Uphold Card?

Operating the Uphold Card for investments is approximate to using a traditional debit card, with only a few differences.

An Uphold Card transaction works as below:

- Initially, link your Uphold exchange account to your Uphold Card account.

- Deposit or buy supported funds (crypto, fiat, or precious metals) to your Uphold exchange account.

- You can directly spend your assets online or in-store at any Mastercard-approved merchant.

- Now, Mastercard will confirm that there are adequate funds available in your account to finish your transaction.

- Next, Uphold converts the selected asset into fiat currency.

- At last, the merchant receives payment in their local fiat currency, regardless of which asset was purchased.

Is the Uphold Card Worth the Hype?

The Benefits

- Easy to learn for beginners: The physical debit card and accompanying mobile app are well suited for beginners.

- Frequent Audits: Uphold endures independent audits quarterly to confirm that user funds are secure. In addition, Uphold’s precious metal holdings are audited daily.

- Mobile App Features: The Uphold Card mobile app enables users to access or hide card details, receive push notifications for purchases, place temporary card freezes, change their PINs, and break down spending by category.

- F.X. Fees Refunded: At the end of each quarter, cardholders are reimbursed for any foreign exchange (F.X.) fees charged when using the Uphold Card for international purchases.

- Asset Spending Options: Users can use crypto, fiat, and precious metals for purchases with the Uphold Card.

- Cashback Rewards: Users may earn cashback rewards for online and in-store purchases made with fiat or crypto assets (up to $5,000 monthly).

The Drawbacks

- Waitlist for Signup: Eligible cardholders are required to sign up on a waitlist before applying for the Uphold Card.

- Regional Availability: Cardholder eligibility is currently limited to United States residents.

- High Fees: Uphold charges high fees compared to traditional debit cards for card issuance, fiat and crypto withdrawals, and ATM withdrawals.

- At this time, the availability and result of the Uphold Card is quite limited. Additional abrupt benefits and drawbacks may only become apparent once the card launches in regions outside the U.S.

- In addition, the Uphold Card appears to be a user-friendly, flexible option for spending crypto assets, fiat currencies, and precious metals. Due to its low F.X. fees, high cashback rewards, and feature-rich mobile app, it is currently recommended that potential cardholders consider the Uphold Card.

Pros and Cons of Uphold card

| Pros | Cons |

|---|---|

| Cardholders are reimbursed for any foreign exchange (FX) fees. | There’s still a waitlist for the Uphold Card. |

| Cardholders can directly spend their crypto, fiat, and metal assets using the Uphold Card. | Cardholder eligibility is currently limited to US residents. |

| The Uphold Card offers 2% cashback on crypto-asset transactions and 1% cashback on fiat currency transactions. | Deposits and withdrawals are unavailable for several supported assets. For example, cardholders can only spend Platinum (XPT) by purchasing it through the Uphold exchange, which charges an extremely high fee of 3.95%. |

Conclusion

While the initial product uprise is ongoing, the Uphold Card appears to be a good preference compared to most crypto debit cards available nowadays. Further, the debit card lets you pay more than 50 million merchants using your assets in Uphold exchange. However, the Uphold card is only available in the USA and you’ll have to pay $9.95 to get it.

Frequently Asked Questions

Is there a spending limit on Uphold?

On Uphold, you can have up to 50 limit orders in place synchronously using the same pool of capital. Uphold allows you to place all three orders simultaneously using the same $1000 stake. The first order to achieve its price target would fill and take the $1000.

Is it possible to use the Uphold card at an ATM?

As a part of the Mastercard network, the Uphold card is accepted by almost 50 million merchants and digitally all ATMs globally.

Is there a fee for the Uphold card?

They charge no fees to open an account and hold amounts with Uphold. Uphold accounts are free of cost for customers who maintain active accounts. If you are using a Debit/Credit Card or China Union Pay to fund your account, a fee of 3.99% applies.

Does the Uphold Card provide contactless transactions?

No. The Uphold Card currently does not support contactless payments (NFC enabled) for in-store purchases. However, according to Uphold, this feature is now being reviewed.

What fees are affiliated with using the Uphold Card?

Uphold Card fees are usually higher than traditional debit cards:

Physical card issuance fee: Uphold charges users around $9.95 per card issued.

ATM withdrawal fees: Traders are charged $2.50 per domestic ATM withdrawal and $3.50 per international ATM withdrawal.

Fiat and crypto withdrawals: Traders are charged $20 per withdrawal of CAD and PLN. Withdrawal fees vary per crypto asset.

Also, read