Whether you have been working in trading cryptocurrencies or a newbie, you must have come across CoinDCX. Especially if you are here and reading this article, it means you are thinking of using this platform, right? So, without wasting much time, let’s start the CoinDCX review.

Table of Contents

Overview

CoinDCX is a cryptocurrency exchange platform with over 200 different types of cryptocurrencies. It is a Singapore-based company and has been active since 2018. In India, the CoinDCX office is located in Mumbai.

The Unique Selling Point of CoinDCX is the fact that they offer numerous cryptos like Bitcoin, Ethereum, and many other altcoins. It means that different altcoin traders can use this platform and won’t have to wander elsewhere. However, this comes at a cost too. Numerous crypto means that there might be more scam coins because a newly launched altcoin will not have the same scrutiny.

The current top investors for CoinDCX funding include Polychain, Bain Capital Ventures, and 100x Ventures. Besides these three main ones, CoinDCX has ten investors who have raised a sum of $ 5.5M in three rounds.

CoinDCX Review: Summary

- CoinDCX is the safest platform for cryptocurrency trading, with proper security features for both user’s account details and transactions.

- It supports more than 200 varieties of cryptos.

- Features like an instant buy and sell, user-friendly experience, limitless trading makes CoinDCX a favorite platform for thousands of users.

- CoinDCX also has low trading and withdrawal fees, which attracts users.

- It has 24 hours customer support.

How to Create an Account on CoinDCX?

Step 1: Visit the Website

To create an account, you have to visit the CoinDCX webpage and click on the register to start the signup process. You will find the register button in the top-right corner, as shown in the screenshot.

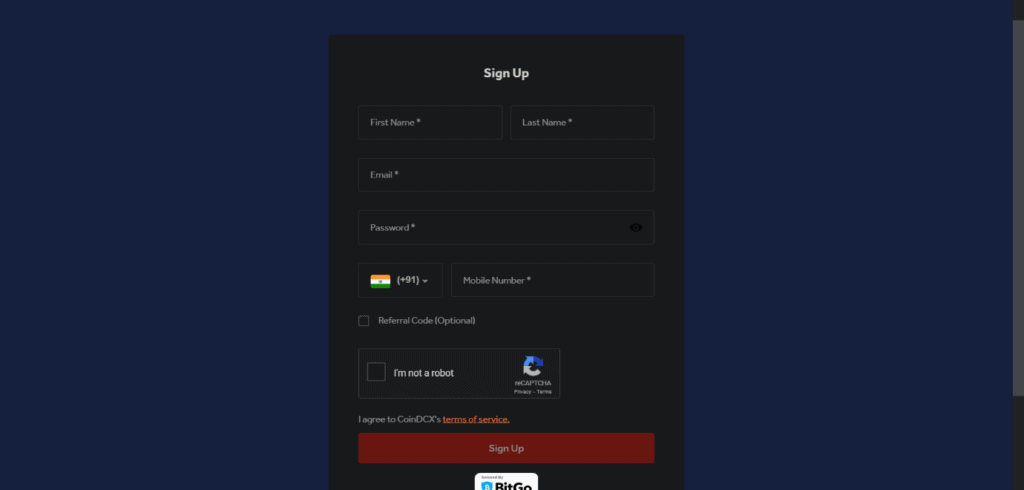

Step 2: Fill in the details to sign up

You will have to fill in your details like name, email address, phone number, and others. After filling them, click on the signup option.

Step 3: Email and Phone Number Verification

For Email verification, check your email inbox for the verification link you will receive from CoinDCX. To verify the phone number, you will receive an OTP.

Step 4: Verification of Bank Account

To verify your bank account, you will have to follow the following steps:

- Go to your profile section by clicking on the profile icon in the top right corner.

- You have to click on the Verify Bank Account, and it will redirect to a new screen.

- On the new screen, fill in all the bank details and others.

- To confirm the bank details, you will receive a deposit and withdrawal of a small amount from your account for the verification process.

- You have to enter a 12-digit UTR number that you will receive after bank account details verification.

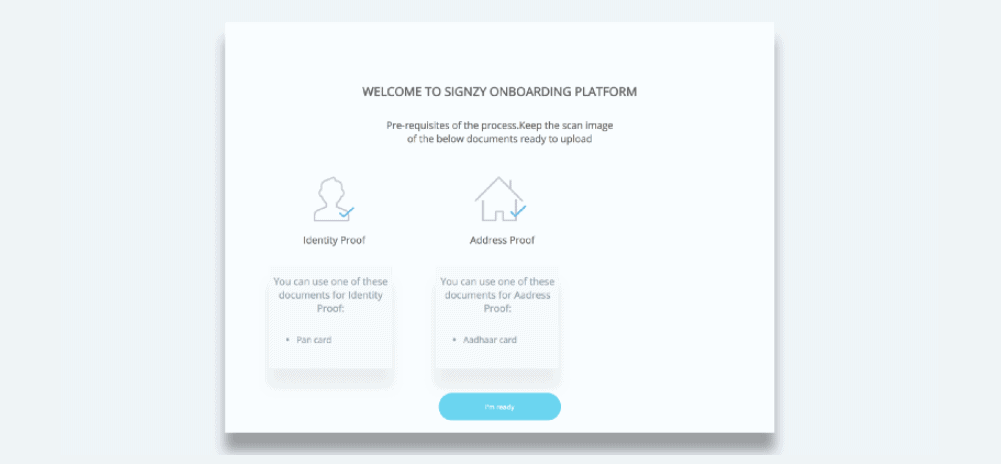

Step 5: KYC Verification (Optional)

The CoinDCX login process is simple. So, log in to your account to start the KYC verification process. The process is hassle-free if you have all the documents that are mandatory KYC.

To complete the process, you will have to upload images of two documents:

- Pan Card: It is a mandatory document that you will have to upload.

- Identity Card: You can use any one document from Aadhar Card, Voter Id Card, and Passport. Upload both the front and back.

Please note that the use of a license as an Identity Card is not applicable now. For international users, they can upload an equivalent local government ID for verification.

CoinDCX Withdrawal

CoinDCX minimum withdrawal limit in INR differs based on whether the user has done the KYC verification or not. Similar is the case with the maximum INR withdrawal limit.

Accounts with KYC Verification

The minimum value is Rs. 500, and the maximum value is 5,00,000 per day. You can also withdraw the amount manually if it is beyond automated limits.

Accounts without KYC Verification

The minimum value is Rs. 500, similar to the users with complete KYC. However, unlike them, the maximum value is only 10,000, as the Max. trade value is up to INR 10,000. Also, you can withdraw manually if the transaction is beyond automated limits.

CoinDCX Crypto Withdrawal Limit

Users with complete KYC verification have no withdrawal limit. Simultaneously, the accounts without KYC verification can only withdraw up to 4 BTC per day.

CoinDCX Fee: Trading and Withdrawal Fees

The trading and withdrawal fees are crucial factors of a platform, which also play a role in getting new users or losing the previous ones.

CoinDCX Trading fees

Whenever you place an order, the exchange charges you a particular amount which is called trading free. It is generally a relevant percentage of the amount of your order. CoinDCX charges 0.04% and 0.06% on takers and makers, respectively.

Here takers are the ones who take an already existing order from the order book, and the makers are the ones who add a trade to the order books. The fee is relatively low and below the industry average, which gives users another fact to prefer CoinDCX over other platforms. The current industry average is around 0.10% – 0.15%.

Based on your club, the trading fees is shown as below:

| Club | Maker (%) | Taker (%) |

|---|---|---|

| DCX Bitcoin | 0.040 | 0.060 |

| DCX Elite | 0.050 | 0.070 |

| DCX Platinum | 0.060 | 0.080 |

| DCX Diamond | 0.070 | 0.085 |

| DCX Emerald | 0.075 | 0.090 |

| DCX Gold | 0.080 | 0.100 |

| DCX Silver | 0.085 | 0.100 |

| DCX Bronze | 0.090 | 0.100 |

| DCX Pro | 0.095 | 0.100 |

| DCX Genesis | 0.100 | 0.100 |

CoinDCX Withdrawal fees

The lower trading fee is overcome by the high withdrawal fees by the CoinDCX. It charges around 0.001 BTC per BTC withdrawal. This withdrawal amount is high when compared to the industry average charges. According to the current industry average, the withdrawal amount is around 0.0006 BTC per BTC withdrawal. If we talk in percentage, then the CoinDCX withdrawal feel is 60% above the industry average.

CoinDCX Deposit

In CoinDCX, users can deposit INR instantly, while it takes around half an hour for the cryptocurrencies. The withdrawal of INR can take up to 6 hours to deposit in your bank account, and the withdrawals of cryptocurrencies take a few minutes to reach your wallet.

CoinDCX Review: Security

The most secure crypto trading platform in India and across the globe is CoinDCX. This platform gives utmost priority to the user’s private information and does not share the KYC details with any third party. It contains industry-leading security protocols regularly maintained and tested to check for any violations.

It has a two-factor authentication, which adds an extra level of security to a user’s account. Not only that, all cryptocurrency withdrawals go through multiple verification processes before they are processed to avoid any fraud withdrawal.

CoinDCX Lending

As the name suggests, crypto lending is an alternate form of investment. Lending in terms of cryptocurrencies means investors lend cryptocurrencies to the borrowers with an interest rate. CoinDCX lending services are secure and comfortable. With just one click, you can lend for a maximum duration of 7 days. Also, the maximum annual interest rate is 16.25%.

CoinDCX Staking

Staking is an activity where a user locks cryptocurrencies to receive rewards. You can compare it with mining. The CoinDCX platform offers staking services to the users for passive earning. To start staking, all you need is to register, hold a minimum balance of the supported cryptocurrencies, and be eligible for earning rewards.

CoinDCX Review: Customer Support

According to CoinDCX, giving the best services to the users is the key to a business to rise and flourish. Therefore, they have exceptional customer services with 24 hours support. Due to this 24-hour support, users from different countries do not have to worry about the time zone.

Services like onboarding, INR management, and ticketing have 24-hour support assistance. Also, the current duration of the telegram and chatting time is from 06:00 AM to 11:00 PM.

Because of these facilities, the users can solve any queries without waiting for hours for the next day. CoinDCX customer care number is not available on their site, but for customer support, you can mail them at [email protected].

CoinDCX Review: Pros and Cons

After looking at all factors, and crucial facts, let’s summarize them to get a more clear picture of CoinDCX.

Pros

- Availability of a wide range of coins for trading.

- It has adequate liquidity across a vast number of trading pairs.

- The trading charges are low, and the minimum amount for a trading amount is also low.

- You can buy and sell instantly with just one tap.

- It has a margin trading around six times the leverage on numerous assets.

- It accepts payment methods like UPI and IMPS.

- Continuous and live customers are also present to answer queries instantly.

- The futures trading is around 20 times the leverage.

- It is available for multiple platforms.

Cons

- INR is only FIAT currency, and no other options are available.

- You will need verification for higher FIAT values.

CoinDCX Review: Conclusion

With the points mentioned above, it will be easy for you to decide whether CoinDCX is worthy of your time and money or not. Also, you can easily compare these factors with the other crypto trading platforms to check which one will benefit you the most.

CoinDCX Review: Frequently Asked Questions

is CoinDCX safe?

Yes, every fund that is invested in cryptocurrencies through the CoinDCX platform is safe. This platform assures the users that it backs every investment and ensures that they don’t face any issues.

How do I withdraw money from CoinDCX?

First login to your CoinDCX account. Select the Funds section from the DCXtrade page and click on the INR Wallet. Enter the amount you want to withdraw, and go through the verification process to remove the amount.

Is KYC necessary in CoinDCX?

It is not compulsory to complete the CoinDCX KYC. Still, then your account will be limited to a total of INR 10,000 deposits and withdrawals or 4 BTC cryptocurrencies per day for deposit and withdrawal.

Is there any CoinDCX app?

Ans. You can download the CoinDCX app from the play store for Android devices.

Is Pan Card mandatory for opening an account on CoinDCX?

Ans. The Pan Card is not required to open an account on CoinDCX. However, you will need it for verification for KYC.