Quantitative trading is a method of making trading decisions based on mathematical models and algorithms, which can eliminate the influence of emotions and subjective judgments on trading, and improve trading efficiency and stability.

If you are interested in entering the field of quantitative trading, but do not know how to start, you may wish to consider ATPBot, a trading bot that integrates artificial intelligence technology and quantitative trading. In the previous article, we have learned about the unique advantages and functions of ATPBot in the market.

Now let us discuss in more detail how to start quantitative trading and the reasons why ATPBot is recommended.

Table of Contents

Step 1: Learn the Basics

Quantitative trading requires certain financial market knowledge and programming skills. You can build the necessary knowledge base by studying relevant books, courses and online resources.

Understanding the basic knowledge of financial products such as stocks, futures, and foreign exchange, and learning related skills such as statistics, econometrics, and programming languages (such as Python) will help you better understand and apply the concepts and methods of quantitative trading.

Step 2: Choose a trading platform

Choosing a reliable trading platform is an important step to start quantitative trading. ATPBot is a platform that focuses on the development and service of quantitative trading strategies. It combines artificial intelligence technology and quantitative trading to provide users with efficient and stable trading strategies.

The advantage of ATPBot is that it adopts rigorously tested and verified trading strategies using optimal trading patterns and continuously optimizes the performance of the strategies through deep learning algorithms. Choose ATPBot as your trading platform, you can get reliable trading execution and optimized strategies, and improve trading results.

Step 3: Develop a Trading Strategy

Developing an effective trading strategy is the key to the success of quantitative trading. Make a clear trading plan based on your investment goals and risk tolerance. This includes choosing a trading symbol, determining entry and exit rules, setting stop loss and take profit, etc.

ATPBot has rich experience and a professional team in trading strategies. They can develop and optimize quantitative trading strategies for you to help you achieve better trading results.

Step 4: Backtesting and Optimization

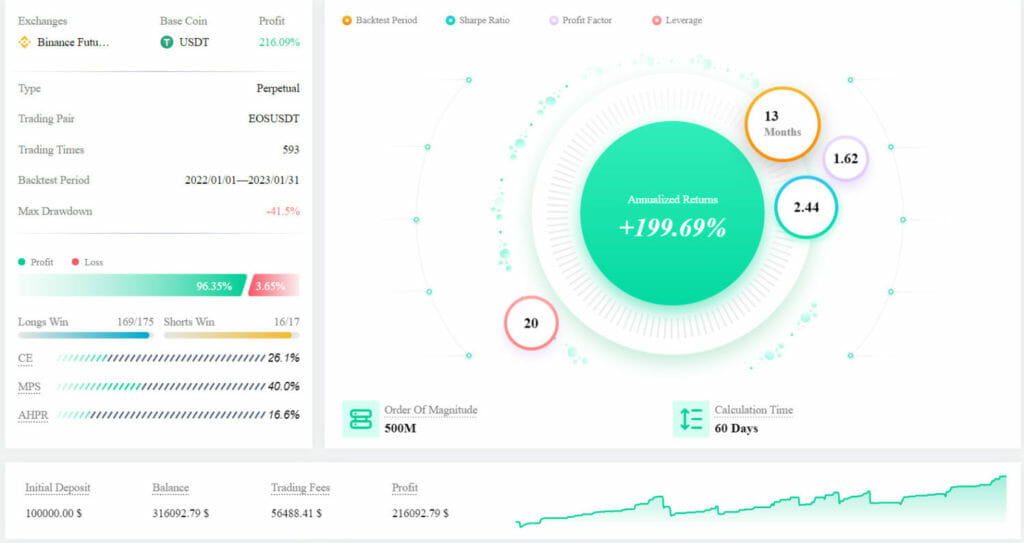

Sufficient backtesting and optimization is necessary before applying a trading strategy to live trading. Backtesting is to simulate the performance of trading strategies through historical data, which can evaluate the profitability and risk characteristics of strategies.

According to the backtest results, you can make necessary adjustments and optimizations to the trading strategy to ensure that its performance in actual trading is more stable and reliable.

ATPBot provides powerful computing power support and optimization algorithms, which can help you quickly and accurately find the best strategy configuration parameters and improve trading results.

Step 5: Firm offer trading and monitoring

After backtesting and optimization, you can apply the trading strategy to live trading. ATPBot has the ability to trade 24 hours a day.

By analyzing market data in real time and extracting valuable information using natural language processing technology, it can quickly respond to market changes and conduct profitable transactions.

You can use ATPBot’s intelligent trading system to let the boot automatically execute trading decisions, avoiding emotional interference and human errors.

Why Choose ATPBot?

As a trading bot integrating artificial intelligence and quantitative trading, ATPBot has the following advantages:

Advanced technology: ATPBot uses leading algorithms to find profitable methods through complex data types.

Easy to use: ATPBot provides ready-made trading strategies, no need to adjust parameters, and you can run profitable strategies with simple clicks.

Millisecond-level trading: ATPBot monitors the market in real time, captures signals and performs fast operations with millisecond-level responses.

Ultra-low management fee: achieve higher return on investment through a one-time permanent payment model.

Security and transparency: All transactions are processed through the third-party exchange Binance, ATPBot cannot touch your funds, and is committed to providing maximum security.

24/7 Trading: ATPBot trades automatically 24/7, making profits even while you sleep.

24/7 Service: Provide one-to-one service to solve your problems in time.

Summary

Quantitative trading is an important tool to improve trading efficiency and stability. By learning basic knowledge, choosing a suitable trading platform, formulating effective trading strategies, conducting backtesting and optimization, and utilizing the powerful functions of ATPBot, you can enter the field of quantitative trading and obtain better trading results.

As a trading bot that combines artificial intelligence and quantitative trading, ATPBot can provide you with efficient and stable trading strategies and optimized trading execution, and is your loyal partner on the road to quantitative trading.

Register with ATPBot, open the door to AI quantitative trading, and share the profits brought by artificial intelligence technology algorithms with ATPBot.