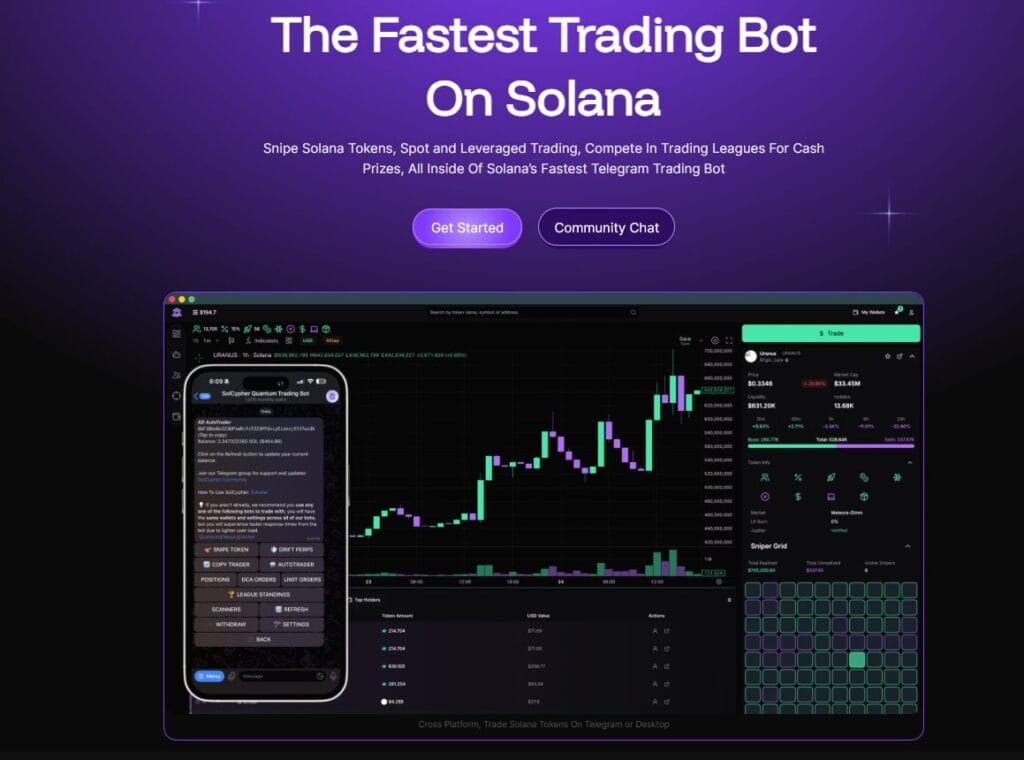

SolCypher is a fast, AI-powered Telegram trading bot for the Solana ecosystem. Instead of opening a separate exchange app, you can scan new tokens, snipe launches, auto-trade, and copy-trade directly inside Telegram. It’s designed to help beginners move from “I saw a token” to “I placed an order” with minimal friction, while still giving advanced users automation tools and revenue-sharing. In this article we will explore Solcypher platform and explore its offerings.

Table of Contents

What Is SolCypher?

SolCypher bundles trading automation (auto-sniping, DCA, stop-loss), copy trading, multi-DEX execution, and community tools (call-bot + leaderboard) in a Telegram interface. The system aims for speed, precision, and ease of use, with an economic layer where $CYPHER stakers receive distributions from bot revenues and LP fees (details below). It’s built for Solana’s fast finality and low network fees.

How to Get Started

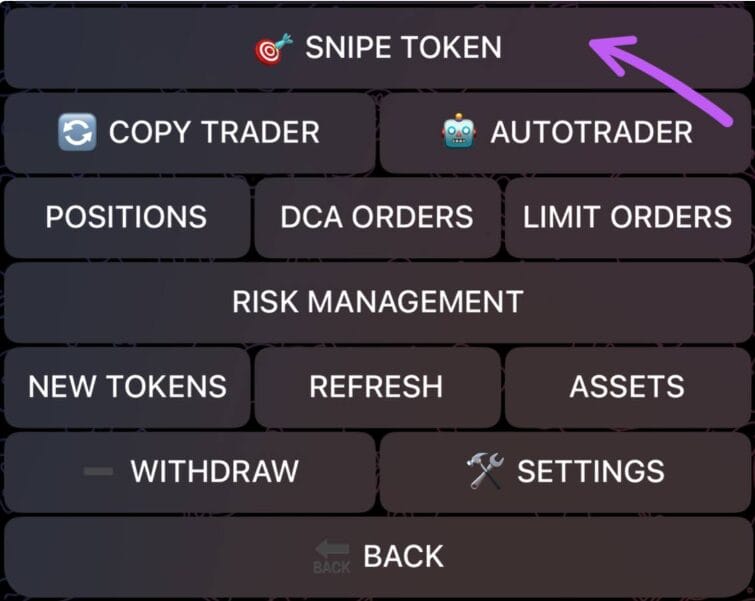

- Open Telegram and go to the official bot

- Tap Start to launch the menu.

- Create a wallet within the bot (hot wallet for trading).

- Fund your wallet with SOL (for gas) and any tokens you want to trade.

- Explore menus like Snipe Token, AutoTrader, Copy Trades, and Call/Leaderboard.

- Begin with very small sizes to learn fees, slippage, and execution speed before scaling up.

Features and Products

- Trading (Market & Limit Orders). Place instant Market buys/sells or set your own price with Limit orders—directly inside Telegram. Every trade is signed from your wallet. You can choose size, set slippage, and add take-profit/stop-loss for protection.

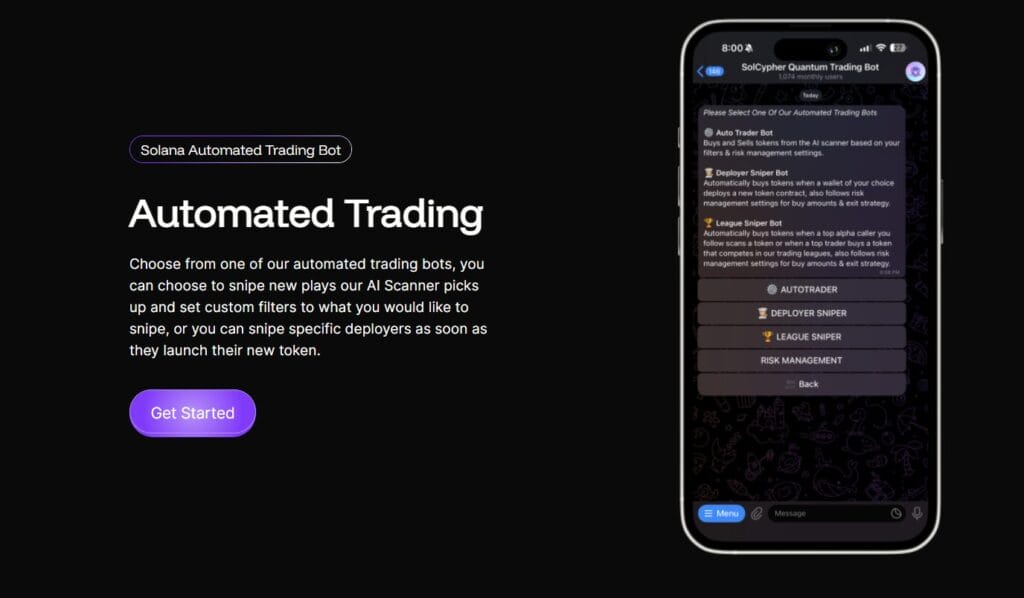

- Auto Trader (set-and-forget rules). Create simple rules—like auto-sniping new launches, DCA entries, and automatic TP/SL exits—and let the bot execute on Solana at speed. Start with tiny sizes until you trust the behavior.

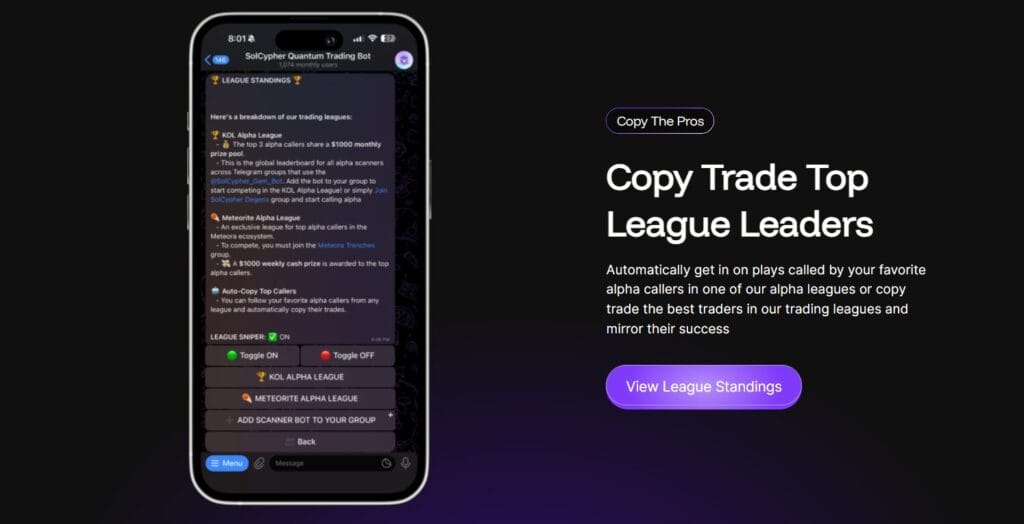

- Copy Trader (mirror pros safely). Follow selected traders and have your wallet replicate their buys/sells in real time. Control allocation, max slippage, max size, and still keep your own TP/SL so you don’t over-risk.

- Multi-DEX Routing. SolCypher connects to multiple Solana DEXs/launchpads and routes orders for better prices and fills. This helps reduce slippage on fresh or fast-moving tokens where a single pool may be thin.

- Wallet Management (hot wallet best practice). Create a trading wallet in the bot, label it, and fund it only with what you plan to trade. Keep savings in a separate (ideally hardware) wallet and withdraw profits periodically.

- New-Token Sniping (early discoveries). Arm quick entries for newly launched tokens with gates like max slippage, max spend, and basic liquidity/contract checks. Be early—but always size small and use a stop-loss.

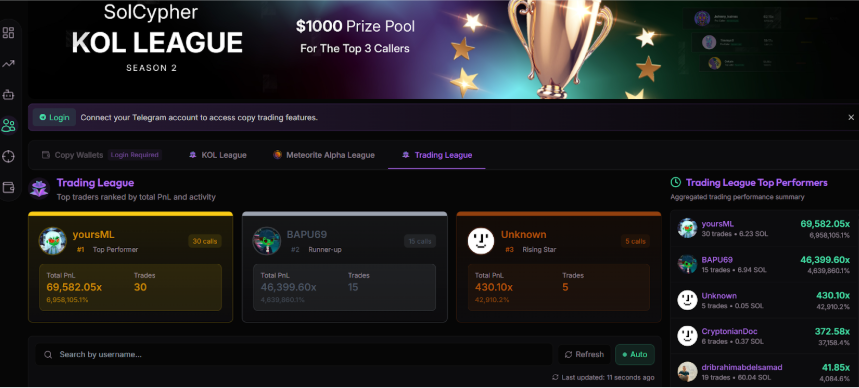

- Signals, Calls & Leaderboard. See calls from creators and check their tracked performance over time. Treat signals as ideas, not guarantees—confirm liquidity and risk, then test with a tiny trade first.

- Portfolio & Fills Tracker. View balances, recent fills, open positions, and PnL without leaving Telegram. This makes it easy to monitor results and adjust your rules (slippage, size, TP/SL) as you learn.

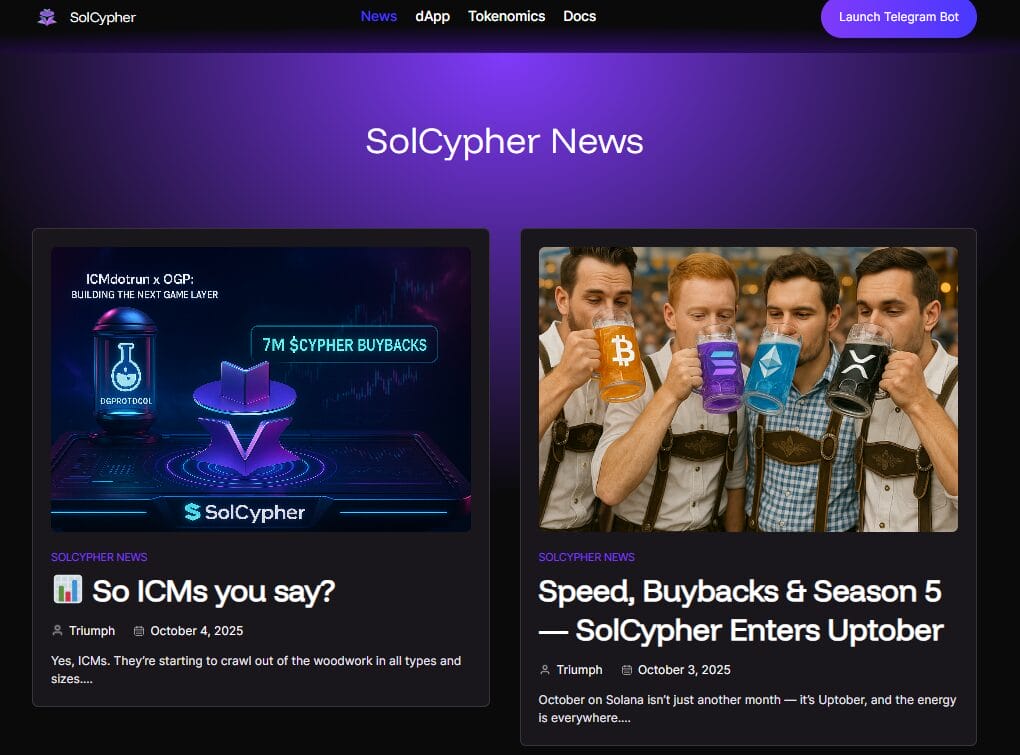

- News & Updates (in-bot): A curated stream inside the bot that highlights key Solana market updates, token launches, feature rollouts, and security notices—so beginners can stay informed without leaving Telegram and jump from headlines to action with a tap.

$CYPHER Token & Rewards

- Purpose: $CYPHER is not a governance token; it’s the value-distribution token for SolCypher’s economy.

- Revenue sharing: Net profits from the bot (after paying call-bot operators and referral partners) are distributed to $CYPHER stakers.

- LP fee rewards: 89% of trading fees from the $CYPHER pair on DEXs are funneled back to the staking pool.

- Why stake: Stakers support liquidity and protocol stability and share in revenue distributions. As always, token prices and yields can change—never stake more than you can risk.

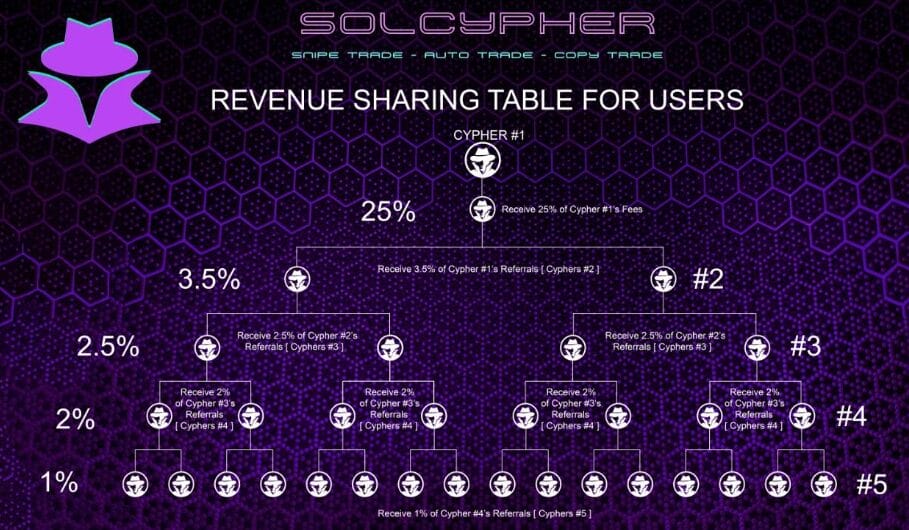

- SolCypher Affiliate System : A built-in referral program that pays you a share of trading fees from people you invite—plus a smaller share from their invitees, up to 5 levels deep.

How it works (levels & rates):

- Level 1 (direct invites): 25% of your invitee’s trading fees

- Level 2: 3.5%

- Level 3: 2.5%

- Level 4: 2%

- Level 5: 1%

This structure lets you build long-term, compounding affiliate income as your network grows.

Getting your link:

Start the bot in Telegram and you’ll automatically receive a unique referral link. Share it with friends, communities, or anyone trading on Solana.

Payouts & threshold:

Affiliate rewards are paid every two hours. Set a payout address in the bot; rewards auto-send whenever your claimable balance ≥ 0.05 SOL.

Tracking & transparency:

Open the Affiliate Dashboard inside the bot to see clicks, signups, levels, and your earned SOL. You can monitor performance in near-real time.

Quick start steps:

- Open @solcypher_bot → Start

- Locate Affiliate / Referral → copy your ref link

- Set payout address (SOL)

- Share the link; watch earnings in the Affiliate Dashboard

Tips for beginners:

- Be upfront: remind invitees about trading risks and to start small.

- Share simple guides (how to set slippage, TP/SL, and test trades).

- Check your dashboard weekly and refine where you share to reach real traders.

User Interface and Experience

Website experience (web app):

- The web app gives you a dashboard view: token scanner, leaderboards, strategy panels (Auto Trader/Copy), and a clearer portfolio & PnL page than chat.

- Point-and-click setup makes it easy to build rules (DCA, stop-loss/take-profit, slippage caps) with tooltips and previews before you save.

- Charts, liquidity/holders, and basic safety cues sit next to the order ticket, so beginners can review and trade without switching tabs.

- It’s better for deep dives (filters, multi-window, longer reading), and for learning features at your own pace.

Inside Telegram (bot experience):

- You operate everything from menu buttons (Snipe, AutoTrader, Copy, Call/Leaderboard), which cuts down typing and keeps you moving.

- The bot walks you through amount → slippage → TP/SL with fast confirmations and status messages (submitted, filled, failed), so the idea → order path is very short.

- Copy Trader and small AutoTrader rules are ideal starting points; you can pause or tweak with a few taps.

- Perfect for on-the-go actions (e.g., reacting to a call or CA you just saw on X), but screens are smaller, so review tokens with caution and keep sizes tiny until you verify liquidity.

How to choose:

- Use Telegram for speed (snipes, quick copies, small adjustments).

- Use the website for planning (building strategies, reviewing history/PnL, comparing tokens).

- In both, treat the in-bot/web wallet as hot: start small, set TP/SL, keep slippage conservative, and verify you’re on official links.

Fees and Pricing

- Bot trading fee.

SolCypher charges 0.9% per trade via the Telegram bot. This is your platform fee for using the bot’s execution and tooling. - Network (Solana) gas.

Every on-chain action costs Solana gas. It’s usually small, but can rise during busy periods. Gas is paid to the network, not to SolCypher - Slippage (not a fee, but a cost).

If the price moves while your order is executing, you may “pay” that difference. Keep slippage tight on thin tokens; widen only in small steps if orders keep failing. - Copy Trader costs.

Copy trades still incur the 0.9% bot fee and gas like any other trade. There isn’t a separate “copy fee,” but you’ll see the same line items as if you traded manually.

Customer Support & Community

- Where to ask: Start with the bot’s help prompts and official community channels linked from the official bot.

- Self-help: Many strategies (sniping, DCA, copy rules) are best learned by testing small and reading community guides.

- Impostors warning: Only trust links from official posts/messages. Support will never ask for your seed or private keys.

- Official Links (stay safe): SolCypher publishes verified links to its Instagram, X (Twitter), YouTube, and Linktree. Always use these official profiles to avoid phishing, find announcements, tutorials, and community news, and confirm you’re interacting with the real project.

Security

- Encrypted keys; no seed access by SolCypher. Your private keys are encrypted and stored via confidential computing. The team states it cannot view or recover your seed phrase—only you control it.

- Use a hot-wallet mindset. Treat the in-bot wallet as for trading only. Deposit just what you plan to use, then withdraw profits to your main wallet. Keep long-term funds on a hardware wallet.

- Stick to official links. Launch the bot from the verified Telegram handle and the project’s official Linktree/X/YouTube/Instagram. Ignore DMs and unofficial clones; support will never ask for your seed or codes.

- Start small; control slippage. Learn fees and execution with tiny sizes first. Keep slippage conservative, add stop-loss/take-profit, and avoid chasing thin-liquidity tokens.

- Secure your devices & Telegram. Enable Telegram 2-Step Verification, keep your OS/wallet apps updated, and avoid public Wi-Fi. Lock your phone and use strong, unique passwords.

- Backups & recovery hygiene. Store your seed phrase offline (paper/steel), never in screenshots or cloud notes. If you suspect a compromise, move funds immediately to a new wallet you control.

Conclusion

SolCypher.ai brings fast, AI-assisted trading to Telegram, letting beginners and advanced users scan new Solana tokens, automate entries/exits, and mirror seasoned traders without juggling multiple apps. The bot’s strengths are its speed, modular tools (Auto Trader, Copy Trader, Snipe), multi-DEX routing, and a clear economic layer via $CYPHER staking and a multi-level affiliate program. Security is handled with encrypted keys and confidential computing, but you should still treat the in-bot wallet as “hot,” start small, and use stop-loss/take-profit. If you want a Telegram-first workflow that compresses discovery, risk checks, and execution into a single chat, SolCypher offers a capable, beginner-friendly toolkit with an ambitious roadmap.

Does the bot support tokens with transfer fees or unusual tokenomics?

Some tokens with atypical mechanics can cause slippage or failed fills. Test with tiny size first; if behavior looks odd, avoid.

Can I pause or stop Copy Trader instantly?

Yes. You can pause/unfollow leaders at any time; actions after pausing won’t copy to your wallet.

Are there geographic or age restrictions?

You must be legally allowed to trade crypto in your jurisdiction and meet any regional limitations the bot or partners enforce.