Sandglass is revolutionising decentralised finance (DeFi) as a cutting-edge yield trading protocol that empowers users to dissect, trade, and hedge yield exposure with surgical precision. By unbundling yield-bearing tokens into principal tokens (PTs) for stable returns and yield tokens (YTs) for speculative upside, it creates liquid markets for on-chain fixed income strategies. At the forefront is tETH, an innovative yield instrument backed by Ethereum restaking derivatives like eETH, ezETH, rswETH, and steakETH, now live on Eclipse—a Solana-compatible rollup delivering blazing speed and minimal fees. This article explores Sandglass’s mechanics, the tETH market’s dynamics, liquidity provision flows, trading strategies, risks, and practical onboarding, equipping Web3 enthusiasts to navigate this yield frontier confidently.

Table of Contents

What is Sandglass?

In the sprawling ecosystem of Solana-aligned DeFi, Sandglass stands out as a pool-based yield trading protocol engineered for liquidity, transparency, and composability. Launched in July 2024, it draws parallels to Pendle but optimises for Eclipse’s high-throughput environment, enabling seamless on-chain yield markets that rival traditional fixed-income instruments. At its essence, Sandglass allows participants to trade and hedge yield exposure, transforming passive staking rewards into active, derivative-like positions.

The protocol’s genius lies in its atomic splitting of yield-bearing tokens (YBTs)—assets like staked ETH or restaking derivatives—into two fungible components:

- Principal Token (PT): A discounted claim on the underlying principal, redeemable at maturity for a fixed yield, ideal for conservative yield locking.

- Yield Token (YT): Pure exposure to the variable yield stream, enabling leveraged bets on incentives, fees, or airdrops without principal at risk.

This dual-token model democratises sophisticated yield management, letting users speculate on rate curves, hedge against downturns, or monetise future accruals. With no custody required and redemptions available anytime at market prices, Sandglass fosters a permissionless arena for yield engineering. Its Eclipse deployment marks a pivotal expansion, bridging Solana’s efficiency with Ethereum’s vast restaking liquidity pools. As DeFi TVL surges past $100 billion chain-wide, Sandglass carves a niche in the $5 billion+ restaking sector, positioning itself as the go-to for on-chain fixed income.

How Sandglass Works: Principal vs. Yield Tokens

Sandglass’s architecture is elegantly simple yet profoundly powerful, centred on time-bound vaults where YBTs are deposited and split via smart contracts. Upon entry, a user’s tETH (or similar) is fractioned into PT and YT, with the sum of their values equaling the underlying asset’s market price at any moment—enforced by an automated market maker (AMM) powered by concentrated liquidity curves.

- PT Mechanics: Priced at a discount reflecting the implied fixed yield to maturity (e.g., 8-12% for tETH), PTs accrue no variable upside but guarantee principal redemption plus locked yield. Holders can exit early by selling on the AMM, capturing any premium from market sentiment shifts.

- YT Mechanics: These tokens capture 100% of the yield delta, amplifying returns during incentive booms (e.g., EigenLayer points multipliers) but exposing holders to downside if yields compress. YTs are zero-sum with PTs: As one appreciates, the other adjusts inversely.

Trading occurs within isolated PT/YT pools, minimising impermanent loss for liquidity providers (LPs) through bonding curve pricing oracles like Pyth. Strategies abound: Buy PTs and sell YTs for a synthetic fixed-rate bond; long YTs for 2-5x leveraged yield farming; or pair them in delta-neutral positions for hedged income.

This setup not only mirrors interest-rate swaps but enhances them with DeFi’s composability—redeem PTs into lending protocols or collateralise YTs for perps. On Eclipse, sub-second finality and fees under $0.001 per swap make micro-trades viable, outpacing Ethereum-based rivals by orders of magnitude.

tETH: Sandglass’s First Live Market

tETH represents Sandglass’s bold entry into cross-chain yield trading, a tokenised basket aggregating premier Ethereum restaking derivatives: eETH (Ether.fi), ezETH (Renzo), rswETH (RSW), and steakETH (Steakhouse Finance). This diversified exposure taps into Ethereum’s $10 billion+ restaking TVL, channelling AVS (Actively Validated Services) rewards and staking yields into Eclipse’s Solana-speed ecosystem.

The tETH vault matures in three months, offering fixed yields around 8-12% based on current implied rates, with YT pools spiking to 20-40% APY during incentive epochs. TVL for the Eclipse deployment sits at $132,376, contributing to Sandglass’s overall $4.04 million across chains, with daily volumes at $1,535 amid bootstrapping efforts.

Traders can speculate on restaking narratives—betting YTs on EigenLayer airdrop hype—or lock PTs for stable returns decoupled from ETH volatility. LPs deposit tETH single-sided, earning 100% of swap fees plus protocol incentives, such as points multipliers for future token drops. This market exemplifies Sandglass’s vision: Yield trading as a bridge between ecosystems, with Eclipse’s SVM compatibility ensuring seamless Solana wallet integration.

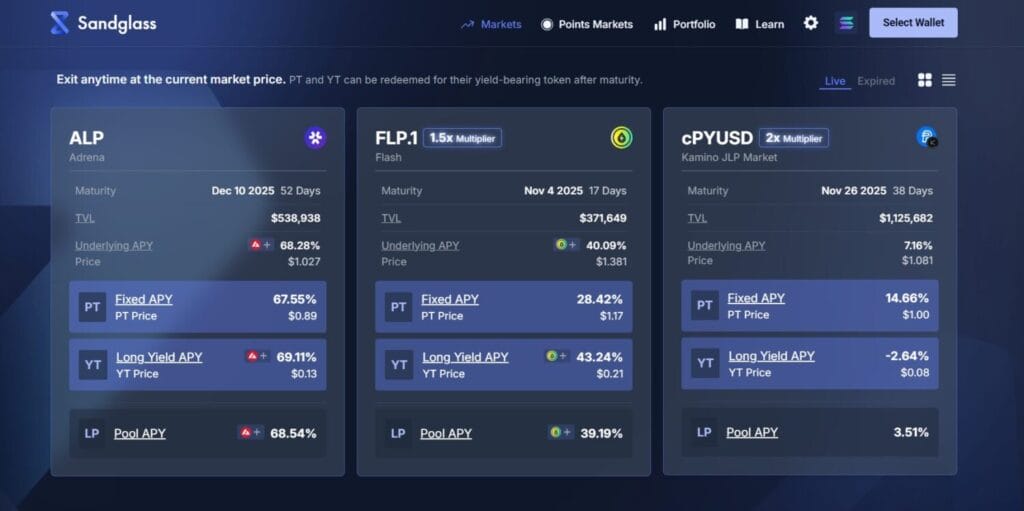

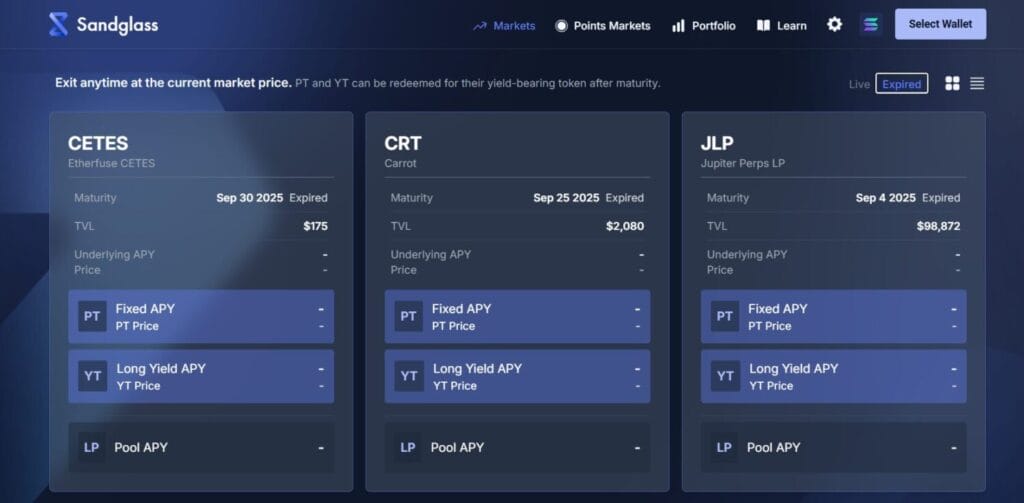

Inside the Sandglass Markets Page

The Markets page at sandglass.so/markets is a masterclass in DeFi UX—clean, data-rich, and action-oriented. Users land on a sortable dashboard listing active vaults, headlined by tETH with real-time vitals: TVL ($132k), fixed yield (implied 10%), pool APY (25%), and maturity (Dec 2025). Filters by chain (Eclipse/Solana) and asset type streamline discovery, while embedded charts plot yield curves, volume trends, and liquidity depth via Dune oracles.

Clicking tETH expands a modal with granular intel: PT/YT prices, redemption ratios, and risk metrics. The trade module mimics Uniswap’s familiarity—select swaps (e.g., tETH to YT), tweak slippage (0.1-1%), and execute with one click. A prominent “Live on Eclipse” banner confirms deployment, linking to bridge tools for ETH inflows.

For deeper dives, analytics tabs integrate DefiLlama feeds showing 30-day volume ($81k cumulative $694k) and LP APRs. Mobile-optimised for Phantom or Backpack wallets, the page balances pro tools such as API endpoints for bots with retail accessibility, making yield trading as intuitive as spot DEXes.

How to Provide Liquidity on Sandglass

Liquidity provision on Sandglass is streamlined for passive earners, emphasizing single-sided deposits to sidestep pair imbalances. Here’s the flow for tETH:

- Navigate to Markets: Select the tETH vault on Eclipse.

- Deposit tETH: From your wallet, input amount (e.g., 1 tETH). The UI displays current balances (tETH: 1; LP-tETH: 0), max liquidity mode toggle, and projected pool share (e.g., from 0% to 2.6%).

- Confirm Split: Preview PT/YT allocations and fees (none for deposits).

- Earn Rewards: Post-deposit, track via dashboard—trading fees accrue proportionally, plus incentives like 1% bonus APY during campaigns.

The deposit interface is visually crisp: Green-highlighted tETH balance fields, maturity countdown (Jul 2025? Wait, aligned to Dec), and post-deposit share estimates ensure transparency. Risks include AMM divergence (PT/YT drift from tETH) and low initial depth, but Eclipse’s cheap exits mitigate impermanent loss. With pool APRs at 15-30%, LPing tETH offers a compelling carry trade for restaking holders.

Trading Strategies for On-Chain Yield

Sandglass unlocks institutional-grade plays for retail DeFi users, leveraging tETH’s restaking sensitivity:

- Fixed Yield Lock: Acquire PTs at discount, sell equivalent YTs for net positive carry—yielding 10% fixed minus funding costs.

- Leveraged Speculation: Long YTs for amplified AVS rewards; a 20% yield surge could double YT value.

- Hedging Tailwinds: Short YTs via PT longs to shield staking positions from rate cuts.

- Tenor Arbitrage: As multi-maturity vaults launch, trade forward curves for basis profits.

- Neutral LP Carry: Deposit tETH for fees while delta-hedging PT/YT imbalances.

These strategies thrive on Eclipse’s composability—pair with Marginfi lending or Drift perps for turbocharged setups—turning Sandglass into a yield derivative hub.

Risks and Key Considerations

Innovation begets nuance; Sandglass users must navigate:

- Smart Contract Vulnerabilities: Audited code, but exploits remain a DeFi specter.

- Market Volatility: YT prices swing with yield expectations; tETH basket rebalances could introduce basis risk.

- Liquidity Divergence: Early pools may suffer slippage; monitor via DefiLlama.

- Oracle Dependencies: Pyth feeds underpin pricing—downtime risks rare but real.

- Regulatory Overhang: Restaking derivatives face evolving scrutiny.

To mitigate risks effectively, diversify across assets, implement stop-loss orders, and stay informed through community vigilance via @sandglass_so updates—all while leveraging a reliable portfolio tracker like CoinStats or Delta to monitor and enforce position sizing under 5% of your total portfolio, ensuring exposure remains prudent.

Ecosystem and Deployments

Eclipse anchors Sandglass’s multi-chain ambitions, fusing Solana’s VM with Ethereum L2 liquidity for hybrid yields. tETH’s basket democratises restaking access, while future Solana-native vaults (e.g., JitoSOL) loom. Partnerships with Ether.fi and Renzo amplify incentives, with $100k+ in points farming. As Firedancer upgrades Solana throughput, Sandglass eyes 10x TVL growth, cementing its role in interoperable yield markets.

Analytics and Monitoring Tools

Stay ahead with:

- DefiLlama: TVL/volume dashboards for tETH health.

- RootData: Protocol metrics and incentive trackers.

- Dune Queries: Custom yield curve visuals.

- X/Discord: @sandglass_so for real-time alpha.

These tools illuminate slippage, utilisation, and fee accrual, empowering data-driven trades.

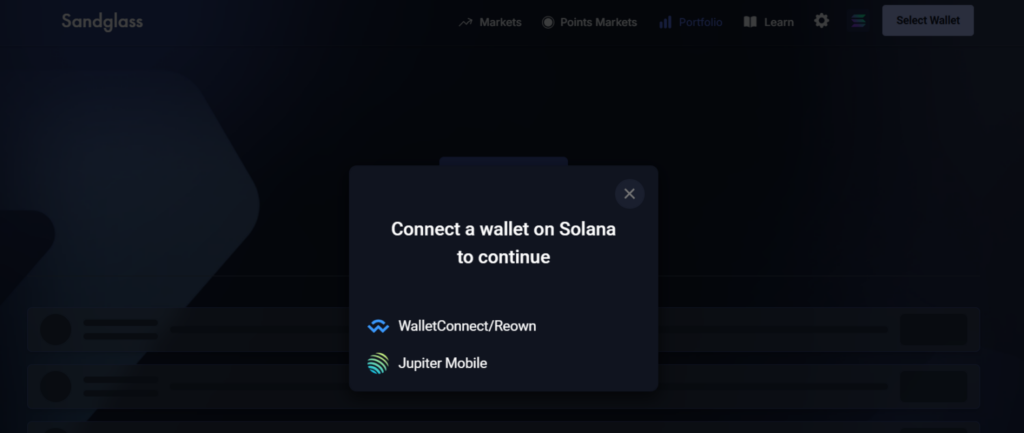

Getting Started: Step-by-Step

- Visit the official Sandglass website

- Check the Eclipse-specific deployment at which explicitly states Sandglass “lets you bet on an asset’s yield … live on Eclipse.”

- Confirm via the Sandglass X (Twitter) account: a post announces “Sandglass is now live on @EclipseFND! The first asset up for trading is tETH…”

- Make sure your wallet/bridge supports the Eclipse network and the correct token (tETH) before proceeding.

- Ensure you use the official links and domain names (sandglass.so / eclipse.sandglass.so) to avoid phishing or scam sites.

Onboard in minutes, harvest yields indefinitely.

Conclusion

Sandglass Markets herald a yield trading renaissance, where principal and yield tokens forge on-chain fixed income into a vibrant, tradable asset class. tETH on Eclipse exemplifies this—blending Ethereum restaking firepower with Solana’s velocity for hedgers, speculators, and LPs alike. As volumes climb ($81k monthly) and incentives flow, Sandglass isn’t just a protocol; it’s the infrastructure for DeFi’s fixed-income evolution. Dive in, strategize boldly, and claim your slice of tomorrow’s yield alpha in this non-custodial, composable playground.

Frequently Asked Questions (FAQs)

What is Sandglass, and how does it differ from other yield trading protocols like Pendle?

Sandglass is a pool-based yield trading protocol on Eclipse and Solana that splits yield-bearing tokens into PTs (fixed yields) and YTs (variable exposure) for on-chain strategies. Unlike Ethereum-based Pendle, it uses Eclipse’s Solana VM for sub-second trades under $0.001, optimizing for restaking assets like tETH.

What is tETH, and why is it significant on the Sandglass Markets?

tETH is a tokenized basket of Ethereum restaking derivatives (eETH, ezETH, rswETH, steakETH), live on Eclipse since September 2025. It bridges Ethereum’s $10B+ restaking yields to Solana-speed trading, letting users lock 8-12% fixed APY via PTs or speculate on AVS rewards with YTs, plus points multipliers.

How do I provide liquidity on Sandglass, and what are the rewards?

Visit sandglass.so/markets, connect a wallet like Phantom, select tETH vault, and deposit single-sided tETH. Earn 100% of PT/YT swap fees (0.3%) plus incentives like bonus APYs. tETH pool APRs hit 15-30%, with low divergence risk from concentrated curves—ideal for passive farming.

What are the main risks of trading PTs and YTs on Sandglass?

Risks include YT volatility from yield shifts, smart contract bugs (audited but possible), AMM divergence (PT/YT drift), oracle (Pyth) issues, and basket rebalances. Mitigate via diversification, stop-losses, and DefiLlama monitoring—DYOR, as DeFi yields vary.

How can I get started with yield trading on Sandglass Markets?

Bridge ETH to Eclipse, go to sandglass.so/markets, connect wallet. Check tETH PT/YT quotes and yields. Buy PTs for fixed income or YTs for leverage via AMM. Track on DefiLlama; follow @sandglass_so on X. Onboard in <5 minutes for yield alpha.