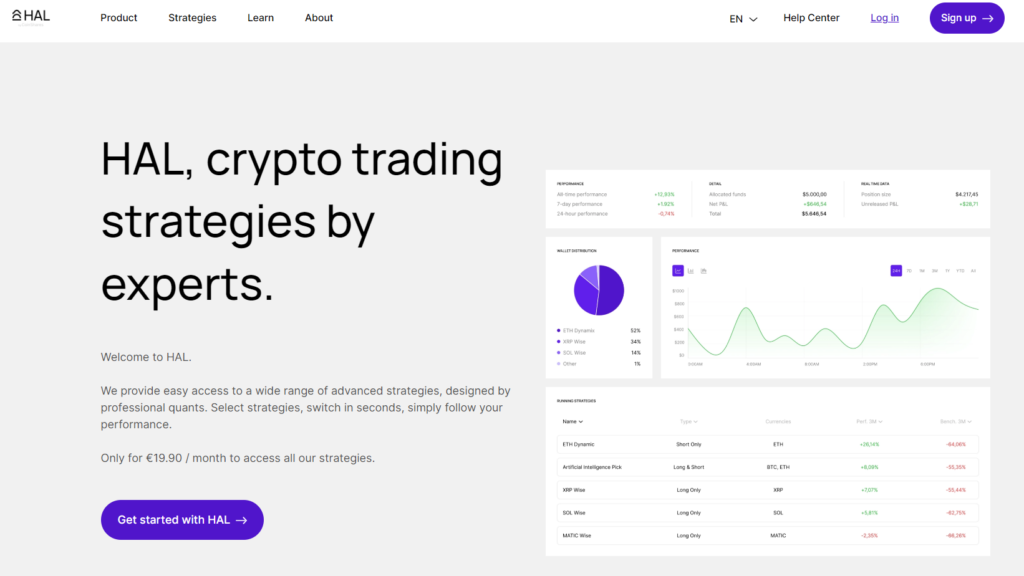

HAL is a platform exclusively dedicated to crypto and provides automated strategies that individuals can use for trading on different exchanges. Experts design these strategies based on market analysis and time frames.

In today’s article, we’re going to take you through the HAL review.

Table of Contents

Summary (TL;DR)

- Established in 2018, Napbots (now HAL) is professional and has a straightforward setup.

- CoinSharesEurope’s largest digital investment firm acquired Napoleon Group in December 2021.

- Access multiple-level expert trading strategies at your fingertips.

- Designed trading strategies rely on script algorithms.

- Free sign-up in a few seconds.

- Compatible with Binance, Kraken, and Bitfinex (more exchanges to come), connect through API to trade automatically.

- Enjoy a 15-day free trial period with flexible and transparent pricing.

What is HAL?

HAL.trade is a platform launched in 2019 by Napoleon Group, a wholly-owned subsidiary of CoinShares International Ltd.

The user interface of the platform is simple and clean. HAL is compatible with most of the industry’s leading exchanges, including Binance, Kraken, etc., and is actively expanding its list. It supports three languages – English. French and German.

There are over 30 cryptos available to trade with HAL, including BTC, ETH, SOL, and BNB. Moreover, the traders can readily use 15 work-specific strategies designed by professionals for trading.

Although the platform is available in most countries, it does not operate in the United States due to restrictive policies.

HAL Review: Features

- HAL is an automated trading platform that provides its users with pre-built strategies that are internally designed by their expert trader’s team.

- The Quick Connect feature makes HAL intuitive and easy to use.

- The platform offers an extensive list of algorithmic-based strategies that amateur and expert traders can easily use.

- Trade bots execute orders automatically, thus saving both time and effort.

- There are over 15 strategies, each optimized for different trading profiles.

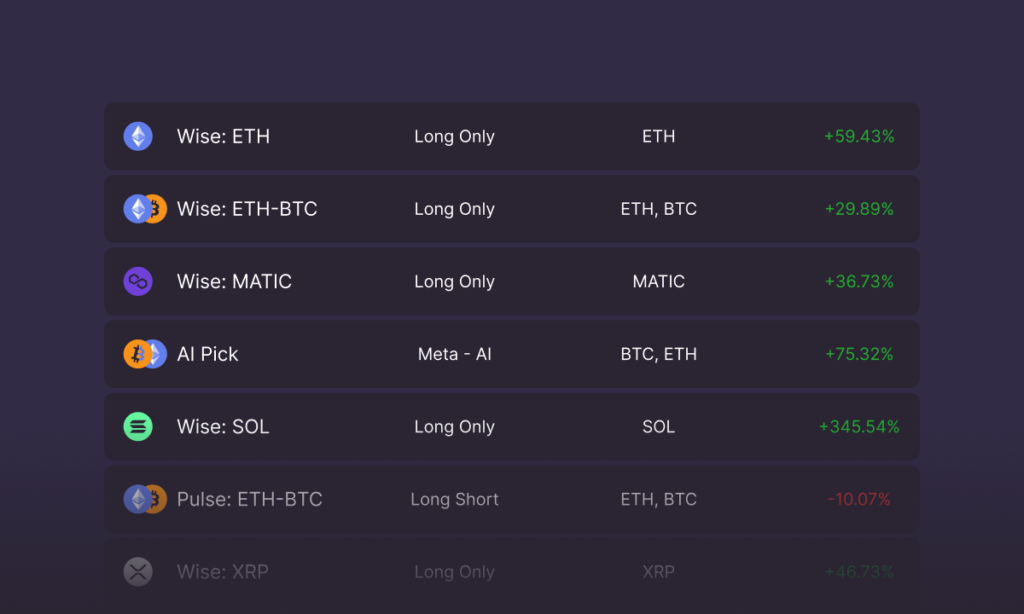

- On HAL, trading strategies can be divided into four types – Wise, Pulse, Dynamic, and AI Pick.

What’s Wise Strategy at HAL?

Long-term strategies that follow positive trends on underlying assets are referred to as wise strategies. HAL has 10 Wise strategies, which trade ADA, DOGE, MATIC, SOL, XRP, BTC, BCH, BNB, and ETH.

Under this strategy, the bots continue to buy until the market is up, and in downturns, they stop buying. Each of these strategies includes three indicators: two medium-term and short-term.

A medium-term indicator is called a tracking indicator. It takes positions daily or weekly and triggers buy signals whenever the asset’s price moves above the trend indicator.

The short-term strategy is called Contrarian, and it triggers buy signals when the asset is oversold. Oversold assets are those whose value is expected to rise despite already trading at a lower price.

The wise strategy is most effective in a bull market, as they profit from the upward momentum and switch to neutral in times of downtrends.

Basic Terms Related to HAL Wise Strategy

- P&L: It refers to the total profit or loss made by an individual over a certain time period.

- Lookback Period: You use a lookback period to judge whether a market is bullish, bearish, or range-bound based on your time horizon. A trend-following system could, for example, assess the market every day based on 30 days of price data.

- Turnover Ratio: The number of positions opened or closed by a particular strategy during a period is known as the Turnover Ratio. The higher the turnover, the more the transaction costs.

- Win/Loss Ratio: A win/loss ratio compares the total number of winning trades with the total number of losing trades.

- W/L Ratio = Total Wins/Total Losses

- Max Drawdown: It is the highest value of loss realized during a specified period. It indicates the downside risk.

- Position: The term refers to either an open position, which can incur a profit or loss, or a closed position, which has been canceled recently. A position can be profitable or unprofitable based on market trends, movements, and fluctuations.

HAL Review: Products

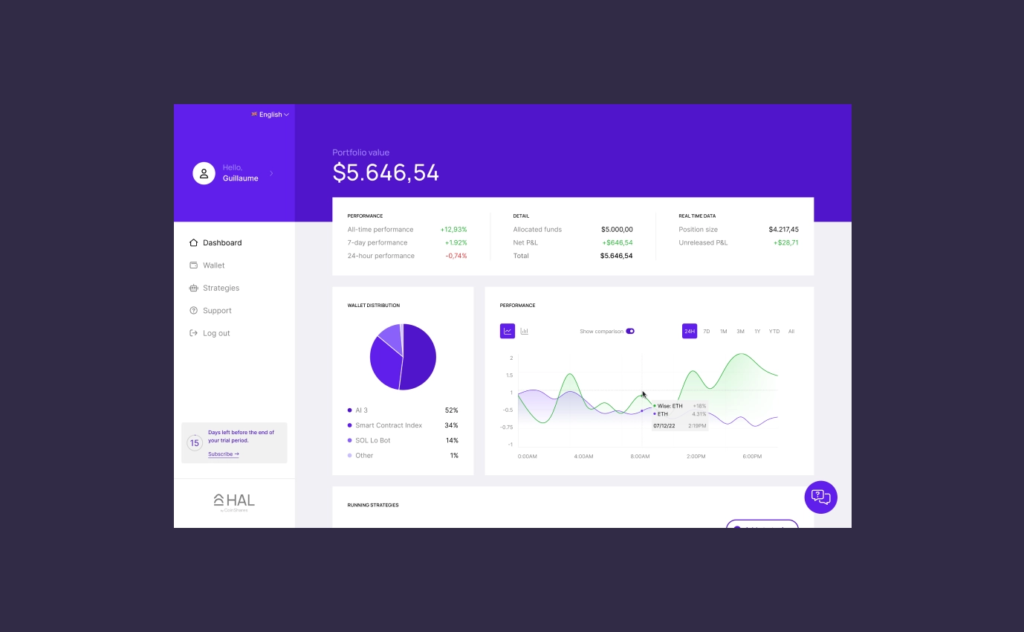

On HAL (previously Napbots), you’ll access a variety of automated crypto trading strategies. Investors can readily use these.

Automated bots make trading easier since you need not monitor the markets at all times. These bots work 24/7 on your behalf and place orders based on your preset strategies by relying on the market data. The bots take positions on an hourly, daily and weekly basis using advanced indicators such as trends, tracking, price, etc.

You can track the bots’ performance directly through the dashboard or switch to any other strategy. Additionally, the platform shares a quarterly report on the performance analysis of its strategy.

Also, in an update coming in the following weeks, you will be able to see the comparison between strategy performance and the underlying asset directly from the monitoring dashboard.

Getting Started with HAL

Here’s an easy guide to help you get started on HAL in 5 minutes.

- Go to HAL and sign up choosing your preferred plan.

- Select a suitable exchange of your choice to access trading strategies

- Now, pick your favorite trading strategy from the list.

- Monitor performance and rebalance your strategies using a single dashboard.

- You need to enter your card details once your trial has finished.

HAL Review: Pricing

HAL is relatively straightforward when it comes to the pricing model. It has a fair, transparent, and flexible pricing system with no hidden charges.

- HAL costs only €19.90 / month, regardless of the amount you’d like to trade.

- You can trade up to $100,000 on HAL, always for €19.90 / month.

- You’re free to stop your subscription whenever you want.

Payment Methods

Users can pay HAL subscriptions through fiat money. Further, the payment options include using a credit/debit card via Stripe.

Is HAL (previously Napbots) safe?

The HAL team considers protecting the users’ data as its top priority.

To ensure a smooth-secure crypto trading experience, they conduct regular security audits of the HAL website.

HAL cannot access the users’ assets; they remain on the investors’ exchange accounts. Hence, the platform cannot withdraw funds but can only execute trades.

In addition, HAL only works with exchanges that maintain high-security standards.

HAL Review: Pros and Cons

Pros

- Intuitive design

- Quick Set-Up

- Free trial

- 24/7 Support

- Comparative Pricing

- Just follow strategies and watch your portfolio

Cons

- No mobile app

- Not for US citizens

Customer Support Service

Users have access to live chat support 24/7 on Napbots (now HAL). They also have an active help desk to answer all the customers’ questions within 24 hours, in English and French.

You can find comprehensive guides and articles, and FAQs. Further, you can receive more educational content and market updates in Napbots’ (now HAL) weekly newsletter called Snapshot.

You can find HAL’s community on platforms including Facebook, Twitter, Linkedin, and Instagram.

HAL Review: Conclusion

Truly, HAL is a professional platform that can help you ace up your game and make that difference. The platform’s user-friendliness makes it easy for even novice traders to navigate its features. In addition, the platform is quite transparent, which appeals to users.

Frequently Asked Questions

What exchanges are available on Napbots (Now HAL)?

HAL offers a wide variety of local and international exchanges for investors, including Binance, Kraken, and Bitfinex (more exchanges to come).

Can I switch to another exchange?

Yes, you can. Napbots (now HAL) allow you to switch your existing exchange plan without any additional fees.

Also, read