Huobi Global is one of the most popular trading platforms; hence it is evident that you are reading this because of that very reason. So in this article, we will introduce Huobi leverage trading and explain everything you need to know before beginning your margin trading journey at Huobi.

Table of contents

Summary

- Huobi is one of the most popular trading exchanges and provides margin trading services with your capital as collateral.

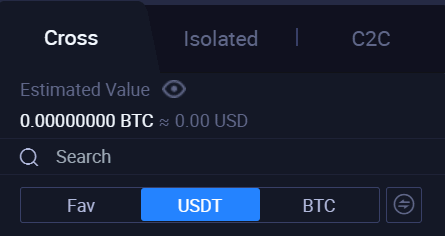

- You can trade in three different modes, which are cross, isolated and C2C.

- Maximum leverage of 5x is available at Huobi.

- The exchange offers many features in the margin trading window, such as trigger order, stop-limit, risk level indicator, etc.

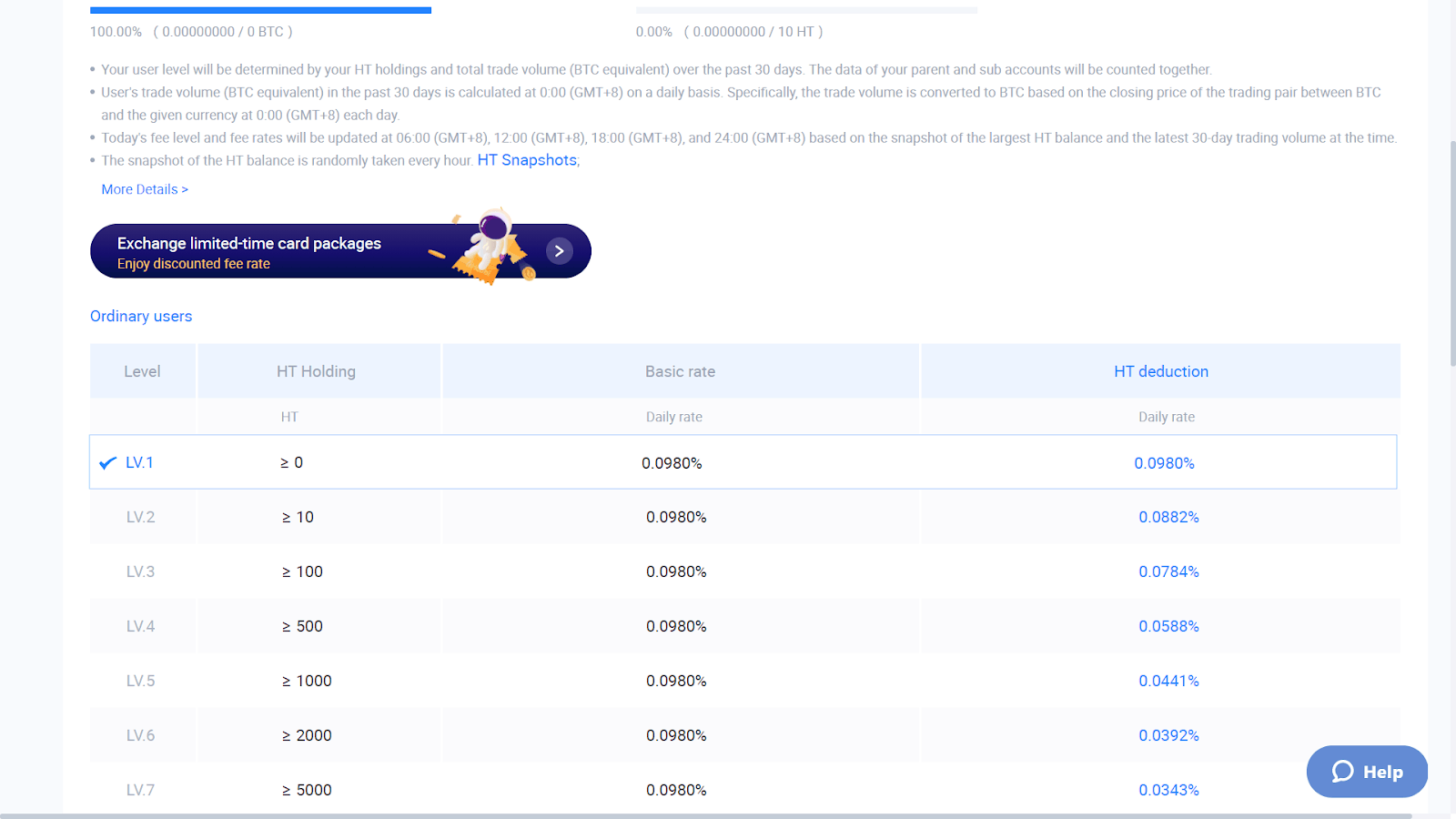

- Huobi charges a high margin interest of 0.098% from level 1 users.

What is margin trading?

Wouldn’t it be nice if you could gain extra returns with your fixed capital? Well, this is where margin trading comes in; it allows you to use your capital as collateral and borrow funds to open a position.

How does Huobi leverage trading work?

At Huobi, the leverage for a particular mode is fixed and cannot be changed; hence you can simply choose your preferred method and place an order. Huobi automatically provides you the required funds to open a position.

Huobi cross margin trading

Huobi cross margin trading allows you to prevent liquidations by keeping a shared account for all of your open positions. Suppose one of your positions is losing and the other is gaining. Then the one in profit can cover the losses and prevent that position from liquidation.

Huobi isolated margin trading

Huobi isolated margin trading increases your chances of liquidation; however, it does reduce the chances of any further losses from your main account. It does so by handling the capital of each position separately.

Both cross and isolated margin trading have three modes.

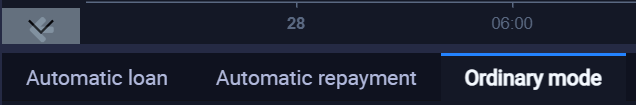

Automatic loan

Rather than going through the conventional loan procedure, you can choose the automatic loan mode. Huobi automatically lends you the required funds to open a position of your choice.

Automatic repayment

You can repay the loan amount manually, or you can just select the automatic repay mode. Now all of your incoming profits will be first used to repay your loan amount.

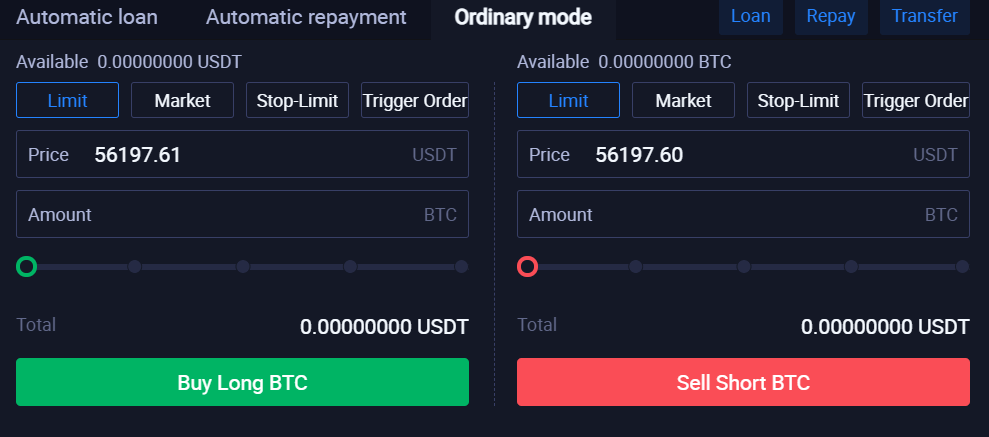

Ordinary mode

Ordinary mode simply allows you to open or close positions, and you can repay the loan amount manually.

Huobi C2C

You can even lend your assets directly to a Huobi user and gain interest in the amount. You can do so by using the C2C mode and going long or short. Huobi C2C only offers an ordinary method, and you can trade only in BTC/ USDT.

Huobi quick margin

Huobi offers a quick margin feature for your ease, as you don’t have to borrow or repay your loan manually. Huobi does that for you, and all you have to do is place an order from an automatic loan or repayment mode.

Leverage offered at Huobi

Huobi allows you to trade on a series of leverage options. You get leverage of 3x in the cross and C2C margin trading. At the same time, you get 5x leverage in isolated margin trading.

Using higher leverage can increase your returns by several times. However, the risk of a particular trade rises with an increase in leverage.

For example, a long position with 100X leverage will liquidate with a 1% fall in the asset’s value. In comparison, trade with 10x leverage will need a decrement of 10%.

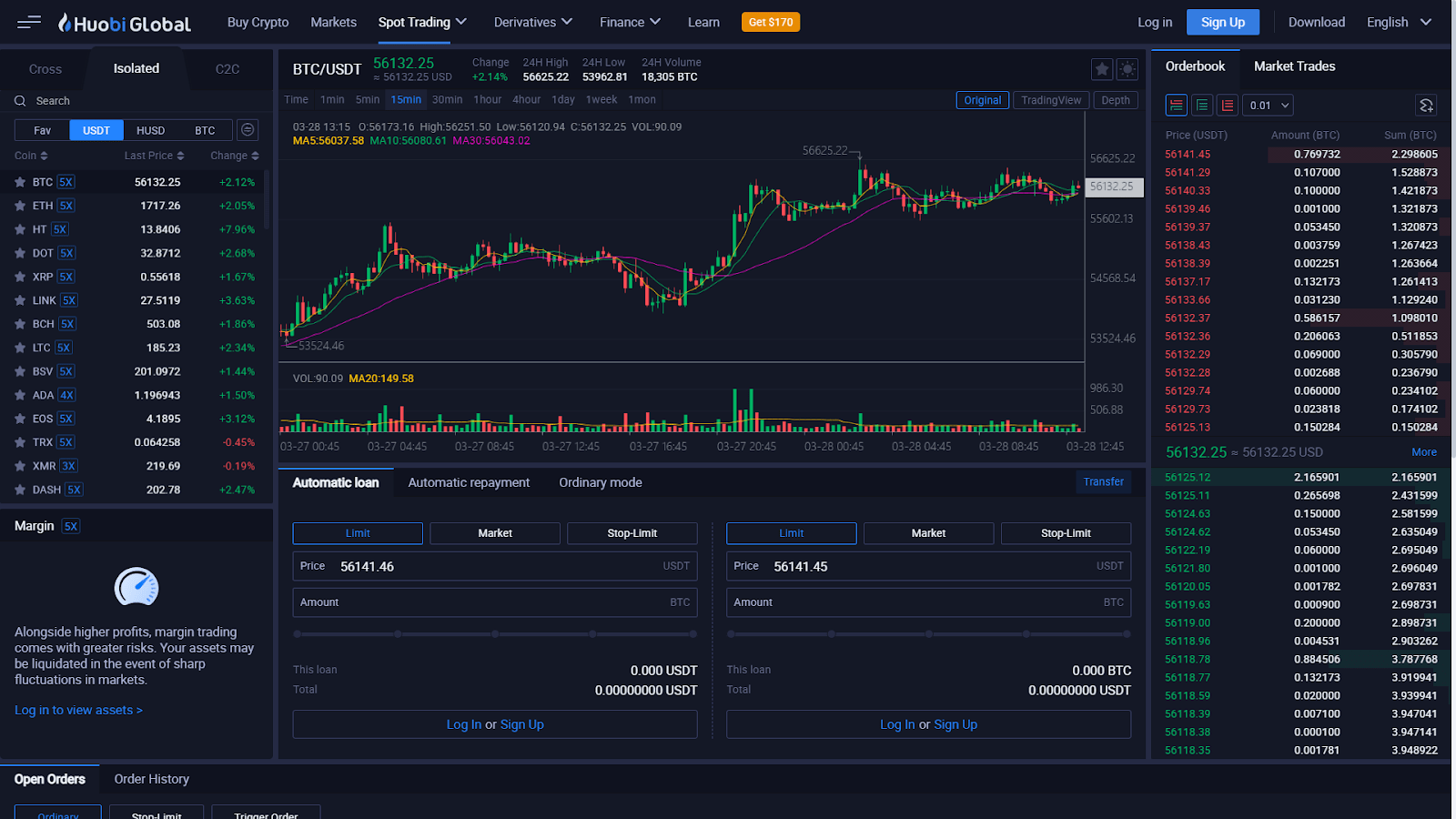

Margin trading window

Huobi has tried its best to keep the margin trading window simple and easy to use. Let’s have a look at all the elements of the margin trading window one by one:

Candlestick chart

The very first thing you observe on the margin trading window would be the candlestick chart. Whether you’re a day/long-term trader, you can view the candlestick chart in multiple time frames.

There are there different chats available at Huobi:

- Original trading graph

- TradingView chart

- Market depth

The order book

You can use the order book to determine the price of an asset where maximum orders are placed. You’ll find the order book on the right side of the screen.

Margin trading tab to place orders

Huobi makes margin trading simpler for you by accumulating all its margin trading features in a single tab. It is most helpful to day traders as it saves time and you can open/ close a position at your preferred value instantly. Some of those features are as below:

Limit

You place an order at a predetermined price by selecting the limit order mode. You just have to enter the limit price and place the order. Once the market reaches that price, your order will execute.

Market

At Huobi, you can also place orders in real-time by selecting the market mode. This is most useful when there is a sudden fluctuation, and this way, you can make use of the market fluctuation to gain some returns.

Stop-limit

You can use stop-limit order to minimize your risks. These let you set a price for executing an order while maintaining a risk limit below which the order will be closed.

Trigger order

Trigger allows you to spare the screen for a while. As you can set the trigger price, and the order is automatically triggered when the price is met. When an order is triggered, the exchange will automatically transfer your position to a limit order. To learn more about trigger orders, click here.

The Loan/ Repay button

In case you don’t wish to borrow or repay automatically, you can always choose the manual mode. There is a Loan and a Repay button below the candlestick graph that allows you to select the loan and repay the amount manually.

Transfer button?

The transfer button beside the Repay button allows you to transfer funds in your Huobi margin account without visiting the funds’ section. You can click on it, enter the amount you wish to share, and press the confirm button.

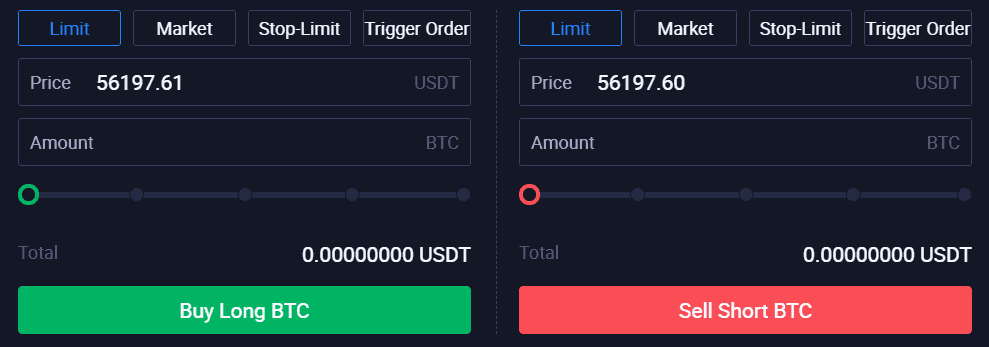

How to go long at Huobi?

Going long means predicting that the market will go up. You can go long by entering all the details in the column above Buy Long BTC or the green button.

How to go short at Huobi?

Going short means selling the assets at a higher price and then again buying it at a lower cost to gain significant returns. You can go short by entering all the details in the column above Sell Short BTC or the red button.

What is the risk rate?

Risk rate is the losses caused by the changes in the interest or the market going sideways. You can see your risk rate percentage on the left side of the screen. If your risk rate goes below 110%, then your position will be automatically liquidated.

Risk limit indicator

You’ll observe a risk level meter on the right side of the screen. This meter tells about your risk level in a particular position, where red being the highest risk and blue being low or no risk.

Huobi fees

There is a maximum 0.2% maker/ taker fee and a maximum of 0.0980% margin interest rate. You can observe the tiered margin interest rate for ordinary users in the table below.

To know the entire spot trading fee, click here. Also, click here to see the margin interest rate’s whole tiered structure.

If you wish to deduct your fees using your HT holdings or using fee deduction point cards, you can enable those options by clicking here.

How to use Huobi leverage trading?

Huobi Global is one of the most popular crypto exchange platforms, and maybe that is the reason you’re here. Now, you can begin margin trading at Huobi by simply following the steps below one after the other:

How to sign-up at Huobi?

The very first step on your margin trading journey at Huobi will be creating an account:

- Visit the official website of Huobi global.

- Now click on sign-up and enter your email and password.

- Enter the code sent to your email and complete the verification.

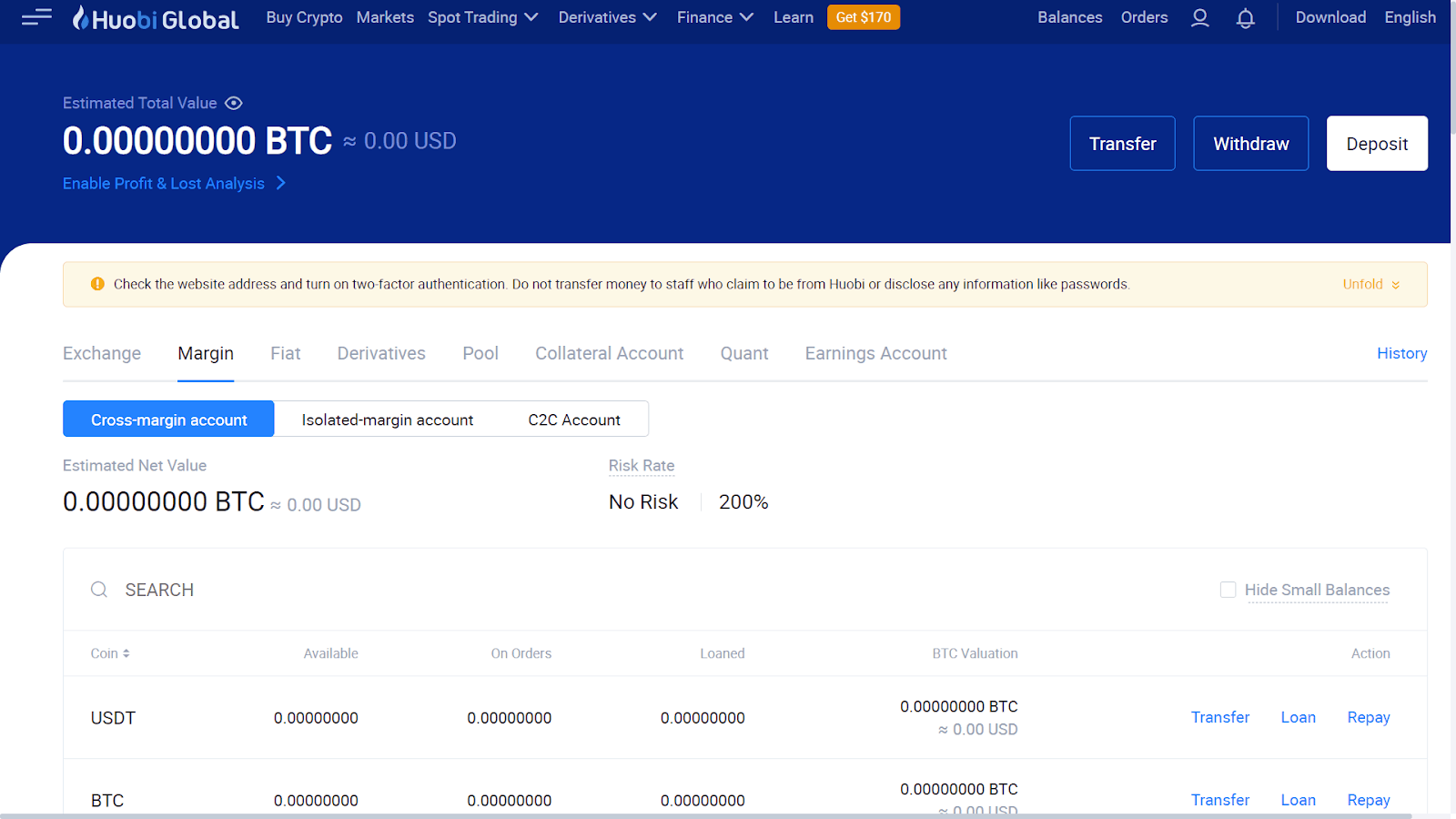

How to deposit funds at Huobi?

Now to open your first position, you need to deposit funds to your Huobi account. You can do so by following the below steps:

- Login to your Huobi account and then hover on Balances in the header.

- Now click on Margin account, and then choose your preferred account.

- Now, click on deposit.

- Huobi will send you the deposit address through the mail and show it on the screen.

- Make sure both the addresses are the same.

- Now transfer funds. You can also scan the QR code and deposit funds.

How to place a margin trading order at Huobi?

Since you now have funds in your margin account, you can just visit the margin tab and follow the below steps:

- From the home screen, hover over spot trading and click on margin.

- Now choose your preferred trading mode from cross, isolated, and C2C.

- Scroll down and enter the trade details.

- Click on Buy Long BTC to go long or on Sell Short BTC to go short.

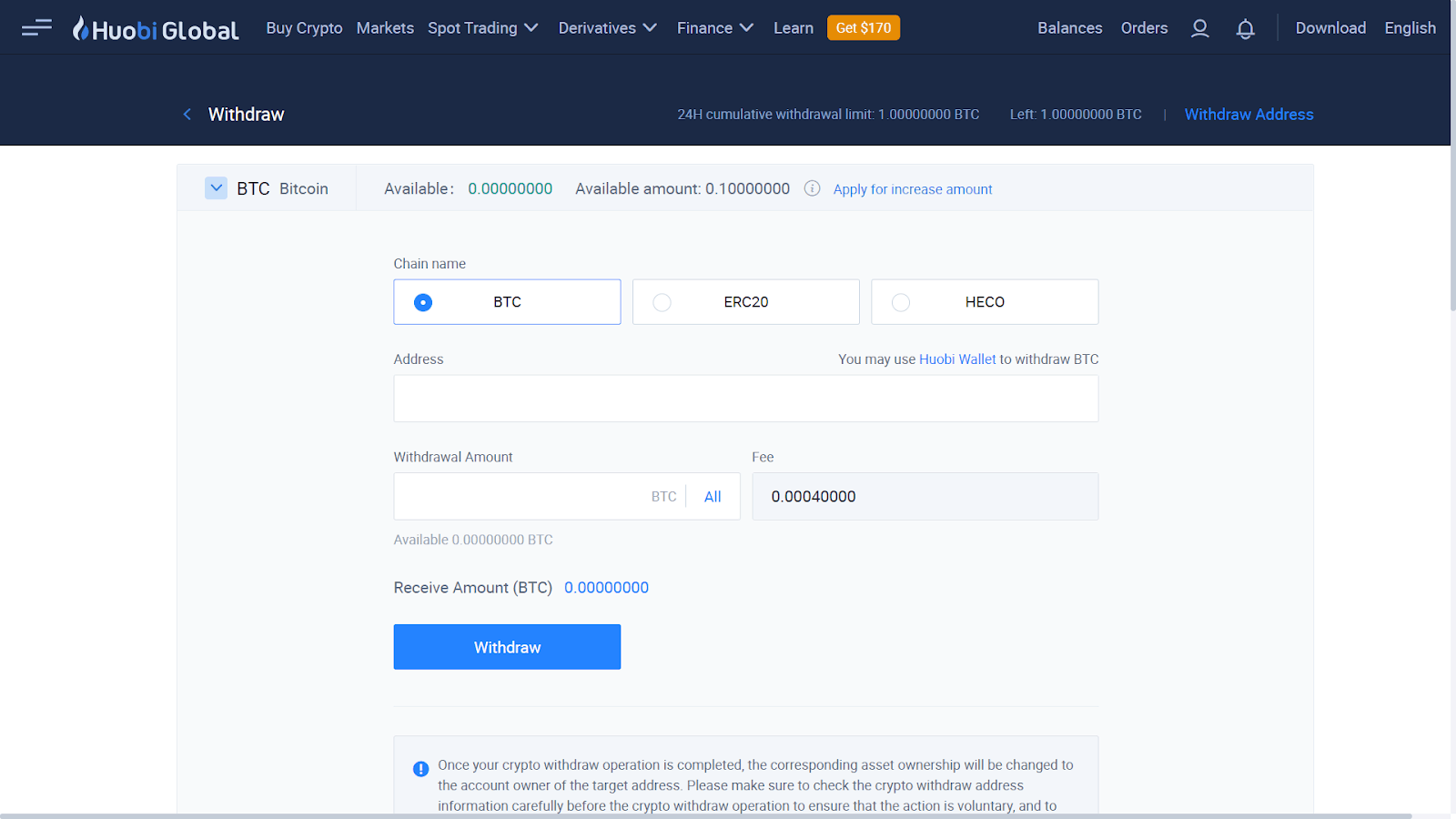

How to withdraw funds at Huobi?

Now when you’ve gathered some returns, then you can withdraw the coins to your external wallet. Huobi also supports FIAT withdrawal; hence you can directly receive your funds in your bank account, and to do so, you can follow the below steps:

- Firstly, hover on balances and click on the margin account.

- Secondly, on the next window, click on withdraw button.

- Now, choose from crypto or FIAT withdrawal.

- Then enter the wallet address for your crypto withdrawal.

- Finally, enter your bank detail and the amount you wish to withdraw in case of FIAT.

You learn many other things like risks involved in margin trading, how does margin trading works, maintenance margin, etc., by reading our blog on margin trading.

Huobi Leverage Trading: Pros and Cons

| Pros | Cons |

|---|---|

| Huobi offers a simple user interface that is perfect for beginners. | The platform offers limited leverage. |

| You can choose Huobi to learn, and the platform awards you for learning about different crypto assets. | The platform charges a high-interest rate from lower-level users. |

| You get access to a wide range of tokens and coins. | The maximum leverage is 5x. |

| Huobi offers 24*7 customer support. |

Huobi Leverage Trading: Conclusion

Huobi global offers competitive, margin trading services around the globe. The exchange provides lower leverage when compared to other platforms, but that prevents noob traders from losing more than they can afford. You can easily sign-up and begin your margin trading journey at Huobi global.

Frequently Asked Questions

What is Huobi?

Huobi Global is a trading platform offering its services in crypto and futures trading. Huobi also offers its digital lending and borrowing services and trading bots.

Is Huobi Global safe?

Huobi Global is one of the best crypto exchange platforms in the market; hence their security level is of premium quality. The platform has even passed many third-party security tests.

Where is Huobi based?

Huobi Global came into existence in China and presently operates from Hong Kong, South Korea, Japan, and the United States.