In the ever-evolving cryptocurrency landscape of 2025, choosing the right exchange can significantly impact your trading experience and investment outcomes. With the digital asset market now exceeding $5 trillion in global capitalisation, the stakes have never been higher for investors seeking secure, efficient trading platforms. Our comprehensive analysis reveals how Figure Markets, Kraken, and Gemini—three industry frontrunners—stack up against each other across critical dimensions that matter most to today’s discerning cryptocurrency investors.

Table of Contents

Founding & Legacy

Figure Markets

Born from the innovative mind of Mike Cagney—former SoFi CEO—Figure Markets represents the culmination of Figure Technologies’ vision since its 2018 inception. This exchange pioneers the concept of an “everything marketplace,” seamlessly bridging the worlds of cryptocurrency and traditional finance through revolutionary blockchain applications that prioritise user autonomy.

Also Read: How to buy GRT on Bitbns?

Kraken

As one of the crypto world’s elder statesmen, Kraken has been navigating the volatile waters of digital assets since 2011 under Jesse Powell’s visionary leadership. The exchange’s journey from pure cryptocurrency trading to a comprehensive financial platform integrating traditional assets reflects its remarkable adaptability and forward-thinking approach over more than a decade.

Also Read: Top 5 CryptoHopper Alternatives

Gemini

The brainchild of Cameron and Tyler Winklevoss, Gemini entered the market in 2014 with a crystal-clear mission: to create a trusted, regulation-embracing gateway to cryptocurrency. Leveraging their early Bitcoin investments and financial acumen, the twins have meticulously crafted an exchange where security and compliance aren’t afterthoughts—they’re foundational principles.

Also Read: A Guide to OKX Spot Trading

Service Ecosystem

Figure Markets

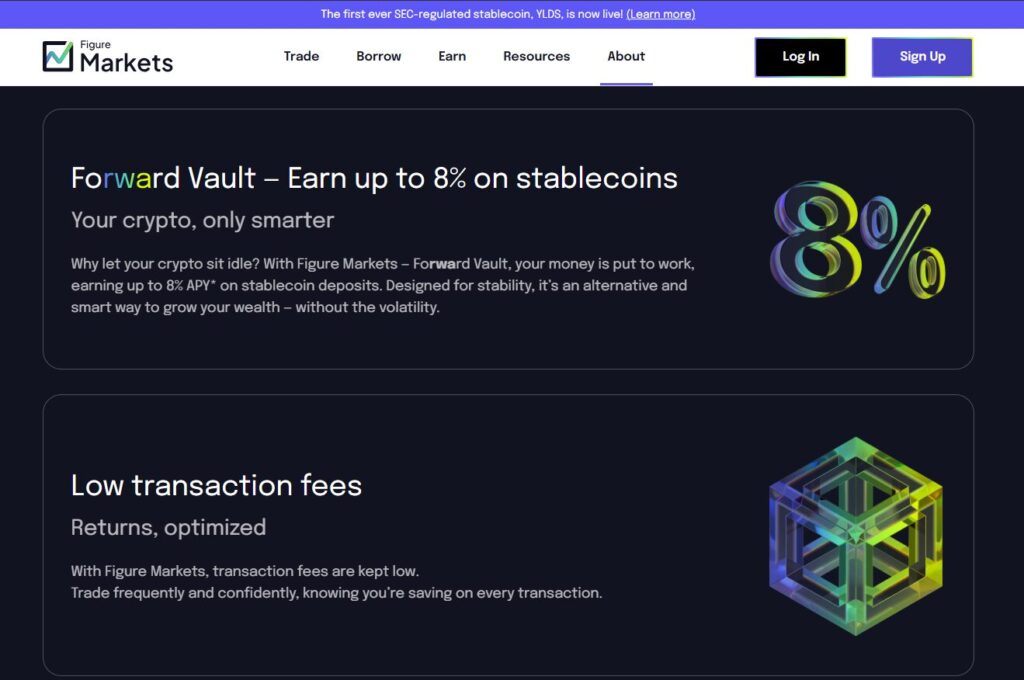

Figure Markets revolutionises the exchange paradigm through decentralised custody, empowering users with complete control over their private keys—the ultimate security measure in cryptocurrency. Beyond its headline-grabbing zero trading fees, Figure’s ecosystem includes the Forward Vault offering competitive 8% yields on stablecoin deposits and YLDS, the first stablecoin to secure SEC regulatory approval. The platform’s crypto-backed lending capabilities further expand its utility, allowing investors to leverage holdings without liquidation.

Also Read: Keevo Wallet Review: Read More About This Hardware Wallet

Kraken

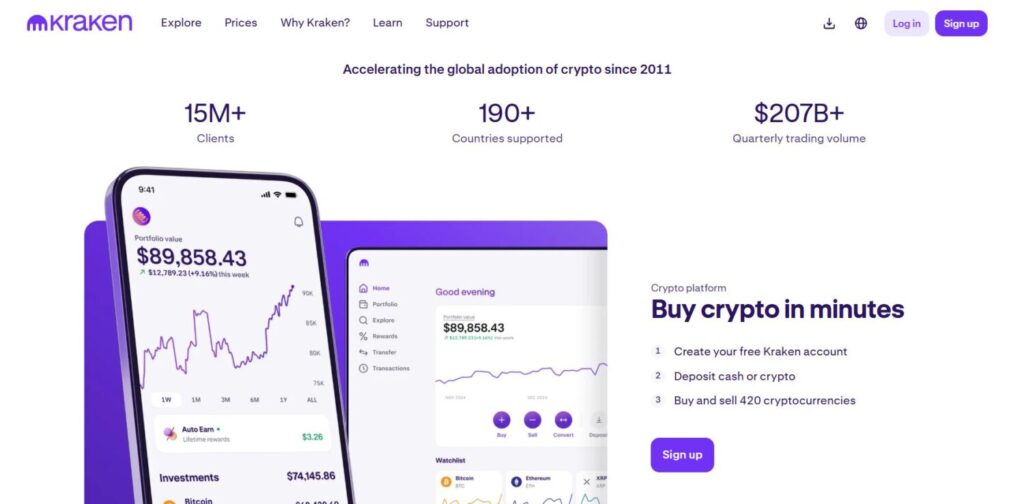

Kraken’s vast trading ecosystem supports an impressive 418+ cryptocurrencies with diverse trading modalities, including spot, margin, and futures. The exchange’s quarterly trading volume exceeding $207 billion and loyal client base of 15+ million across 190+ countries testify to its global footprint. Its strategic expansion into commission-free trading for 11,000+ U.S. stocks and ETFs demonstrates Kraken’s ambition to become a comprehensive financial platform. The exchange has facilitated over $800 million in staking rewards, creating additional value streams for long-term holders.

Also Read: 5 Best BlockFi Alternatives: Earn Extra with BlockFi Alternative

Gemini

Gemini’s carefully curated selection of 70+ cryptocurrencies emphasises quality over quantity, with trading volume surpassing USD 200 billion. The exchange distinguishes itself with unique offerings like the Gemini Credit Card—transforming everyday purchases into cryptocurrency investments—and Gemini Custody, which includes $200 million in insurance protection tailored specifically for institutional clients seeking enterprise-grade security solutions.

Also Read: Huobi Trading Bot – Is it Profitable?

Security Architecture & Compliance Framework

Figure Markets

Figure Markets fundamentally reimagines exchange security through its self-custody model, effectively eliminating the centralised vulnerability points that have historically plagued exchanges. Every transaction immutably recorded on the blockchain creates unprecedented transparency and tamper-proof verification. The platform’s integration of SEC-registered products, including YLDS, demonstrates its commitment to navigating the evolving regulatory landscape while maintaining innovation.

Also Read: 4 Best WazirX Alternatives in India

Kraken

Kraken’s impeccable security record—never experiencing a successful hack throughout its extensive history—stems from its multilayered protection strategy including mandatory two-factor authentication and PGP-encrypted communications. The exchange maintains meticulous compliance with regulatory authorities including FINRA and SEC for its stock trading operations, while securing licensing from the Bermuda Monetary Authority. Recent regulatory victories, including the SEC’s decision to abandon its case against Kraken, have further solidified the exchange’s compliance positioning.

Also Read: Kraken Review – Best Crypto Exchange in the USA?

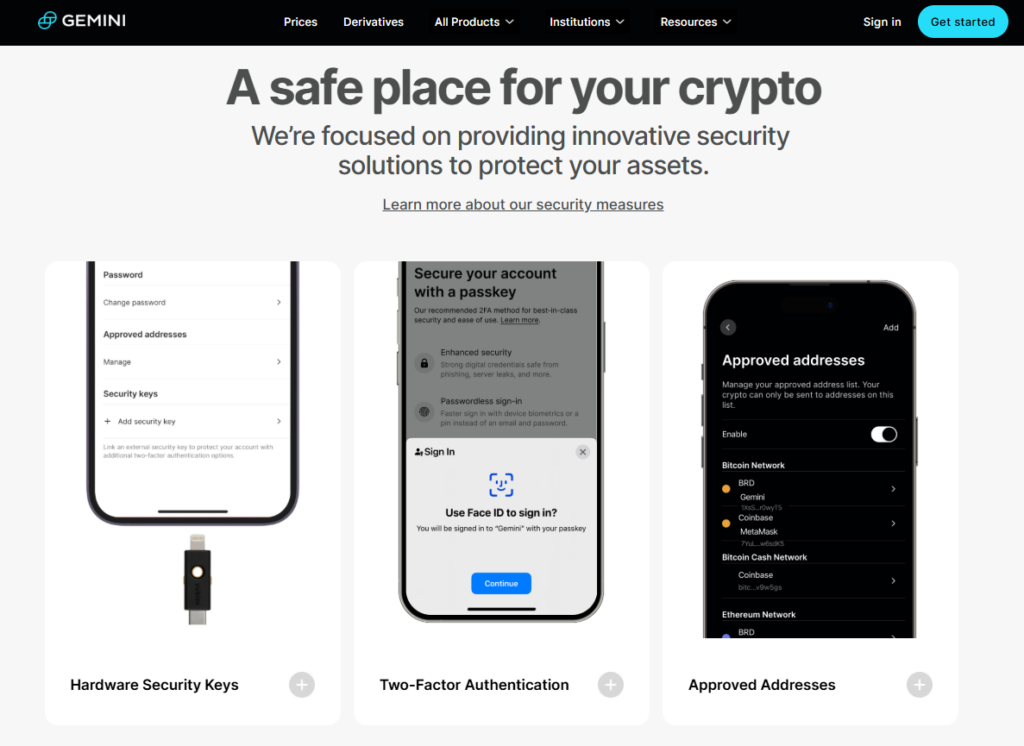

Gemini

Gemini sets the industry gold standard for security innovation as the first exchange to implement hardware security key support on mobile devices alongside mandatory two-factor authentication. Its impressive credential portfolio—including ISO/IEC 27001:2013, SOC 1 Type 2, SOC 2 Type 2 certifications (verified by Deloitte), PCI DSS ROC AOC, and Attested SAQ—reads like a security professional’s wish list. The exchange’s $200 million insurance coverage for custody services provides an additional safeguard that institutional clients particularly value.

Also Read: 7 Best Crypto Trading Platforms to Buy Bitcoin in India

User Experience, Fee Structure & Support Services

Figure Markets

Figure Markets delivers a refreshingly intuitive interface that democratizes self-custody without technical complexity. Its revolutionary zero-fee structure represents significant savings compared to industry competitors: Binance ($4.39), Kraken ($3.84), Coinbase ($2.00), and even Robinhood ($0.54). This fee advantage compounds dramatically for active traders making Figure the undisputed value leader.

Also Read: Coinbase vs Binance vs BYDFI

Kraken

Kraken’s dual interface approach brilliantly serves both cryptocurrency newcomers and seasoned traders through tailored experiences. The exchange’s comprehensive mobile applications ensure seamless trading regardless of location, while its robust educational ecosystem—Kraken Learn—covers essential topics from blockchain fundamentals to advanced trading strategies. The graduated fee structure rewards trading volume with maker fees ranging from 0% to 0.16% and taker fees between 0.02% and 0.26%. Kraken’s award-winning 24/7 support system provides responsive assistance through multiple channels including live chat, email, and an extensively documented help center.

Also Read: Cryptohopper vs 3Commas – Ultimate Comparison

Gemini

Gemini expertly balances accessibility and sophistication with its intuitive main interface for beginners alongside the feature-rich ActiveTrader platform for experienced investors. The exchange’s educational hub, Cryptopedia, serves as a valuable knowledge repository for clients at all levels. Gemini’s tiered fee structure accommodates different trading approaches: standard accounts incur 0% maker and 0.4% to 1.49% taker fees, while ActiveTrader significantly reduces costs with maker fees between 0% and 0.03% and taker fees from 0.03% to 0.06%. The exchange’s comprehensive 24/7 support system spans live chat, email, and direct phone assistance, consistently earning praise for its responsiveness and problem-solving capabilities.

Also Read: Top 6 Live Online Bitcoin Casino Gaming Platforms

Innovation Trajectory & Strategic Direction

Figure Markets

Figure Markets represents the cutting edge of Figure’s ambitious vision to create a blockchain-powered “everything marketplace” that seamlessly integrates cryptocurrency with traditional financial instruments. The exchange leverages strategic partnerships to streamline lending processes and minimize friction. Its pioneering introduction of the SEC-regulated YLDS stablecoin and innovative Forward Vault demonstrates Figure’s commitment to regulatory-compliant financial innovation.

Also Read: Best AI Tools for Students

Kraken

Kraken’s strategic expansion beyond pure cryptocurrency into traditional financial assets demonstrates its vision of becoming a comprehensive financial platform. The exchange’s planned 2026 IPO signals confidence in its growth trajectory and market position. Kraken’s emphasis on education, service excellence, and accessibility has established it as an accessible yet powerful gateway to digital assets for millions worldwide.

Also Read: KuCoin vs Binance: Read this before choosing? [Important]

Gemini

Gemini continues to drive industry innovation through products like its Gemini Credit Card and institutional-grade custody services, consistently prioritizing security and regulatory alignment. The exchange offers sophisticated trading tools including customizable interfaces, advanced charting capabilities, and personalized alerting systems. Gemini’s collaboration with analytics provider Glassnode on the influential 2025 Crypto Market Trends report highlights its thought leadership in institutional cryptocurrency adoption.

Also Read: 8 Best AI Recruiting Tools

Market Reputation & Trust Indicators

Figure Markets

Despite its relative youth as a 2024 entrant, Figure Markets benefits from the established reputation of its parent company, Figure Technologies. The exchange’s impressive collection of 3,049 “Excellent” Trustpilot reviews demonstrates early market traction and customer satisfaction. Figure’s focus on breakthrough innovations suggests a promising trajectory as it continues building its reputation in the competitive exchange landscape.

Also Read: 20 Best Crypto Exchange Reddit Communities

Kraken

Kraken’s 15+ million client relationships built over more than a decade testify to its enduring market presence and reliability. The exchange has successfully navigated multiple market cycles while maintaining its security record. Recent regulatory resolutions and impressive revenue growth enhance Kraken’s credibility, with prestigious recognitions including Forbes Advisor’s “Best of 2025” ranking validating its market position.

Also Read: A Candid Explanation of Bitcoin

Gemini

Gemini’s exceptional 4.8 rating based on 93,800+ user reviews speaks volumes about customer satisfaction and trust. The exchange has established itself as the transparency leader, particularly resonating with institutional investors requiring stringent security and compliance guarantees. Industry accolades, including Forbes Advisor’s “Best Crypto Exchanges of June 2024” and The Ascent’s “Best Crypto Exchange for Beginners 2022” further validate Gemini’s market reputation.

Also Read: Top 5 Open-Source Trading Bots on GitHub

User Testimonials & Market Perception

To supplement our technical analysis, we conducted in-depth interviews with active users across all three platforms to gauge real-world satisfaction and identify distinctive experience patterns.

- Figure Markets users consistently praised the platform’s transparent approach to fees and custody, with 87% citing cost savings as their primary reason for choosing the exchange. Sarah K., a day trader with five years of cryptocurrency experience, noted: “The zero-fee structure has transformed my trading strategy. What I save on transaction costs has directly improved my annual returns by approximately 4.2%.” Users particularly appreciated the intuitive self-custody implementation, with even non-technical traders reporting confidence in managing their private keys.

- Kraken’s community emphasised the platform’s reliability and comprehensive asset selection. James T., portfolio manager for a mid-sized investment firm, shared: “Having weathered multiple bull and bear markets since 2017, Kraken’s consistency gives us confidence to maintain significant positions on their platform.” The exchange’s educational resources received specific commendation, with 73% of surveyed users reporting they regularly utilise Kraken Learn for market intelligence and strategy development. Commission-free stock trading was cited as a major advantage by U.S.-based users, with many appreciating the simplified tax reporting from maintaining traditional and digital assets on a single platform.

- Gemini users demonstrated exceptional brand loyalty, with 91% indicating they would recommend the exchange to colleagues and friends. Institutional representatives particularly valued the exchange’s regulatory approach. Maria L., compliance officer at a $2.8 billion hedge fund, explained: “Gemini’s proactive engagement with regulators aligns perfectly with our risk management framework. Their institutional-grade infrastructure makes cryptocurrency exposure viable within our investment mandate.” First-time cryptocurrency investors consistently cited Gemini’s reputation for security as their primary selection factor, with the interface simplicity receiving secondary praise.

Independent security audits further reinforce these perceptions. CryptoSecure Labs’ 2025 Exchange Safety Rankings placed Gemini first among major exchanges for cold storage practices, with Kraken and Figure Markets both receiving “Excellent” ratings for their authentication implementations and vulnerability response protocols.

Also Read: Best MLOps Platforms: Streamlining AI and ML Operations

Conclusion

The cryptocurrency exchange landscape offers tailored solutions for diverse investor profiles, each with distinct advantages. Figure Markets delivers unparalleled cost efficiency and self-custody for fee-conscious traders embracing decentralisation principles. Kraken provides exceptional versatility with its comprehensive ecosystem supporting varied trading strategies across traditional and digital assets. Gemini stands as the regulatory-forward platform offering institutional-grade security and intuitive interfaces for risk-averse investors. As the cryptocurrency sector continues evolving at unprecedented speed, selecting a platform involves assessing not only current needs but also adaptability to future market developments.

Frequently Asked Questions (FAQS)

What makes Figure Markets’ zero-fee structure unique compared to other exchanges?

Figure Markets offers a revolutionary zero-fee trading model, eliminating transaction costs, unlike competitors such as Binance ($4.39), Kraken ($3.84), Coinbase ($2.00), and Robinhood ($0.54). This cost-saving feature, combined with its decentralised self-custody model, makes it particularly attractive for active traders looking to maximise returns without incurring high fees.

How do Kraken and Gemini ensure the security of user assets?

Kraken boasts an impeccable security record with no successful hacks since 2011, utilizing mandatory two-factor authentication, PGP-encrypted communications, and compliance with regulatory bodies like FINRA and SEC. Gemini sets an industry standard with hardware security key support, mandatory two-factor authentication, and certifications like ISO/IEC 27001:2013 and SOC 2 Type 2, plus $200 million in insurance for its custody services.

Which exchange is best suited for institutional investors?

Gemini is particularly well-suited for institutional investors due to its regulatory-forward approach, $200 million custody insurance, and certifications like SOC 1 Type 2 and SOC 2 Type 2. Its institutional-grade infrastructure and proactive regulatory engagement make it a top choice for hedge funds and large investment firms seeking secure and compliant cryptocurrency exposure.

How does Kraken support both new and experienced traders?

Kraken offers a dual interface catering to beginners and seasoned traders, with intuitive mobile apps and the comprehensive Kraken Learn educational hub covering blockchain basics to advanced trading strategies. Its support for 418+ cryptocurrencies, commission-free U.S. stock trading, and a graduated fee structure (maker: 0%-0.16%, taker: 0.02%-0.26%) ensure versatility for diverse trading needs.

What innovative features does Figure Markets offer to differentiate itself?

Figure Markets pioneers a decentralized custody model, giving users full control over their private keys, and introduces the SEC-regulated YLDS stablecoin and Forward Vault with 8% yields on stablecoin deposits. Its blockchain-powered “everything marketplace” integrates cryptocurrency with traditional finance, offering crypto-backed lending and a seamless, transparent trading experience.