DODO is a well-known decentralized exchange built on the proactive market maker (PMM) algorithm. The exchange also provides competitive prices for DEX traders and reduced impermanent loss (IL) for liquidity providers. In this DODO exchange review, we’ll go through the nitty-gritty of the platform and try to decide whether it is safe to use or not.

Table of Contents

Summary (TL;DR)

- DODO is on-chain and community-owned. Further, it uses a new order matching and filling mechanism different from mainstream LP called PMM.

- The platform’s contract-fillable liquidity translates to fast and more efficient price discovery comparable to centralized exchanges.

- DODO’s PMM algorithm helps market makers and LPs concentrate their assets and provide strong liquidity without onerous capital requirements.

- The platform is both an aggregator and a DEX; it supports trading between any two tokens available on the market and has its own liquidity pools.

- Furthermore, DODO provides the ability to issue new assets but at the lowest price and create highly liquid pools via Crowdpooling.

Also read: Symbiosis Finance Review: The Cross-Chain Liquidity Aggregator

What is the DODO Exchange?

DODO Exchange is a low-slippage on-chain liquidity and capital-efficient provider built on Ethereum and Binance Smart Chain. It is powered by the Proactive Market Maker (PMM) algorithm. This algorithm helps market makers and LPs concentrate their assets and provide strong liquidity without onerous capital requirements. In addition, it features highly capital-efficient liquidity pools that support single-token provision, minimizes slippage for traders, and reduce impermanent loss. Working to solve impermanent loss and featuring single-asset liquidity, DODO offers a smooth trading experience and lucrative liquidity provision opportunities.

Moreover, DODO also offers SmartTrade, a decentralized liquidity aggregation service that routes to and compares various liquidity sources to quote the optimal swap rate between any two tokens.

Also Read: A Beginner’s Guide to On-Chain Analysis

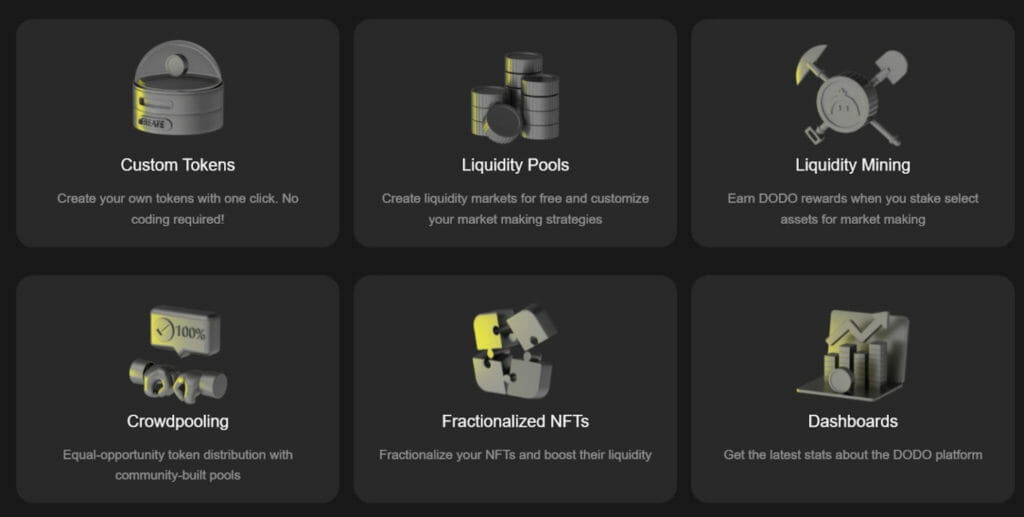

DODO Exchange Review: Features

- Dashboards: The DODO exchange gives you all the latest statistics about the platform.

- Custom Tokens: You can make your token, which won’t even need coding if you are interested.

- Crowdpooling: The platform serves equal-opportunity token distribution with community-built pools.

- Liquidity Pools: Users always choose to customize their market-making strategies by creating liquidity markets for free.

- Fractionalized NFTs: You can also prefer to fractionalize your NFTs and boost their liquidity.

- Liquidity Mining: You can win a chance to earn DODO rewards when you stake select assets for market making.

- One-click: You can buy and sell any asset with one click on DODO, whether fungible or non-fungible, mainstream or “long-tail.” With efficient routing algorithms comparing prices across the entire network, you get the best bang for your buck.

DODO Exchange Review: SmartTrade

DODO enables trading between two arbitrary tokens available on the same network. This feature gives traders the best price by intelligently finding the best order routing from aggregated liquidity sources. Moreover, users who execute trades may also receive DODO tokens by participating in trade mining.

Also Read: Best Paid And FREE Crypto Trading Bots

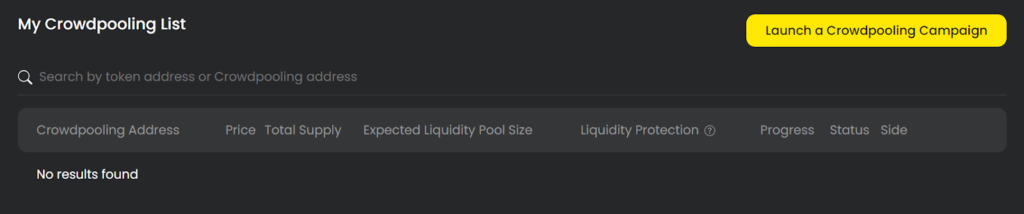

DODO Exchange Review: Crowdpooling

Crowdpooling is an equal-opportunity token launch platform that allows users to access projects in the fairest way possible directly. The platform supports two different types of Crowdpooling, and those are:

- Fixed-Price CP: The token assets will be sold at a set price for this type of Crowdpooling.

- Variable-Price CP: A preset pricing curve indicates the price of a token asset for this type of Crowdpooling. The price will become high as more tokens have been distributed. All participants will receive tokens proportional to their pool shares at the initial cost.

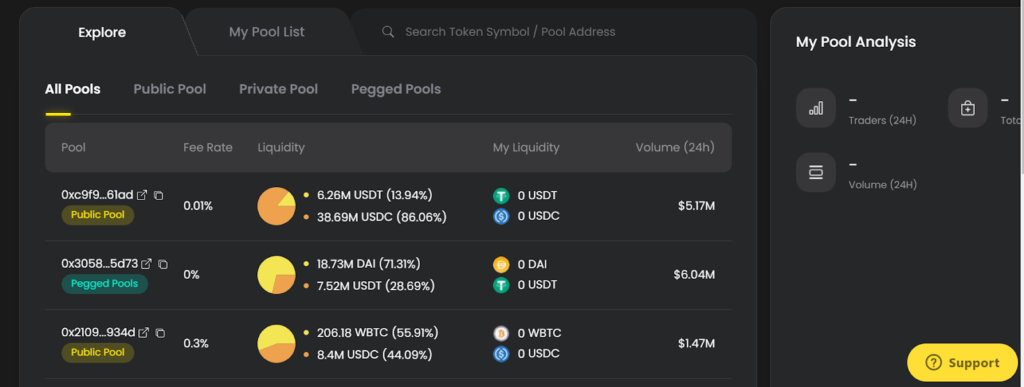

DODO Exchange Review: Pools

The pool is an available liquidity market venue through which you, the market maker, can provide liquidity for the pair, select a trading pair, and earn fees accrued from the pair’s trading activity. There are three types of pools:

1. Public Pool

This type of pool is also known as DODO Vending Machine. All liquidity providers share the trading fees accrued proportional to their pool percentage in this pool, and anyone can provide liquidity for this pool. After the creation of the pool, the parameters cannot be modified.

2. Private Pool

Private pools can also be called DODO Private Pool, and the pool creators can only provide the liquidity of this pool. Unlike Public Pool, the parameters here can be modified at any time after creation.

3. Pegged Pool

In this pool, anyone can provide liquidity suitable for synthetic assets and cannot modify the parameters of the pool after the creation.

You can also select the liquidity pool template from the pool types. There are three pool templates from where you can choose:

- Standard: Standard pools are the same mode as Uniswap pools in terms of efficiency and capital allocation. However, Standard Pools allow you to set more parameters.

- Single-Token: Single Token pools can be created with one token type only. They can be used to raise funds by selling project tokens. It further supports the initial single-token supply. Moreover, with this pool template, you can customize the init price, token type, trading fee rate, the number of tokens, and the slippage coefficient.

- Customized: With customized pools, creators can configure all parameters such as trading fee rate, token types, slippage coefficient, min price, and amount of base and quote tokens.

Also Read: DeFi Yield Farming and Liquidity Mining

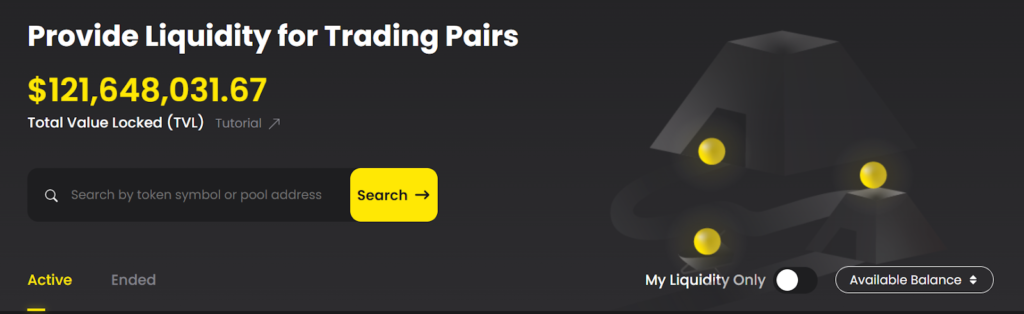

DODO Exchange Review: Mining

1. Liquidity Mining

Liquidity mining is an integral part of the DODO platform and refers to decentralized market making. It is all about providing liquidity via cryptocurrencies to DEXs (Decentralized Exchanges). DODO’s liquidity mining can be redeemed at any time as it has no lock-up period. Moreover, rewards are accumulated per block.

2. Combiner Harvest Mining

In this mining DODO platform, users get exposure to promising and trending projects willing to collaborate with the platform. Liquidity pools can be created by vetted projects, and liquidity providers of these pools will further receive DODO reward tokens.

Also Read: How to Mint your First NFT on FTX?

DODO Exchange Review: NFT

NFT stands for Non-Fungible Tokens, and these are basically the rights to anything, be it digital art, any document, manuscript, image, music, etc. All the information store is stored on a blockchain and hence, nobody can prove your ownership wrong until you transfer the ownership rights to someone.

How DODO NFT works?

- Firstly, you need to create or use your existing NFTs by pledging them into the DODO NFT Vault.

- Then fractionalize the DODO NFT Vault, i.e., divide the DODO NFT Vault into pieces and issue fungible tokens representing them.

- Create a liquidity pool for the NFT by establishing a flexible and efficient market to trade these pieces. This is powered by DODO’s Proactive Market Maker(PMM) algorithm.

- Through DODO’s SmartTrade and liquidity aggregation service, the pieces can be traded with any tokens at the best price.

- In a few cases, a collector can buy up all the pieces of a DODO NFT Vault and acquire the NFTs in it.

DODO Exchange Review: PMM

PMM stands for Proactive Market Maker, a new blockchain market-making model. It leverages price oracles, efficiently allocates funds near the market price and mimics the behaviors of human market makers. Furthermore, as the market price changes, PMM shifts the price curve in a similar direction to ensure that the section in the market price vicinity remains flat. This further confirms the constant provision of sufficient liquidity. In addition, PMM dynamically adjusts the price when a trade occurs by encouraging arbitrage trading to minimize price risks and counterparty risks for LPs.

DODO Exchange Review: Custom Token

DODO platform allows users to create their custom tokens without any coding requirement. It can just be done with only one click. To create a new token, you need to fill in a few parameters and move with further proceedings. Moreover, there is a service fee of 0.02 ETH that is charged. Furthermore, there are a few features that can be added, and those are:

- Burn: In this, for each on-chain transfer, a percentage of tokens will be sent to the burn address.

- Trading Fees: A percentage of tokens will be sent to the creator’s address for each on-chain transfer.

- Support Supply Increase: After creating the token, this feature allows creators to issue additional tokens.

Also Read: Best Crypto Swap Platforms

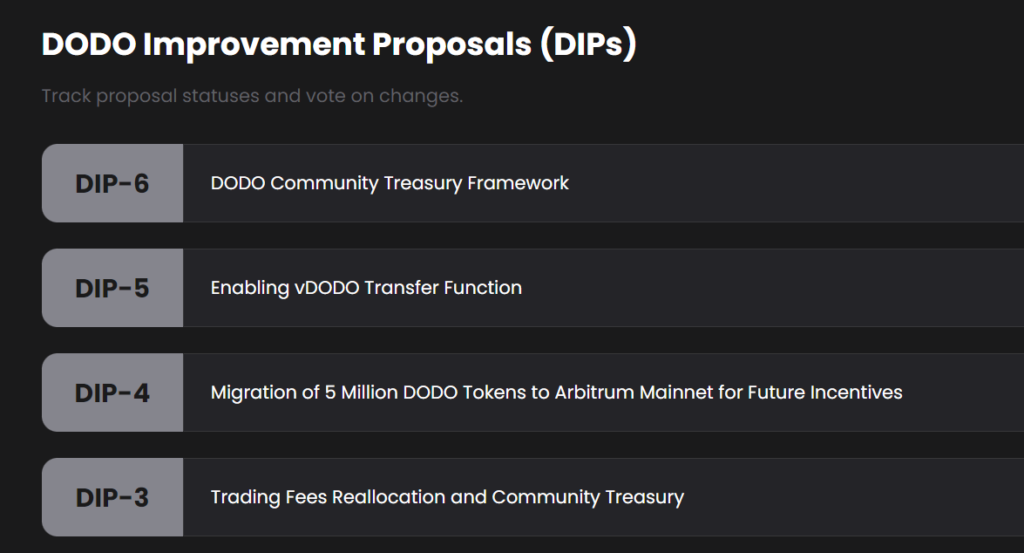

DODO Exchange Review: Governance

Behind DODO’s development, there are its community governance initiatives known as DIPs (DODO Implementation Proposals). Traders play a significant role in determining the direction of ecosystem development through these initiatives. The core team submitted and created DIPs and then voted on by the community. Eventually, community members can also submit the DIPs for approval. Further, this will expand the community’s role in guiding DODO’s evolution, culminating in the platform’s eventual transition to a DAO (Decentralized Autonomous Organization)

DODO Exchange Review: Bridge

A bridge is usually a type of connection that allows the transfer of arbitrary data and tokens from one chain. Both chains can have rules and governance models, different protocols, but the bridge provides a compatible way to interoperate on both sides securely. The DODO website consists of four such bridges: Arbitrum bridge, BSC bridge, cBridge, and Polygon bridge.

Is DODO Exchange Safe?

The security of a platform is a topic of concern for everyone using it or about to use it. Therefore, there have been many security audits from many companies: SlowMist, PechShield, Certik, Beosin, and TrailofBits. These are some well-known blockchain security companies that keep the platform more secure as all the smart contracts, Crowdpooling contracts, and audited DODO Vending Machine.

Also Read: 10 Best Decentralized Exchanges (DEX) to Trade Crypto

Customer Support

DODO has excellent customer support service for its users. They provide you with a help desk that will answer most of your questions. Also, they have DODO’s Docs, where everything is mentioned in quite a detail. Apart from these, users can also raise a complaint/ticket regarding any issue they face with the platform. Furthermore, users can also engage in community discussions if they have anything left that is unsolved and help shape the future of decentralized finance. This can be done via Telegram, Twitter, Discord, and Forums.

DODO Exchange Review: Conclusion

DODO exchange is profitable for both the Liquidity Providers and traders and has made tremendous contributions to decentralized finance. Moreover, the platform has a fast and simple user interface that ensures accessibility and easy navigation for users. Hope this “DODO Review” has given you a glimpse of how the DODO works.

Frequently Asked Questions

How to connect to a wallet?

Visit the DODOEx website and then the “Connect to a wallet” button in the upper right corner.

Do read the risk disclaimer and confirm that you have read, understood, and agreed on the Terms of Services.

Choose the wallet of your choice, i.e., from Coinbase, WalletConnect, and Portis.

Open the wallet you chose and scan the QR code to connect it. That’s it. You are done connecting your wallet.

What is vDODO?

DODO is a non-transferable token that works in DODO’s loyalty program as a user’s proof of membership. The benefits for vDODO also include Crowdpooling and IDO allocations, Governance rights, vDODO membership rewards, Trading fee discounts, and Dividends paid out from trading fees.

What is the DODO NFT Vault?

Non-fungible tokens of users can be pledged into the DODO NFT Vault, which will further generate an ERC-20 token contract. This means that owners can decide on the token’s name and fragment their NFT into multiple tokens.

Also read,