The world is now moving fast, transforming, and constantly evolving into a digitalized economy. With that, Cryptocurrency is being used and has become a favored option worldwide. Decentralized exchanges regulate and manage access to resources in an application, more outstanding and fairer service can be achieved. Symbiosis is a comparatively new cross-chain liquidity aggregator, and that is what we’d be talking about in this Symbiosis Finance review.

| Characteristics | Symbiosis Finance |

|---|---|

| Launched in | 2021 |

| Mobile application | No |

| Decentralised/ Centralised | Decentralized |

| Beginner-Friendly | Yes |

| [email protected] | |

| Protocol Token | $SIS |

Table of Contents

Summary

- Symbiosis finance offers a decentralized environment ensuring multichain liquidity protocol, which provides its users with features like swapping Cryptocurrency between multiple blockchains without changing the owners who invest their funds.

- This platform is non-custodial and has a simple interface which makes it beginner-friendly.

- Symbiosis does not ask its user to install any wallet, or separate software, as well as there are no long waiting durations which makes it very efficient.

- It has an active customer care service, and the user may reach out to them on different platforms like Telegram, Twitter, and Discord or mail them at [email protected].

- There is no mobile application launched yet; however, users can access the website from their mobile phones.

- Users can participate in consensus and sign transactions by staking SIS tokens to run a node within the relayer network.

Also Read: What is an Automated Market Maker (AMM)?

What is Symbiosis?

Symbiosis offers a decentralized environment with a multichain liquidity protocol. What that means is Symbiosis helps to move liquidity across different blockchains. Further, the platform allows its users to swap their assets between all the blockchains while remaining the sole owners of the funds they invest. The user does not need to connect to any other crypto wallets or go through long waiting durations or further steps to proceed with a swap.

Further, Symbiosis has a simple and interactive interface that targets numerous token pairs across all blockchains while offering the best purchase prices for swaps between any arbitrary token pair. However, only the testnet is out right now, and you can access it using the button below.

Also Read: DeFi Yield Farming and Liquidity Mining

Symbiosis Finance Review: Features

- Symbiosis Finance offers a non-custodial service that allows users to be owners of their digital assets at any point.

- Further, the symbiosis finance team does not have access to user funds in any way.

- The main goal of Symbiosis finance is to encourage interoperability and connect various networks as it can connect almost every popularly used blockchains in the market.

- Symbiosis finance can facilitate cross-chain liquidity on a limitless basis where token pairs across different blockchains guarantee that they provide the best price for swapping their asset between any two arbitrary token pairs owing to constant monitoring.

- Symbiosis finance tries to create a reliable multichain liquidity platform that is easy for beginners to understand and be used any time they need to swap cryptocurrency.

- Symbiosis does not require its users to download any separate software or wallet. Swapping cryptocurrencies is simple as doing the same thing on Uniswap.

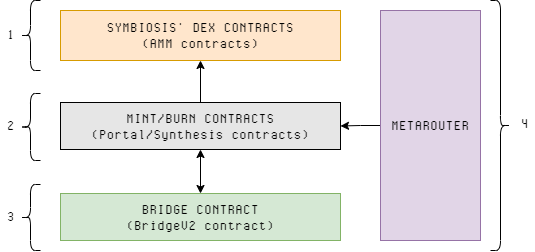

- The protocol of this platform aggregates exchange liquidity across numerous EVMs (Ethereum virtual machines) and even non-EVMs to allow cryptocurrency swaps to take place.

- Users can participate in consensus and sign transactions by staking SIS tokens to run a node within the relayer network.

Also Read: Unbound Finance: The Cross-Chain Aggregator Layer For AMMs

Is Symbiosis Finance Safe?

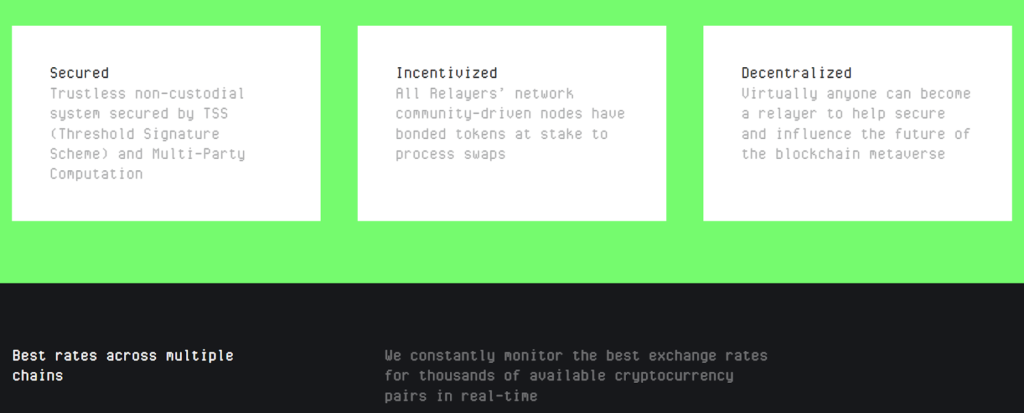

Symbiosis finance tries to provide their users a secure and safe platform and rely on the working of the relayers network, which is secured by the following mechanisms:

- Cross-chain multi-party computation (MPC) is a cryptographic tool that permits different and collective parties to make computations using their combined data without disclosing their input. It functions with complex encryption to distribute computation between many different parties.

- Moreover, another cryptographic protocol, the Threshold signature scheme protocol (TSS), ensures distributed key generation and signing. It provides constructing a signature distributed among different parties, and each user acquires a share of the private signing key.

- Crypto economic approaches combine cryptography and economics to create decentralized solid P2P networks that thrive over time despite adversaries trying to disrupt them.

- Since the network of this platform is not owned by anyone, each validator runs the same procedure upon receiving on-chain events on every connected chain.

- Each event progresses simultaneously, and for each event, the network is expected to reach a consensus of 2/3d of the network. As the network approaches the consensus on this event, all the nodes collectively sign a transaction through MPC on the destination chain.

Symbiosis Finance Review: Mobile Application

Since Symbiosis Finance is a new platform that is gaining popularity with every passing day, no mobile application has been launched yet. The users may reach out to the website through their mobile devices at any time. Since it does not require the user to connect to any wallet, it becomes easier and straightforward to use the website.

Symbiosis Finance Review: Partners

Since this particular platform was established as the multichain liquidity provider, symbiosis finance has partnered with various renowned entities, platforms, and institutions active in the world of Cryptocurrency. Some of these entities include Bybit, Avalanche Network, Polygon. Recently, Evolve Capital and has joined the list of investors at Symbiosis finance.

Symbiosis Finance Review: Supported Blockchains

Symbiosis Finance supports blockchains that receive market traction and are encouraged by the users. However, if there are any legal risks of integrating new blockchains, the team consult legal advisors before incorporating any. The list of supported blockchains includes the following :

- Ethereum (Rinkeby),

- Binance (Testnet),

- Polygon (Mumbai),

- Avalanche (Fuji),

- Huobi Eco Chain (Testnet),

- OEC, formerly known as OKExChain.

They’ll soon be bringing Solana as well.

Also Read: A Beginner’s Guide to DeFi (Decentralized Finance)

Symbiosis Finance Review: Customer Care

- Although the customer care service of Symbiosis Finance does not provide the feature of live chat or video chat with the Symbiosis Support team, the user may reach out to them on various platforms, which include Telegram, Twitter as well as Discord.

- Further, users can write a mail to them at [email protected] anytime.

- The Customer care team of this platform is active. The community on telegram has nearly 50,000 followers where they keep their users updated with everything that happens on the platform.

- A separate section is dedicated to all the frequently asked questions where the user may find the answers to the doubts he might have.

Symbiosis Finance Review: Pros and Cons

| Pros | Cons |

|---|---|

| It has an easy-to-use and interactive interface. | No Mobile Application. |

| It does require the user to connect to any wallet. | |

| Non-custodial service |

Conclusion

Symbiosis finance seems loyal, according to our research, as their high-level scheme of its protocol makes it easier to build optimal routes for swaps at the best available rate all over the network at any given time. Moreover, symbiosis finance offers an uncomplicated solution for crypto users requiring immediate liquidity in a cross-chain environment. These features and the significant backing received from its partners & investors make Symbiosis finance an investment-worthy entity, especially now when quick, safe, and easy multichain swap services are nowhere to be found. Moreover, since it’s a new platform, it’s gaining more popularity and enhancing itself, ensuring to fulfill what a customer might need.

Frequently Asked Questions

Q1. Do bridge operators (relayers) get bonuses for bridging blockchains?

They do not receive any reward for bridging. However, they receive bonuses as a part of the relayer’s consensus distribution.

Q2. Are there rewards in the form of additional SIS for participation in governance functions?

Token holders don’t get any reward for participating in the governance process.

Q3. Which tokens are supported by Symbiosis Finance?

Some supported tokens include Ethereum (Rinkeby), Binance (Testnet), Polygon (Mumbai), Avalanche (Fuji), Huobi Eco Chain (Testnet), OEC, formerly known as OKExChain.

Also read,

![Crypto.com Review| Lending, Staking, Trading [Must Read] 10 Crypto.com Review](https://coincodecap.com/wp-content/uploads/2021/03/Crypto.com-review-768x432.png)