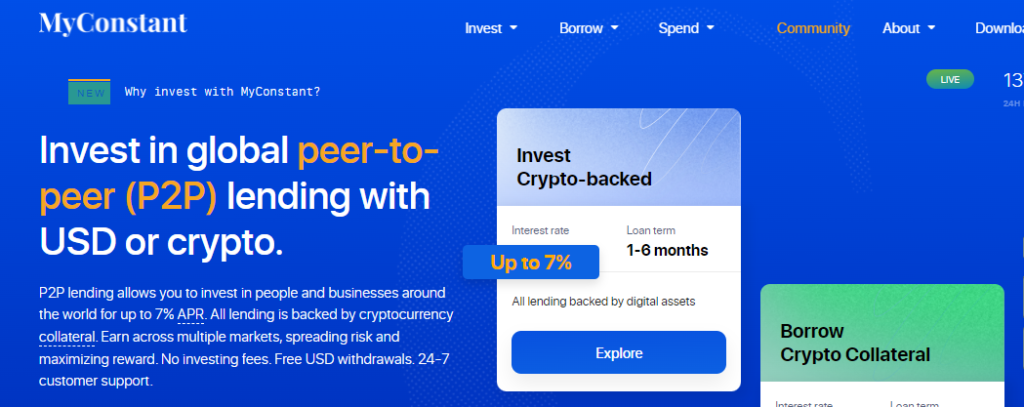

MyConstant is a global peer-to-peer lending platform with USD or Crypto. A unique platform designed to let its users invest in people and businesses for interest up to 7% APR, and in turn, let other people and businesses borrow with interest up to 6% APR. The only global platform that lets its borrowers borrow against the collateral of 75 plus cryptocurrencies. Read our MyConstant review to know more about the platform that connects investors and borrowers with no deposit and withdrawing fees.

Table of Contents

Summary (TL;DR)

- A safe platform to start investing in fiats and cryptocurrencies.

- No hidden charges are involved.

- Beginner-friendly interface

- No need to sell your cryptocurrencies to borrow a loan, keep it as collateral. Take back your collateral as you repay your loan.

- Different set of products and features are offered for investors and borrowers.

- The platform is insured by Prime Trust.

- 24/7 live customer support available.

- Mobile application is available.

What is MyConstant?

MyConstant is a platform that connects people who wish to invest and people or businesses that need an instant loan. It is not a bank, as users do not receive interest simply by depositing money on the platform. Instead, the platform allows you to create an instant account or lend your USD for a fixed period, like six months or a year. In addition, you can also opt for a plan where it lets you withdraw as and when you like with no withdrawing fees charged. Moreover, you get to enjoy the interest up to the date you withdraw.

Also Read: BlockFi vs CoinLoan vs Nexo 2021 | Best Lending Platform?

How does MyConstant work?

When you invest with the platform through USD or Crypto, they connect your investment with a loan seeker. A collateralized borrower can back their loan with 200% of the loan amount or his crypto portfolio where the crypto acts as the collateral. It can be a decentralized exchange or liquidity pool. Thus saving your investment even if there is a fail in repayment of the loan. You do not have to sell your portfolio or crypto for loan seekers. All you have to do is give your crypto as the collateral, and you get back your collateral as you repay the loan amount.

While the lenders back the investors’ funds, money flow is managed by the platform’s custodial partner Prime Trust.

MyConstant Review: Products for Investors

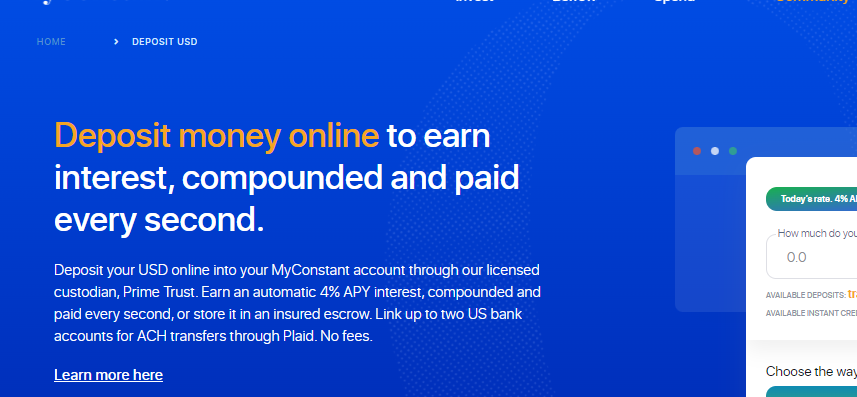

1. Deposit USD

Here the users can deposit USD through the ACH banks or wire transfers. The deposit made is initially held on in the instant-access investing account. In this account, the users earn up to 7% APY and at the same time enjoy any time withdrawal facility. You can deposit and earn interest every second, compounded; or store it in the insured escrow by the Prime Trust.

The default instant account is not insured. However, to ensure your account, you need to change the account setting by going to your account page.

Also Read: Celsius Network vs BlockFi vs Hodlnaut | Interest Rates, Fee and Risks

How To Deposit in MyConstant?

To deposit, follow the steps given below:

- Sign-up and verify yourself through KYC

- Create your deposit order

- Deposit your funds either via transfer wire or ACH through a linked US bank account.

- Considering the mode of deposit and time taken, you will have your account balance updated.

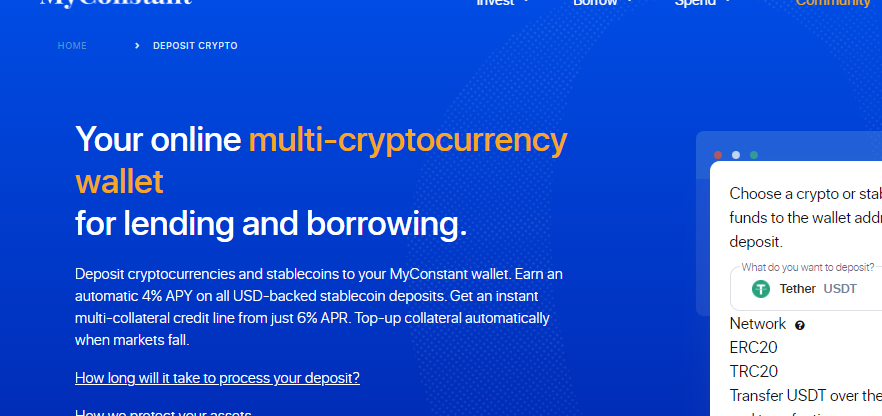

2. Deposit Crypto

The platform MyConstant has a wallet to deposit your cryptocurrency and other stable coins. More than seventy-five cryptocurrencies are supported, deposit, and start earning interest up to 4% APY instantly. There is no maximum deposit limit. These crypto deposits can act as your collateral and provide you with instant credit against your portfolio from 6% APR.

You can deposit crypto by scanning the platform’s wallet QR code or copying the wallet address from your wallet app.

Also Read: Top 7 Cryptocurrency Savings Accounts | Earn Interest on Crypto

3. Lend USD

You can lend your money to MyConstant and earn interest up to 20x better than the plain deposit. You can earn up to 7% APR by lending money to people and businesses worldwide. You can again pick a plan of your choice, either withdraw anytime for free or invest in a fixed period. The interest earned varies with the fixed plan opted.

| APY | Number Of Days |

|---|---|

| 4% | Instant Access |

| 6% | 30 |

| 6.5% | 90 |

| 7% | 180 |

Other than these interest rates, you also get various other benefits like:

- You receive immediate returns

- Flexible terms provided

- Lending is backed by cryptocurrencies as collateral

- No deposit or withdrawal fees

Also Read: Bitbns FIP [2021]: Earn Passive Income in India

4. Lend Crypto

Deposit crypto and earn more interest than usual depositing. The platform takes your lending crypto and redistributes it to their trusted exchange like Binance, Gemini, TrueUsd, Stably, and a few others. Your investments provide liquidity to the exchanges, so you earn through their trading fees. In addition, you start earning compounded interest every second, giving you immediate returns. Note that you pay interest in cryptocurrencies like BNB and PRV. You also get a 4% generous APY backed by the MyConstant Guarantee.

Note that you can lend Bitcoin, Ethereum, and Binance Coin.

Also, read 5 Best Crypto Lending Platforms in the UK

5. Secondary Market

A secondary market is a product dedicated to benefiting the investors if, at some point, they want their principal back amidst the commitment period. The platform here connects the seller of the investment with the buyer of investments. The investment buyers enjoy the interest for the entire term regardless of the time left for the term to end.

6. Lending Lottery

The lending lottery is a product where you invest and lend money on the exchange and earn 1% APR and free lottery tickets. The tickets can make you win up to $10M. Every time you invest $100, you get a lottery ticket. Winners of the ticket are announced every Sunday. No fees are involved.

Products Provided to Borrowers

1. Crypto-backed Loans

In the crypto-backed loan, you can borrow a loan against single crypto or multi-crypto that is your portfolio acting as collateral. Then, you can either trade or cash in the value of your portfolio. The collateral is stored securely and gets returned when you repay. To understand better, have a look at the example given below:

Let us assume you want to borrow 10,000 USD. To borrow this amount, you must give collateral of any cryptocurrency whose value is based on the current market value. So let us assume you will put your Ethereum as collateral. You must give 3.623 Ethereum to get the loan. The interest rate varies with the length of the term. For 30 days, the rate is 6% APR; for 90 days, 6.5% APR for 180 days, 7% APR.

Also Read: 5 Best BlockFi Alternatives to Consider

How To Get A Crypto-backed Loan?

- Sign-up and go to “Borrow Crypto-Backed Loans” and choose the length of the term for which you want the loan. The shorter the term, the lesser the interest.

- Receive the loan in either cash or crypto. Note that for the crypto, you will not have to pay any trading fees.

- Deposit your collateral, and you can combine multiple cryptocurrencies to meet the value.

- Withdraw your loan while your collateral is securely stored in Prime Trust Cold Wallet, an Ethereum smart contract, or a password-protected wallet.

2. Futures

You can borrow crypto from the platform with Futures by putting USD as collateral. You have to predict the price fluctuation of the coin, and if your prediction is correct, you make a profit.

For example, if you predict the price of Bitcoin will rise, the platform buys an equivalent amount of crypto up to 50x leverage that is 50 times more crypto than the USD value.

Now, if the prediction is correct, you get 2.5x of your collateral. On the other hand, iOn the other hand, if the prediction goes wrong, you lose your collateral.

Note that to use future, the platform charges fees. The fee for using the product is 0.2%. So, for example, if you open a position with $50 at 50x leverage, your charges are $5. This will be charged irrespective of your prediction coming true.

Also Read: YouHodler vs CoinLoan vs Hodlnaut [Read Before You Invest]

3. Institutional Loans

Institutional loans are a product that is highly dedicated to businesses and institutions. Consult with the consultants of the platform to know in detail. You can receive loans up to $10M, with no credit checks, free USD withdrawals, competitive interest rates, customer support around the clock, support of over 73 cryptocurrencies all a click away.

In addition, the collateral can be customized to suit the unique needs of different users.

4. Short Selling

Short selling benefits users who know the market pretty well. If you are one of them, then this one is for you. Borrow the asset you think will fall in price and sell it in the market. Now when you sell the asset and your prediction comes true. Price falls, then re-sell it in the market. Repay the loan amount, and the difference amount is your profit. Note that you will have to pay more to pay back the asset borrowed if the price increases.

Also Read: Crypto Lending vs Crypto Staking

How Does Short Selling Work?

The platform lets you borrow in pairs. The pairs provided are as follows:

- USD/BTC

- USD/ETH

- USD/BNB

To borrow the asset mentioned above, you must deposit the USD. Then you must set a stop-loss and take-profit to secure profit and minimize losses. Finally, follow the screen instructions and hit the button “Short Crypto Now.”

5. Crypto Swap

The platform offers the “swap” feature for its users, an exchange. They can swap crypto-to-crypto and trade on the platform with fees as little as 0.1%.

The prices shown on the MyConstant swap feature are based on Binance’s minute-by-minute exchange rate.

Also, read Best Crypto Swap Platforms

MyConstant Review: Opening an account

Opening an account on MyConstant is a straightforward process. Follow the steps given below to have a quick guideline:

- Go to the official web page of MyConstant.

- Click on “create account” at the right corner of your screen

- Give your Email ID, and set a password. Your account will be created.

- For better experience verify your email, KYC, add your bank details, and you are good to go.

MyConstant Review: Other Features

- Gift Cards: You can shop with 40+ retailers and save up to 3% with MyConstant’s gift cards. These payments are made instantly through the MyConstant account, and the cashback is also given in the MyConstant’s account. Note that you have a limit of $5000 worth of orders per month with the gift cards. However, this limit can be increased if a friend sign-up and deposits USD with your reference.

- Debit Cards: With debit cards, you can invest and earn all in one place. The card allows you to pay bills and other online transactions with no hidden fees. The fixed-term investments give you a credit of $2000 with no interest for up to 30-days. If you keep your funds on the debit card, your funds are insured by FDIC for up to $250,000.

MyConstant Review: Fees

- Deposit Fees: There are no deposit fees at all in whether you deposit fiat, stablecoins, or collaterals.

- Withdrawing Fees: To withdraw fiats there are no charges.

- To withdraw stablecoin, there are charges involved. Flat fee per token, while for Tether (USDT), the fee is 24 USDT on network ERC20. At the same time, on the TRC20 network, the fee is 1 USDT.

- To withdraw USD coin (USDC) on network ERC20, the fee is 25 USD.

- In collateral withdrawal flat fee per token is charged.

Is MyConstant Safe?

Investing and borrowing on the platform is pretty safe and has minimal risk. The platform provides a thorough security and risk guideline on that. However, the platform is not regulated under any financial institution. This can be a threat if the platform gets hacked.

However, MyConstant ensures the user’s account via Prime Trust, an accredited US financial institution. In addition, they have a MyConstant guarantee feature worth $10 Million(mixed-both in cash and crypto). This amount is stored across banks and cold wallets.

MyConstant Review: Customer Support

MyConstant provides customer support through live chat, Email, and support centre. The platform also offers a service called “get on a call,” where you can book a call to understand the features and products offered in detail.

The platform has a community on Facebook, Twitter, Medium, and Youtube.

Pros and Cons of MyConstant

| Pros | Cons |

|---|---|

| Low fees. | Not regulated by any financial institution. |

| Interest paid every second. | Taking a loan can be an expensive deal as the collateral has to be the double value of the loan. |

| Start depositing with as little as $10. | You can not purchase cryptocurrencies. |

| No maximum limit. | Only USD is accepted. |

| End term early in fixed-term investment is available. | |

| A mobile application is available on both Android and iOS. | |

| Fiat is supported. | |

| Great customer support is available through mail and calls. |

Conclusion

MyConstant is an exchange platform that allows you to invest, borrow, lend, swap, trade futures, etc. The platform is a great way to make extra money by lending and investing. You can also deposit your assets for a fixed term and earn a reasonable interest rate. Investors need not worry about their investment assets as the borrower keeps collateral of double the amount of loan taken. Various other benefits come with this platform, like interest earned per second, no trading fees, live customer support, beginner-friendly interface, and much more. If you are looking for a platform where you can safely invest without any market fluctuation, then this one is a must-try.

Frequently Asked Questions

You can make money on MyConstant by depositing on the platform. While if you move your funds to fixed term plans, you can earn more interest than the instant access account.

Yes, you can borrow against your cryptocurrencies. More than seventy-five cryptocurrencies are supported.

You can earn interest on MyConstant by either keeping your funds in the instant access account or in the fixed-term plans.

Also read,