Bitbns is an Indian crypto exchange launched on December 14, 2017, by Buyhatke Internet Pvt. Ltd. Moreover, Bitbns Fixed Income Plan guarantees assured returns on investments made in this plan. Furthermore, Bitbns FIP allows you to earn a passive income just like any crypto savings account on steroids.

Table of Contents

Summary (TL;DR)

- Bitbns is a crypto trading platform launched in December 2017.

- Its Fixed Income Plan (FIP) feature allows its users to gain interest on their BTC or USDT deposit for a fixed maturity period.

- 24 hours is the minimum maturity period for a FIP investment.

- The maturity period begins when the user has fulfilled the allocation limit of that selected plan.

- Interest on the principal deposit by the user is calculated by the rate of return of the selected plan if the deposit is not redeemed prior to the maturity period.

- In case of early withdrawal, the interest is calculated based on the early redemption rate of that plan.

- You can invest in FIP by signing up on the official Bitbns website and selecting your desired FIP investment plan.

- After entering your desired amount BTC or USDT as a principal investment to be transferred from your Bitbns wallet, click on Deposit to initiate the procedure.

- The FIP feature is available only on the Bitbns website as of now.

- Crypto can be deposited to the Bitbns wallet only through wire transfer.

- KYC verification is required only to deposit or withdraw fiat currency.

What is Bitbns?

Bitbns is a cryptocurrency trading platform introduced in December 2017. It charges 0.25% taker and maker fees. It also allows you to trade with 4X leverage. Bitbns is a secure platform with a 2FA security system. Bitbns mobile application is available on both Play Store and Appstore. It has also introduced a kind program called the Fixed Income Plan, which we will be talking about next. To learn more, read our Bitbns review.

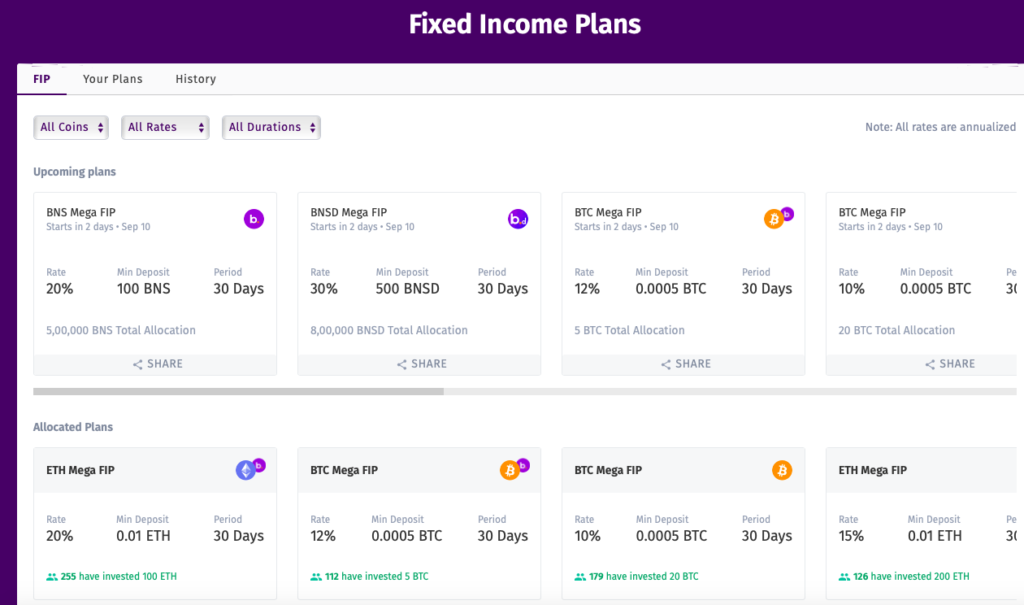

What is the Bitbns FIP (Fixed Income Plan)?

The Bitbns Fixed Income Plane (FIP) enables its users to invest a fixed sum of USDT or BTC in one or more of the FIP plans for a predefined time frame and rate of return. The money invested will be locked in for the fixed maturity term in order to calculate interest. When a FIP’s maximum allocation is achieved and funds are locked in, the maturity period begins. During this fixed timeline, the interest on your investment is computed. When the maturity term expires, the user receives the principal amount, as well as the interest earned, in their Bitbns wallet. It is important to keep in mind that 24 hours is the minimum maturity period for a FIP investment.

However, investors can also redeem before maturity. The money you withdraw will earn interest based on the Early Redemption Rate for the number of days it was invested in the plan. In the case of partial redemptions, the amount redeemed will earn interest at the Early Redemption Rate, while the remainder will earn interest at the Ordinary Rate of Return.

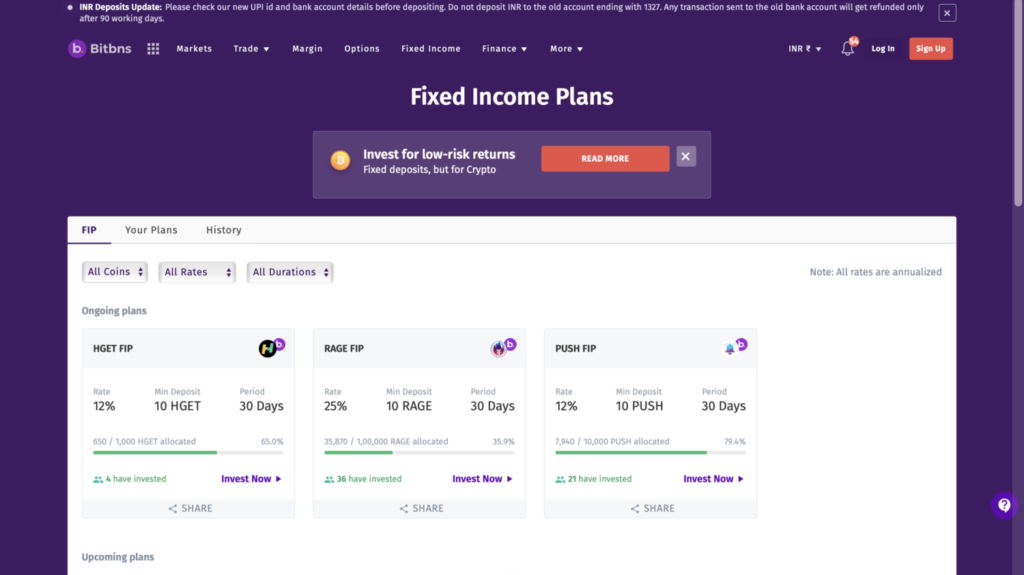

Investors can select an appropriate plan from among the several FIP options accessible on the dashboard. However, each plan has an allocation limit over which no additional investments in that plan will be allowed.

The minimum amount for your initial investment in a certain FIP is 10 USDT or corresponding BTC. There is no minimum amount after the initial deposit.

Note: The Fixed Income Plan feature is available only on the Bitbns website as of now. Bitbns FIP Interest Calculation Procedure

Bitbns has assured transparency in the Fixed Income Plan system working. We will now be discussing how the interest in your principal investment amount in a FIP is determined:

- Users can choose one or multiple plans from the Fixed Income Plan board to invest in, where each plan has a Rate of Return and early Redemption Rate.

- The user must fulfil the maximum allocation limit for a particular plan to initiate the commencement of the maturity period in which interest is calculated.

- Then, interest on the user’s principal amount is generated as per the rate of return of that given plan for the fixed maturity period.

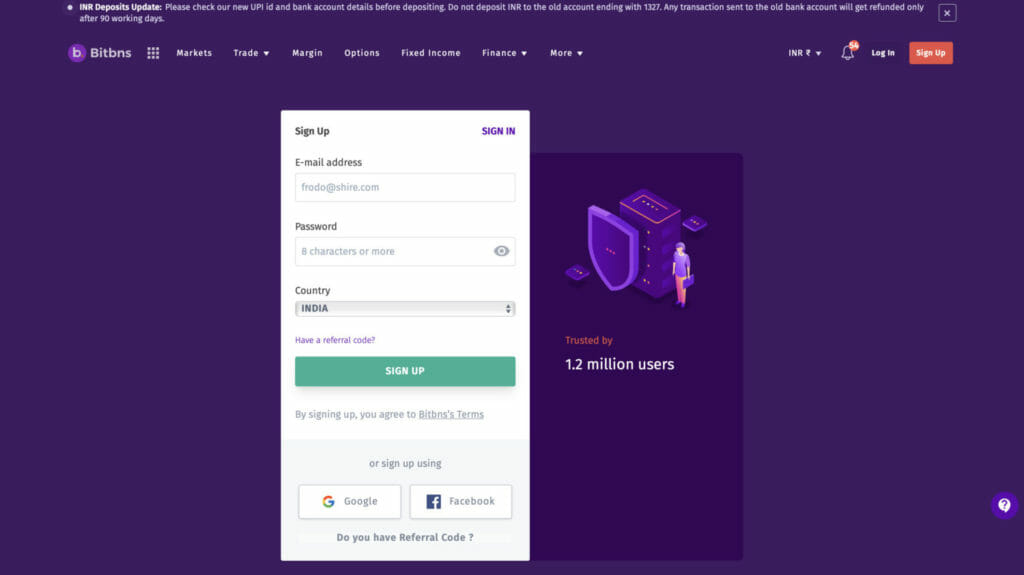

How to invest in the Bitbns FIP?

Follow the steps given below to successfully invest in a Fixed Income Plan:

- Click on Sign Up at the official Bitbns website.

- Enter your email address, password and country then click on SIGN UP. You can also sign up using your Google or Facebook account.

- Then you will receive a verification link on your entered email address. Click on the click to verify your account.

- KYC verification is not mandatory to trade, deposit or withdraw crypto. It is required only if you wish to deposit or withdraw fiat currency.

- The documents required for Indian users to do KYC verification are PAN Card, Bank Account details and Aadhar Card/ Driving License/Passport or Voter ID.

- The documents required for international users to do KYC verification are national ID and Driving License.

- After that, deposit some FIAT into your Bitbns wallet using wire transfer and buy some crypto listed in the FIP section.

- Then click on Fixed Income Plan or FIP at the top of the navigation menu.

- You can go through the various plans provided on their website and choose one or more to your liking.

- Make sure you check the early redemption rate, the rate of return as well as the maturity time period before deciding on the plan.

- Click on the ‘Invest Now’ button after deciding on the plan.

- Enter the amount of asset you wish to invest in this plan. Then this selected amount would be transferred from your Bitbns wallet.

- Then click on Deposit to begin the procedure.

Bitbns FIP: Pros & Cons

| PROS | CONS |

|---|---|

Guaranteed fixed returns. | Cannot redeem before 24 hours. |

Follows a strict safety protocol. | Requires complete fulfilment of a funds allocation limit of a plan to initiate maturity period. |

| Allows interest calculation even if the amount is redeemed before the maturity period through the early redemption rate. | |

Easy and simple investment process. |

Conclusion

The Bitbns Fixed Income Plan is a great initiative to enable crypto enthusiasts to earn passive income by investing in any given FIP. It is safe and transparent with an easy user interface. Moreover, through the early redemption rate, interest can be calculated even if the amount is redeemed before the maturity term. The guaranteed interest returns on the principle invested amount make an attractive offer for potential investors.

Frequently Asked Questions

No, it permits wire transfer only.

No, withdrawals are not allowed during the allocation period.

Also, read