Crypto trading bots are now so commonplace that choosing the right one could be tricky. There are too many options. This article reviews and compares three popular crypto trading bots: Stoic vs 3Commas vs Cryptohopper.

While Stoic, 3commas, and Cryptohopper are all popular crypto trading bots, they have different trading strategies and pricing models.

At the same time, they have pretty robust security models, mostly outsourced to crypto exchanges. All three crypto trading bots work with Binance, the world’s largest crypto exchange that holds tens of billions of dollars worth of crypto. Binance today likely has the most advanced and comprehensive cybersecurity system globally.

The table below summarizes parts of this article.

| Features | Stoic | 3Commas | Cryptohopper |

|---|---|---|---|

| Trading strategy | Hedge fund-grade long-only portfolio of altcoins with daily rebalancing based on quant research — a ready-to-use strategy, no user set up required | Dollar-cost-averaging bots, Grid bots, Options bot, and signals — the user must set up the strategy | Market-making bot, Visual Strategy designer, and Marketplace bots — the user must set up the strategy |

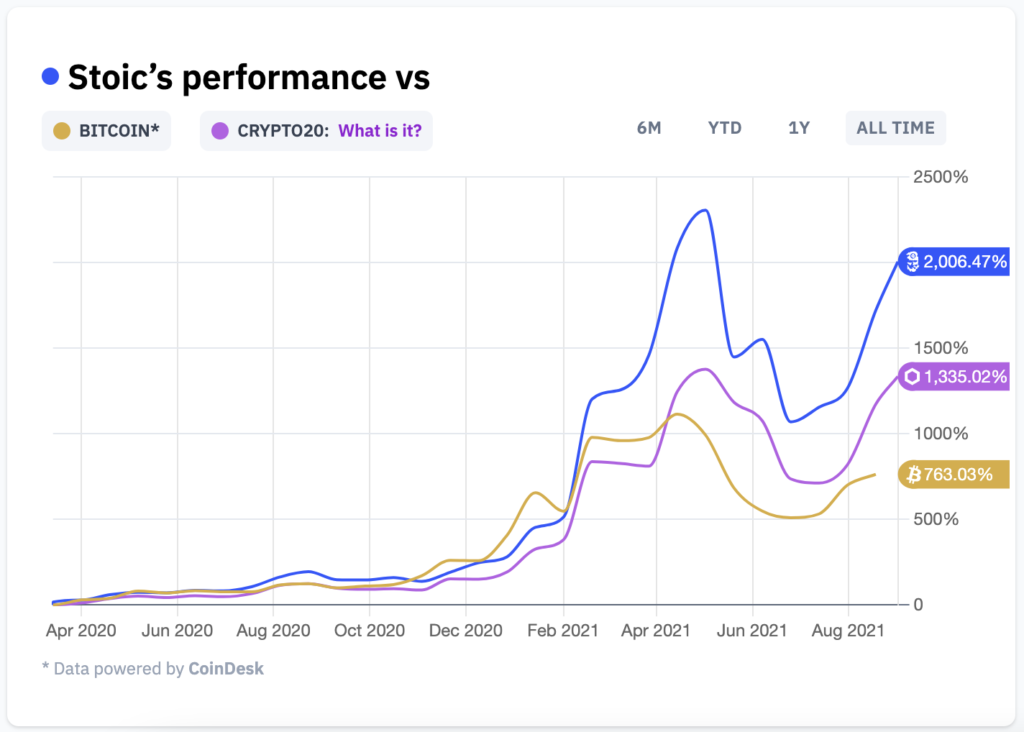

| Performance | +2,006% since March 2020 | n/a, depends on user settings | n/a, depends on user settings |

| Security | High, crypto remains on Binance, the world’s largest crypto exchange | High, crypto remains on Binance, the world’s largest crypto exchange | High, crypto remains on Binance, the world’s largest crypto exchange |

| Pricing | 5% of assets, annually | Accessible to $99/month | $19 to $99/month |

Summary

- Stoic is a crypto trading bot with a ready-to-use hedge fund-grade strategy that since March 2020 has returned +2,006% as of 1 September 2021. It requires no set-up and suits both experienced and new traders; costs 5% of assets;

- 3Commas is an advanced crypto trading platform with DCA bots, Grid bots, and Options bots that advanced users can tailor to their own needs; costs $0 to $99 a month;

- Cryptohopper provides a visual strategy designer that helps experienced traders to create and run bots without coding; less experienced users can subscribe to strategies on the Marketplace; costs from $19 to several hundred dollars a month, depending on the strategy.

What is Stoic?

Stoic is a crypto trading bot with AI, developed by the Cindicator team. Unlike most other trading bots, Stoic offers a ready-to-use strategy for investing in a wide range of cryptocurrencies. It could be considered a broad crypto index with smart weightings and rebalancing based on hedge fund-grade quantitative research.

Read our Stoic Trading bot review to know more.

What is 3Commas?

3Commas is a suite of crypto trading tools for both experienced and new traders alike. 3Commas helps users to automate their strategies. 3Commas offers ready-to-use bots: the so-called Grid bots and options trading bots.

Read our 3Commas review to know more.

What is Cryptohopper?

Cryptohopper is an advanced platform for running crypto trading bots. Its visual strategy constructor lets users create crypto bots with different settings. There is also a tool for backtesting a strategy. Finally, Cryptohoppers also has a marketplace where users can buy and sell automation templates, trading strategies, signals, and apps.

Read our Cryptohopper Review to know more.

Stoic vs 3Commas vs Cryptohopper: trading strategies

The most essential part of any crypto trading bot is the strategy. The bot automates the trading according to the strategy, so the user does not have to make any decisions and execute trades manually. However, this means there is also no scope for correcting any trades that go awry.

Stoic Crypto Strategy

Stoic is one of the few trading bots that offers a profitable ready-to-use trading strategy. Its strategy is a long-only portfolio of altcoins, built and rebalanced based on hedge fund-grade quantitative research.

To build the portfolio, Stoic aims to algorithmically analyze any cryptocurrency with at least $10 million in daily trading volumes on Binance. The algorithm reviews volatility, correlation, and other factors to find assets poised to continue trading upwards. Stoic also reviews assets already in the portfolio to see if it’s time to cut losses or take profits.

Since this strategy was launched in March 2020, Stoic returned +2,006% for the team’s live demo portfolio. This proved to be better than just buying and holding Bitcoin or a portfolio of top-20 cryptos with equal weights. And, of course, it’s also better than just trading manually without a coherent strategy.

[optin-monster-inline slug=”kypqbd8bxbsurarmqsxd”]The actual past performance of one of the team’s accounts is visible in the demo mode after signing up for Stoic.

Stoic’s core value proposition is to “remove emotional suffering,” as its name implies. Most human traders lose money because they can’t cope with strong emotions that arise in the heat of trading. For example, when the price moons, traders fear missing out. And when everything crashes, traders often first wait it out and then panic sell at the very bottom.

Stoic solves this by trading algorithmically according to a well-tested strategy.

3Commas Strategy

Launched in 2017, 3Commas grew into a whole comprehensive trading platform with lots of features.

With 3Commas, the user must pick a strategy and set it up. So it’s hard to judge the profitability of available strategies.

3Commas trading strategies include:

- DCA bots: these are simple trading bots that regularly (for example, every week or month) buy a specific cryptocurrency for a fixed amount of fiat currency such as USD or EUR. This strategy is known as ‘dollar-cost averaging’ and it helps to reduce the risk of buying at the top.

- Grid Bots: these bots aim to buy when the price is low and sell when the price is high. The user must define the range, creating a grid-like chain of orders for the bot. While the bot automates execution, the most difficult part, however, is to select that range.

- Options bots: as the name suggests, these bots trade options. The options bot helps to easily execute more advanced options strategies such as straddles with a visual strategy builder. The user can see the strategy’s pay-offs and play around with different strikes and expiration dates to find something that suits their needs. However, it’s up to the user to define the exact strategy.

- Crypto signals: this feature essentially lets users create bots that follow the trades of experienced users. Some of the signals are free while others have monthly subscriptions of $10 and higher. While potentially profitable, it’s hard to judge each strategy and evaluate how exactly it is constructed.

Overall, 3Commas is a terrific tool for advanced traders with a working strategy that they just want to automate. Newbie traders can benefit from subscribing to strategies available via the marketplace, but users still need to bear the responsibility of picking the right strategy.

Cryptohopper Strategy

Like 3Commas, Cryptohoppers evolved into a suite of tools for automating trades. The project started as a tool that traders build for themselves, and it shows in the range of diverse instruments for automated trading.

- Market-making bot: this is an advanced strategy that allows anybody to become a market-maker, generating liquidity for exchange participants. The strategy makes the difference between the bid and ask, i.e. between the price in the order book at which traders can buy and sell particular crypto. Cryptohopper helps to target pairs with the highest spread, which should lead to higher profits. The users can pick a pre-maid strategy for a bearish, neutral, or bullish trends.

- Strategy designer: users can also design their custom made strategy. The drag-and-drop tool lets you pick from a wide range of technical analysis indicators and different types of orders. While for new traders this choice could be overwhelming, experienced traders can essentially automate what they would do manually.

- Marketplace: traders can also subscribe to a range of strategies,

Overall, Cryptohopper is an excellent tool for experienced traders who understand how the market works and want to streamline their operations.

Stoic vs 3Commas vs Cryptohopper: Security

- All crypto trading bots connect to the user’s crypto exchange account via API.

- The bot’s security ties down to the exchange’s security.

- The largest crypto exchanges hold tens of billions of dollars worth of crypto. They invest heavily in security, and their business depends on this.

- Binance is the largest crypto exchange globally, and all three crypto trading bots — Stoic, 3Commas, and Cryptohopper — work with Binance.

- Finally, some might argue that it’s safer to keep crypto on a cold wallet. This is true to an extent, but it’s also impossible to trade on an exchange while crypto remains on a cold wallet.

Also read, 5 Best Free Crypto Signals | Top Crypto Trading Signals Telegram Channel

Stoic vs 3Commas vs Cryptohopper: Pricing

Most crypto trading bots are priced monthly or annually, with subscription fees ranging from ‘free’ (usually a trial version with minimal functionality) to several hundred dollars a month.

3Commas has several plans. The most basic plan includes one DCA bot (one multi/single pair for spot and one for futures trading), one Grid bot, and one options bot — these could be run on any of the 23 supported crypto exchanges. An Advanced plan costs $49 a month and includes many DCA bots. A PRO plan is $99 a month and includes an unlimited number of bots.

Cryptohopper has a free version that includes some features but does not support any crypto trading bots. The Explorer package costs $19 a month and includes one active crypto trading bot. The most comprehensive plan, the Hero package for pro traders, costs $99 a month and includes a market-making bot and all other features.

Additional bots and strategies are also available in Cryptohopper’s Marketplace. Some strategies are free, and some have monthly subscriptions paid on top of Cryptohopper’s pricing packages. Subscriptions for strategies range from $1.99 to $99 a month.

Stoic has a different pricing model. There is no monthly subscription, and instead, Stoic’s crypto trading strategy charges an upfront fee of 5% of assets on the Binance account. Stoic trades all the assets on the account, so it’s best to withdraw any assets meant for long-term holding.

Stoic requires a minimum starting balance of $1,000. So for that balance, the fee would be $50 (5% of $1,000) for 12 months. This makes Stoic affordable for most crypto investors who want to try it before allocating higher amounts.

Stoic vs 3Commas vs Cryptohopper: Conclusion

To sum up, all three trading bots are well-suited to advanced traders. These tools help to save valuable time by automating manual tasks.

3Commas and Cryptohopper allow experienced traders to execute strategies automatically. Yet the user must define the strategy.

Stoic is one of the few crypto trading bots that offers are ready-to-use trading strategy. Its long-only crypto portfolio is similar to a wide crypto index with smart rebalancing based on quant research.

Stoic’s strategy would suit experienced traders who don’t want to spend time on manual rebalancing. And for people who are entirely new to crypto, Stoic can help invest in the broad crypto market while spending zero time researching coins or making the trades.

Also read,