With more than 9 years of experience, BitKan is a leading cryptocurrency exchange that has served 5+ million users in 170 different countries. BitKan users are able to trade 1200+ crypto coins across its partner exchanges (Binance, OKX, Huobi, Bitfinex, Poloniex, FTX, Gate.io and Bit.com.) with 1 BitKan account. Aside from Spot Trading, Futures Trading, and Automated Bot Trading, the crypto exchange recently launched BitKan Earn and BitKan Auto-Invest for users to turn their savings into wealth. BitKan also holds the Digital Asset Exchange License from the Financial Services Agency of Japan.

1. Capture Trading Opportunities 24/7 Even While You Are Asleep

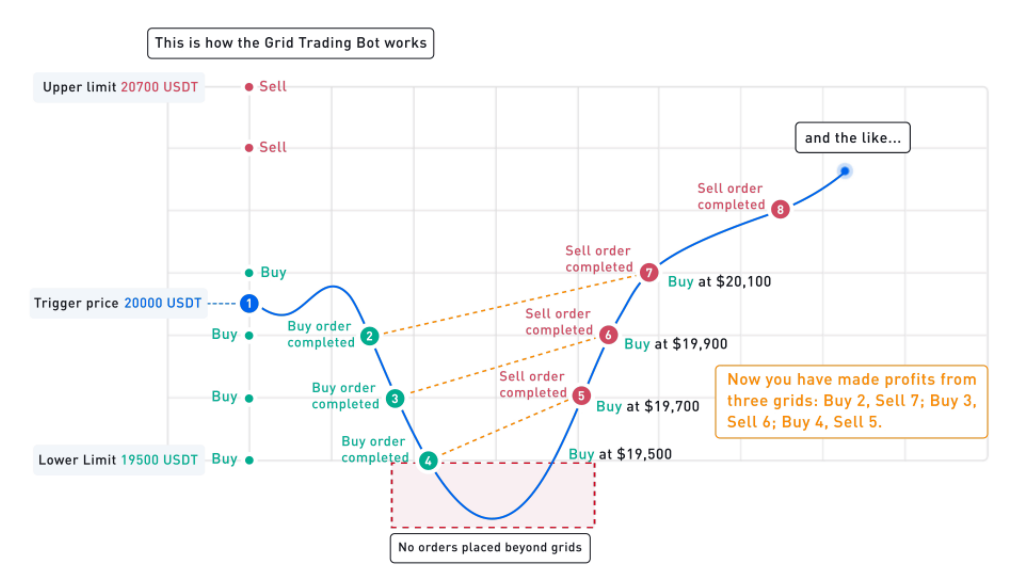

A crypto trading bot automatically executes orders without your manual intervention. With the trading process being fully automated, there is no need for constant monitoring of the cryptocurrency market. A trading bot will enter and exit the trades whenever certain circumstances and conditions are met.

Furthermore, an automated bot works around the clock and helps you to earn profits even while you are asleep. It is worth noting that most trading bots are cloud-based, which means there is no need to power on your phone or computer and keep it constantly running for the whole day.

Since the cryptocurrency market moves quickly with price movement easily stretching into double-digit percentages on a daily basis, an automated bot can leverage the market’s volatility and capture trading opportunities 24/7. Imagine capturing an additional 6 – 7 hours of daily trading opportunities using an automated trading bot in comparison to a manual trader who needs to rest during meal times and sleep hours!

2. Trading Bots Are Free

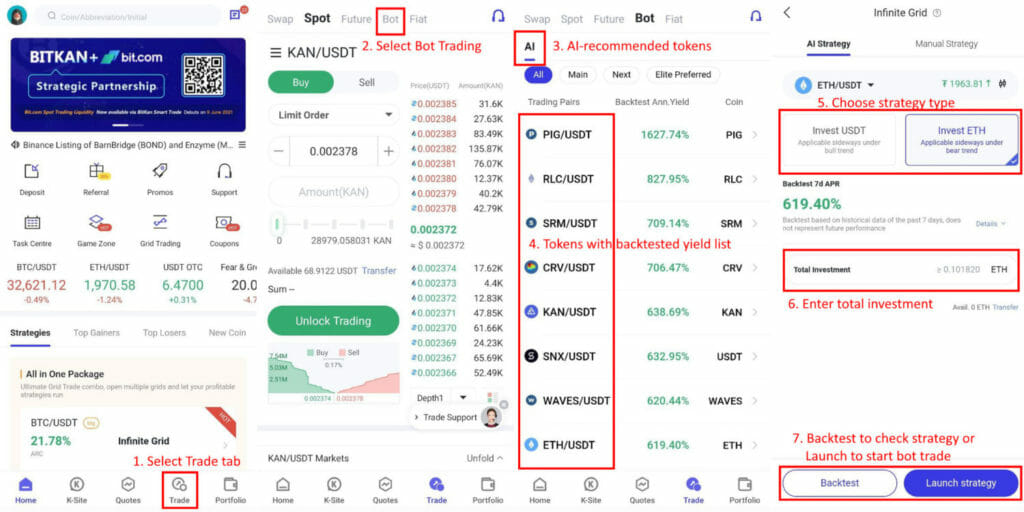

While many cryptocurrency platforms offer different purchasable programs and APIs depending on your needs, there are various cryptocurrency exchanges such as Binance, KuCoin, BitKan, and Pionex that provide free crypto trading bots that are already in-built on their platform. Contrary to popular belief that an automated cryptocurrency bot requires substantial starting capital, knowing how to code, and wholesome data analytical skills, it is actually free and simple to set up.

Moreover, it has pre-built ready-to-use trading strategies that can be implemented within minutes. These recommended automated trading strategies are backed by past data and help beginners to dip their feet into bot trading before venturing into customizing their personal automated trading strategy. Nowadays, automated bots are safe, simple, and make a trader’s life ten times easier.

3. A Trading Bot Prevents Emotional Trading

Fear and greed are the biggest obstacles when it comes to crypto trading. These two forces facilitate random trading and prevent you from making the right trading decisions. But, these emotional vices are not present in bot trading. The trading bots do not operate on hunches making them even more efficient in trading.

Furthermore, a trading bot overcomes all physical and computational limitations of humans. It is impossible for you to be in multiple locations simultaneously which means you can’t possibly implement all of the trades you want to and gain profits. With its predetermined criteria and high-speed decision-making in executing orders, a trading bot is capable of capturing even the smallest of changes in the market to generate consistent profits over time.

With its robust backtesting features with a strong emphasis on being number-centric, a trading bot executes orders based on data as opposed to falling prey to feelings and intuition. An automated trading bot eliminates the psychological strains involved in crypto trading and executes the trade orders with rationality.

Conclusion

It is highly encouraged to use a trading bot that is already in-built within a cryptocurrency trading platform. There are two main advantages: firstly there is no need to fumble around with external APIs. Secondly, these cryptocurrency trading platforms are accountable for the trading bots they provide which makes it easier for you to keep in touch with them. In addition, you are able to approach the support staff who is able to give accurate feedback if you were to have any questions in regards to its trading bots. Since there are so many trading bots available in the market, how do we choose one that best fits us?

It would be ideal to try using a crypto exchange that has a Test Mode where traders can try and have a sense of how trading bots work. An example would be BitKan which offers a $50 USDT Bot Trading Gift to its new users. The first time you launch a bot trade of $100 USDT or more on BitKan, you will receive a $50 USDT loss-coverage insurance. This means that BitKan will cover any losses amounting to $50 on your first bot trade, and you keep all profits generated from it.

With the advancement of trading bots enabling us to make our trades on autopilot, it is a great tool in providing us with additional hours of exposure for a periodic rebalancing of our portfolio without requiring us to be actively monitoring our positions. Give bot trading a try, it might just be what you have been looking for all this time!

Also, read