YouHodler is a crypto lending platform that started operating in the year 2018. The platform lets you get a cryptocurrency loan backed by the top 15 coins with approximately a 90% Loan to Value ratio. You will get to know more about the platform with this article on this YouHodler Review.

Table of Contents

Summary

- YouHodler is the one of the most advanced lending and borrowing platform where you can HODL and earn Interest simultaneously.

- Crypto loans let you take advantage of new investment opportunities without sacrificing your precious crypto and get cash for your everyday needs.

- Multi HODL has flexible fees, use funds from your crypto savings and keep weekly Interest.

- YouHodler’s savings account helps you benefit from the new digital economy and earn up to 12% APY with weekly payouts.

- Furthermore, the platform lets you do swap crypto, Fiat, and stablecoins options. They accept all significant digital assets and stablecoins such as BTC, ETH, XRP, BNB, DOGE, HT, USDT, HUSD, PAXG, TUSD, and more.

What is YouHodler?

YouHodler is among the best European crypto lending platform that enables you to earn an excellent yield on your cryptocurrency or borrow money in exchange for cryptos as collateral. The platform came into the picture in the year 2018. It is a Swiss-based and an EU brand with its two main offices in Switzerland and Cyprus. Moreover, on YouHodler, you can deposit your cryptocurrency or your Fiat such as Euro, USD, CHF, GBP and exchange them in crypto so you can start earning interest on your deposits. The platform also supports ETH, BNB, BCH, LTC, XLM, DASH, XRP, REP, HT, and many other popular cryptocurrencies and tokens.

In addition to this, the YouHodler team has unique and strong expertise in FX/CFD and Finance, creating e-learning platforms and e-commerce, Distributed Ledger Technology, and Blockchain. Furthermore, your digital assets are guarded safely with Ledger Vault’s advanced custody and security options.

Also Read: YouHodler vs CoinLoan vs Hodlnaut [Read Before You Invest]

YouHodler Review: Features

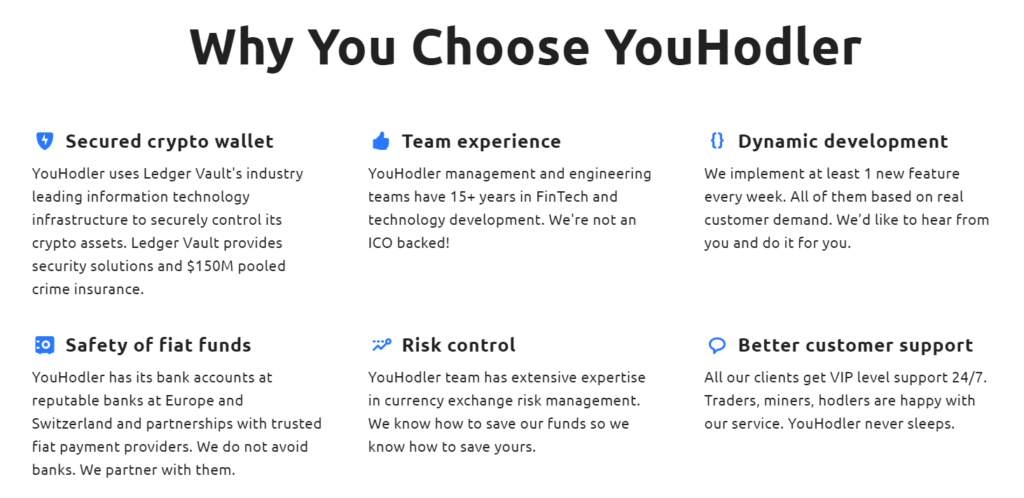

1. Risk Control

In currency exchange risk management, the YouHodler team has extensive expertise. They very well know how to properly manage risks.

2. Secured Crypto wallet

The platform uses Ledger Vault, an industry-leading information technology infrastructure, to control its crypto assets securely.

3. Dynamic development

There’s the addition of at least one new feature every week based on actual customer demand. So they certainly believe in hearing from you and doing it for you.

4. Team experience

The engineering and management team of YouHodler has over 15 years of experience in development. They are not ICO-backed.

5. Safety of fiat funds

It is a trusted platform as it has partnerships with trusted fiat payment providers and has bank accounts at reputable banks in Switzerland and Europe.

6. Customer Support

YouHodler provides all of their clients with 24*7 support. It never sleeps and is always ready to help customers.

Also Read: YouHodler – 4 Easy Ways to Make Money

YouHodler Review: Products

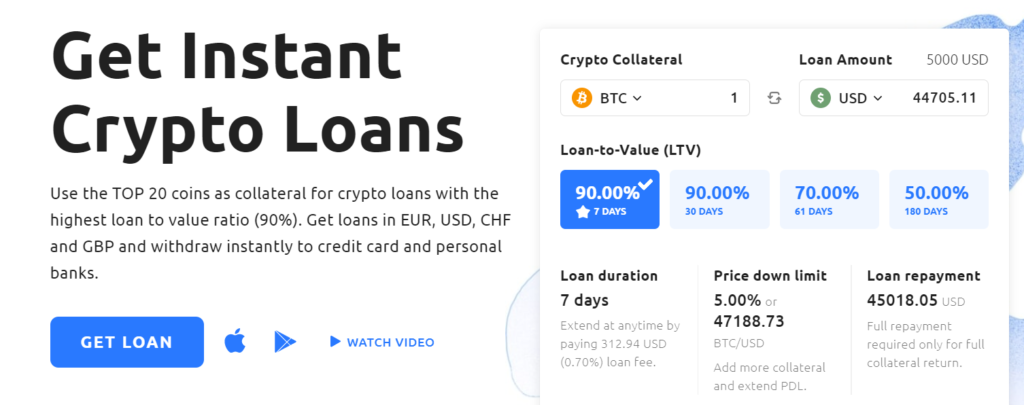

1. Crypto Loans

Crypto Loans are designed to give you cash without having to sell your favourite investment. YouHodler’s crypto loan lets you use your crypto assets as collateral and get Euro, US dollars, or a variety of stable coins in exchange. As soon as you repay the loan, you get your crypto back. In addition to this, we can also calculate your LTV (Loan-To-Value) to be sure of everything.

Furthermore, below are some features of Crypto loans:

- Digital asset management system with $150M pooled crime insurance by Ledger Vault.

- You can get instant cash from their fiat fund, and there is no need to find a lender like in P2P.

- There is flexible repayment date and Loan-To-Value options.

2. Exchange

YouHodler is a trustworthy platform to buy and exchange cryptocurrency. With its full range of crypto conversion tools, you can exchange or buy cryptocurrency, Fiat, and stablecoins with real-time execution prices and low fees on the platform. This further saves you money, time and avoids risk on external crypto exchange platforms. You can do this by buying via your credit cards (Visa, Mastercard) and using your SEPA bank account.

YouHodler serves their customers with many offerings, and below mentioned are some of them:

- Secure wallets

The platform offers you hot and cold crypto storage technology, further backed by a team of talented developers to keep it additionally safe. All credit card transactions are monitored under PCI Security Standards and crypto-related operations by Cryptocurrency Security Standard (CCSS).

- Top 20 coin support

You can buy bitcoin with a button click. You can buy cryptocurrencies include top 20 options like Bitcoin, Ethereum, Ripple, Bitcoin Cash, Chainlink, and many more. Also, new coins are added every month.

- Fiat currency support

It supports fiat currencies like Euro, US dollar, Swiss franc, British pounds, etc.

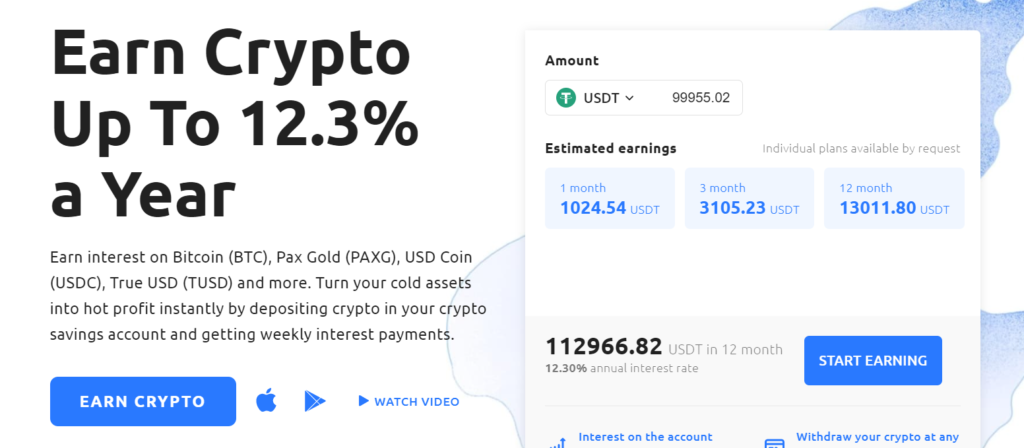

3. Earn Interest

The savings account has always been a risk-free and high-yield tool to store your coins. However, if you are also tired of nearly 0% banks’ Interest, you benefit from YouHodler’s new digital accounting and get incredibly high Interest.

YouHodler’s crypto saving account offers you high Interest on stable coins and also lets you earn Interest on Bitcoin (BTC), Pax Gold (PAXG), True USD (TUSD), USD Coin (USDC), and more. This product of YouHodler turns your cold assets into hot profit instantly by depositing crypto in your crypto savings account and getting weekly interest payments. Moreover, if you do not have such cryptos, you can convert them from other cryptocurrencies or fiat currency. For example, you can earn 12.3% on EUR, USD, and GBP by converting Fiat to stablecoins in seconds using the platform.

YouHodler minimum deposit amount

- By crypto – 5 USD in crypto equivalent

- By Bank Wire – 100 for USD/EUR/CFH/GBP.

YouHodler minimum withdrawal amount

- By Bank Card – 2 USD/ 2 EUR

- By Bank Wire – 500 for USD; 50 for EUR; 500 for CHF and GBP

Also Read: BlockFi vs CoinLoan vs Nexo | Best Lending Platform?

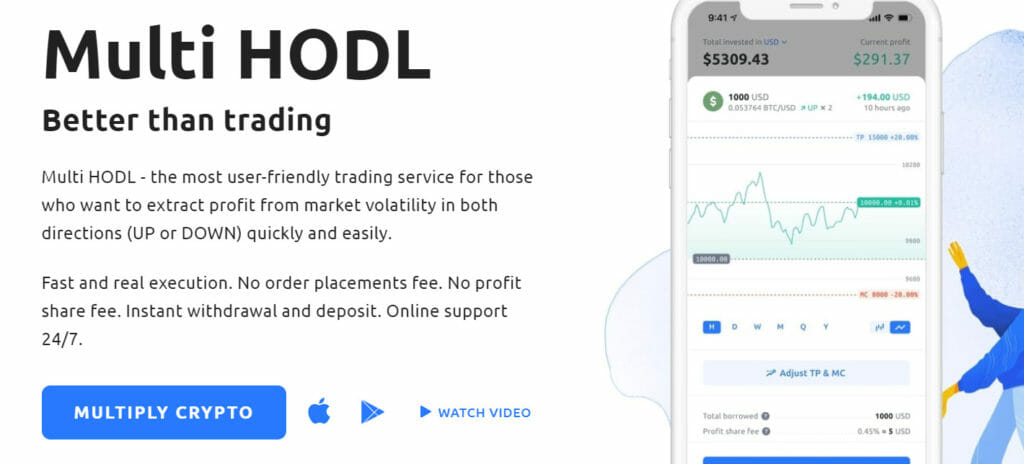

4. Multi HODL

Multi HODL is an easy-to-use tool to multiply your crypto funds in all market conditions. It is an innovative and efficient tool powered by crypto-backed loans to help you capitalize on market volatility in both directions, i.e., UP or DOWN. Multi HODL combines the best of both CFD trading and crypto exchanges into one. It has a simple interface, free leverage, and convenient trade management. Further, it helps to boost your savings and keep your daily Interest. It allows you to find the right balance and stimulate your crypto with limited risk. In addition to this, it anticipates the market movements and multiplies your crypto to x30.

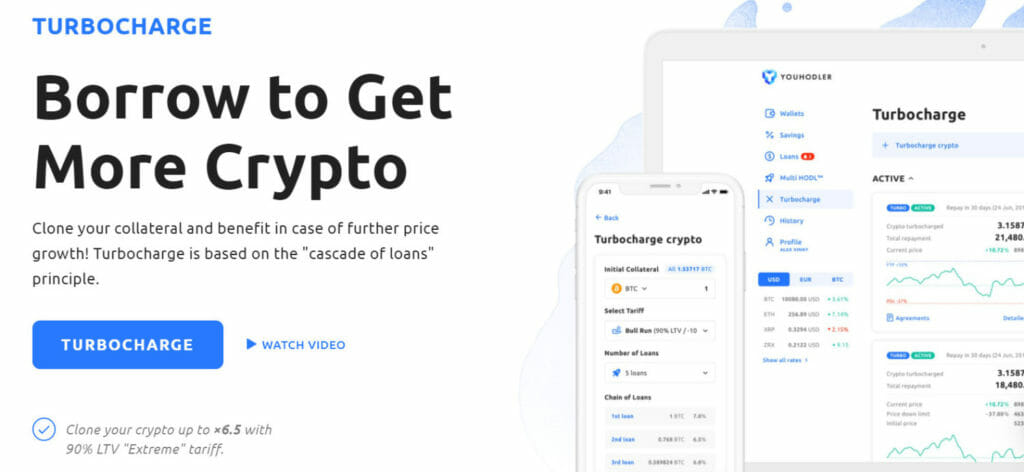

5. Turbocharge

YouHodler’s Turbocharge allows you to get more crypto with borrowed funds. This turbocharge service will enable users to get a chain of loans based on the “cascade of loans” principle. The platform uses borrowed Fiat to purchase additional cryptocurrency without commission and then uses it as collateral for other loans in the chain. With this product of YouHodler, you can clone your crypto up to 6.5x with a 90% LTV “Extreme” tariff. Moreover, it has no rollover or fixed fee and is cheaper than trading.

How Turbocharge works?

- Firstly, you need to transfer your crypto to your YouHodler wallet.

- The platform then calculates the turbocharged amount by automatically using the borrowed funds from the first loan to buy more crypto and get another loan.

- Set the Take Profit price so that when your collateral coin hits the Take Profit price, YouHodler will automatically use the collateral to pay the fees. The remaining crypto will be returned and the benefit from the price’s growth.

- You can repay the total amount or close all loans at any time.

- Lastly, you can use the list of advanced features to manage your Turbocharge conditions and how it reacts to the market’s movements.

Also Read: Celsius Network vs BlockFi vs Hodlnaut | Interest Rates, Fee and Risks

YouHodler Review: Fees

YouHodler’s fee varies for deposits and withdrawals and different products.

Deposit

- Bank Wire – No fees (except USD SWIFT – 25 USD fee per deposit, EUR SWIFT – 25 EUR fee per deposit)

- Credit card (loan repayment) – 4.7% (1 USD/EUR minimum)

- Crypto – No fees

- Stablecoins – No fees

Withdrawal

Fiat

- Bank wire – USD (SWIFT) – 1.5% (min 70 USD) / EUR (SEPA) – 5 EUR, EUR (SWIFT) – 55 EUR / GBP,CHF – 0.15% (55 GBP / 55 CHF min)

Loans

- Close now fee – 1% from the overdraft amount

- Reopen Fee – Interest fee + 1% service fee (from the borrowed amount)

- Extend PDL – 1.5% from the additional collateral

- Increase LTV- 1.5% from the increased amount

Turbocharge

- Close now fee – 1%

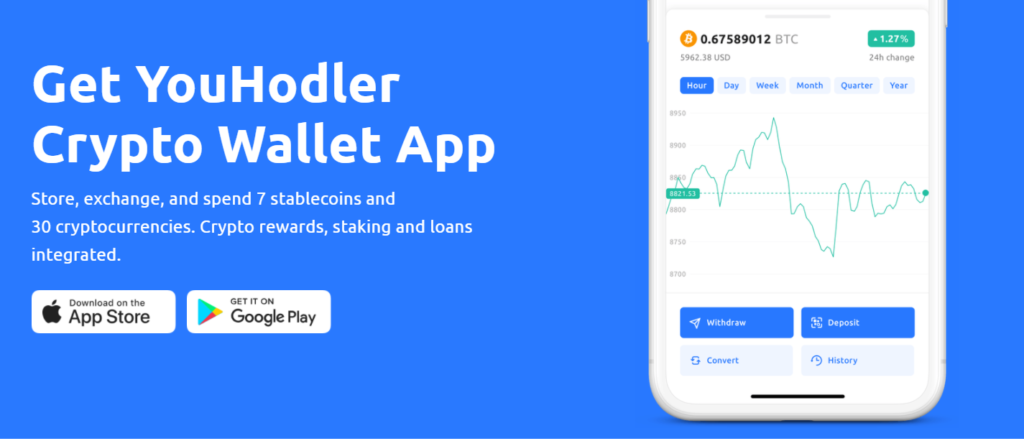

YouHodler Review: Bitcoin Wallet

YouHodler’s multi-coin wallet is one of the best places to HODL, earn and multiply crypto. The wallet is uniquely designed to manage your coins and tokens more accessible than ever and simplify crypto details. Moreover, you can easily HODL, multiply digital currency, and earn Interest in these beautiful smartly designed crypto wallets available for Android, iOS, and desktop OS. Furthermore, multi-coin wallets support 14+ popular cryptocurrencies such as USDT, TUSD, DAI, LINK, BUSD, ETH, EURS, etc.

Also Read: How to Mint your First NFT on FTX?

YouHodler Review: NFTs

Simply put, NFTs are ownership rights to assets that are blockchain-based and can represent items like artwork, rare digital collectibles, digital/ physical assets, or any video game virtual goods. YouHodler also supports the NFT drop of singer-songwriter Polarrana’s new single, ‘Full of You.’

Moreover, YouHodler is licensed to accept NFT’s as collateral as they have an official pawnbroker license from Switzerland and are authorized to accept items as collateral in exchange for a loan. Hence, you can get loans on YouHodlers using NFTs as collateral. For this, you need to contact [email protected] and include information about NFT and the loan terms you want in the mail. The platform will then review your application and will let you know.

YouHodler Review: Mobile App

Users always want convenience in trading and accessing their accounts from anywhere around, so mobile applications came into the picture.

YouHodlers app is user-friendly and efficient. The mobile app lets users store, exchange, and spend seven stablecoins and 30 cryptocurrencies. It also offers users many features and products like affordable loan process, savings account, crypto rewards, staking, trading tools, Multi HODL, Turbocharge, etc. The YouHodler’s mobile application is available for both Android and iOS users.

Also Read: Flash Loans – Borrow Without Collateral

Is YouHodler Safe?

Every user gets concerned about the crypto exchange’s security, but with YouHodler, there’s no need to get worried as all of its operations are 100% secured. The platform follows industry best practices for IT data protection, security checks, access rights, and data encryption. In addition, they store fiat funds at reputable Bank accounts in Switzerland and Europe and partner with trusted fiat payment providers.

Moreover, YouHodler also uses Ledger Vault’s industry-leading information technology infrastructure to securely control its crypto assets with a multi-authorization self-custody management solution and $150 million pooled crime insurance. Apart from this, all credit card operations are under PCI Security Standards, all crypto operations – in accordance with Cryptocurrency Security Standard (CCSS). Furthermore, they run external security audits regularly.

YouHodler Review: Customer Support

YouHodler has great customer support, just like the great service to their users. The platform has its Glossary, which describes each and every term in the platform. It also has a FAQ section that will answer most of the general questions you might have regarding the platform and answer you in the best possible way. Furthermore, if you are not yet satisfied, you can text them at [email protected]. In addition to this, it also offers a chat option where you can initiate a conversation by simply sending a message to them. You can also leave feedback if you want to.

YouHodler Review: Pros and Cons

| Pros | Cons |

|---|---|

| The platform supports crypto-fiat currency and crypto-crypto conversions. | The minimum deposit for the platform through Bank Wire is 100 USD. |

| It has a high LTV ratio and weekly compound interest. | When compared to other platforms it does not offer the highest returns for stablecoins. |

| The platform runs security audits regularly. | |

| The user can instantly withdraw profit. | |

| It provides web and mobile wallets that are safe and easy-to-use alternatives to sensitive crypto wallets. | |

| It also offers traders savings accounts that are simply about earning high interest on deposits. |

YouHodler Review: Conclusion

YouHodler is the ultimate “one-stop-shop” crypto-fiat wallet to get crypto-backed loans. Users can also earn interest in Bitcoin and other cryptocurrencies with crypto savings accounts, multiple crypto assets with innovating trading tools, and much more. YouHodler is the best choice if you are looking for a short-term loan for their cash flow requirements.

Frequently Asked Questions

How much interest can I earn with YouHodler?

The annual interest that you can earn on YouHodler is up to 12%. These interest payments are delivered directly to your YouHodler account weekly.

How do crypto savings work?

There are multiple methods that YouHodler provides to users in order to gain profit from their digital crypto assets. Moreover, users can earn interest via these cryptos by depositing and keeping cryptos in their YouHodler’s wallets.

How to get a loan?

Users can get loans by keeping their crypto assets as collateral. In return for their assets, they will receive an agreed loan amount in Fiat. Users will get their collateral back after repaying the loan.

Also read,