Capital.com is an online broker to trade stocks, currencies, commodities, and cryptocurrencies in one place and is available worldwide. In this Capital.com review, we’d be talking about its pros and cons, features, trading fees, security, etc.

Table of Contents

Summary

- Capital.com provides a trading platform irrespective of experience in trading, and their AI techniques help users to make trading decisions as per their behaviors and investment in the market.

- Zero sign-up, deposit, inactivity, per-trade, or withdrawal fees.

- The trading platform is available on the web and mobile devices.

- Artificial Intelligence techniques analyze investors’ trading behavior and predict the next decision they can consider.

- Offers zero commission and opportunity to trade on 4,000 of the world’s most traded stocks, commodities, and currencies.

- capital.com provides technical indicators, charts, and price alerts for better trading.

What is Capital.com?

Capital.com is a platform to trade CFDs and other derivatives online. If we search for details, Capital.com was founded in 2016, and currently, 1.8 million users have been registered. As per data provided on their websites, the traded amount in Capital.com is $88+ B.

Capital.com has been recommended for beginners as it offers training and support to its users. There is a whole different section, ‘Learn to Trade’ on their website and App to guide investors. Users can attend live webinars or take courses to learn, and also ideas from expert traders are available to know things. For more understanding, let’s see what the features of Capital.com are.

Also Read: eToro vs PrimeXBT vs Capital.com vs AvaTrade

Capital.com Review: Features

- Stock and Crypto at one Place: The trading platform of Capital.com gives you leverage to trade stock and crypto in one place. Investors can trade both in the same way on a single platform. As per details provided by Capital.com total of 3700 instruments are in their platform that includes stocks and currencies. However, for UK investors, Cryptocurrencies are not available.

- Minimum Deposit: Minimum deposit is an essential factor for beginners. Well, with Capital.com, investors can start with $20, and for withdrawal, the minimum amount should be $50. However, the minimum deposit amount might be slightly higher than its competitors, but investors can start quickly with fewer risk factors.

- Accepted payment type: Capital.com accepts clients worldwide from different countries. It provides several payment methods to add money. Investors can use debit and credit cards, Union pays, Apple Pay, World Pay, Asian online banking, GiroPay, RBS, etc.

- Trading Hours: As Capital.com is available worldwide, it provides trading 24×7. Users can deposit and withdraw anytime if the amount meets the minimum value. Market opening time depends on the asset you choose, but they also provide opening and closing times on their website.

- Demo Mode: Users can check the demo mode available on Capital.com. Users can do most of the available things in Capital.com in demo mode and get the idea. Demo and learn modes are the most vital tools in Capital.com if we compare with its competitors.

- Learning Mode: Capital.com provides courses, blogs, and tutorials to learn basic to advanced. Users can learn and also check the ideas that professional traders suggest. This is one of the best advantages for beginners.

Also Read: NinjaTrader vs TradeStation: Which is the Best Broker?

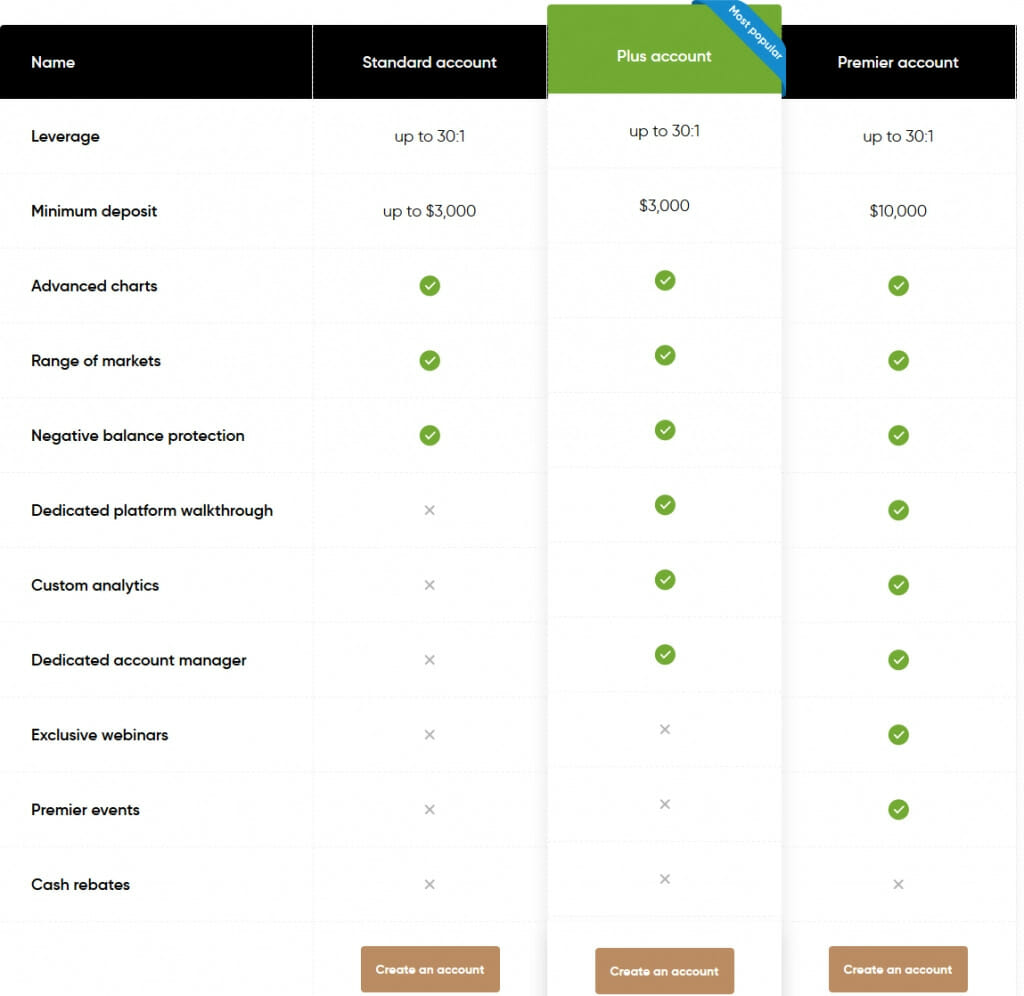

Capital.com Review: Account type

Capital.com offers three types of accounts for investors.

- Standard

- Plus

- Premier

The minimum amount is different for each type of account. The current account is the same for all three, and the Minimum deposit for the Standard account is up to $3k; for the plus account type, it varies from $3k-$9k, and for the premier account minimum amount is $10k. All other facilities are the same for all three account types. It also offers a professional account that is only available for selected users who qualify for a certain degree in trading or have experience in trading.

Also Read: FMZ Quant Review: Quantitative Trading For Everyone

Is Capital.com Safe?

Capital.com provides AI-based technology in their platform that analyzes your trading behavior and gives you options for more profitable decisions. They process users’ data according to GDPR, making Capital.com compliant with Data protection rules. As they provide different account levels and verification is required before trading, it makes them a more reliable and secure platform.

Capital.com Review: Fees

Fees that investors give to brokers are essential things to consider before deciding on a broker. While trading in Capital.com, you won’t have to pay any fees except overnight fees. The overnight fee is based on the leverage provided rather than the entire value of the investor’s position. There is zero signups, deposit, inactivity, per-trade, or withdrawal fee. More than 1000 markets are available on Capital.com, and they do not charge any commission. Instant price alerts are also available to help investors of Capital.com.

The minimum amount for investment is $20, and investors can start with fewer risk factors. The minimum amount for withdrawal is $50 on Capital.com. There is no fee for adding or withdrawing money.

Also Read: How to Earn Crypto on OKEx

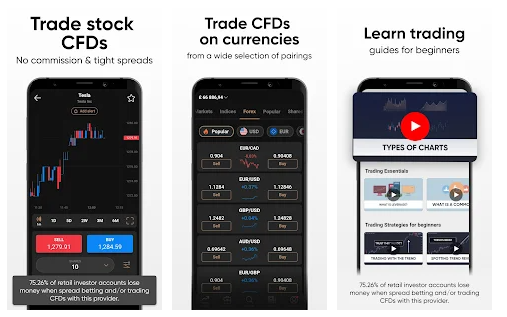

Capital.com Review: Mobile Application

Capital.com is available in web and mobile versions, irrespective of Android and iOS. It provides a free demo for new users and guides how to use the App. Once you go on their website, you will see the option for a free demo where users can’t actually trade or open trading accounts. When you create a new account, it will ask some questions related to your income and then basic details like name, residence, DOB, etc.

They verify the user’s details, requiring Government ID proof. Users will get the option to choose the currency available on Capital.com. Creating an account is easy, and then a chart will show all trending trades, as shown below. Learning mode is available in App, and it is suitable to learn from your phone. News related to every asset is also readily available.

Also Read: Earn Sign-up Bonus – 10 Best Crypto Platforms

Capital.com Review: Pros and Cons

| Pros | Cons |

|---|---|

| Focused on user education and providing training for beginners and Demo accounts are available. | Overnight fees |

| Accept USD, EUR, and GBP account currencies | Few services are restricted for UK Clients |

| No fees for educational materials | |

| Trending Indices, commodities, cryptocurrencies, shares, and currency pairs are available. |

Conclusion

Capital.com allows you to trade indices, forex, commodities, crypto assets and shares all in one place. Further, the platform offers an intuitive mobile app and TradingView charts for keeping track of the market remotely. As a beginner, you can also read the guides at Capital.com and begin your trading journey. The platform is also a safe haven for professional traders as it provides trading tools, news, etc.

Is Capital.com suitable for beginners?

Yes! Even if a user doesn’t know much about trading, he can explore the learning mode and get enough knowledge before trading. Capital.com also provides AI techniques to predict decisions as per investor’s behaviour.

Does Capital.com charge any fees?

No! Capital.com only charges overnight fees.

Capital.com is regulated by Complaints procedure- FCA, ASIC, and CySEC. Users can check the policies in detail on their website, and this platform has been considered safe for trading.

Also read,