Nowadays, Quantitative trading is accessible to retail investors, which comprises trading strategies based on quantitative analysis. Founded in 2014, FMZ Quant is a quantitative trading platform for traders to write, test, and run their trading strategies.

Today, we will review one of the crypto trading platforms called FMZ Quant to learn its features, pros, cons, and prices.

Table of contents

What is FMZ Quant?

FMZ Quant is a quantitative trading platform supporting many bitcoin/eth/altcoin exchange markets for cryptocurrency traders. It also provides a simple trading terminal. They currently offer the most efficient fundamental quantitative tools, allowing customers to skip complicated programming details and concentrate on strategy and backtesting. On their platform, customers can establish an all-rounder automated trading system from:

- High to low frequency

- Cross-cycle to cross-market

Summary

- FMZ Quant is Quant Strategy Development, Quantitative Learning Resources, Strategy Rental, and Sale, Online Communication Community.

- The quantitative trading platform offers:

- High-performance coverage

- Massive & Accurate data, Rapid User Experience

- A variety of trading markets

- A variety of development programming languages

- Accelerate the quantification of business processes

- Reduce the cost of research and development of its systems

- FMZ provides a cross-platform to unify multi-markets into one API interface to share, sell, discuss, and Learn.

- Cloud Deployment-FMZ provides a stable and highly scalable cloud platform.

- Easy use and Stable- One-click deployment to run our strategy

- Seamless Support for China Commodity Futures, Digital Assets. The only quantitative platform available that supports the three primary financial markets.

- Language support- Javascript, MyLanguage, Python, C++, Blockly

- Stable and flexible- FMZ provides superior stability and compatibility. It only focuses on the logic of algorithms. No concerns for underlying details!

- FMZ provides more than 30 crypto exchanges with intelligent market-making strategies and technical support.

- The FMZ Quant provides a variety of intelligent investment business scenarios using a variety of flexible extension programs.

- It supports all kinds of blocking asset transactions in all aspects and quickly provides a one-stop technical service for blocking financial institutions.

- FMZ provides seamless consolidation of quantitative trading modules into any existing system.

- The FMZ Quant works with in-depth cultivation, safety, innovation, efficiency, and convenience as the core values and strives to improve the software functions to adapt to various trading needs.

- The FMZ Quant provides a multi-scenario application for an intelligent investment consultant and uses various flexible extension programs.

- Customer support includes – Telegram, GitHub, and Twitter.

FMZ Review: Products

Fmz.com provides multiple products.

- Quantitative Trading Platform

- Strategy Research and Development

- Investment Consultant Application Expansion

- Unblocking Asset Trading System

It provides strategy security, accurate data, stable platform, fast steep, and compliance transactions, basic needs of all quantitative investors.

The FMZ Quant has two primary trading platforms:

- Cloud – FMZ cloud server docker

- Local – FMZ online console and trading terminal

To provide the best technical solutions for commodities futures brokers, investment institutions, and individual customers.

Quantitative Trading Platform Architecture

FMZ Quant Trading Platform is the only quantitative platform that supports the three primary financial markets. The FMZ quantitative platform consists of three parts:

- FMZ cloud server docker

- FMZ online console

- FMZ quantitative trading terminal

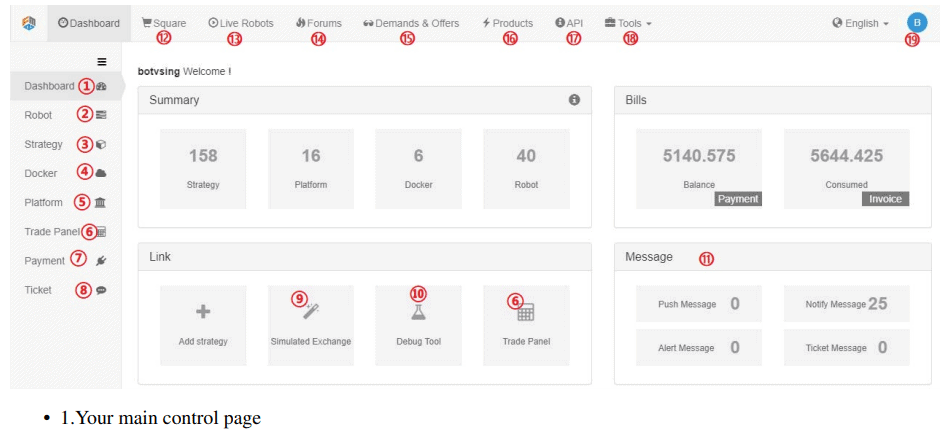

FMZ Online Console

The online console and FMZ terminal monitor manage strategies, giving an integrated visual operation interface for strategy development, research, management, operational monitoring, risk control, and signal analysis. It can build strategy-based funds, positions, performance indicators, and rich risk control rules for tradeable markets and codes with a comprehensive risk control mechanism. It can specify risk control behaviors from reminders, warnings, restricted transactions to the automatic closing position.

FMZ Review: Cloud Server Docker

Cloud server dockers are responsible for giving data and infrastructure services in the background. A regular strategy event model integrates real-time data/analog data/playback data/transaction data into the Complex Event Processing Engine (CEP), driven by a typical event pattern. Flexible switching of data sources does not require modified code to achieve seamless migration of all strategy phases. Cloud server docker’s Background Service is 24/7 available, ensuring that users can develop, debug, check and simulate transactions 24/7 to improve strategy development efficiency.

FMZ Review: Quantitative Trading Terminal

Intelligent cloud server docker:

- Standardizes data and transaction interfaces,

- Access data and compliance trading channels in dominant markets,

- Completely shield the gaps and complexity of exchange access, and

- Avoid high technical and Labour costs.

It supports all major programming development languages such as C++, Python, JavaScript, etc., to ensure the honesty of the platform to the greatest extent.

FMZ Review: Features

FMZ Quant has many other features for its users.

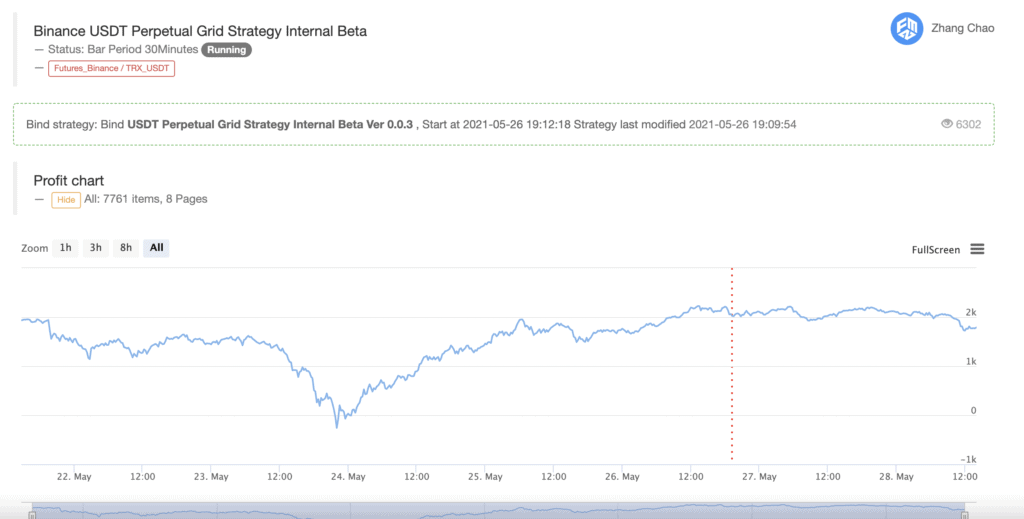

Real-time Backtesting System

It has an efficient simulated backtesting environment. The industry-leading high-performance QPS/TPS backtesting engine accurately represents the history, reduces common quantitative traps, and quickly recognizes strategies for deficiencies, thus better helping to invest in real-world investments.

Best Choice for Beginners and Professionals

Easy to commence, the specific API documentation and the standard template strategies help users to start immediately. For beginners, they have serious tutorial videos that can help us at each step.

Massive Supporting Different Exchanges

Cross-platform, support all major trading exchanges. A strategy wrote on the platform is suitable for all major exchange platforms, which means that a strategy is usable across platforms. For example, a strategy running for the Binance is transferrable to OKEX or other exchange platforms. It supports more than 50 exchanges all around the world.

Feely Access

The remote hosting trading program and web-based control mechanism are very convenient. We can view the revenue, modify and turn on and off the strategy whenever the internet is accessible anytime, anywhere.

Trading Varieties

FMZ offers traditional spots and futures trading, such as leverage trading on Bitmex. Additionally, It provides cross-platform, cross-market arbitrage trading. Substitute all kinds of cryptocurrencies trading in any way we want.

Supported Crypto Exchange and Programming Language

FMZ supports nearly all popular exchanges, such as Binance, Bitfinex, Bitstamp, OKEX, Huobi, Poloniex, etc. We can also trade futures on OKEX and BitMEX. We only need to write one strategy and can run it on all exchanges without any changes.

FMZ supports Javascript, MyLanguage, Python, C++, Blockly (JavaScript and Python recommended) for coding strategies. FMZ supports general and widely used programming language. It helps in improving our quantitative trading and programming skills at the same time.

FMZ Quant Fees

FMZ fee is low. It is 0.125 RMB per hour, which means 0.01804 dollars per hour {translates to 1.32 INR per hour}. Compared with those monthly payments and low customized options, the platform provides a quantitative instrument to improve user’s strategies to the bottom programming level. It offers simulation trading for free.

FMZ Quant Review: Security

FMZ Quant platform is secure and reliable. The docker of distributed architecture is decentralized disposed on a specific server. Users need to use and maintain their respective docker independently (either on their computer or buy a cloud server), reducing the risk for the platform to become a hotspot for hackers. The platform server does not store any user’s funds and transaction logs to preserve users’ information. There are no privacy issues between the platform and the users.

FMZ Quant Review: Pros and Cons

Like two sides of a coin, everything has its pros and cons. We have tabulated some of the advantages and disadvantages of using FMZ Quant below. You can take a quick look at them in the table below and decide further.

| Pros | Cons |

|---|---|

| Provides Quantitative learning resources. | It does not support foreign exchange for traditional markets |

| The trading platform offers Massive & Accurate data, Rapid User Experience. | Basic customer support restricted to Telegram and GitHub |

| High-performance coverage. | |

| A variety of trading markets. | |

| A variety of development programming languages- Javascript, MyLanguage, Python, C++, and Blockly. | |

| Low cost of the quantitative trading platform. | |

| A cross-platform to unify multi-markets into one API interface. | |

| Stable and highly scalable cloud platform. | |

| Easy use and Stable. | |

| Seamless Support for China Commodity Futures, Blockchain Assets. | |

| Supports three major financial markets | |

| Provides more than 30 crypto exchanges | |

| Intelligent market-making strategies and technical support | |

| A multi-scenario application for investment consultants. |

FMZ Quant Review: Conclusion

FMZ Quant is a platform primarily for quantitative trading, supporting various cryptocurrencies, crypto exchanges, and programming languages. They provide a comprehensive quantitative trading platform and many other features such as backtesting, trading varieties, etc.

The FMZ Quant tool is devised for high-frequency trading and has rigorous requirements for performance and safety. The platform carries high-frequency strategy, arbitrage strategy, and trend strategy. It integrates the entire process of strategy development, testing, optimization, simulation, and actual trading. In addition, it supports both simple and easy-to-use M languages, as well as advanced quantitative trading languages { such as Python and C++ }.

It has low fees than any other platform out there- 1.32 INR/hour or 0.01804 USD/ hour. The platform is entirely safe and reliable.

Only, the downfall is that it does not support foreign exchange and basic customer support. Apart from this, The platform user-friendly and packed with features. It is excellent for beginner quants.

Frequently Asked Questions

Does it have a mobile app?

FMZ Quant offers necessary mobile device applications, pushing alerts on our mobile devices to view trading status, convenient for checking our trading logs 24/7. The mobile app is completely customizable.

What can FMZ do for me?

FMZ provides a lot of benefits for beginners or any automated trader in general. A trader can

– Learn to write bots(strategies) from provided strategies’ square that contains lots of open source code,

– Share strategy’s code with others,

– Ask for professional help any time,

– Run strategy on any exchanges,

– Control bot on the website with computer or cellphone,

– Sell strategies if desired,

– Communicate with many others auto-trading lovers in the group provided by the platform.

Concisely, FMZ is a comprehensive platform for those who want to do automated trading.

Is the number from the backtesting system accurate? Can the results be trusted?

FMZ divides the backtesting system into:

1. Real market-level- holds the whole completed historical data backtesting

Simulation level- carries the K-lines data at regular intervals.

2. The real market historical data make the basis for both the levels, which is most accurate. Hence, The results are more reliable.

How to use FMZ Quant?

FMZ Quant is not just a Quantitative trading platform.

It provides quantitative learning resources. It has a very sleek and simple interface. FMZ also offers in-depth video tutorials and blogs to teach how to use the platform. Using FMZ is pretty simple! We need to have considerable computer knowledge and skills for quantitative trading. However, the platform simplifies that as well with tutorials and user guides on the website.