Whether you are new to the crypto space or an experienced hodler, it is no news that the crypto industry is known for its volatility. While Bitcoin and Ethereum witnessed their all-time highs this year, the prices still keep fluctuating. With such an extreme market, it becomes imperative to look for ways to earn a greater yield on your coins despite the market being bullish or bearish.

This is where the crypto lending platforms step in to bring some stability in the otherwise volatile market. Simply put, crypto interest-earning platforms allow you to earn interest on your crypto assets as you lend these assets on the platform. This way, you don’t need to actively do anything, and you can earn a passive income consistently.

If you live in Hong Kong and are keen on earning passively with a crypto lending platform, then look no further. We have put together the top 5 crypto lending platforms in Hong Kong to watch out for in 2022.

Table of Contents

1st Best Crypto Lending Platforms in Hong Kong: Crypto.com

Crypto.com is regarded as one of the leading organizations in the crypto lending industry for earning interest on cryptocurrencies. Furthermore, because this loan platform accepts over 50 different coins, it is willing to provide USD Coin with an annual percentage income of up to 14.0%.

Among the various exchanges we studied, Crypto.com stood out because it offers appealing crypto lending options, such as the option of selecting a flexible loan length that you may lock in for 1 or 3 months.

Naturally, locking in your cryptocurrency will earn you better rates (you will be penalized if you withdraw it sooner), but you can also earn higher rates if you unlock it before that time.

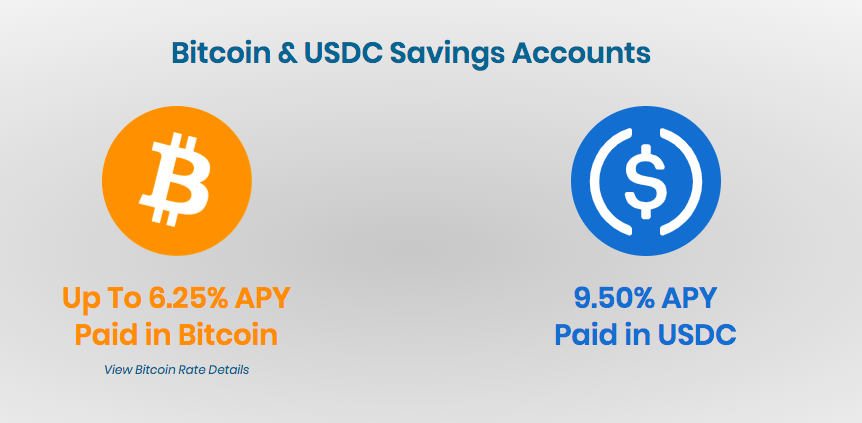

2nd Best Crypto Lending Platforms in Hong Kong: Ledn

Ledn is a Canada-based robust and secure platform that helps you maximize your Bitcoin holdings and secure a loan against your BTC. If you are looking for a Bitcoin-specific loan or savings account, then Ledn is a good option. The platform mainly offers three products. First are the Bitcoin-backed loans for those who want to take a loan while leveraging their bitcoin holdings. Another product is their bitcoin and USDC savings account which offers up to 6.10% APY on Bitcoin and 9.5% APY in USDC.

Lastly, we have the B2X product, which is a quick way to double your Bitcoin balance with a bitcoin purchase and Bitcoin-backed loan. B2X allows users to increase their bitcoin holdings with a bitcoin-backed loan. With this service, users can hold twice as much bitcoin with a B2X loan for the amount of dollar used to purchase the BTC. As for the savings account, you can withdraw the funds at any time. However, you will have to bear a $10 fee for each USDC withdrawal.

Also read: Celsius Network vs BlockFi vs Hodlnaut | Interest Rates, Fee and Risks

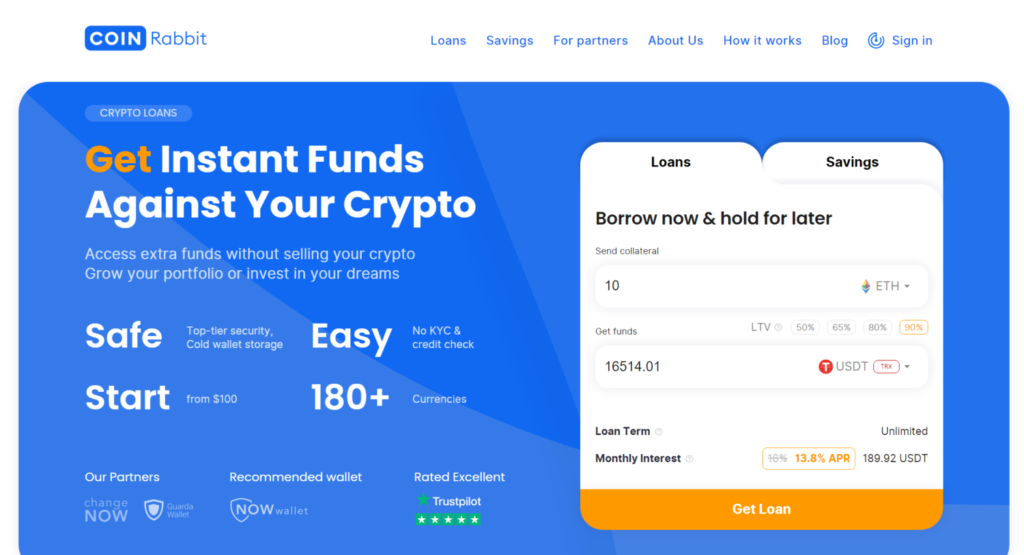

3rd Best Crypto Lending Platforms in Hong Kong: CoinRabbit

CoinRabbit provides a number of borrowing solutions to meet the needs of various consumers. Users can select either a collateralized or uncollateralized loan. Users can borrow up to 80% of the value of their bitcoin assets with a collateralized loan, while users can borrow up to $5,000 without the requirement for collateral with an uncollateralized loan.

The site accepts a variety of cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and others. CoinRabbit also provides fixed-term loans, in which consumers may select the loan term and interest rate that best meets their needs.

Further, when compared to other cryptocurrency loan platforms on the market, CoinRabbit’s interest rates are competitive. Interest rates are set by market demand and supply and are modified on a regular basis.

Read our CoinRabbit review to know more.

4th Best Crypto Lending Platforms in Hong Kong: Nexo

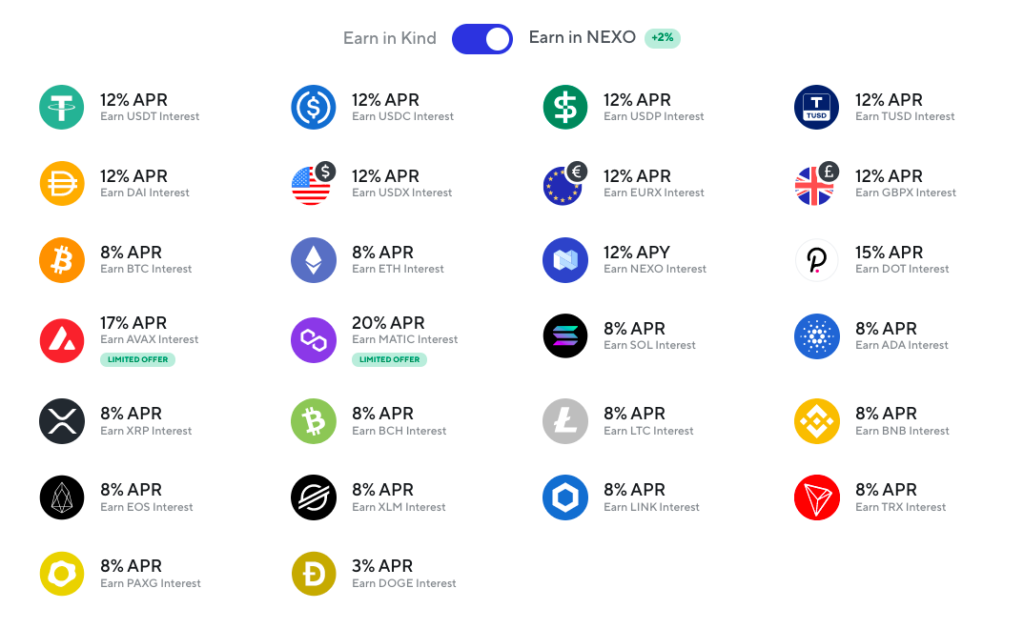

Nexo is based in London and offers a multitude of products. It has interest accounts with which users can earn lucrative interest rates on their crypto or fiat assets. Nexo also has a Nexo card, and crypto loan, and a debit card that grants access to the crypto credit line using which users can spend without selling their crypto.

Nexo aims to replace the traditional banking system and offer tax-efficient and high-yield products to maximize the value of digital assets. The platform supports various crypto assets, including Bitcoin and Ethereum, and fiat currencies like the Pound Sterling. It offers up to 12% APY for users who choose to earn Nexo tokens.

Read our Nexo review to know more.

Also, read BlockFi vs CoinLoan vs Nexo| Best Lending Platform?

5th Best Crypto Lending Platforms in Hong Kong: Youhodler

YouHodler should not be overlooked while discussing the crypto loan exchanges that stand out the most for Australian investors. It is on par with Crypto.com in terms of variety, as the facility offers lending across 50 different cryptocurrencies.

There are a variety of interest rates available, however Tether has the highest rate at 12.3% APY, followed by USD Coin at 12.0% APY and Bitcoin at 4.8% APY.

YouHodler‘s distinct characteristics set it apart from other lending platforms. You can, for example, use the crypto in your savings account as collateral for crypto loans by taking out crypto loans.

Conclusion

If you are a crypto hodler in Hong Kong who would like to leverage lending platforms, then the platforms mentioned above are worth trying. You can earn passive income in one of the easiest ways by simply holding your coins with these platforms. Having said that, you should do your due research and choose the right platform for yourself.

Also read,