o1.exchange is a decentralized trading terminal built on Base and Solana, offering advanced trading features, multi-wallet management, fiat on ramps, token analytics, and a robust rewards ecosystem. In this article, we will explore the o1.exchange Review.

Table of Contents

What Is o1.exchange?

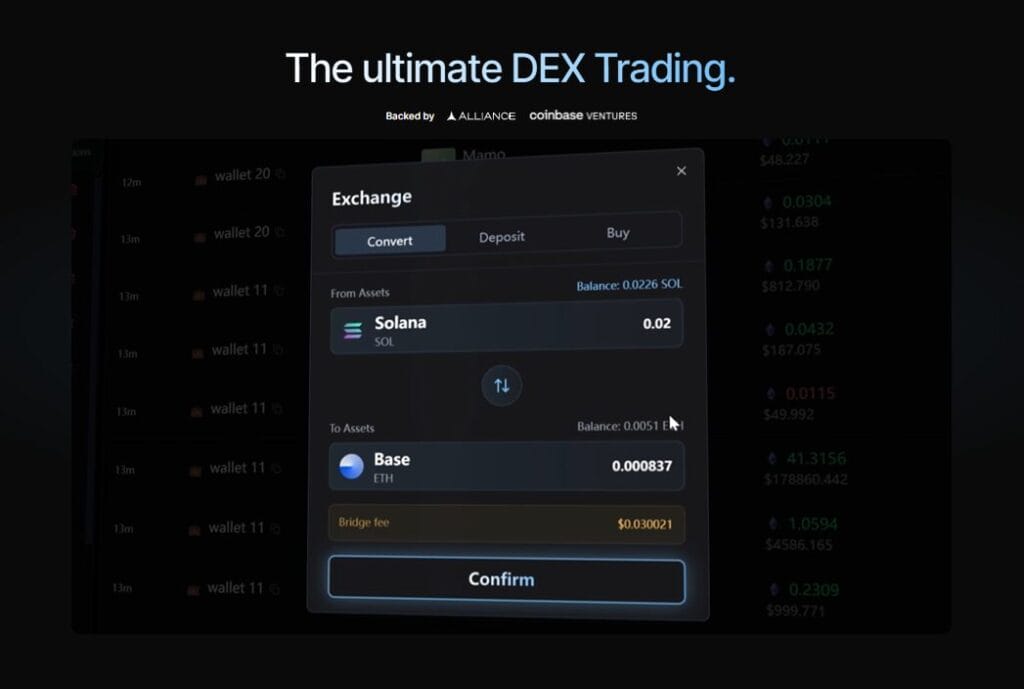

- o1.exchange is the first full-featured trading terminal on Base and Solana, offering users a unified platform to explore tokens, execute trades, manage wallets, analyze portfolios, and engage in reward programs while retaining full ownership of their funds through a non-custodial design.

- The platform integrates decentralized protocols directly into its trading engine, ensuring all transactions occur on-chain with complete user control. Its architecture combines professional-grade tooling with retail-friendly usability, supporting fast execution and multi-chain operations.

- Users can discover trending tokens, perform high-speed trades, buy crypto through an integrated onramp, track earnings, manage rewards, and execute advanced order types—all within an interface designed to match centralized exchange performance while maintaining decentralized transparency.

- With support for Base and Solana, and more chains planned, o1.exchange functions as a cross-chain trading hub, enabling users to bridge assets, switch networks, and track portfolios easily without external tools or custodial dependencies.

Features and Products

- o1.exchange includes a streamlined fiat-to-crypto onramp powered by Coinbase, allowing users to convert traditional currencies such as USD and EUR directly into digital assets using credit cards, bank transfers, or digital wallets without leaving the platform’s trading environment.

- Users can purchase assets instantly with major credit and debit cards, enabling fast liquidity access, while ACH and wire transfers offer lower-cost options for users prioritizing reduced fees or larger transaction amounts during fiat onboarding.

- Digital wallet support enables seamless payments through Apple Pay, Google Pay, and popular digital wallets, allowing users to execute fiat conversions with high convenience and immediate settlement into their non-custodial wallets.

- The token exploration suite includes comprehensive discovery tools such as trending token lists, new listings, top gainers and losers, high-volume assets, and market insights, allowing users to analyze performance and identify emerging opportunities directly within the terminal.

- Trending token indicators highlight assets gaining community attention, while new listings help users stay updated on early-stage opportunities. High-volume filters emphasize tokens with strong liquidity and trading activity for strategic decision-making.

- Advanced trading features include spot trading for instant market execution, limit orders for price-targeted execution,sniper orders for high-speed targeting of liquidity events or token launches, and TWAP strategies that distribute orders over time for controlled market impact.

- The trading engine is built for precision and flexibility, allowing traders of all experience levels to choose execution methods aligned with their strategy. High-speed execution and on-chain settlement ensure transparency and control over every order.

- Wallet management tools offer users the ability to create, import, export, and organize wallets under a single o1.exchange account, enabling multi-wallet workflows that support different strategies, asset allocations, or security preferences.

- Users can generate new wallets instantly, import existing wallets using secret keys, or export up to 100 wallets at once through a unified 12-word recovery phrase, simplifying migration and consolidated backup processes.

- Individual wallet actions allow users to archive unused wallets, set primary wallets for transactions, export private keys when needed, or toggle wallets active or inactive to maintain an organized dashboard for multi-strategy asset management.

- Token splitting and consolidation features allow users to move tokens between wallets effortlessly, enabling strategic organization, account segmentation, or simplified portfolio distribution for different trading or holding purposes.

- Multi-wallet analytics enable users to select specific wallets, group wallets into custom sets, or analyze performance across all active wallets simultaneously. Aggregated analytics deliver holistic overviews with token allocation, performance trends, and real-time valuations.

- The portfolio dashboard provides real-time analytics across all wallets, presenting token balances, performance tracking, distribution breakdowns, and multi-wallet comparisons, allowing users to analyze financial behavior across selected wallets or combined aggregated views.

Fees

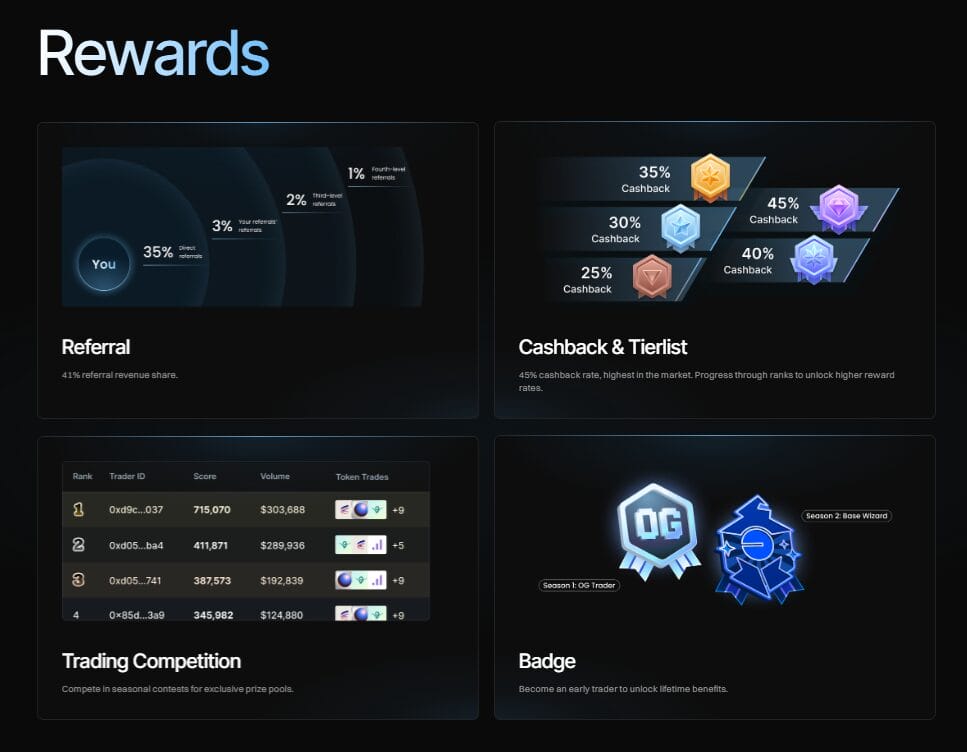

- o1.exchange uses a competitive fee structure compared to standard 1% trading terminals, offering cashback tiers that reward frequent trading. Cashbacks are applied directly to net fees, reducing overall trading cost as trading volume increases.

- Tier 1 provides 0.25% cashback with an effective net fee of 0.75%, offering immediate savings over typical market rates. Higher tiers progressively improve rewards with increased trading volume, incentivizing continued platform engagement.

- Tier 2 rewards users with 0.30% cashback for a net fee of 0.70%. Tier 3 increases cashback to 0.35% with a net fee of 0.65%, providing advantages for mid-volume traders seeking meaningful fee optimization.

- Tier 4 offers 0.40% cashback with a 0.60% net cost, while Tier 5 provides the highest reward at 0.45% cashback with a net fee of 0.55%, making high-volume trading significantly more cost-efficient for active platform participants.

Security

- o1.exchange is fully non-custodial, ensuring funds and private keys remain under user ownership at all times. Security infrastructure relies on industry-leading systems and Turnkey-based key management for secure, distributed wallet control.

- All trades, transactions, and portfolio operations occur on-chain, eliminating reliance on centralized intermediaries. This structure enhances transparency, reduces risk exposure, and positions o1.exchange as a trustless, user-controlled trading environment.

Affiliate / Referrals and Rewards

o1.exchange offers a 4-tier referral system with competitive reward rates:

- Tier 1: 35% from direct referrals

- Tier 2: 3% from second-level referrals

- Tier 3: 2% from third-level referrals

- Tier 4: 1% from fourth-level referrals

All referral rewards are credited in real time, directly to your account as your network trades. Users can maximize earnings by building a strategic trading network, educating referrals on platform usage, and leveraging community platforms to expand referral reach. The rewards program includes a comprehensive point system that issues points for trading activity, referrals, and participation in seasonal events. Points are earned through multiple sources:

- Trading points based on trade volume across all supported networks

- Referral points from multi-level network activity

- Bonus points during seasonal events and promotional campaigns

Trading points follow a structured formula with multi-network aggregation and token-based multipliers; e.g., default rate is 50 points per 1 SOL traded (or equivalent). Referral points accrue up to four levels deep, with different point rates per level and support for multi-chain accumulation. Additional point sources include:

- 200 points per direct invite

- Promotional event bonuses

Trading Season 1 (Early Beta) rewarded OG traders who supported the platform during its beta launch.

Trading Season 2 (Base Season) focuses on ETH trading volume and provides tier-based seasonal rewards on the Base network.

The Zora Trading Contest is an eight-week competition offering 2,500,000 ZORA tokens to participants holding the Base Wizard Badge.

Data Analytics and Performance

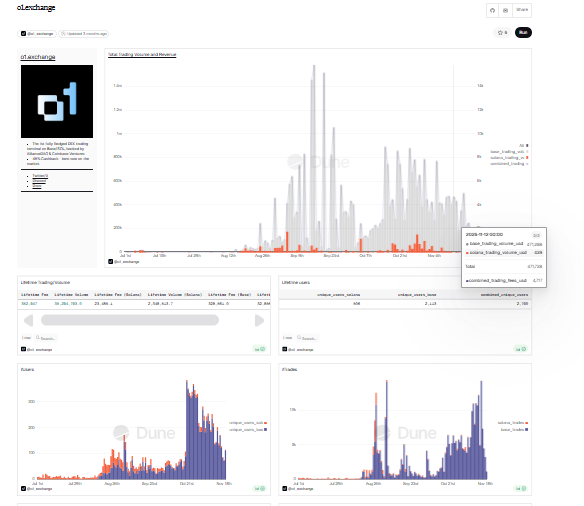

- o1.exchange shows strong, accelerating growth, with trading volume rising sharply from July onward and peaking during September–October.

- Base network dominates activity, with significantly higher volume than Solana, highlighting Base as the platform’s primary liquidity hub.

- Weekly and monthly charts indicate consistent increases in both volume and total transactions, proving sustained user engagement rather than short-lived spikes.

- Cumulative user metrics show steady onboarding of new traders, with unique users rising across daily, weekly, and monthly periods.

- Trading peaks align with reward seasons, campaigns, and token launches, showing incentives significantly boost activity.

- Overall performance trends suggest strong retention, expanding multi-chain usage, and growing trader confidence, positioning o1.exchange as a fast-rising DEX terminal on Solana and Base.

Conclusion

o1.exchange is rapidly emerging as a leading on-chain trading terminal across Base and Solana, combining powerful trading features with intuitive wallet management, fiat onramps, and a strong rewards ecosystem. Dune analytics show consistently rising trading volume, growing weekly and monthly transactions, and steady onboarding of new users—proof of sustained momentum rather than short-lived spikes. Base remains the primary driver of activity, while incentive campaigns significantly boost engagement. With its competitive cashback model and expanding multi-chain support, o1.exchange is positioned for continued growth as a high-performance, user-focused DeFi trading platform.

Does o1.exchange support multi-language interfaces?

At this time, the platform is primarily available in English. Multi-language support may be introduced as the user base expands.

Does o1.exchange charge withdrawal fees?

Withdrawals occur directly from your non-custodial wallet, so the platform does not charge withdrawal fees. You only pay standard network gas fees based on the blockchain used.

Are there trading limits on o1.exchange?

No platform-level trading limits exist for on-chain trades. Limits may apply only to fiat onramps or by the user’s connected wallet balances.