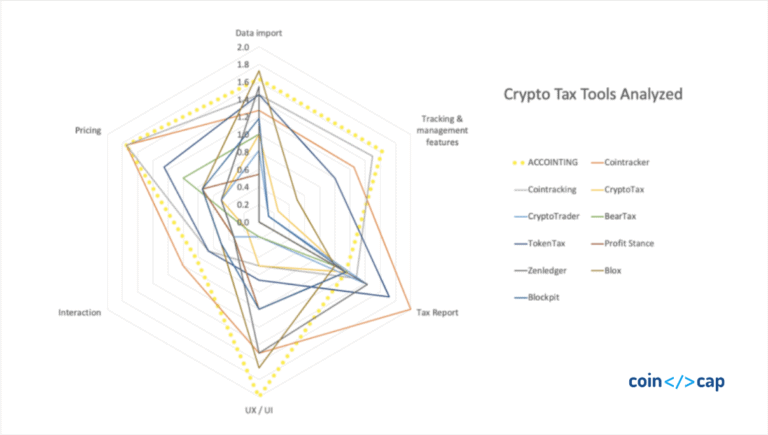

Crypto tax filing can be a lengthy and overwhelming process. In addition, choosing the best crypto tax software may seem another complicated task, but if you find the right one, it can help you pay the right amount of tax at the right time, save your time to file crypto tax reports, thus make your work simpler. Therefore, here are some of the best crypto tax softwares for you:

| Crypto Tax Softwares | Registered Year | Price | No. of crypto exchanges supported |

|---|---|---|---|

| Accointing | 2018 | Ranges from $79 – $299 | 400+ exchanges |

| CoinTracking | 2012 | Ranges from 10.99 USD – to 54.99 USD | 110+ exchanges |

| TokenTax | 2017 | Ranges from $65 – $799 | All exchanges |

| TaxBit | 2018 | Ranges from $50 – $500 | 500+ exchanges |

| CrytoTax Calculator | 2018 | Ranges from $49- $299 | 400+ exchanges |

Table of Contents

What are Crypto Tax softwares?

Crypto Tax software are tools that can help you prepare your taxes for the cryptocurrency assets you hold. Moreover, these tools allow you to estimate profit and loss from cryptocurrency trading and take deductions on expenses. In addition, this software imports data from wallets and exchanges to track the cost of the crypto assets, and generates tax reports.

Also read, Best Bitcoin Accounting and Crypto Tax softwares

Accointing: 1st Best Crypto Tax Software

Accointing can automatically import all your transactions from more than 300 wallets and exchanges through APIs or Xpubs or manually input them via a provided Excel template, which helps the software calculate taxes. This is an all-in-one platform that offers its customers a lot of services like a crypto tax calculator, trading tax optimizer, crypto tracker, and hub. Moreover, along with a crypto tracker, it also has a cryptocurrency tax calculator that delivers specific outputs for Germany, Switzerland, Austria, the UK, the US, or any other country.

Also read, Accointing Review- A Complete Crypto Tax solution

Accointing: Features

- Crypto Tracker: With the platform’s crypto tracking and insight tool, you can dive deep into all your transactions. All your wallets and exchanges will be connected automatically with its crypto portfolio tracker. In addition to this, they also provide you with free templates, making your portfolio easily manageable.

- Dashboard: The platform provides you with an intuitive dashboard with a summary of all your token’s buy and sell, overall gains, net profit, and much more. Moreover, you can track your entire crypto portfolio and gain performance in real-time.

- Crypto Tax Calculator: This particular platform is for US-based citizens to file their yearly income and taxable gains to the IRS or through Turbotax.

- Classifies and calculates crypto taxes: Accointing automatically classifies all your transactions on taxes based on your country’s regulations for margin trading, Defi staking, mining, etc. Moreover, it optimizes transactions by recognizing possible tax-saving opportunities by checking tokens held for almost a year and thereby helps you harvest loss.

- Trading Tax Optimizer: The platform’s Trading Tax Optimizer (TTO) is looking forward to optimizing its crypto taxes. It is temporarily available free of cost and as a part of your crypto tax package. Furthermore, it gives low risks and high rewards.

Accointing: Fee Structure

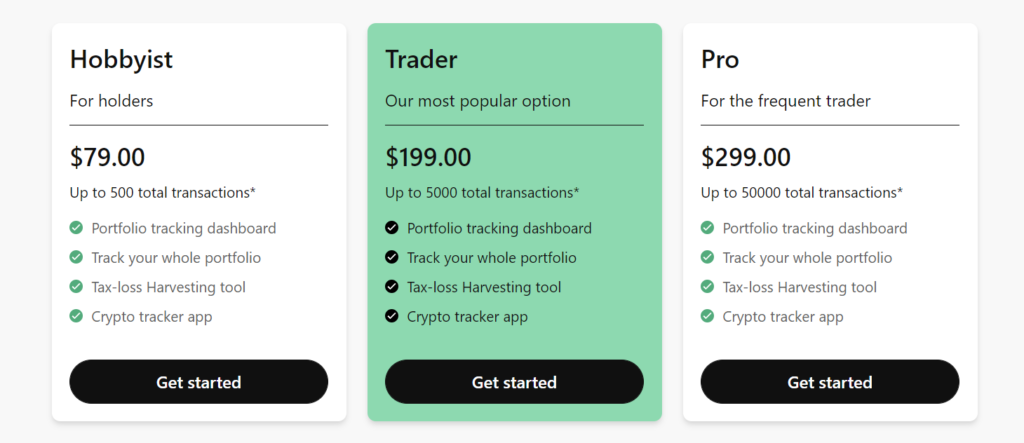

With Accointing, you can get started for free, but it’s only limited to up to 25 transactions per year. Apart from this, there are three main pricing plans that the platform provides, and these are:

- Hobbyist: This plan is basically for holders and costs $79 per year. It supports up to 500 total transactions.

- Trader: This plan is one of their most popular options and costs around $199 per year. It supports up to 5000 total transactions.

- Pro: This plan is for frequent traders and costs $299 per year. It supports up to 50000 total transactions.

All the above plans Also provide a Portfolio tracking dashboard, Tax-loss Harvesting tool, and Crypto tracker app. Moreover, it also lets you track your whole portfolio.

Accointing: Pros and Cons

| Pros | Cons |

|---|---|

| Pros | Cons |

| The platform is easy to use and manageable. | There are no cons so far. |

| Accointing provides you with an intuitive dashboard. | |

| Moreover, the platform supports over 400+ crypto exchanges and wallets. | |

| They provide you with a crypto tax calculator. |

CoinTracking: 2nd Best Crypto Tax Software

CoinTracking is the world’s first cryptocurrency portfolio manager and test reporting tool. It was founded back in 2012 and went online in April 2013. The goal of this company is to make lives easier for cryptocurrency traders and not only during the tax season. CoinTracking has over 106 tax lawyers and tax advisers to assist with international tax filing. The platform’s work is to analyze all your trades and generate real-time reports on the values of your coins, unrealized and realized gains, profit and loss, reports for taxes, and many other things.

Also read, CoinTracking Review – A Reliable Crypto Tax Software

CoinTracking: Features

- Crypto CPAs: This is among the best tax software is all you need to begin serving cryptocurrency traders and expand your menu of services. CoinTracking is always preferred for Cryptocurrency CPAs as it is affordable, works with all the major cryptocurrency exchanges, and is affordable.

- Fund Managers: CoinTracking provides a hassle-free environment for all the fund managers who deal with multiple cryptocurrency portfolios.

- Professional Help: The platform offers you professional help, and the Full-Service team reviews your tax. Moreover, there are crypto tax laws imposed for 100+ countries.

- Tax Reports: CoinTracking allows you to generate tax reports for free if you made 100 or fewer trades during a year.

- Trade Imports: You can trade imports from across 110+ exchanges automatically via APIs or directly syncing with the blockchain.

- Coin Charts & Trends: The platform provides chart history for all 18345 coins that are listed and shows the latest prices for all. In addition, you can find the historical prices for all the coins in the form of a chart.

CoinTracking: Fee Structure

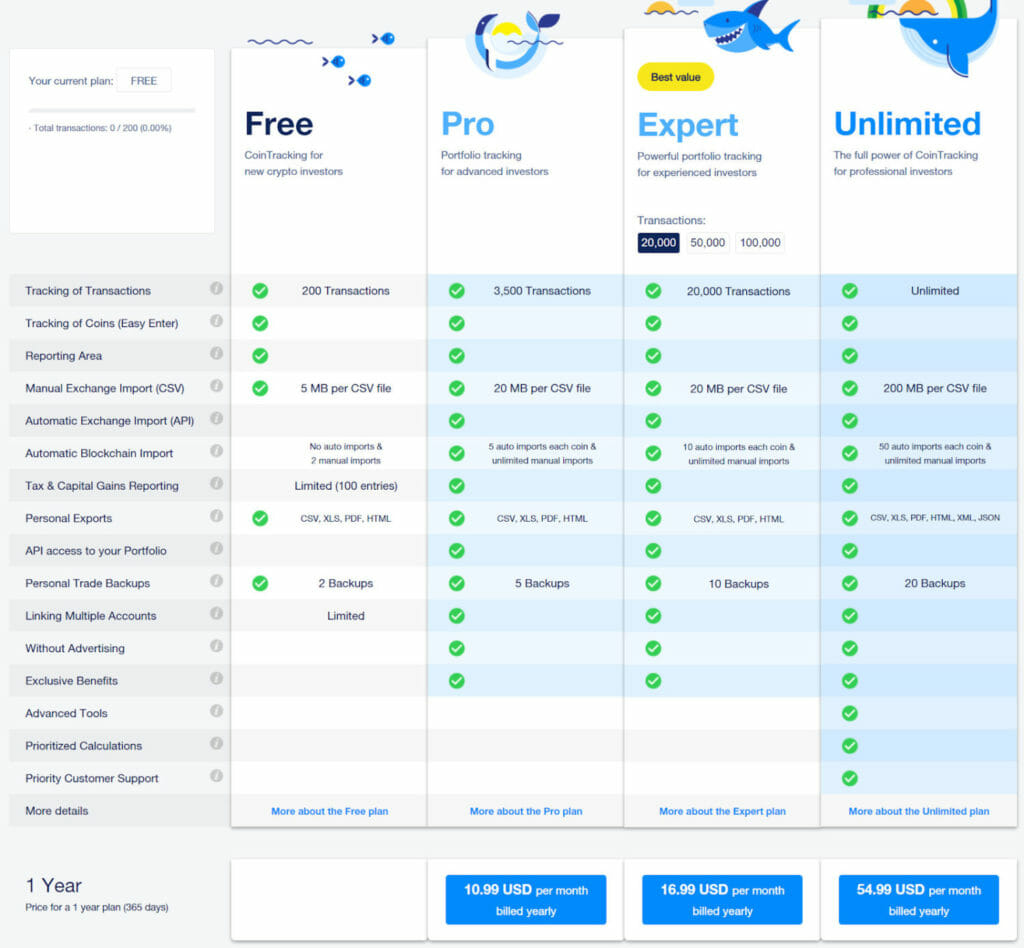

CoinTracking offers you four different pricing structures, one of which is free. Moreover, you can choose the duration of your plan, like one year, two years, or a lifetime. These pricing plans are as follows:

- Free Plan: This plan is for new crypto investors and supports 200 transactions. It also provides 2 backups and limited linking of multiple accounts.

- Pro Plan: This plan costs about 10.99 USD per month billed yearly and is for advanced investors. It supports up to 3500 transactions and 5 backups.

- Expert Plan: This plan is the best value plan you can get and costs 16.99 USD per month billed yearly. It is made for powerful portfolio tracking for experienced investors. There are 2 different transactions you can choose from, and that is 20,000 transactions, 50,000 transactions, and 100,000 transactions. Moreover, it supports 10 backups.

- Unlimited Plan: The unlimited plan costs you about 54.99USD per month billed yearly. It gives you the full power of CoinTracking and is for professional investors. The number of transactions it supports is unlimited and gives 20 backups.

Coin Tracking: Pros and Cons

| Pros | Cons |

|---|---|

| The platform provides you with a customizable reports feature. | The platform is a little hard to use at first glance. |

| It supports over 100 countries. | |

| There is a wide list of tax reports. | |

| The platform also offers you professional help. |

TokenTax: 3rd Best Crypto Tax Software

If you are searching for a platform that can do your taxes with the help of professionals but still with a considerably lower price than all the other competitors, we highly recommend TokenTax. Their custom-build platform handles all aspects of digital asset taxes, from automatic tax form generation to capital gains calculation. Moreover, TokenTax helps in seamlessly tracking your capital losses, capital gains, and tax liability for every virtual currency transaction.

TokenTax: Features

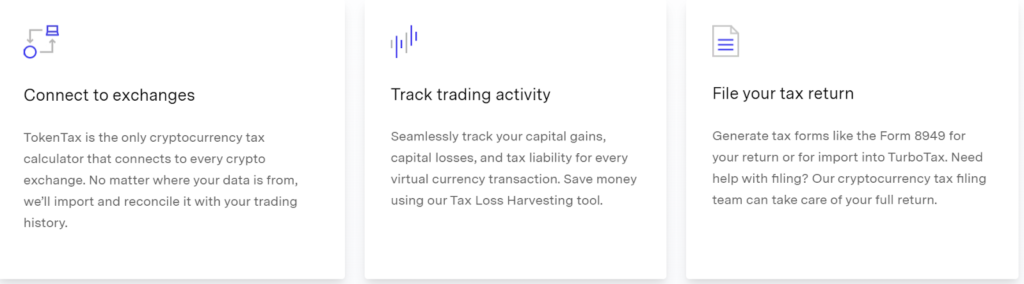

- Connect to Exchanges: It is the only crypto tax calculator that connects to every crypto exchange. They will import and reconcile your data with your trading history no matter where it is.

- Track trading activity: For every virtual currency transaction, seamlessly track your capital gains, tax liability, and capital losses. Then, save your money using the tier Tax Loss Harvesting tool.

- Supports every exchange: TokenTax supports and connects every exchange like BitMEX, Binance, and Coinbase with API import.

- Tax Loss Harvesting: The platform’s Tax Loss Harvesting Dashboard tells you what exactly your unrealized losses and gains are.

- International Taxes: You can calculate your crypto taxes in the U.K., Sweden, Australia, Canada, South Africa, Japan, or any other country as the platform supports any country in any currency.

Also read, 5 Best Crypto Exchanges In South Africa

TokenTax: Fee Structure

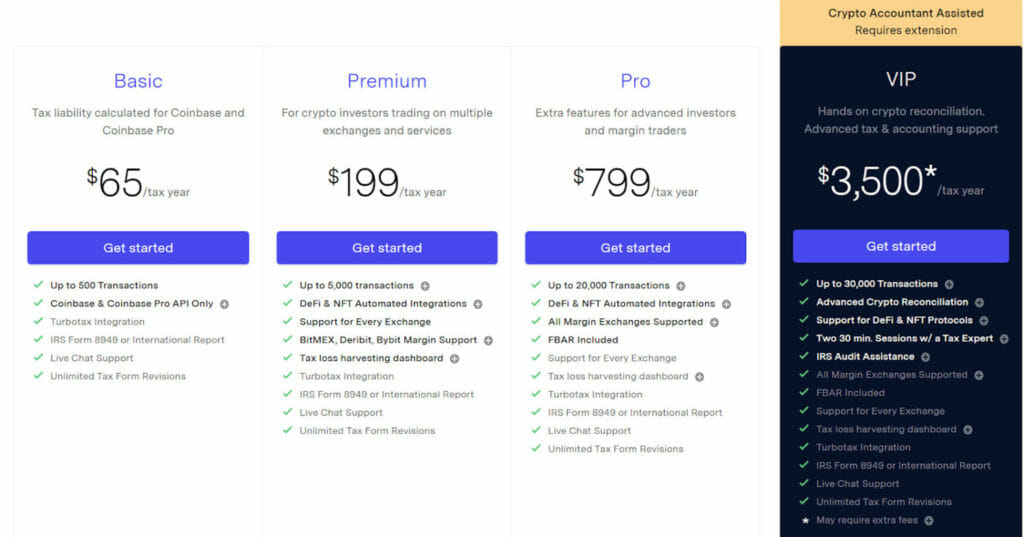

TokenTax pricing structure consists of fours plans, including one VIP plan. In addition to this, you can save 10% if you purchase a plan for multiple years. These plans are as follows:

- Basic Plan: It costs $65 per tax year and calculates tax liability for Coinbase and Coinbase Pro. It supports up to 500 transactions.

- Premium Plan: The plan costs $199 per tax year and is for crypto investors trading on multiple exchanges and services. This plan can support up to 5,000 transactions.

- Pro Plan: This plan costs $799 per tax year and has extra features for advanced investors and margin traders. For example, it supports up to 20,000 transactions.

- VIP Plan: The VIP Plan costs you $3500 per tax year and gives you hands-on crypto reconciliation along with advanced tax & accounting support. Moreover, it supports up to 30,000 transactions.

TokenTax: Pros and Cons

| Pros | Cons |

|---|---|

| The platform is user-friendly and clean. | It is expensive at higher tiers. |

| It supports majorly all cryptocurrency exchanges and NFT marketplaces. | Some of the key features are lacking in the Basic and Premium versions. |

| The platform works in all countries. | There is no mobile app available. |

| Moreover, they can handle all aspects of digital-asset taxes, from capital gain calculation to automatic tax form generation. | |

| There Tax Loss Harvesting dashboard tells you exactly what are your losses and unrealized gains. |

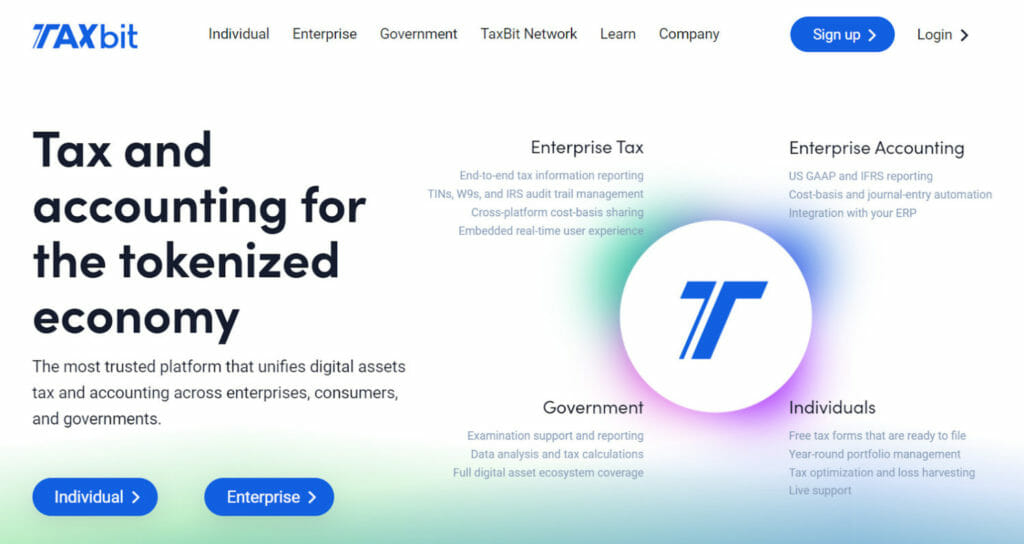

TaxBit: 4th Best Crypto Tax Software

TaxBit is the most trusted platform that unifies accounting and digital assets tax across governments, consumers, and enterprises. The platform was founded in the year 2018 by CPAs, software developers, and tax attorneys. Their tax experts, excellent customer service, and software can help you subvert and solve roadblocks with new compliance protocols or reporting issues. TaxBit works by bringing all of your cryptocurrency balances and transactions from your wallets and exchanges into one place. Moreover, TaxBit has its headquarters in Seattle and Salt Lake City.

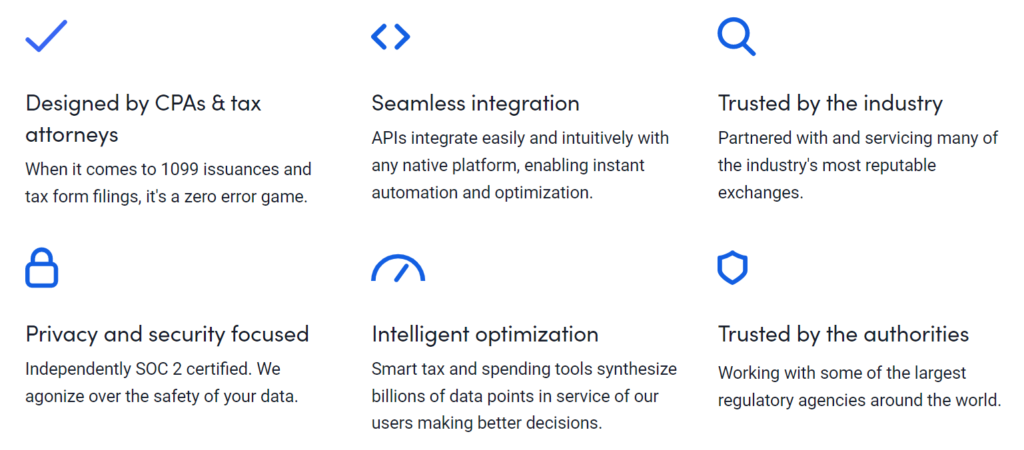

TaxBit: Features

- Seamless Integration: APIs integrate intuitively and easily with any native platform, enabling instant optimizations and automation.

- Intelligent Optimization: Spending tools and Smart tax synthesizes billions of data points in service and further help users make better decisions.

- Portfolio Management: TaxBit provides an easy-to-navigate platform and aggregates data from over 500 exchanges, DeFi protocols, NFT marketplaces, wallets, and more for free.

- Regulatory Compliance: TaxBit works with some of the most significant regulatory agencies around the world to provide data analysis, tax calculation and examination support, and more.

- Security and Privacy: The platform agonizes over its data safety as it is independently SOC 2 certified. Also, it’s a zero error game when it comes to 1099 issuances and tax form filings.

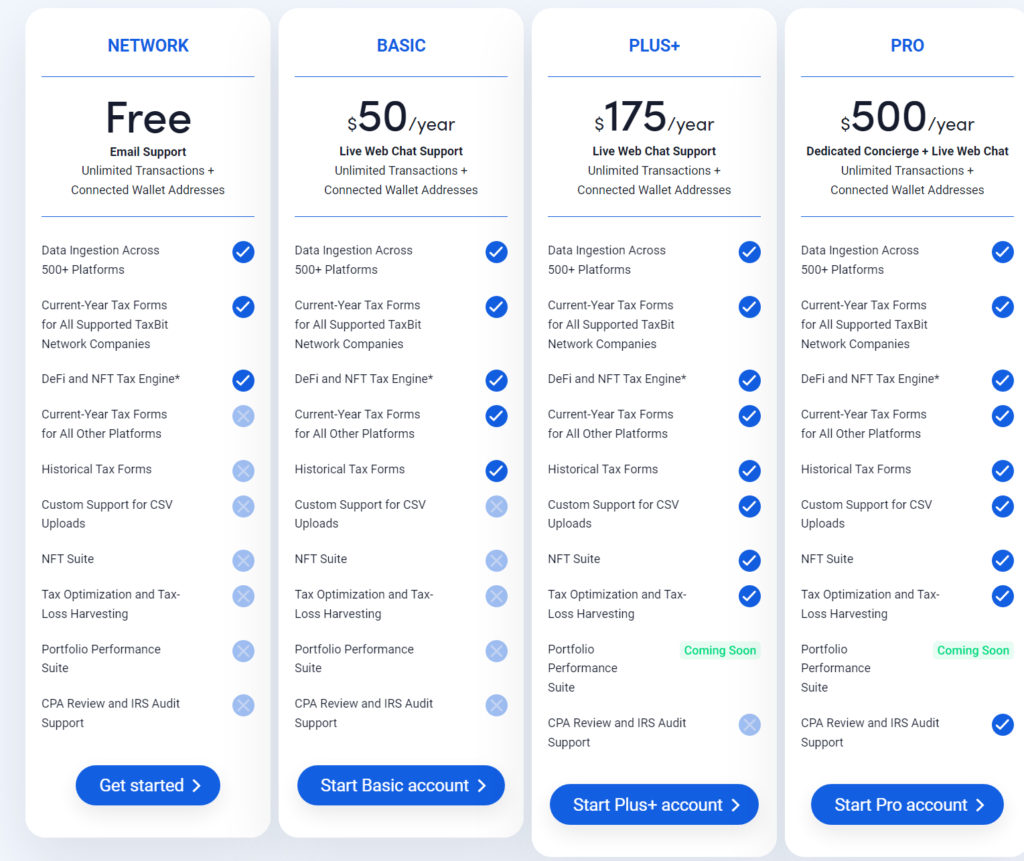

TaxBit: Fee Structure

You can get started for free with TaxBit’s pricing structure. TaxBit has divided its pricing structure into four plans.

- Network Plan: It is a free plan with email support, unlimited transactions, and connected wallet addresses. It also supports Data Ingestion across 500+ platforms and DeFi and NFT Tax Engine.

- Basic Plan: This plan costs $50 per year and has Live Web Chat support with unlimited transactions and connected wallet addresses. In addition, there are many other features that the plan supports.

- Plus+ Plan: This plan costs $175 per year and has Live Web Chat support with unlimited transactions and connected wallet addresses. Furthermore, there are more features available here than the basic plan.

- Pro Plan: This plan costs around $500 per year and has a Dedicated Concierge, Live Web Chat, unlimited transactions and connected wallet addresses. In addition to this, it consists of all the features like CPA review and IRS audit support, NFT suite, Historical Tax forms, and many more.

TaxBit: Pros and Cons

| Pros | Cons |

|---|---|

| TaxBit’s primary focus is on its security and the great service provided by its team. | You will need to spend more money to get access to more premium features. |

| There is full transparency with their data and has simple reporting on TaxBit’s dashboard. | The platform’s application is not available for mobiles. |

| It is supported by major countries all around the world. | |

| The platform has a 14-day free trial. | |

| Provides you with 24*7 customer support service. |

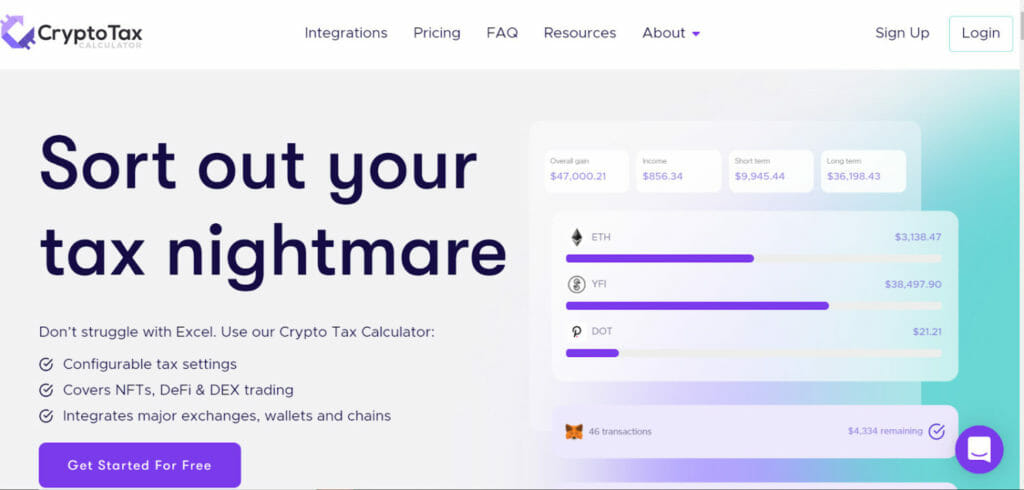

CryptoTaxCalculator: 5th Best Crypto Tax Software

CryptoTaxCalculator is built in such a way that they can simply understand your tax obligations. Their tools help identify, organize, and track all your crypto activities across hundreds of exchanges and blockchain with accuracy and ease. The platform was co-founded by brothers Tim and Shane Brunette. It came into the picture in the year 2018 and is headquartered in Sydney, Australia. Moreover, don’t struggle with excel anymore and use Crypto Tax Calculator to get configurable tax settings. Furthermore, it integrates major exchanges, wallets, and chains and also covers NFTs, DEX, and DeFi trading.

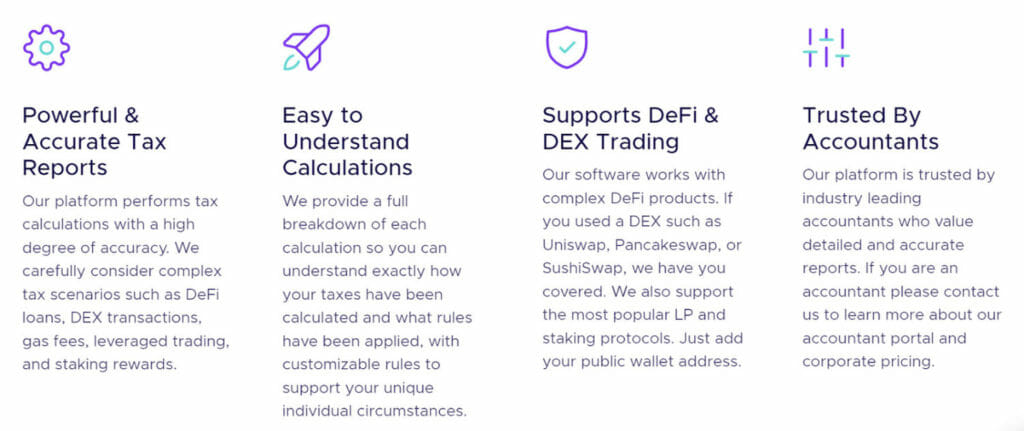

CrytoTaxCalculator: Features

- Powerful and Accurate Tax Reports: CryptoTaxCalculator performs all tax calculations with great accuracy. Also, they carefully consider all complex scenarios such as DEX transactions, Leveraged trading, DeFi loans, staking rewards, and gas fees.

- Easy Calculations: The platform provides you with a full breakdown of each calculation to easily understand how exactly your taxes have been calculated and what all rules have been applied.

- Supports DeFi and DEX Trading: Their software even works with complex DeFi products. Moreover, if you have used a DEX such as PancakeSwap, SushiSwap, or Uniswap, then they got you covered on that too.

- Trusted by Accountants: CryptoTaxCalculator is trusted by industry-leading accountants who value accurate and detailed reports.

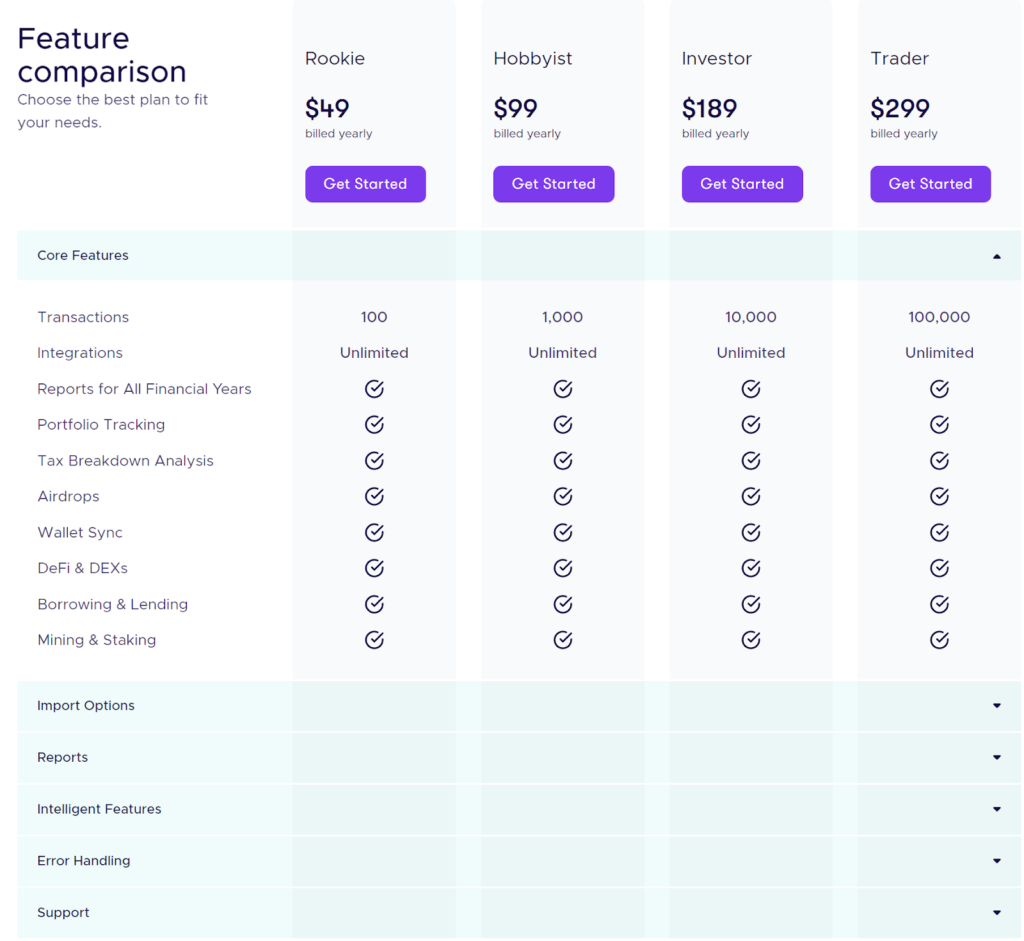

CrytoTaxCalculator: Fee Structure

The pricing structure of CrytoTaxCalculator offers you four different plans for your personal accounts. In order to get your crypto tax reports, you need to pay for the plan. The pricing structure id the platform works with the yearly subscription method. Moreover, all plans have a 30-day money-back guarantee if you are unsatisfied with the work. So, the four types of plans are:

- Rookie: This pricing structure is for users who dabble in the crypto space. Its yearly price is $49. It supports 100 transactions and is ideal for crypto enthusiasts or hodlers.

- Hobbyist: This pricing structure is billed $99 per year and is for crypto enthusiasts who use centralized exchanges. It supports storing assets in wallets and up to 1,000 transactions.

- Investor: This plan starts from $189 per year and is for active investors who have complex transactions. It covers DeFi, DEXs, Staking, Derivatives, and 10,000 transactions.

- Trader: This is the fourth and last plan billed $299 per year for day traders with high volume transactions counts. It supports all of the investor plans and up to 100,000 transactions.

CryptoTaxCalculator: Pros and Cons

| Pros | Cons |

|---|---|

| CryptoTaxCalculator’s interface is quite user-friendly and straightforward. | There are no free plans available. |

| The platform provides you with easy calculations. | |

| It is trusted by industry-leading accountants. | |

| All tax calculations are done with great accuracy. | |

| There is huge wallet and exchange support. |

Conclusion

Within a short span of time, cryptocurrencies have become very popular. The reason behind this is the high chances of getting massive profits from it. But if you trade in cryptos, then you might also need to pay taxes, and for that purpose, you will need crypto tax software. Hope the Best Crypto Tax Software mentioned in the article above might have given you a brief knowledge about all tax platforms.

Frequently Asked Questions

Is Accointing safe?

Accointing takes its safety and security very seriously. They implement SSL, OAuth, and user-specific keys for data encryption. Apart from this, they also implement all GDPR requirements and have data processing agreements with all the service providers.

What exchanges are a part of the TaxBit Network?

TaxBit continuously adds more and more platforms to its network each passing day. Some of the crypto platforms that are part of this network are Binance.US, BlockFi, Coinbase, CEX.IO, Gemini, Okcoin, MetalPay, SuperRare and many others, excluding these.

How does crypto taxes work?

Crypto taxes are all about calculating your capital gains and loss totals. It can also be the difference in value between the cost of acquiring an asset and the selling price of the same.

How to calculate tax on crypto transactions?

You can calculate tax on crypto to crypto transactions by recording the value of the crypto in your local currency that is used at the time of the buying and selling. However, this can be mundane work to do as it is time-consuming, and also, some of the exchange records do not consist of a reference price point.

Also read,

![Cryptocurrency Tax - 5 Questions You Need To Be Asking [Bitcoin Tax] 33 Cryptocurrency Taxes](https://coincodecap.com/wp-content/uploads/2020/03/tax-on-bitcoin-768x432.png)