With over 150 DeFi protocols and over 680 dApps in various categories, the Solana blockchain has developed into a center for cutting-edge and accessible decentralized exchanges. Hence, we have picked the 8 Best Solana DEX Platform in this article.

Table of Contents

What is a Solana DEX platform?

A decentralized cryptocurrency exchange platform built on the Solana chain that allows for direct, peer-to-peer trading without intermediaries is known as a Solana-DEX. On Solana DEX, trade settlement is automated using self-executing or smart contracts, guaranteeing quick and seamless transactions free from human intervention. No user needs to rely on a central operator because these exchanges enable trustless transactions. Additionally, they can continue to be the only owners of their money and not require a third party to act as custodians. Solana DEX platform use liquidity pools and automated market-making systems to preserve trade and liquidity efficiency. Some Solana DEXs employ the Central Limit Order Book mechanism for total transparency and fair trade, which guarantees matching buy and sell orders based on price and time priority.

How do you choose the best Solana DEX platform?

Choosing the best Solana DEX platform will require you to analyze the following points :

- Firstly, Assess Your Trading needs. Do you need advanced trading features, or are you satisfied with basic token swaps? Your unique demands will direct you to the DEX that provides the necessary features and tools.

- Ensure you consider the interface that is easy to use is essential, particularly for beginners. Select a Solana DEX platform with a user-friendly, straightforward platform.

- Transaction fees can mount up, particularly if you trade regularly. Examine the costs of many DEXs to select one with the lowest fees.

- Although Solana DEX platform typically have minimal costs, there may be exceptions.

- Seek for DEXs with high liquidity, often suggestive of a significant trading volume and many active traders.

- Beyond simple trading, some DEXs include services like yield farming, staking, lending, and borrowing. Think about the other services you could find helpful.

- Check for systems with robust security measures like cold storage, multi-signature wallets, and frequent security audits.

- Integration of the Solana ecosystem with other projects can improve DEX’s efficiency and liquidity.

- Trading experiences are made more efficient on platforms that have good integrations with wallets, portfolio trackers, and other DeFi services.

- Try a few short deals on a few different DEXs to see how they work and how easy they are to use. This practical method might help you gain a deeper comprehension of the platform.

Try these Solana trading bots Gmgn, BullX, Ave , Autosnipe, Dbot, Trojan Bot, Maestro Bot, and Unibot.

9 Best Solana DEX Platform

GMGN

- GMGN is a cutting-edge trading bot designed specifically for Solana’s dynamic decentralized exchange (DEX) ecosystem. It enhances trading efficiency, automates complex strategies, and provides a seamless user experience for both novice and experienced traders.

- GMGN leverages smart algorithms to automate trades, ensuring optimal entry and exit points across multiple Solana DEXs. This automation minimizes manual intervention and maximizes profit opportunities for traders.

- The bot supports multi-DEX compatibility, enabling integration with popular Solana DEXs such as Jupiter, Raydium, Orca, and more. This allows traders to access diverse liquidity pools and efficiently utilize arbitrage opportunities.

- GMGN provides customizable strategies tailored to user goals. Traders can execute limit and market orders, implement advanced setups like dollar-cost averaging (DCA), and use stop-loss mechanisms to protect their investments.

- Real-time analytics is another standout feature of GMGN. The bot offers comprehensive data dashboards, live price tracking, and trade performance metrics to keep users informed and ahead of market trends.

- GMGN prioritizes security with robust encryption and wallet integration. This ensures that users’ assets remain secure and transactions are processed without exposing sensitive information.

- The user-friendly interface makes GMGN accessible to beginners. With intuitive design, quick setup guides, and simplified workflows, traders can easily create and monitor trading bots.

- Cost efficiency is a core advantage of GMGN. The bot optimizes transaction costs by selecting the most efficient trade routes, reducing slippage, and minimizing unnecessary fees.

- GMGN leverages Solana’s high-speed, low-cost blockchain infrastructure to enhance trading efficiency. Solana’s lightning-fast transaction speeds and low fees ensure that even high-frequency trading remains economical.

- By integrating GMGN with your preferred Solana DEX platform, you can automate repetitive tasks, gain data-driven insights, and secure your trades with confidence. Its advanced features and seamless compatibility with Solana make GMGN a game-changer for traders in the DeFi ecosystem.

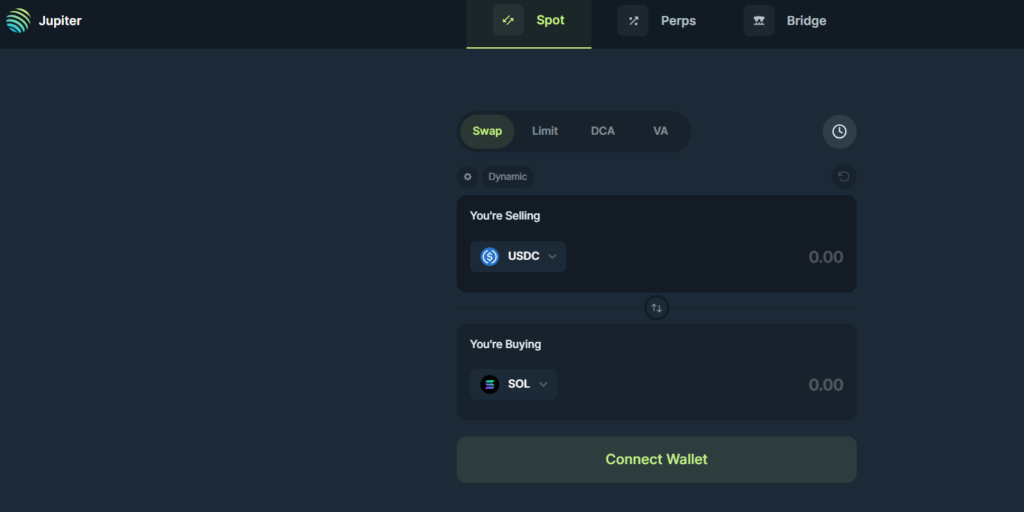

Jupiter

- Jupiter was launched in 2021 with the goal of redefining DeFi on Solana and is currently ranked first by trade volume.

- Jupiter provides unparalleled trading pair variety and smooth cross-chain liquidity by aggregating data from over 31 DEXs, guaranteeing your constant participation in the market.

- In addition, Jupiter Spot offers 4 trading methods help to buy or sell spot assets on Solana include Limit Order, Dollar Cost Averaging order, Swap and Value Averaging (VA).

- Through the integration of external bridges like AllBridge Core, Mayan, and deBridge, Jupiter Bridge facilitates the transfer of funds to Solana and the wallet linked to Jupiter from the most popular chains (Ethereum, Optimism, BNB, Polygon, Base, Arbitrum, Tron, etc.).

- Users of Jupiter Perpetuals may trade a variety of assets, including SOL, ETH, and wBTC, with high leverage (up to 100x).

- Jupiter’s trading engine optimizes trades on Solana by streaming tokens in phases and enabling routes to divide and merge fluidly. It uses a potent routing algorithm called Metis.

- Jupiter stays ahead of market trends through market agility, automatically incorporating new tokens with sufficient liquidity, giving users immediate access to new opportunities inside the Solana ecosystem.

- Jupiter is a cross-chain force, providing multi-hop and direct routing that picks up the best rates from any vendor in all DEX marketplaces and AMM pools.

- The JUP coin also increased interest and trading activity on the Jupiter Swap platform. Its native token, JUP, is utilized for governance and cost reductions for the DEX aggregator platform.

- Dollar-cost averaging allows consumers to buy a predetermined number of tokens at a predetermined price range for a predetermined amount of time, with flexible time intervals.

- Bridge Enables tokens to be bridged to Solana from non-EVM blockchains like Tron to EVM blockchains like Ethereum, BNB Chain, and Arbitrum, ensuring the best pathways for minimal slippage and transaction costs.

- With a maximum leverage of x100, Perpetual enables users to trade futures contracts for compatible tokens. It is powered by the largest oracle network in Solana, Pyth Network.

- Depending on order type the fees ranges from 0.1% -0.2%. For a DCA order a fees of 0.1% on order completion is charged. Furthermore, Limit Order has a fee of 0.2% on taker.

- Partners who integrate Jupiter Limit Order will get 0.1% of the referral fees; Jupiter will keep the other 0.1 % as platform fees.

Raydium

- Metis ensures that your trades are more than transactions by combining route generation and quotation to avoid the traps of inefficient paths and take advantage of a larger token set for intermediary roles.

- Metis balances size and efficiency by smartly dividing transactions into smaller portions for large-scale trades or assets with low liquidity, ensuring the best rates.

- Based on the Solana blockchain, Raydium is an automated market-maker that lets users exchange, swap, and profit from digital assets.

- With respect to token selection, Raydium offers limited orders and unmatched liquidity. Raydium’s connection with Serum DEX makes both of these features available.

- Around 260+ market pairs are actively supported on its user interface.

- Additionally, Raydium features a swap interface that allows users to switch assets inside a liquidity pool by setting prices using a constant function market maker.

- Contributions to the Liquidity Pools on Raydium allow users to farm rewards through RAY tokens. Anyone may establish a liquidity pool for any SPL token pair on the exchange with its “permissionless pool” feature.

- By staking and generating interest, Raydium enables holders of its native token, “RAY,” to acquire extra RAY tokens. A 10.29% interest rate on staked RAY is now available through the RAY staking pool.

- The fees linked to swap in a Raydium liquidity pool vary based on the pool you are using, from 1% to 0.01%.

Orca

- Using the Solana Blockchain as its foundation, the well-known AMM exchange is the Orca decentralized exchange project.

- AMM users trade their cryptocurrencies through a pool of tokens, as opposed to order exchanges, which function more like traditional finance.

- The Orca project prioritizes user experience and supports native tokens and other stablecoins on the Solana ecosystem in addition to DEX features like Token Swap and liquidity pool addition.

- Orca uses the Fair Price Indicator to attain low slippage (around 1%), quick speed, and low cost.

- On Orca DEX, the ORCA token is utilized for governance, staking to receive fee reductions and involvement in upcoming protocol updates.

- Opportunities for targeted yield farming are provided by Orca’s “Whirlpools.”

- Customers can focus their liquidity on certain price ranges via whirlpools. This will benefit users by boosting liquidity providers’ profitability and enabling traders to trade at lower costs, reducing slippage.

- With Orca, users may supply liquidity to asset pools so that trades in LP tokens can be handled.

- Orcanauts, an NFT Whale Collection, profit from the orca habitat in several ways.

- Liquidity providers, the Orca DAO treasury, and a Climate Fund split trading costs, which vary according on the pool and include rate levels ranging from 0.01% to 2%.

Drift Protocol

- Drift Protocol is a decentralized exchange (DEX) on the Solana blockchain devoted to perpetual futures contracts.

- Its innovative features resolve problems with existing CEXs and seek to completely transform the trading experience.

- Non-custodial and decentralized trading removes the need for a central authority and enables safe and transparent commerce.

- Leveraged perpetual swaps provide traders greater trading flexibility by enabling trading on perpetual swaps with up to 10x leverage.

- Customers can use variable rate returns to participate in lending or borrowing transactions.

- Maker Vaults use market-making to provide passive revenue. Assets are placed in Circuit vaults, where smart contracts carry out trading plans and reimburse depositors.

- Through the staking of assets to a separate fund set, Insurance Funds will contribute to the overall solvency of the exchange by receiving incentives for maintaining the exchange’s stability.

- Staking and liquidity provision lets users actively participate in the platform’s ecosystem by offering liquidity or staking.

- The hybrid CEX-DEX experience aims to preserve the autonomy and accessibility of decentralized finance while offering the effectiveness and user experience of exchanges.

- Creative features for the user experience include quick transaction confirmation, one-click trading via wallet integration, trading interfaces for mobile devices, and simple cross-chain USDC migration.

- To improve the platform, introduce user-driven security measures, and create an insurance fund, user-driven security and liquidity are needed.

- Trading fees are tiered and varies from 3 bps to 10 bps, depending on staking or user volume. While there is a basic spot market taker fee of 5 bps, with makers earning a refund of 2 bps, maker fees have a rebate of 1 bps across all levels.

Lifinity

- Lifinity is Solana’s first proactive market maker (PMM) to improve capital efficiency and reduce temporary loss.

- It uses a delayed rebalancing system and an Oracle-based pricing mechanism to preserve liquidity and make money.

- Lifinity is a unique DEX in the Solana ecosystem with its tokenomics methodology and cutting-edge features like focused liquidity and lazy liquidity provision.

- In addition to its DEX features, Lifinity provides 10,000 animated NFTs called Flares. The money made from trade fees and sales of these NFTs is put back into the platform’s liquidity pools.

- Lifinity provides market making as a service (MMaaS) and liquidity as a service (LaaS) to protocols that want to generate strong liquidity for their tokens effectively.

- Lifinity is also made to interact with other blockchain networks, making cross-chain transactions easier.

- The platform offers extensive assistance through tutorials, manuals, and customer care, and it promotes community engagement through incentive schemes like liquidity mining and token staking.

- The team manually calculates each pool’s trading fee with the goal of maximizing profit. Variations in market volatility and liquidity on rival DEXs can sometimes cause the optimum setup to vary.

Saros Finance

- Saros Finance, which debuted in June 2021, seeks to establish itself as a “DeFi Super-Network” on Solana by providing a range of integrated DeFi solutions and a basic DEX.

- On Saros Finance, the SAROS token performs various tasks, such as governance, staking for platform incentives and fee reductions, and access to upcoming product releases.

- A DEX called Automatic Market Maker (AMM) is used on Solana to exchange SPL tokens.

- SarosFarm aggregates yield farming across many protocols, enabling users to effortlessly optimize their earnings by engaging in diverse liquidity pools.

- SarosStake is for staking just one asset, optimizing rewards from each individual token without posing a risk of temporary loss.

- SarosLabs is a hub and incubator for creative Solana initiatives seeking community support.

- Multi-functional DeFi services provide several DeFi services, such as staking, swapping, and liquidity.

- Farming pools with integrated features allow customers to earn returns on their investments.

- Saros Finance levies a fee of 0.30% in total, of which 0.25% goes to the liquidity providers and 0.05% is retained by the Treasury. Network costs are a part of transactions in SOL as well.

Zeta Markets

- Zeta has established itself as a pioneer in the industry by offering the most dependable and quick perpetual swaps exchange (DEX) available.

- Since Zeta uses Solana’s blockchain, it can execute trades quickly and affordably, making it perfect for large-volume trading.

- Perpetual Contracts are a trading specialty that enables traders to keep ongoing exposure to various cryptocurrency assets without worrying about expiration dates.

- The protocol’s central limit order book (CLOB) structure is recognizable to many DeFi traders who use traditional markets and centralized exchange (CEX) platforms.

- Zeta reduces the hazards associated with centralized exchanges by giving users complete authority over their money.

- Since the network is decentralized, trust and transparency are guaranteed because every transaction is publicly viewable and verifiable on the blockchain.

- The benefits of staking ZEX include an increase in Z-score, important for determining how much may be earned in ZEX rewards, whether a user is eligible for airdrops, and if they can take part in governance procedures.

- The native utility token of Zeta Markets and a vital component of its ecosystem is the ZEX token.

- Zeta uses Chainlink as a backup oracle and Pyth as its primary oracle to obtain the most recent pricing information for cryptocurrency assets traded on the platform.

- Since Zeta provides tiered fees, the number of transactions required to qualify for a discount from the normal rate will determine how much the fee is reduced.

- A 30-day trading volume will determine a 50% reduction in the normal cost, which is 2 bps for makers and 10 bps for takers. Registered Market Makers receive a 2 bps refund in addition to 0 bps maker fees.

Saber

- Saber is a famous wrapped asset decentralized exchange (DEX) and cross-chain stablecoin on the Solana blockchain.

- Within the ecosystem, the native token of Saber, SBR, performs several functions, including governance, staking incentives, and lower costs for holders.

- Saber uses an automated market maker (AMM) approach with optimized algorithms to offer deep liquidity pools and narrow spreads for stablecoin trading.

- With Wrapped asset trading, Easily trade your preferred assets from different chains inside the Saber ecosystem by bridging them onto Solana.

- You may generate passive income through yield farming by giving Saber’s stablecoin and wrapped asset pools liquidity.

- To gain extra incentives and participate in platform governance, stake the native Saber token, SBR.

- Saber forms a comprehensive financial ecosystem through its smooth integration with a range of Solana DeFi applications.

- It is a great option for big stablecoin deals due to the strong liquidity in its pools, and it is optimized for minimal slippage.

- With support for over 80 different stablecoin kinds and wrapped stablecoin trading pairings, Saber also provides cross-chain capability, allowing users to trade wrapped cryptocurrency versions from other blockchains.

- Saber may have much lower transaction fees than other blockchains like Ethereum because it is based on the Solana blockchain. The fee for stablecoin pair swaps on Saber was less than 1%.

Conclusion

Solana decentralized exchanges (DEXs) are expected to be essential in determining the direction of trade in the future as the decentralized finance (DeFi) industry grows. Both beginner and seasoned traders find Solana a compelling platform due to its unique combination of fast transactions, affordable fees, and strong security.

With DEXs ranging from basic token swaps to advanced trading capabilities and all-inclusive DeFi services, Solana offers various DEXs to suit different trading demands. Further, Raydium and Jupiter are the Solana DEX platform cover most demands and can be a suitable choice.

Frequently Asked Questions

What is the best Solana DEX platform?

Some of the best Solana DEX platform include Raydium and Jupiter.

How to trade on Solana DEX platform?

To trade on a Solana DEX platform, take the following actions:

1. Create a Wallet: Phantom, Sollet, or Solflare are the wallets that are compatible with Solana. Your Solana (SOL) and any other tokens you want to trade will be stored there. Verify if there is enough SOL in the wallet to pay transaction costs.

2. Link a connection with a Solana DEX platform: Serum and Raydium are among the Solana DEXes available. Click the “Connect Wallet” button and choose your wallet provider to link your wallet after selecting the appropriate website.

3. Choose a Trading Pair: Tap the trading pair—for example, SOL/USDC—you wish to trade after joining. This is thought to be a representation of two desired tradeable tokens.

4. Place Your Order: Choose between placing a limit order, which allows you to buy or sell at a set fee, or a market order, which allows you to buy or sell right away at the current market fee. Enter the desired trade amount and click “Confirm.”

5. Verify the Transaction: Accept the data in your wallet and allow the DEX to use the inexpensive, quick Solana blockchain to complete the transaction processing.

6. Monitor your transactions: Manage your financial assets comfortably and monitor your transactions right from your wallet.