Tria is a Web3-native neobank designed to simplify how users earn, spend, trade, and move digital assets across chains without gas fees, seed phrases, or blockchain complexity. It unifies traditional financial usability with crypto’s flexibility, offering a seamless, borderless, self-custodial experience for everyday and power users alike. In this article, we will explore Tria Review.

Table of Contents

What is Tria?

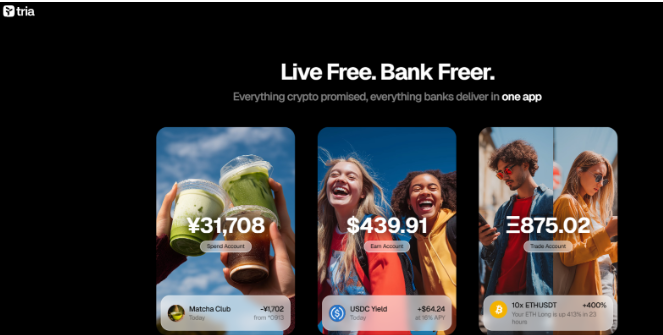

- Tria is a full-stack digital asset neobank built on Web3 infrastructure, enabling users to earn, spend, and move assets across multiple chains without needing gas tokens, seed phrases, or manual bridging, offering a simpler banking-style experience for global crypto activity.

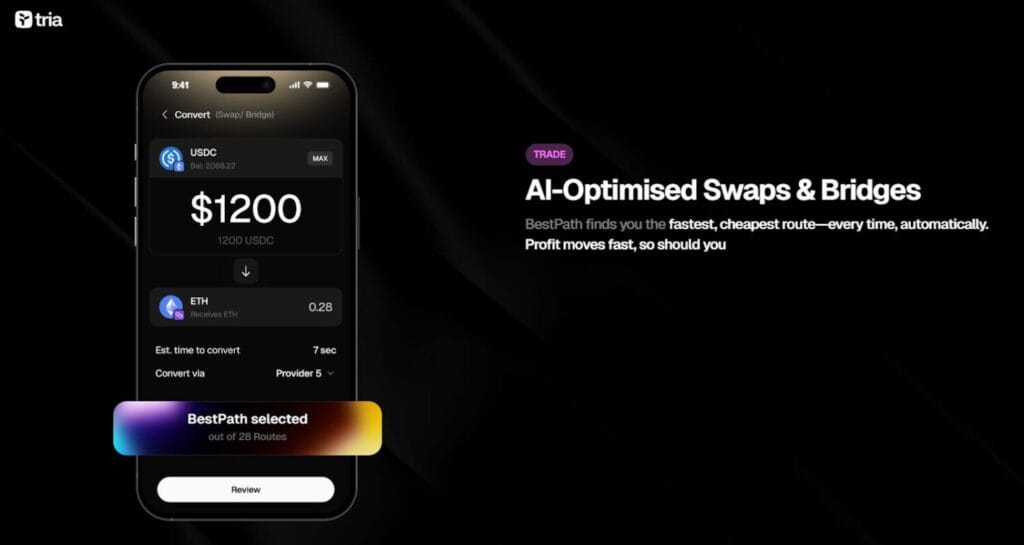

- It combines proprietary trading technology with a chain-abstracted wallet layer, allowing users to interact with crypto as a single balance while the system handles routing, settlement, and optimization behind the scenes for fast and cost-efficient cross-chain execution.

- The platform is structured around self-custody with no intermediaries controlling user funds, enabling users to retain full asset ownership while still enjoying banking-like features such as cards, yield accounts, and instant global asset mobility.

- Tria is invite-only and engineered to function as a financial operating system for both humans and AI agents, offering automation, programmability, and streamlined cross-chain interactions rarely found in consumer-facing Web3 financial products.

Features and Products

- Tria Earn offers optimized on-chain yield strategies designed for performance and transparency, enabling users to stake assets in one click while earning yield that scales with activity, with staking functionality available exclusively to users holding Tria’s membership tiers.

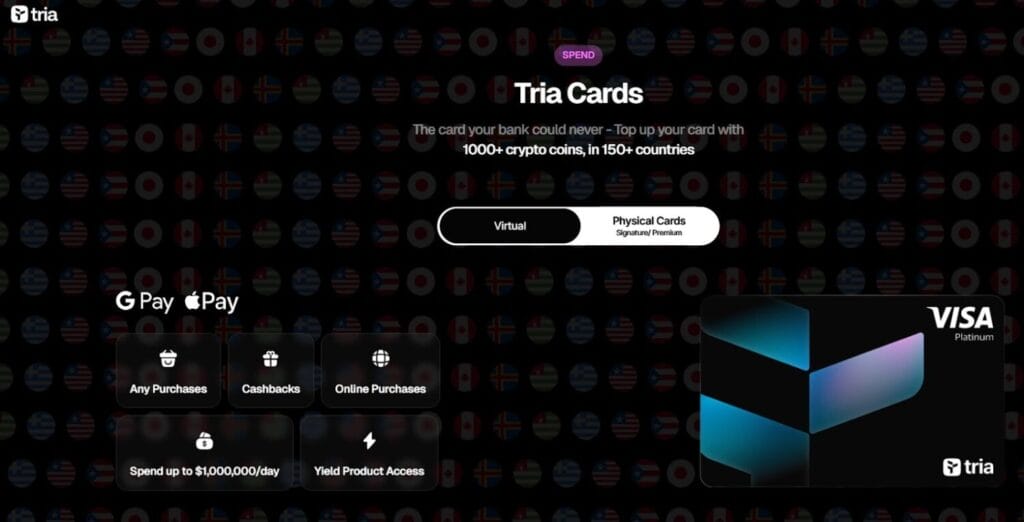

- The Tria Card allows users to spend digital assets globally—online or in-store—across more than one hundred countries, offering cashback, rewards, and seamless asset conversion, enabling crypto to function with the convenience and familiarity of traditional payment methods anywhere cards are accepted.

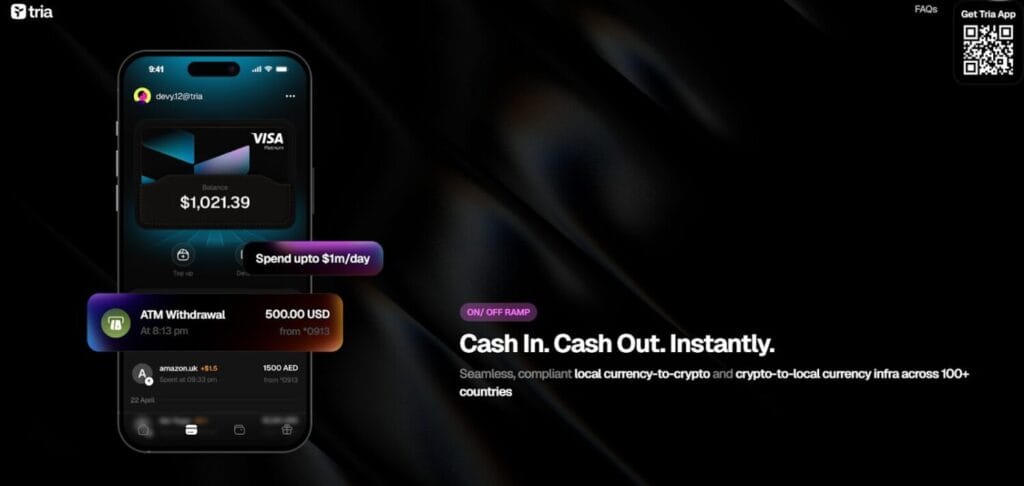

- Tria’s integrated on/off-ramp supports rapid movement between fiat and crypto across regions, enabling users to convert funds instantly using payment methods like SEPA, UPI, ACH, PIX, and others, streamlining cross-border financial operations without lengthy settlement delays.

- It’s full-stack routing system removes the need for chain switching, manual bridging, or selecting gas tokens, as its internal infrastructure automatically handles routing, liquidity selection, execution, and optimization, presenting the user with a single unified transaction process.

- Tria Cards come in multiple membership levels—virtual, signature, and premium—offering benefits such as boosted yield, transaction rewards, higher spending limits, and access to exclusive on-chain earning opportunities, catering to varying user profiles and activity levels.

- Spend, Earn, and Trade accounts operate as separate financial layers within the platform, mirroring the familiar structure of traditional banking while enabling users to designate assets for different purposes, including daily spending, yield generation, or leveraged trading.

Fees

- Tria does not display a universal fee table; instead, fees vary by region, card tier, on/off-ramp provider, and transaction type, allowing the platform to dynamically align pricing with third-party partners while maintaining competitive and performance-optimized execution across supported services.

- Swap and routing costs are embedded within Tria’s proprietary transaction optimization, meaning fees appear as spread-inclusive execution rather than fixed charges, enabling users to receive the best possible route based on time, cost, and security factors within each transaction.

- Card usage fees, ATM charges, and regional compliance costs depend on the issuing partner for each country, requiring users to review card-specific documentation during onboarding to understand withdrawal limits, regional restrictions, and applicable regulatory or network surcharges.

Security

- Tria partners with licensed financial operators for KYC, card issuance, and fiat ramping while ensuring users retain full self-custodial control of digital assets, enabling regulatory compliance without compromising user ownership or exposing wallets to custodial risks commonly associated with centralized platforms.

- Wallet operations are secured through advanced cryptographic structures designed to prevent single-point failures by splitting permissions and ensuring that critical signing and routing logic occurs within protected environments, combining programmability with institutional-grade operational security practices.

- It’s infrastructure adheres to robust security standards that separate user identity from wallet control, ensuring KYC processes for fiat rails do not compromise on-chain autonomy, while infrastructure-level protections reduce risks associated with unauthorized access or compromised routing pathways.

Mobile App

- The Tria mobile app provides a unified view of assets across all supported chains, allowing users to perform staking, spending, swapping, or on/off-ramping with a single interface, removing the need to interact with chain-specific wallets or complex cross-chain settings.

- The interface consolidates Spend, Earn, and Trade accounts into a single dashboard, enabling simple navigation between payment cards, yield products, and trading functions without switching tools, making digital asset management more intuitive for everyday and advanced users.

- Users can access portfolio analytics, live yield tracking, transaction history, and reward statistics directly within the app, ensuring transparent visibility into asset performance and spending activities while maintaining a simple, banking-like user experience suited to global financial behavior.

UI and UX

- Tria’s UI eliminates blockchain jargon, presenting crypto accounts similarly to digital banking dashboards, letting users treat assets as simple balances without needing to understand gas tokens, wallets, seed phrases, or bridging, significantly reducing Web3 onboarding friction.

- The UX is structured around one-click actions, allowing staking, sending, spending, or swapping to occur through minimal steps while Tria handles routing complexity in the background, enabling efficient multi-chain interactions without overwhelming users with technical configuration.

- The platform uses a clean, modern design with dark, high-contrast sections, modular account cards, and consistent visual hierarchy, making it accessible for users transitioning from neobanks and fintech apps who expect polished, intuitive financial interfaces.

Customer Support

- Tria offers structured support through its official help center, providing documentation on account setup, card usage, Earn products, membership tiers, and transaction workflows, ensuring users receive clear guidance without digging through third-party resources or community forums.

- The platform partners with compliant financial service providers for key functions such as KYC and card issuance, meaning region-specific support may also involve authorized partners, ensuring that regulatory questions and operational issues are handled by appropriate licensed entities.

- Additional support is available through its communication channels, where users can receive platform updates, engage with the team, and stay informed about new features, ensuring continuous transparency and open communication throughout the user lifecycle.

Affiliate / Referrals and Rewards

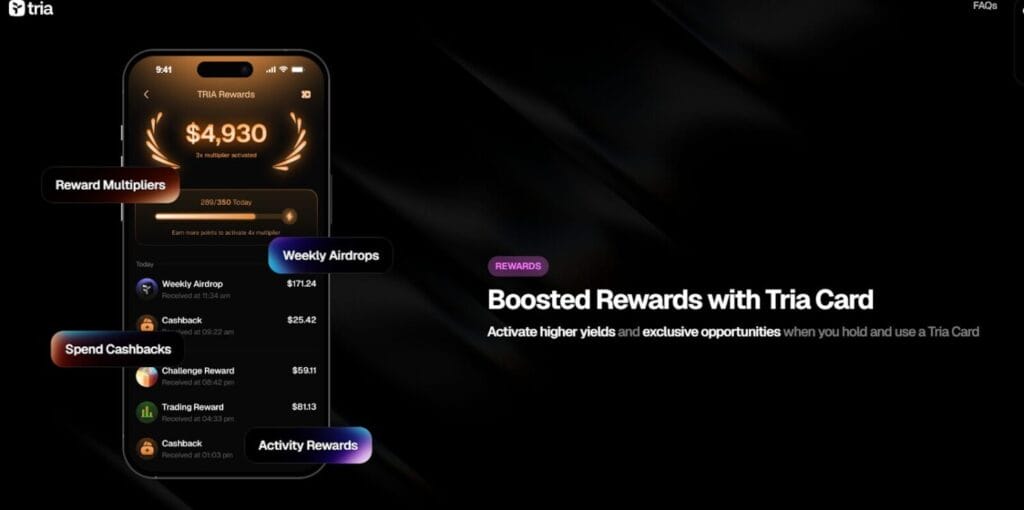

- Tria’s rewards model focuses on platform activity, offering cashback and reward points on Tria Card purchases, enabling users to earn real, spendable value through everyday transactions, encouraging consistent engagement and card-based asset movement.

- Membership tiers unlock boosted earning opportunities, increasing staking rewards, cashback percentages, and reward multipliers, incentivizing users to upgrade card levels to gain higher benefits and improved long-term earning potential on platform activity.

- It emphasizes usage-based incentives rather than affiliate income, meaning users earn most rewards by interacting with the platform rather than referring others, ensuring reward distribution remains aligned with active, value-producing financial behavior.

Tria Review: Conclusion

Tria’s chain-abstracted execution model aligns with these trends by offering users a frictionless way to interact with assets without touching gas tokens or navigating multiple networks, matching the growing expectation for simplified, high-performance multi-chain financial tools.With its neobank-style structure, integrated card program, optimized yield engine, and fully self-custodial architecture, It represents a forward-thinking solution for users seeking a single platform that merges crypto flexibility with modern financial convenience and global accessibility.

How do I move money in and out of crypto?

Tria’s integrated on/off-ramp supports instant conversions between fiat and crypto in over one hundred countries, enabling users to transfer funds using regional payment networks such as UPI, ACH, SEPA, PIX, and more.

Can I spend my crypto like cash?

How do I earn with Tria?

Tria Earn provides optimized on-chain yield strategies accessible through one-click staking, offering transparent performance and boosted rewards for membership holders, including virtual, signature, and premium tiers that unlock higher earning potential.