Based is a self-custodial crypto super-app built on Hyperliquid, now supported by a rapidly expanding user base. According to recent Dune analytics, more than 59,500 holders collectively manage over 8 billion cumulative units of value, reflecting accelerating adoption of Based’s trading, wallet, and reward ecosystem. In this article we will explore Based Review now.

Table of Contents

What is Based?

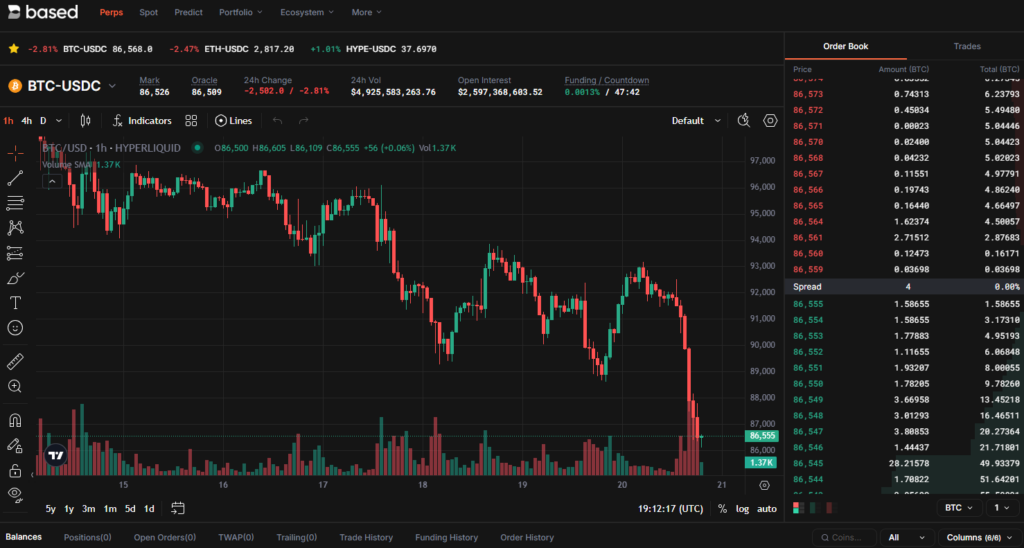

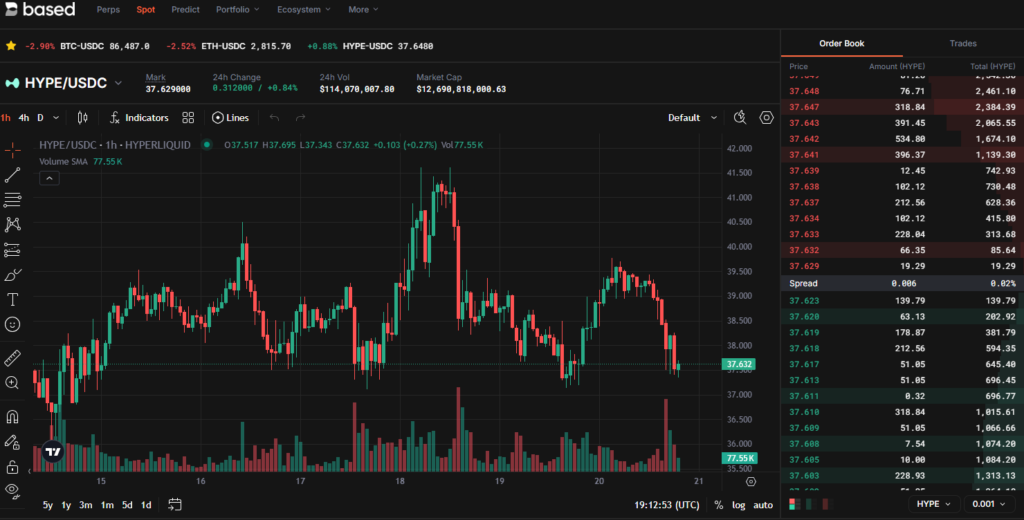

Based is an omnichannel trading platform built on Hyperliquid that aggregates decentralized perpetuals and spot markets, including BTC trading pairs such as BTC-USDC, while keeping execution, risk engine, and liquidity on Hyperliquid’s high-performance orderbook.

It runs across a web terminal, iOS and Android apps, a desktop client, and a Telegram bot, so the same BTC account and positions follow you across devices without separate logins or fragmented trading environments. The platform is self-custodial by design: wallets are owned by users, generated via Privy’s email / Google login flow, and work seamlessly across web, mobile and Telegram, so Based never holds private keys or takes custody of deposited BTC or stablecoins.

eBeyond trading, Based connects Hyperliquid liquidity with real-world spending via Visa cards, plus staking flows around HYPE and other assets, making it a combined trading, yield, and everyday-spend stack rather than a single-purpose DEX interface.

Features and products

- BTC and multi-asset trading – Trade BTC, ETH, SOL and other assets in spot and perpetual markets with Hyperliquid’s deep orderbook, advanced order types (TWAP, trailing stops, scale, scalp), push notifications, and one-tap position management for active traders.

- Omni-platform terminal – Use a browser terminal, desktop app, mobile apps, and a Telegram bot to access the same BTC trading account, allowing you to open, monitor, or close positions from whichever device is convenient without syncing issues.

- Based Visa cards – Spend stablecoins and crypto at over 70 million merchants across 160 countries, with auto-conversion to dollars at payment time, Google Pay support, tiered card products (including Gold+), and no need to off-ramp to a bank.

- Self-custodial wallet layer – Create a wallet via email or Google login in seconds, or connect an existing wallet via “Connect Mobile”; keys remain user-controlled while Based orchestrates trades and spending flows over Hyperliquid in the background.

- Prediction and launch products – Access prediction markets integrated with Polymarket via Based terminals and participate in Launchpad sales such as Upheaval’s HyperEVM listing, earning Gold and potential token allocations alongside normal trading activity.

- Based Cloud and mini-apps – Projects can launch branded Hyperliquid terminals in minutes via Based Cloud, while traders can install mini-apps like grid-trading bots directly inside the web terminal to automate BTC and altcoin strategies and farm multiple reward streams.

- XP, Gold, and gamified campaigns – Season 1 XP and Season 2 Based Gold create ongoing incentives around trading, referrals, PUP holdings, competitions (Flow Battle), livestreams and blind boxes, linking everyday trading and card spending to future token allocations.

- Automation & Smart Bots – Allows traders to build rule-based systems for periodic buys, stop-loss logic, rebalancing cycles, DCA patterns, scheduled orders, and systematic risk management, enabling hands-off execution across volatile markets without manually monitoring price movements.

- Web Terminal Enhancements – Adds algorithmic orders, smart alerts, extended analytics, and flexible charting tools to the Hyperliquid trading core, creating a more powerful command center for professional-style on-chain trading directly within the browser.

- Telegram Trading Bot – Offers fast execution and real-time monitoring inside Telegram, enabling traders to open, manage, or close positions instantly through commands, interactive modes, group leaderboards, chart generation, and exposure summaries tailored for mobile-first workflows.

Based Review: Fees

- Trading fees follow Hyperliquid’s tiered model using a 14-day rolling weighted volume, with separate schedules for perps and spot, and maker/taker rates tightening significantly as your BTC and overall volume rises into higher tiers.

- Perpetual futures fees start from 0.045% taker and 0.015% maker at base tier, stepping down through Wood to Diamond as weighted volume exceeds thresholds from five million up to multi-billion-dollar ranges over the last fourteen days.

- Spot trading fees start from 0.070% taker and 0.040% maker, again declining with higher volume; spot volume counts twice toward your fee-tier calculation, which encourages using spot markets (including BTC-USDC) to unlock better overall pricing.

- Maker rebates are applied when your maker volume share crosses defined thresholds, while HYPE staking tiers can reduce trading fees by up to 40%, aligning long-term stakers with lower marginal costs on high-frequency BTC trading.

- Builder fees, which fund Based as a front-end, add 0.025% on perpetuals and 0.1% on spot sells (none on spot buys), with most of that share recycled back to users via the affiliate revenue-sharing program.

- For cards, the basic USD-settled Based card charges a US$30 annual fee (waived for Singapore residents), has no deposit fees, applies a 1.5% foreign transaction markup, and charges separate issuance and replacement fees for physical cards.

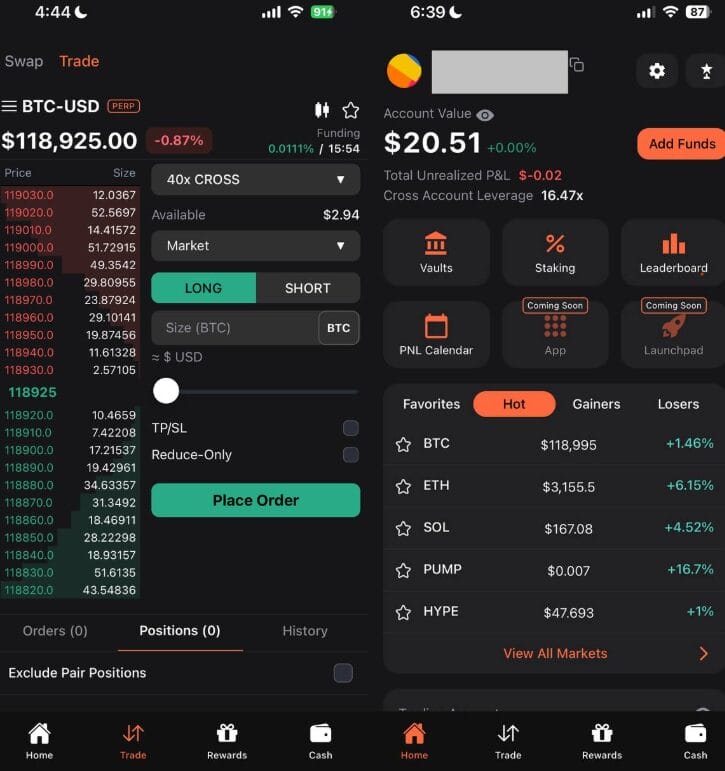

Based Review: Mobile app

- The Based HyperApp is a mobile-first, all-in-one app where you can hold assets, trade BTC and other tokens, and spend via Visa from a single interface, aiming to compress the typical multi-wallet, multi-exchange stack into one screen.

- It supports spot trading, perpetuals, and portfolio views that unify spot, perp, staking, EVM assets, and cash, so you can see BTC exposure alongside other positions without toggling between exchanges or chains.

- Onboarding is designed to be simple: new users sign up with email or Google to create a self-custodial wallet, while existing wallet owners can link via Connect Mobile; in both cases, keys remain user-controlled and are not held by Based.

- Real-world spending is integrated directly into the app: you can request, manage, and use your Visa card from the same mobile interface that manages your BTC positions, removing the need for a separate fintech app for card control.

- You can download the iOS version or the Android version.

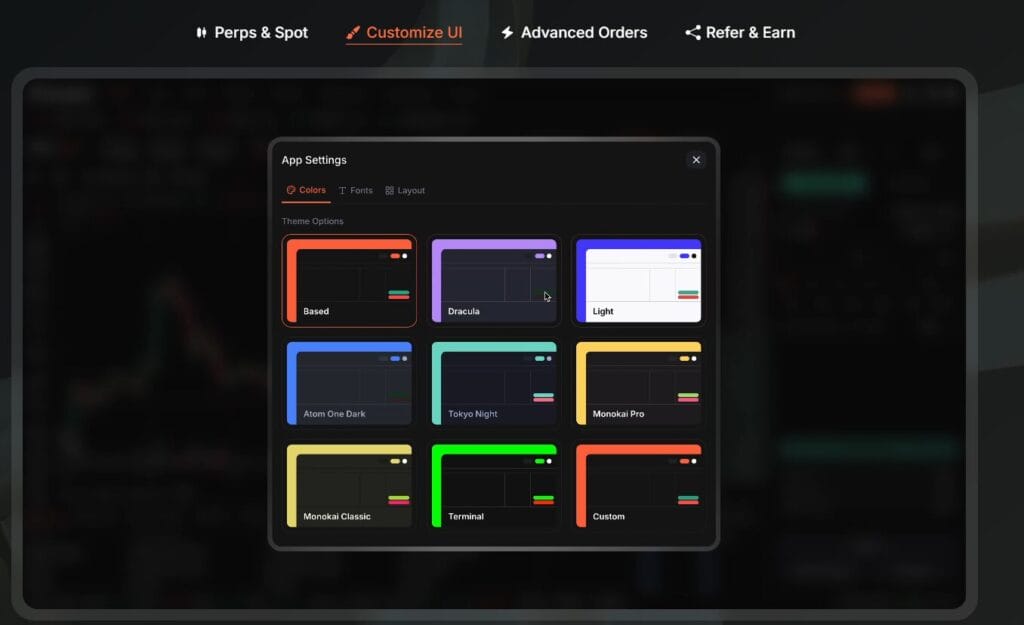

UI and UX

- Based emphasizes a “CEX-grade” experience combined with self-custody, using Privy’s white-label wallet layer for fast, email-based logins, while keeping the visual design and navigation consistent across web, desktop, mobile, and Telegram interfaces.

- The trading UI bundles Hyperliquid’s advanced order types (TWAP, trailing stops, scale orders) with clear position monitoring, automated TP/SL, and push notifications for fills, so active BTC traders can manage risk and execution without leaving the terminal.

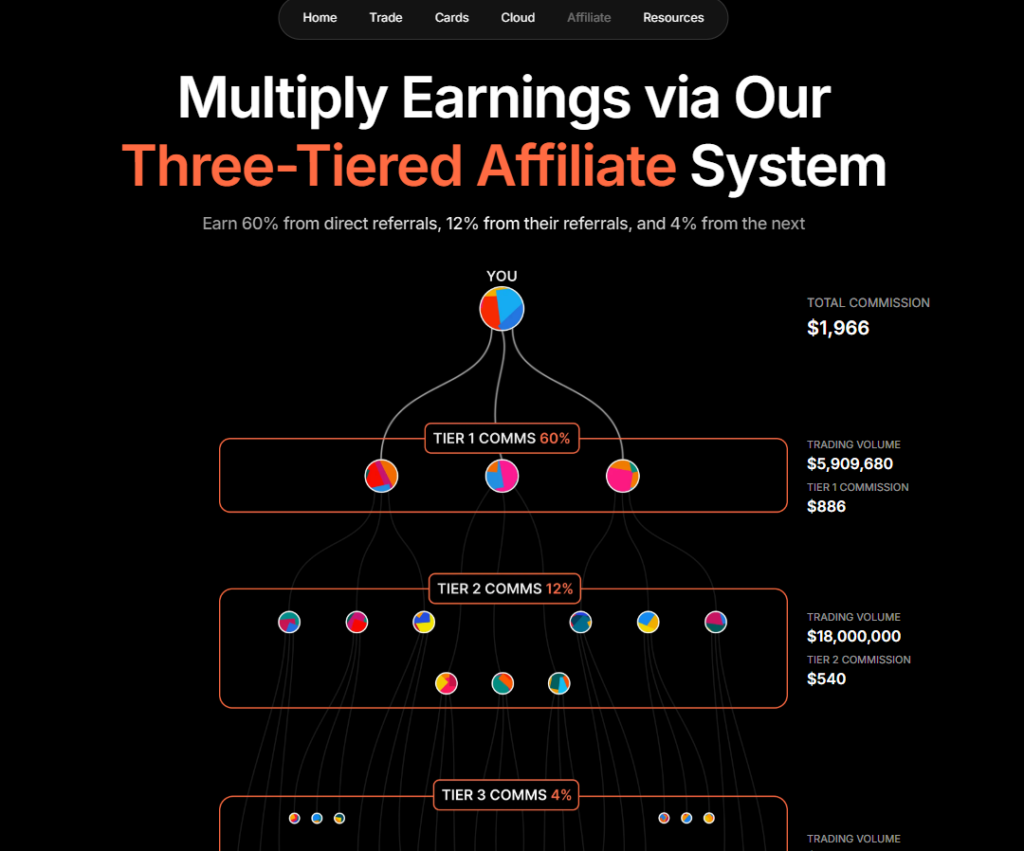

- Affiliate dashboards, XP / Gold progress views, and multi-tier referral trees are surfaced visually, turning what is usually a hidden back-office system into a clear, trackable part of the interface for creators and communities.

Affiliate / Referrals and Rewards

- Three-Tier Referral Ecosystem – Offers high fee-sharing percentages across direct, second-tier, and third-tier referrals, allowing users to earn a significant share of trading fees across their network and benefit from long-term ecosystem activity.

- Season 1 XP Framework – XP earned during the first season is permanently locked and designated for future token airdrop allocations, creating a historical rewards system where early participants gain preferential token distribution based on recorded activity.

- Season 2 Based Gold System – Issues rewards every three days with ten million Gold per epoch, earned through trading, affiliate engagement, and PUP-holder activity; formulas remain undisclosed to preserve fairness and prevent exploitation of reward mechanics.

- Expanded Reward Sources – Includes additional Gold via blind boxes and partner contributions, offering users multiple pathways to accumulate long-term rewards while participating in trading, community initiatives, and ecosystem-linked activities.

Based Review: Conclusion

Based combines advanced trading, automation, spending tools, and on-chain ownership into one unified platform, and the latest Dune metrics reinforce its growing ecosystem strength. With 59k+ holders, an average holding surpassing 134k units, and cumulative value exceeding 8 billion, Based demonstrates strong user confidence and consistent engagement across its trading, rewards, and Visa payment layers. These analytics signal an expanding, active user economy—positioning Based as a maturing, high-velocity environment for traders who prioritize speed, control, and long-term ecosystem value, Based positions itself as a comprehensive platform for traders seeking speed, autonomy, and long-term value generation across interconnected crypto services.

Can I access Based from multiple devices?

Yes. Your account syncs across web, mobile, desktop, and Telegram.

Is the Visa card top-up required?

No top-up is needed; crypto auto-converts at payment time.

Are referral earnings capped?

Referral fee-sharing continues up to the maximum supported trading-fee redistribution levels.