Stablecoins have become a vital part of the cryptocurrency world because they offer a reliable way to hold, trade, and earn in crypto without worrying about extreme price swings. On Solana, stablecoins are especially useful because of the blockchain’s fast transaction speeds and low fees, allowing users to move money quickly and efficiently. In this guide, we will explore the top five Stablecoins on Solana, comparing their features, benefits, and security, helping beginners make informed choices.

Table of Contents

What Are Stablecoins?

Stablecoins are digital currencies designed to maintain a stable value, usually pegged to a real-world asset like the U.S. dollar. They allow crypto users to trade, save, or earn interest without the risks associated with volatile cryptocurrencies such as Bitcoin or Ethereum.

What to Consider Before Choosing Stablecoins on Solana?

- Backing Mechanism:

Check whether the stablecoin is backed by fiat currency (like USD), crypto assets, or algorithms. Fiat-backed coins such as USDC are generally more stable and trustworthy. - Transparency:

Choose a stablecoin that provides regular audit reports or real-time proof of reserves to ensure the issuer actually holds the assets it claims. - Regulatory Compliance:

Verify that the stablecoin issuer follows financial regulations and operates under recognized jurisdictions to reduce legal and operational risks. - Liquidity:

Ensure the stablecoin is widely traded across major exchanges and platforms so you can easily buy, sell, or convert it when needed. - Security:

Confirm that the stablecoin’s smart contracts and reserves are protected through audits, robust custody solutions, and reputable partnerships. - Acceptance & Utility:

Pick a stablecoin that’s accepted across multiple DeFi platforms, wallets, and blockchains for better usability and flexibility. - Stability & Track Record:

Review its price history and market performance to ensure the coin has maintained its peg and avoided major depegging incidents.

Top 5 Stablecoins on Solana

1. USDC (USD Coin)

- Strong Fiat Backing: USDC is one of the most trusted stablecoins, fully backed by U.S. dollars or equivalent assets held in regulated financial institutions.

- High Transparency: It’s issued by Circle, a licensed financial company, which publishes monthly attestation reports verifying that all tokens are fully backed.

- Excellent Liquidity: USDC is widely used on Solana for trading, lending, and DeFi applications, making it easy to swap or move between protocols.

- Fast & Low-Cost Transactions: On Solana, USDC transfers are almost instant and cost just a fraction of a cent — ideal for frequent transactions.

- Multi-Chain Compatibility: Beyond Solana, USDC also operates on Ethereum, Polygon, Arbitrum, and other chains, enabling seamless cross-chain movement.

- Regulatory Confidence: Its compliance with U.S. regulations makes it a top choice for institutions and individuals who prioritize safety and legal clarity.

- Use Cases: Great for payments, remittances, yield farming, and as a base currency in decentralized exchanges (DEXs).

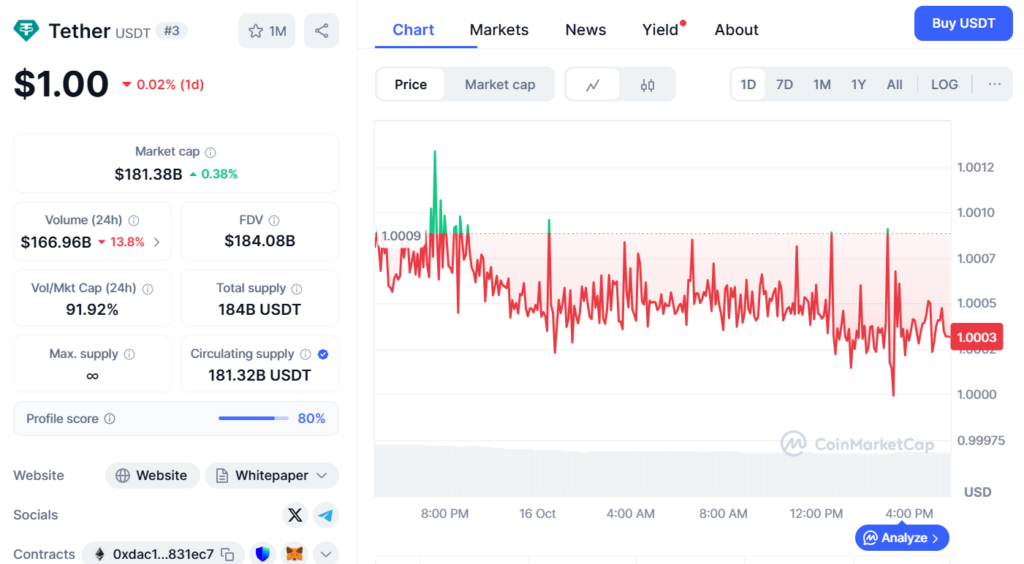

2. USDT (Tether)

- Oldest and Most Widely Used Stablecoin: USDT has been in the market since 2014 and remains the most traded stablecoin globally.

- Massive Liquidity: Its enormous market capitalization ensures that traders can easily convert in and out of positions without affecting price stability.

- Available on Solana: The Solana network gives USDT ultra-fast transaction speeds with near-zero fees, improving efficiency for high-frequency traders.

- Versatile Utility: It’s used across exchanges, lending platforms, and wallets — making it accessible for nearly every crypto application.

- Backing Transparency: Tether publishes quarterly assurance reports from external accounting firms to show details of its reserves, though it’s less transparent than USDC.

- Cross-Platform Support: Available across dozens of blockchains including Solana, Ethereum, and Tron, allowing easy fund movement between ecosystems.

- Best For: Traders who prioritize liquidity and fast transactions across multiple chains.

3. PYUSD (PayPal USD)

- Backed by PayPal: Issued by Paxos and supported by PayPal, PYUSD brings the trust of a major financial brand to the Solana ecosystem.

- Fully Collateralized: Each PYUSD token is backed 1:1 with U.S. dollar deposits or short-term U.S. treasuries held by regulated custodians.

- Easy Integration with PayPal: Users can move between PYUSD and PayPal balances seamlessly, making it perfect for payments and e-commerce.

- Fast Solana Transactions: Solana’s speed ensures PYUSD transactions settle in seconds, offering a smooth experience for global users.

- Regulated & Transparent: Paxos is regulated by the New York Department of Financial Services (NYDFS), providing strong compliance assurance.

- Expanding Use Cases: PYUSD aims to bridge Web2 payment systems with Web3 applications, potentially expanding crypto use among mainstream users.

- Ideal For: Businesses and individuals who want to bridge traditional finance and crypto payments easily and safely.

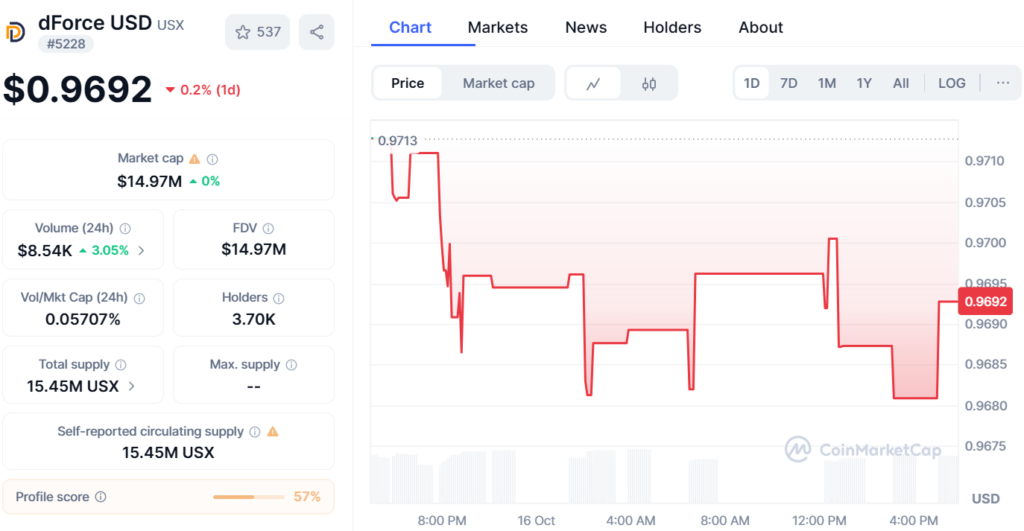

4. USX (Solstice Finance)

- Built for the Solana Ecosystem: USX is a next-generation stablecoin developed by Solstice Finance to offer secure, transparent, and scalable DeFi yield opportunities.

- Fully Collateralized: Every USX token is backed by real collateral, ensuring users can redeem it 1:1 with the equivalent underlying assets.

- Institutional-Grade Yield: Through Solstice’s YieldVault, users can stake USX to earn predictable returns without taking unnecessary market risks.

- Transparent Risk Management: Solstice integrates Chainlink’s Proof of Reserve to verify the collateral backing USX in real time, increasing trust.

- Accessible to All: Users can start investing with as little as $50, making it open to both retail and institutional investors.

- Fast & Low Cost: Being powered by Solana means USX transactions are completed in seconds with minimal network fees.

- Ideal For: Those seeking a stablecoin that combines yield generation, transparency, and accessibility within Solana’s DeFi ecosystem.

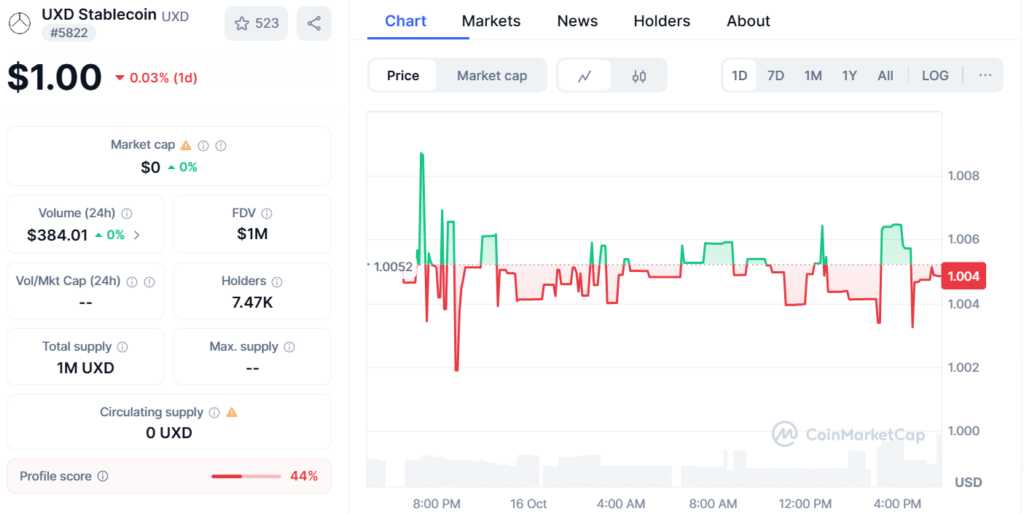

5. UXD (UXD Protocol)

- Algorithmic Yet Collateralized: UXD is a decentralized stablecoin on Solana backed by delta-neutral strategies — meaning it maintains stability through smart hedging, not just collateral.

- Decentralized Control: UXD operates via smart contracts with no centralized issuer, making it more censorship-resistant.

- Delta-Neutral Mechanism: The protocol hedges positions using perpetual futures to maintain a stable peg to the U.S. dollar.

- Strong Solana Integration: Built natively on Solana, UXD benefits from the network’s low fees and fast transaction times.

- Transparent Operations: All reserves, strategies, and trades are verifiable on-chain for complete transparency.

- Earning Opportunities: UXD users can earn stable yields through integrations with Solana DeFi platforms and lending protocols.

- Best For: Advanced DeFi users who prefer a decentralized and innovative stablecoin model with transparent on-chain management.

| Feature | USDC | USDT | PYUSD | USX | UXD |

| Backing Type | Fiat (USD) | Fiat & Assets | Fiat (USD) | Collateralized | Delta-Neutral Strategy |

| Transparency | High | Moderate | High | Very High | On-chain |

| Regulatory Compliance | Strong | Moderate | Very Strong | Strong | Decentralized |

| Yield Opportunities | Moderate (via DeFi) | Limited | Low | High | Moderate |

| Transaction Speed | Excellent on Solana | Excellent on Solana | Excellent | Excellent | Excellent |

| Best For | Secure trading & payments | High-volume traders | PayPal users & merchants | Yield-seekers | DeFi enthusiasts |

Conclusion

Stablecoins have become essential to the Solana ecosystem, combining the stability of traditional money with the speed and low fees of blockchain. For users who value regulation and transparency, USDC and PYUSD are strong choices. USDT offers unmatched liquidity and accessibility, while USX provides steady yields for DeFi investors. For those who prefer full decentralization, UXD delivers an innovative, algorithmic approach to price stability.

No matter which you choose, Solana’s fast, affordable network makes stablecoin transactions smooth, secure, and practical — bridging the gap between traditional finance and decentralized innovation.

Can I earn interest stablecoins on Solana?

Yes, you can earn interest by depositing stablecoins on Solana DeFi platforms that offer yield farming, staking, or lending services. The returns vary depending on the platform and asset.

Are stablecoins on Solana safe for beginners?

Stablecoins like USDC and FDUSD are considered very safe due to full fiat backing, audits, and regulatory compliance. Algorithmic coins like USDe carry slightly higher risk but offer decentralization benefits.

What is the difference between fiat-backed and crypto-backed stablecoins?

Fiat-backed stablecoins like USDC or FDUSD are fully backed by real dollars in banks. Crypto-backed stablecoins like USDe are backed by cryptocurrencies and use algorithms to maintain a stable value.