Since they provide an efficient way of obtaining the best prices across several DEXs, decentralized exchange (DEX) aggregators have become a vital resource for cryptocurrency traders. By connecting to several decentralized exchanges, these systems optimize trade execution and pool liquidity to guarantee that consumers receive the best pricing for their transactions. In this article, we will examine the best DEX aggregator among all options available today.

Table of Contents

What is a DEX Aggregator?

With the help of the blockchain-based DEX Aggregator service, bitcoin traders may profit from various financial tools through a single interface. The acronym DEX stands for Decentralized Exchange, which is based on blockchain technology and offers increased security. To put it simply, DEX aggregators are the financial protocols that enable investors and traders to access several trading pools easily through a single interface. They use an intricate algorithm that considers a number of variables to determine which provider from the different platforms is most suitable for a particular token swap.

How does the DEX Aggregator work?

- DEX aggregators are now a necessary service due to cryptocurrencies gaining popularity and decentralized exchanges gaining traction.

- In the same way, layer-2 solutions are created on top of blockchains, and DEX aggregators are built on top of the current DEXs.

- They provide traders access to all accessible markets, order books, and prices across several blockchains from a single entry point.

- Furthermore, because they are based on advanced algorithms, they may optimize token pricing, slippage, and exchange costs for the advantage of their customers.

- A DEX aggregator, for instance, functions similarly to provide you with the best value possible for a swap instead of traders having to manually check across each DEX, which can be time-consuming and ineffective.

- This is similar to how Google provides you with a compiled list of options for buying something online so you can select the best out of them all rather than searching each, sorting, and deciding on it.

- The liquidity aggregator’s primary responsibility is quickly determining the best price that any other DEX can provide.

- Its goal is to protect users from price impact and decrease the probability of failed transactions.

Try these Solana trading bots Gmgn , HyperLiquid, Axiom Trade, BullX , MevX , Autosnipe , Dbot , Trojan Bot , Maestro Bot , Padre.gg and BullX .

10 Best Crypto DEX Aggregator

GMGN

GMGN is an emerging DEX aggregator designed to streamline DeFi trading and offer users access to multiple liquidity pools at once. By consolidating liquidity from various decentralized exchanges across popular networks, GMGN ensures traders can execute swaps at optimal prices with minimal slippage. Here are some key highlights:

- Multi-Chain Support

GMGN aggregates liquidity from major blockchains such as Ethereum, Binance Smart Chain, Polygon, and more. This multi-chain approach reduces the hassle of switching between different DEXs and networks to find the best rate for a token swap. - Intuitive Interface

Similar to other leading DEX aggregators, GMGN sports a user-friendly dashboard. This makes it easy for both newcomers and seasoned traders to quickly compare prices, track market movements, and execute trades without needing deep technical expertise. - Low Fees & Slippage

The platform’s smart-routing algorithm splits orders between multiple liquidity sources, aiming to minimize overall transaction costs. Additionally, GMGN’s fee structure is transparent, with no hidden charges for buying or selling tokens; traders only pay the standard network (gas) fees. - Advanced Security

GMGN integrates with reputable crypto wallets, including hardware wallets like Ledger and Trezor, to help protect user funds. The platform also utilizes audited smart contracts to further bolster security. - Governance & Utility Token

The GMGN platform is governed by a native token that empowers the community to propose and vote on platform upgrades. Holders may also benefit from reduced fees, staking rewards, and other incentives aligned with GMGN’s long-term growth. - Mobile Compatibility (Upcoming)

A dedicated GMGN mobile app is reportedly in development, aiming to provide on-the-go access to DEX aggregation. Features like real-time price alerts and portfolio tracking could be part of future releases.

MEVX

MEVX.io is a next-gen DEX aggregator focused on MEV protection and cross-chain efficiency. Key features include:

- MEV Resistance: Blocks front-running and sandwich attacks using advanced algorithms, securing high-value trades.

- Cross-Chain Liquidity: Aggregates liquidity from Ethereum, Solana, BSC, and more for seamless multi-chain swaps.

- Gas Optimization: Reduces transaction costs by splitting orders and bundling trades across DEXs.

- Real-Time Analytics: Live slippage predictions, gas fee trackers, and route optimization tools for smarter trades.

- User-Friendly Dashboard: Simple interface with wallet integrations (MetaMask, Phantom) and a “MEV Shield” toggle.

- Native Token (MEVX): Earn fee discounts, staking rewards, and governance rights by holding MEVX tokens.

- Mobile App: Trade on-the-go with iOS/Android apps featuring price alerts and portfolio tracking.

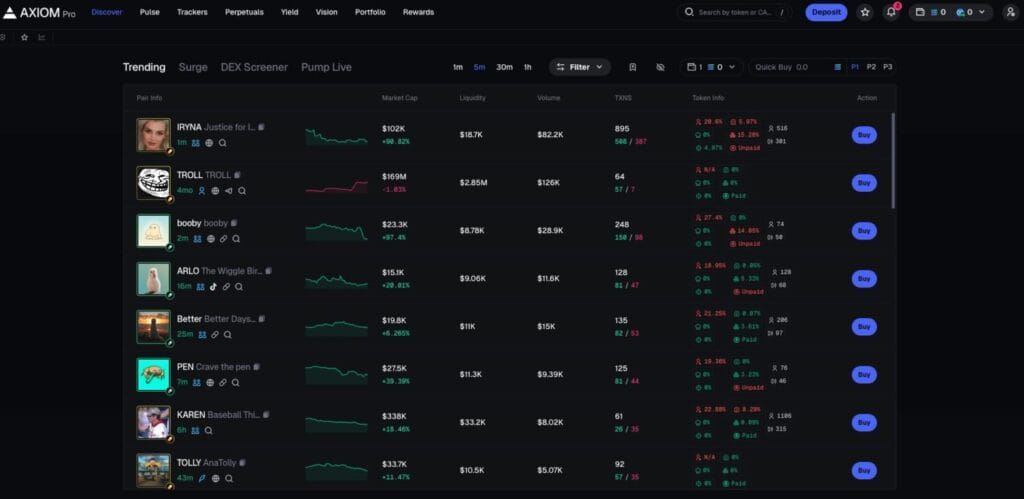

Axiom.Trade

In the cryptocurrency market, Axiom.Trade is one of the top DEX aggregators. It connects to multiple decentralized exchanges and liquidity pools to ensure users trade at the most competitive prices with minimal slippage.

- In the cryptocurrency market, Axiom.Trade ranks among the top DEX aggregators. It taps into liquidity from multiple decentralized exchanges and pools, helping users trade at the best rates with minimal slippage.

- The platform provides thousands of cryptocurrency trading pairs, giving access to a wide selection of tokens at competitive prices.

- Axiom’s fee model adjusts based on your trading volume: beginners start with a net fee of about 0.95%, while high-volume traders enjoy rates as low as 0.75%. Plus, active users earn cashback in SOL—up to 0.25%.

- It also gives you control over Solana network fees—options like priority fee, optional bribe, slippage tolerance, and MEV protection help you tailor speed and cost to your needs.

- The interface works cleanly across mobile and desktop, with a design made for fast order execution—some trades land in under one block—with tools like token discovery (Pulse), wallet tracking, Twitter tracking, and fast alerts for new launches.

- Axiom.Trade supports multiple networks, including Ethereum, Optimism, Arbitrum, Base, and zkSync Era (coming soon), making cross-chain swaps simple.

- The platform is non-custodial and integrates seamlessly with popular wallets, keeping your funds safe and giving you full control.

Maestro Bot

In the world of cryptocurrency trading, Maestro Bot is a standout Telegram-based trading assistant that brings DeFi tools right into your chat. It connects to decentralized protocols and handles trades seamlessly from inside Telegram, without needing to jump between apps.

- The bot works across multiple networks, including Ethereum, Binance Smart Chain, Solana, Tron, Base, Avalanche, Arbitrum, Sonic, TON, Metis, and Linea — giving you access to a wide range of blockchains from one place.

- Maestro’s standard, free tier charges a 1% fee on each buy, sell, or presale sniping trade, which is a typical industry rate.

- For a monthly fee of $200, you can upgrade to the premium tier where transaction fees are removed and advanced features become available.

- The bot includes powerful tools like “Auto Snipe” for catching early token launches, “Anti-Rug” and “Anti-MEV” protections, the ability to use up to 10 wallets at once, copy trading of wallets, limit orders, iceberg sniping, and monitoring tools within Telegram.

- It also includes wallet tracking, alerts from Telegram channels or whales, and portfolio insights — all accessible directly in chat.

- Security is built in: Maestro encrypts keys with AES, protects against rug pulls, front-running, and scam contracts, and never takes custody of your funds.

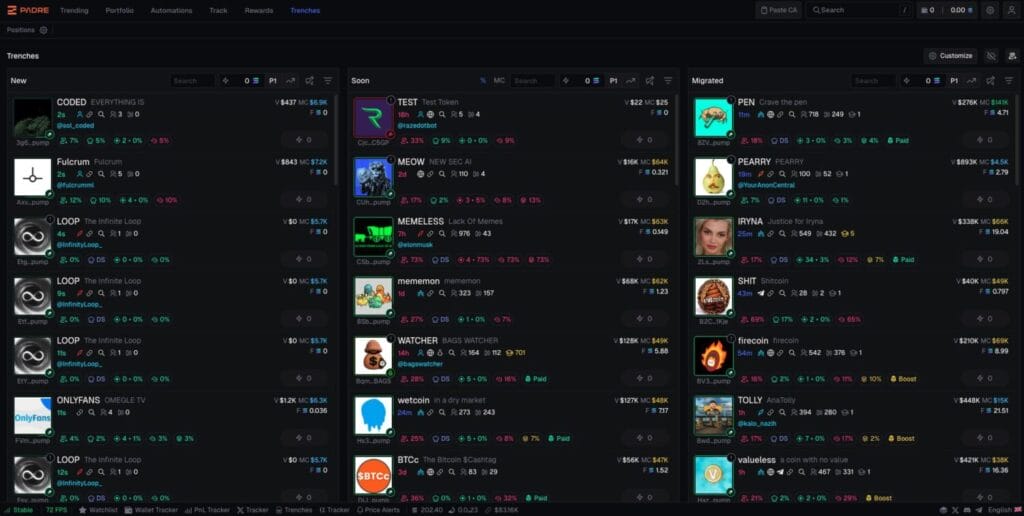

Padre.gg

In the memecoin trading world, Padre.gg is a fast, reliable web-based trading terminal that merges the speed of centralized exchanges with the power of on-chain tools.t

- It supports multiple chains — Solana, Ethereum, Base, and BNB — so you don’t have to switch apps when chasing new tokens.

- The interface is ultra-responsive, using smart routing and transaction simulation to make sure your trades go through quickly and efficiently, even in volatile markets.

- The platform offers advanced trading features including: limit orders (with tools like take-profit, stop-loss, and buy-dip), copy trading, auto-exit strategies, live “jeetgrids” to monitor early holder moves, and chart overlays with real-time feeds.

- You can track your entire portfolio in real time, across all supported chains, with clear historical PnL and balance charts.

- Security is built-in: the platform is non-custodial, uses password encryption, 2FA, and offers anti-rug and MEV protection powered by BloXRoute Labs.

- Standard fees without a referral are around 1% for market orders and 0.5% for limit orders, with a default 10% cashback on those fees.

- However, if you sign up through a referral link, your cashback spikes to 35% — one of the highest rates in the industry — making it a major way to reduce trading costs.

- You can further lower your fees by holding $PADRE tokens. Holding 500 $PADRE earns a 5% additional discount, while 1,000 $PADRE grants a 10% discount plus exclusive access and priority perks. These benefits stack on top of your cashback savings.

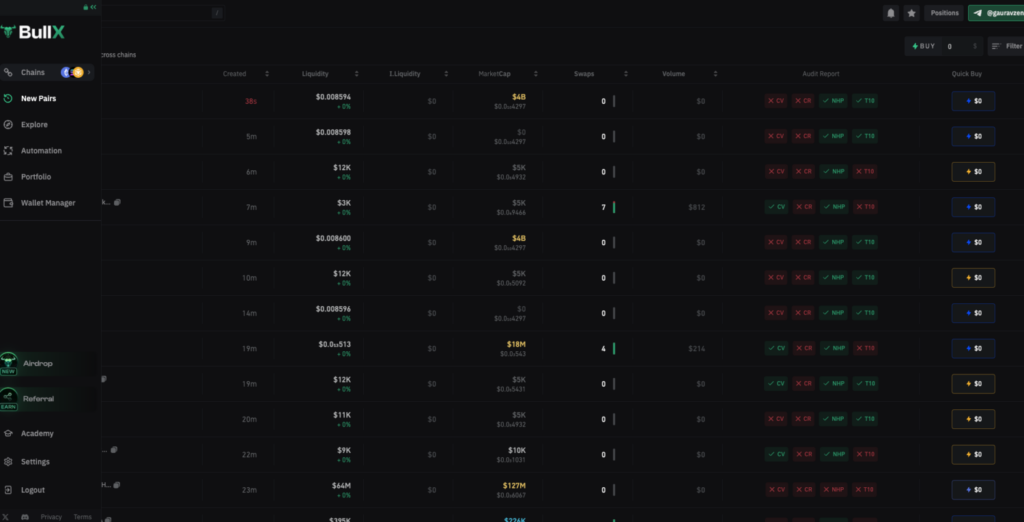

BullX

BullX is a next-gen DEX aggregator designed for fast, efficient, and cost-effective crypto trading. By aggregating liquidity from leading DEXs like Raydium, Orca, Serum, and Uniswap, BullX ensures the best prices with minimal slippage.

- Multi-Chain Support – Trade seamlessly across Solana, Ethereum, Binance Smart Chain (BSC), and Polygon.

- Smart Routing Algorithm – Finds the best price with minimal slippage and low gas fees.

- High-Speed Execution – Near-instant swaps with Solana’s ultra-fast transactions.

- Low Fees – 0.2% swap fee + minimal blockchain gas costs.

- MEV Protection – Shields traders from front-running and sandwich attacks.

- Secure & User-Friendly – Supports Phantom, Solflare, MetaMask, and Ledger wallets.

Fees: 0.2% per swap + standard network fees

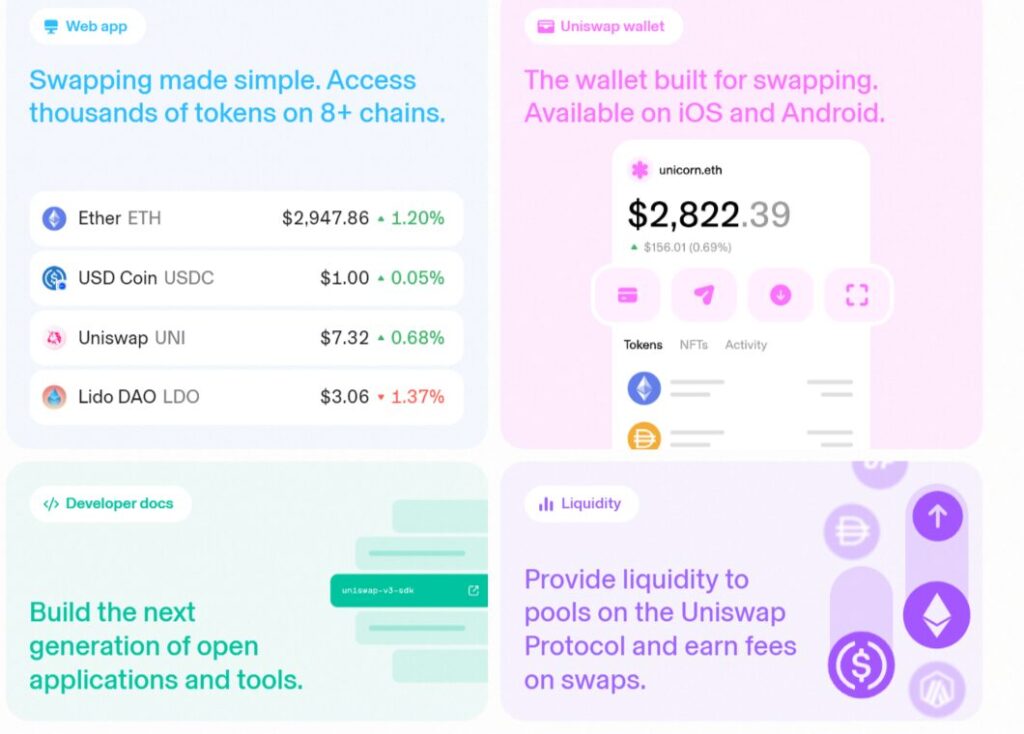

Uniswap

- Uniswap operates on the blockchain of Ethereum. In other words, users may swap and trade ERC-20 tokens on the platform. Uniswap’s ability to use as an AMM, or automated market maker, is its finest feature.

- It lists around 6000 distinct tokens and currencies.

- Prices for more significant swaps are less likely to fluctuate dramatically because of Uniswap’s market position, which draws deeper liquidity pools.

- It is an NFT aggregator, and Uniswap offers a searchable selection of NFTs from leading markets.

- Unisharep charges a 0.3% fee. But if you’re utilizing the Ethereum network, swaps on Uniswap can grow expensive, and gas prices rise during periods of high network utilization.

- Uniswap app is available for Android and iOS users to download from the Google Play Store and Apple App Store.

Pancakeswap

- It’s simple to trade BEP-20 tokens like ETH, BNB, and CAKE. Please note that PancakeSwap does not allow fiat cash; you must first link an existing wallet containing the tokens you wish to swap.

- You may access several pools, or “farms,” with interest rates as high as 10% with PancakeSwap.

- Users can have early access to new tokens added to PancakeSwap through Initial Farm Offerings (IFOs). To exchange CAKE tokens for iCAKE, the only money available for purchasing fresh tokens from farm offers is all that is required to benefit potentially.

- Users of PancakeSwap can win significant quantities of CAKE tokens through the company’s regular lottery promotions.

- Users of PancakeSwap’s prediction market can place bets on how token pair prices will change. If your wager wins, your prizes might be multiplied by the amount you contributed to the pot.

- There is a 0.25% charge for each token swap (spot trade) that you do on PancakeSwap.

- Currently, there is no official app for Pancakeswap.

ParaSwap

- Another well-known DEX aggregator is ParaSwap, which operates an internal liquidity pool called ParaSwapPool.

- ParaSwap does not impose any transaction fees when purchasing or selling cryptocurrency tokens. This implies that the trader’s only payment for a deal is the relevant gas cost charged by the network.

- The exchange has 144 distinct cryptocurrency token pairings available. You may purchase these tokens at the lowest possible price with the least slippage.

- Currently, the platform is compatible with three networks: Polygon, Binance Smart Chain, and Ethereum.

- The Ledger hardware wallet is one of the exchange’s four wallets, providing you with the safest possible transaction experience.

- The Ledger Live program also supports ParaSwap for users with Ledger wallets.

- You can join the ParaSwap Mobile Beta Program and be among the first to explore it.

Orion Protocol

- Like OpenOcean, Orion Protocol aims to unite all DEXs and CEXs in the crypto-verse. This raises the platform’s total liquidity.

- Prominent brokers, including Injective, AscendEx, KuCoin, MEXC, etc., are available on the platform.

- Currently, Ethereum and Binance Smart Chain are the two networks the site supports.

- Moreover, Orion Protocol enhances transaction security by supporting four distinct wallets, including Trezor and Ledger’s hardware wallets.

- The platform’s governance is handled by Orion Protocol using an internal token known as ORN. Furthermore, ORN coins may be utilized for liquidity mining and staking.

- Orion offers a very reasonable price that starts at only 0.25% for trades made via CEXs involving assets other than stablecoins.

- The platform is launching its app very soon, which you can use.

OpenOcean

- The first comprehensive aggregator of the cryptocurrency market, OpenOcean, gathers liquidity from the centralized exchanges (CEX) and several accessible DEXs.

- This offers the consumer the lowest amount of slippage and the best overall pricing.

- Being the first comprehensive market aggregator, Binance is the first CEX to interface with OpenOcean.

- In addition to trade, the platform may be used for lending, insurance, and yield farming.

- The exchange provides 143 distinct cryptocurrency token pairings. You may purchase these tokens at the lowest possible price with the least slippage.

- Ethereum, Binance Smart Chain, Ontology, Tron, Solana, Polygon, Heco, OKExChain, and Avalanche are the nine networks that OpenOcean supports.

- The platform’s internal coin, OOE, may be applied to the governance of the platform.

- You can download the OpenOcean app from the Google Play Store and Apple App Store.

- Trading on this exchange is free of OpenOcean exchange fees. However, there is a fixed 0.2% OpenOcean crypto charge for accessing the liquidity pools to trade tokens, of which 0.15% goes to the liquidity providers and 0.05% to the Treasury.

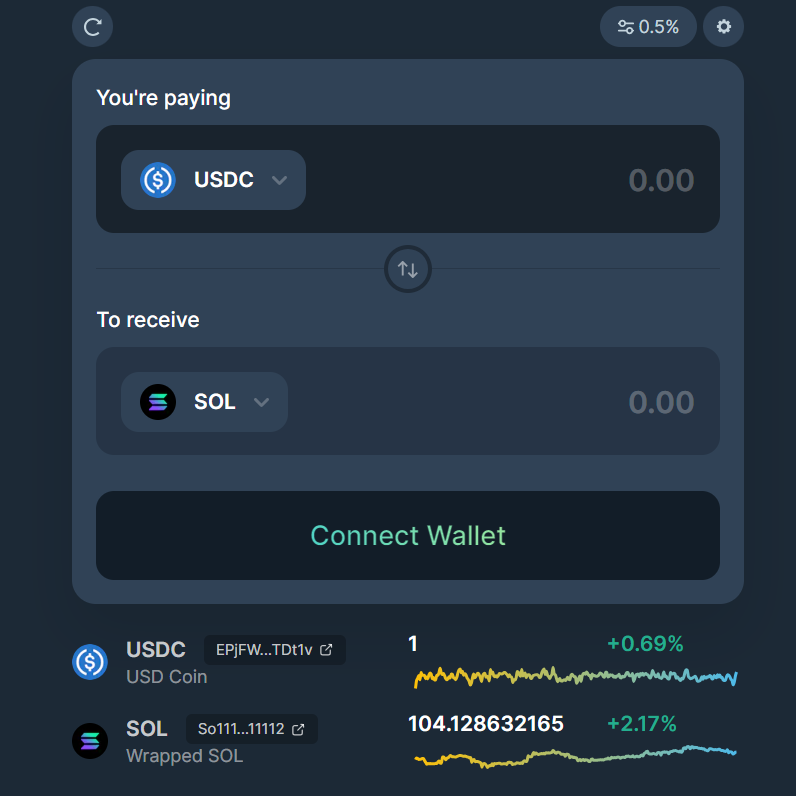

Jupiter

- Jupiter is the leading DEX aggregator on the Solana blockchain. It gets liquidity from several Solana DEX, like Raydium and Orca, to mention a couple.

- At the moment, Jupiter features 605 markets (cryptocurrency trading pairs), 307 cryptocurrencies, and 0 fiat currencies. USDC/USDT is the most traded pair on Jupiter.

- The foundation of the Jupiter cryptocurrency exchange is the Solana blockchain. It is a decentralized exchange with an AMM foundation founded in 2021.

- However, the exchange allows users to place a restricted number of orders.

- Numerous crypto-crypto pairings are available for trading on Jupiter. Jupiter protocol fees don’t exist. Nevertheless, integrator-introduced Jupiter exchange costs can apply to swaps. These costs are expressed in basis points.

Conclusion

DEX aggregators, which provide a practical means of obtaining the best prices across several decentralized exchanges, have become a vital tool for cryptocurrency traders. It’s critical to select the aggregator that best fits your trading demands and tastes out of the many possibilities accessible. You may choose the ideal DEX aggregator for your trading needs by considering elements like supported tokens, liquidity sources, and sophisticated features.

What separates DEX aggregators from traditional centralized exchanges?

DEX aggregators provide customers direct access to several decentralized exchanges from a single platform, setting them apart from conventional centralized exchanges.

Are DeFi exchanges reliable?

Numerous decentralized exchanges have established themselves as trustworthy options for every token trading requirement and desire of their consumers. However, because a lot of secrecy is involved, frauds continue to occur in the sector in large numbers. This is why most people would rather use centralized exchanges, which are a safer option.

What are the different types of DEX Aggregators?

Trading aggregation and information aggregation are the two main categories of DEX aggregation.

- Trading aggregation: These aggregators’ primary function is to compile deals. These give consumers a range of alternatives to select to make the most profitable deal.

- Aggregation of information: A trader would desire access to better information so they can make more informed judgments. Because most traders rely on data analysis done in real time to predict market moves, information aggregators are essential.