Blockchain analytics is an essential component of comprehending and keeping an eye on the activity inside a blockchain network. The demand for efficient blockchain analytics tools has increased with the growing acceptance of blockchain technology. We’ll look at some of the best tools for blockchain analytics.

Table of Contents

What are Blockchain Analytics Tools?

Blockchain analytics tools refer to web-based software solutions that assist investors in mitigating risk and gaining real-time market insights and data tracking. These tools for Blockchain analytics compile blockchain data and display it in an easily understandable manner. Using blockchain analytics tools, investors may collect and examine a range of blockchain indicators, such as fees, transactions, and users. These tools are indispensable for traders and investors who wish to make well-informed financial decisions. AI-powered platforms, round-the-clock security, monitoring, tracking, and exchanging pertinent data on blockchain transactions are just a few of the capabilities that these technologies have to offer.

8 Best Tools for Blockchain Analytics

Glassnode

Glassnode is one of the most advanced on-chain analytics platforms, offering high-quality blockchain data, market intelligence, and actionable insights for traders, institutions, and researchers. It provides deep visibility into network activity, liquidity trends, supply movements, and investor behavior across major crypto assets.

With its clean dashboards and highly granular datasets, Glassnode helps users predict market cycles, spot accumulation/distribution phases, and understand macro on-chain signals.

Key Features

- On-chain market indicators such as NUPL, MVRV, SOPR, RHODL, and more

- Exchange flows & liquidity metrics for smart money tracking

- Entity-adjusted data for more accurate wallet activity analysis

- Comprehensive dashboards for BTC, ETH, and other major assets

- Glassnode Studio with customizable charts

- API access for developers and quant traders

- Market reports & newsletters covering weekly crypto insights

Best For

- On-chain analysts

- Professional traders

- Institutional investors

- Funds and research teams

Pros

- Some of the most accurate and reliable on-chain metrics

- Deep institutional-grade analytics

- Great visualizations and dashboards

Cons

- Advanced metrics require a paid subscription

- May be overwhelming for beginners

Pricing

Glassnode offers Free, Advanced, and Professional plans with increasing access to indicators, time horizons, and metrics.

Arkham Intelligence

Arkham Intelligence is a cutting-edge blockchain intelligence platform specializing in wallet deanonymization and entity mapping. It provides real-time data on wallets linked to exchanges, funds, market makers, hackers, insiders, and other key actors across multiple blockchains.

Arkham stands out for its AI-powered algorithms that cluster addresses, detect relationships, and uncover hidden wallet identities — making it extremely valuable for investigators, traders, and compliance teams.

Key Features

- Entity-linked wallet database (exchanges, funds, whales, hackers, & more)

- Real-time transaction monitoring across multiple chains

- Arkham Intel Exchange for buying/selling blockchain intelligence

- AI-driven address clustering to uncover hidden identities

- Custom alerts on wallet movements and whale activity

- Portfolio tracking for known entities

Best For

- On-chain investigators

- Compliance and risk teams

- Whale watchers & active traders

- Security and forensics researchers

Pros

- Best-in-class wallet deanonymization

- Real-time intelligence feeds

- Unique “Intel Exchange” marketplace

- Excellent for tracking whales and exploits

Cons

- Advanced features may be too technical for beginners

- Some data depends on community-verified intel

Pricing

Arkham provides a Free tier plus Premium plans that unlock advanced data, additional wallets, and deeper analytics.

Coinpath

- The software used by Coinpath continuously scans blockchain transactions for trends and clues of unethical activity, such fraud or money laundering.

- Using strong analytics and machine learning methods, the program examines transaction data to spot any risks.

- The platform generates reports that businesses may use to prove they are in compliance with laws and regulations, such as know your customer (KYC) and anti-money laundering (AML). These reports may be customized to meet the unique reporting requirements.

- Customers may simply examine and understand the data associated with their blockchain transactions by using the user-friendly data visualization tools on Coinpath’s platform. This includes customizable interactive charts and graphs.

- Using Coinpath, you can make Detailed APIs for building advanced DEX Terminals and Consoles by accessing data from decentralized exchanges (such as Uniswap and PancakeSwap).

- Apart from analysis, it provides you with all-encompassing crypto tax software tools, obtain historical and real-time data on token values, balances, and transfers in USD and other major fiat currencies.

Elliptic

- With 99% coverage of cryptoassets and more than 100 billion data points, Elliptic’s blockchain analytics software enables comprehensive tracking and analysis.

- Financial service providers and enterprises can identify their exposure to cryptoassets by using the platform’s crypto wallet screening feature.

- Elliptic’s technology, which includes crypto transaction monitoring, enables companies to stop illegal financial activity and guarantee regulatory compliance.

- The program supports financial intelligence units (FIUs) and regulators in their efforts to enforce AML/CFT and penalties laws.

- Elliptic’s blockchain intelligence makes it possible to identify illegal activities, which expedites and simplifies the investigation of intricate cybercrimes.

- The platform’s customizable risk criteria and asset-agnostic scoring capabilities enable a customized approach to risk assessment.

- It gives users a single platform to receive a comprehensive risk perspective across all crypto assets.

TRM

- TRM Labs uses blockchain analytics to learn more about Bitcoin transactions, follow the history of funds, and assist in locating and pursuing questionable individuals or organizations.

- It allows for mapping the movement of funds across several blockchains and dynamic risk assessment for each entity in real-time, based on over 150 configurable indicators monitored for all entities and allowing for a speedy examination of alarms.

- With support for over 70 million assets across 29 blockchains, TRM Labs offers extensive asset coverage for efficient monitoring and analysis. This includes industry-leading NFT coverage and DeFi protocols.

- TRM Transaction Monitoring supports over 1,000,000 digital assets and 28 blockchains, including all ERC-20 tokens, well-known stablecoins, DeFi tokens, and more, allowing the monitoring of deposits and withdrawals for AML/CFT compliance.

- The platform’s threat intelligence team proactively tracks modifications to sanctions lists to guarantee compliance. This way, customers can rely on reliable information for risk assessment and monitoring.

- TRM Labs provides robust APIs, examples, sample code, and a test environment for smooth integration, making it simple to include in current AML procedures.

- To guarantee best practices for security, availability, and confidentiality, the platform also goes through an annual SOC 2 examination.

- The platform’s international staff guarantees 24/7 access, including in-app support, giving users dependable and ongoing help.

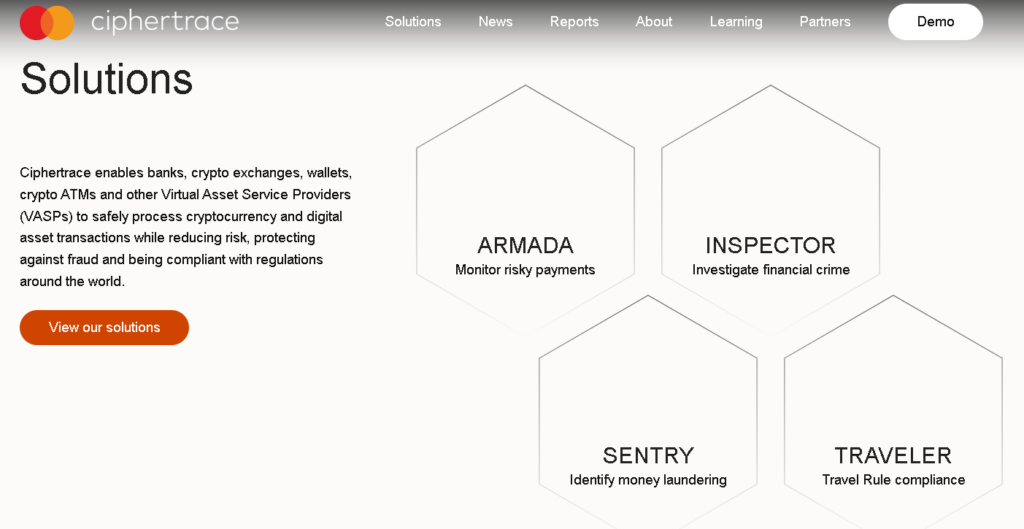

CipherTrace

- One of the top tools for blockchain analytics and forensics companies, CipherTrace, provides tracking solutions, keeping an eye on and looking into Bitcoin transactions.

- This program allows users to visualize transaction networks, track money movement, and spot questionable activity. It clusters wallet addresses, examines transaction patterns, and de-anonymizes bitcoin addresses using in-house developed algorithms.

- This solution aims to watch for and identify dangers related to virtual asset service providers, or VASPs, including Bitcoin wallets and exchanges.

- It detects possible money laundering activities, evaluates high-risk VASPs’ regulatory compliance, and identifies them using sophisticated data analytic tools.

- To help users evaluate the possible risk involved with certain transactions, CipherTrace additionally provides a tool that rates crypto transactions.

- CipherTrace connects cryptocurrency wallet addresses to IP addresses, sanctioned organizations, and other real-world identities. Financial and crypto organizations can use this data repository to determine which addresses to steer clear of.

- CipherTrace makes a thorough and effective way to track, analyze, and look into Bitcoin transactions and evaluate and lessen possible hazards related to certain transactions and companies.

CryptoQuant

- CryptoQuant offers market analytics and on-chain solutions that offer actionable information to assist users in analyzing cryptocurrency markets and identifying opportunities based on data.

- The platform provides several choices for selecting data, ranging from unprocessed blockchain information to abstraction tables that classify and arrange intricate data.

- Users may apply conditions and filters to the metrics-selected data with the tool’s sophisticated filtering tools. With a column, users may also add a dimension to the data.

- The no-code analytics offered by CryptoQuant has a low learning curve and doesn’t require any prior experience with data tools. After reading the tutorial for only about an hour, users may quickly learn how to undertake complex data analysis.

- Users may examine data from several blockchains to get a comprehensive picture of Bitcoin transactions using the platform’s cross-chain analytics feature.

- CryptoQuant offers extensive asset coverage for efficient monitoring and analysis, supporting over 70 million assets across 29 blockchains, including industry-leading NFT coverage and DeFi protocols.

- By examining Bitcoin entity flow data, the tool offers comprehensive information about price movements and gives consumers insightful knowledge about market patterns.

- A basis for blockchain education, basic research, institutional reporting, and content production is provided by CryptoQuant’s on-chain data and tooling.

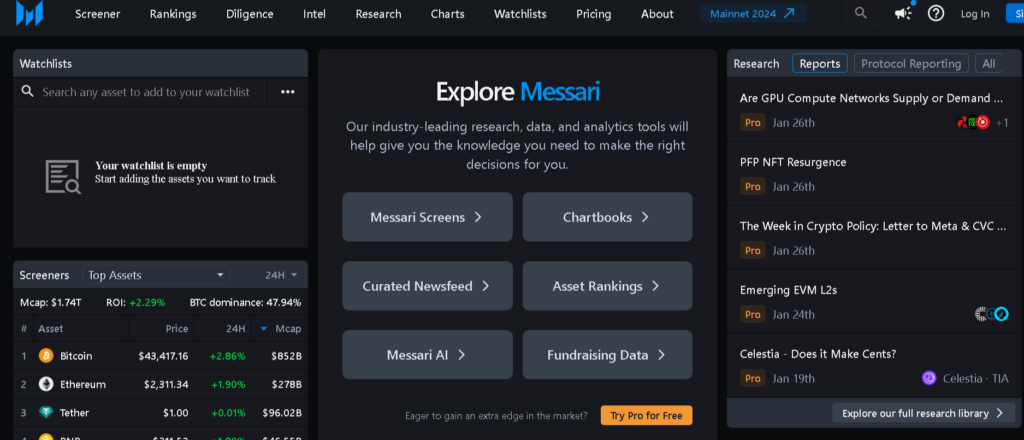

Messari

- Messari offers top-notch data, analytics, and research to assist customers in making wise decisions in the cryptocurrency market.

- An internal team of researchers at the site produces comprehensive market research studies and offers insights into various cryptocurrency industry topics.

- Messari is a reliable resource for risk management, market analysis, and tools that monitor trade volume, market capitalization, and other crucial indicators.

- Messari provides a community forum where users can interact and work with other platform users.

- Top platforms and funds in the market rely on Messari Enterprise to deliver real-time monitoring and warnings for all major crypto assets.

- Messari gives customers real-time data on all significant cryptocurrency assets, enabling them to keep updated about market trends and make well-informed decisions.

- In-depth statistics, indexes, forecasts, and other tools are all available on the site to assist users in making better investing and cryptocurrency trading choices.

- Messari’s enterprise-level solution is trusted by some of the largest platforms and funds in the cryptocurrency sector, offering consumers accurate and dependable data.

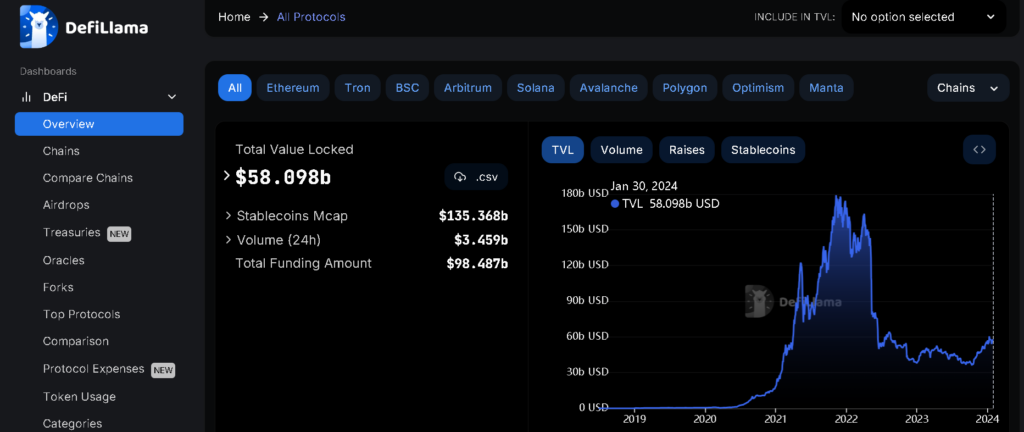

DefiLlama

- The blockchain analytics tool from DefiLlama is an all-inclusive platform for monitoring DeFi protocols, assessing market patterns, and making wise investment choices in the decentralized finance industry.

- The website’s ” Chains ” section lets users track the effectiveness of DeFi protocols and evaluate their alternatives by listing layer one blockchains and their total value locked (TVL) statistics.

- For data gathering, the analytics platform from DefiLlama calls specific endpoints of the DeFi protocols or conducts blockchain calls.

- The platform presently supports EVM-based chains; fetch adapters are needed for other chains’ protocols to retrieve the balance for tokens in the DeFi protocol’s smart contract.

- DefiLlama asserts that it offers DeFi analytics services to its consumers while maintaining data quality and openness by not adding paid content.

- DefiLlama’s Yield Chart provides a yield farming calculator tool that allows users to compare different yield farming strategies, enabling users to input the parameters of their farming strategy, such as the number of loops for lending and borrowing.

Conclusion

The tools for blockchain analytics are getting more advanced and potent, and the area of blockchain analytics is increasing. By utilizing these technologies, researchers and analysts may uncover important information about blockchain transactions, identify fraudulent activity, and guarantee regulatory compliance. Strong blockchain analytics tools are essential as blockchain technology continues transforming many sectors.

What advantages may blockchain analytics tools offer?

Blockchain analytics tools are crucial for tracking and evaluating on-chain activities, keeping an eye on compliance, looking into blockchain activity, and studying markets. They provide the visualization and comparison of blockchain data, facilitating the discovery of trends and patterns. Strong compliance features, efficient transaction filtering, tracking and investigating blockchain activity, and the ability to ban addresses from sanction lists are all made possible by these technologies.

How might investors benefit from blockchain analytics tools?

With these tools, investors may collect and examine various data related to transactions, blockchain networks, and other market activities. They can assist investors in lowering risk and gaining market insights and real-time data tracking. These tools allow them to compare measurements, view past performance, and examine the foundations of a coin.

What to consider when choosing blockchain analytics tools?

Consider these factors while selecting the top blockchain analytics tool:

- Data Sources: Verify that many blockchains are supported.

- Analytics Capabilities: Look for advanced pattern identification and transaction monitoring.

- Visualization and Reporting: Look for tools for customizable reporting and clear visualization.

- Compliance and Security: Ensure robust security protocols, AML compliance, and KYC adherence.

- Scalability and Performance: Assess the tool’s capacity to manage substantial data.

- User-Friendly Interface: Give thorough documentation and simplicity of use a priority.