Key Takeaways

- Despite the present market conditions, MicroStrategy CEO Michael Saylor stated today that the company is not under any immediate pressure to sell its Bitcoin (BTC) holdings.

- To receive a margin call to replace its leveraged position, the company needs bitcoin to drop to $3,562.

- To buy more BTCs, the corporation appealed to Silvergate Bank for a $205 million loan. The bitcoin-backed loan, on the other hand, was interest-only, with the principal due at the end of the loan term.

- Even if Bitcoin continues to fall, the corporation can provide more bitcoin as collateral for the leveraged position. Because of the company’s big ownership, the asset’s price must fall to $3562 for the position to be jeopardised.

MicroStrategy, the biggest corporate bitcoin holder, is down in the stock market, a move precisely proportional to bitcoin’s sharp drop, which is closing in on $30,000.

Since August 2020, the business intelligence software company has been amassing bitcoin for its balance sheet. According to company records dated April 4, it has 129,218 bitcoins. The corporation had bought bitcoin with the help of a bitcoin-backed loan.

Surprisingly, this decline has recently been linked to technology equities. Since peaking above $69,000 in November, the most popular cryptocurrency has lost more than half of its value.

The corporation turned to Silvergate Bank in March for a $205 million loan to purchase more BTCs. The bitcoin-backed loan, on the other hand, was interest-only, with the principal due at the end of the loan term.

The interest-only term loan is secured by bitcoin held in MacroStrategy’s collateral account with a custodian that Silvergate and MacroStrategy have mutually authorised. MacroStrategy will utilise the loan proceeds to

(i) purchase bitcoins

(ii) pay fees, interest, and expenditures relating to the loan transaction, or

(iii) for MacroStrategy’s or MicroStrategy’s general corporate objectives, according to the terms of the contract.

Notwithstanding the current market conditions, MicroStrategy CEO Michael Saylor reaffirmed today that the company is not under any urgent pressure or need to liquidate its Bitcoin (BTC) holdings. In fact, the corporation needs bitcoin to drop to $3,562 in order to receive a margin call to replenish its leveraged position.

The news that MicroStrategy subsidiary MacroStrategy had received a $205 million loan sparked rumours that the company might sell its bitcoin to prevent potential damages. Today’s update from Michael Saylor, on the other hand, tries to allay any anxieties. With 129,218 BTC (about $4 billion at today’s pricing), the business is the newest corporate bitcoin owner.

As a result, even if Bitcoin continues to fall, the corporation can provide further bitcoin as security for the leveraged position. Because of the company’s big ownership, the asset’s price must fall to $3562 for the position to be jeopardised.

It is critical to understand that $MSTR cannot be liquidated:

Under a severely negative 2025 scenario (i.e. bitcoin below $10,000), the company would simply have to contemplate selling some of its $btc. MSTR works with a variety of sectors to supply corporate software and analytics.

The company generates around $500 million in revenue with gross margins of >80% and is expanding revenue in the low single digits.

@808_Investor explains how $MSTR has 129,218 bitcoin, which is presently worth $5 billion at market pricing.

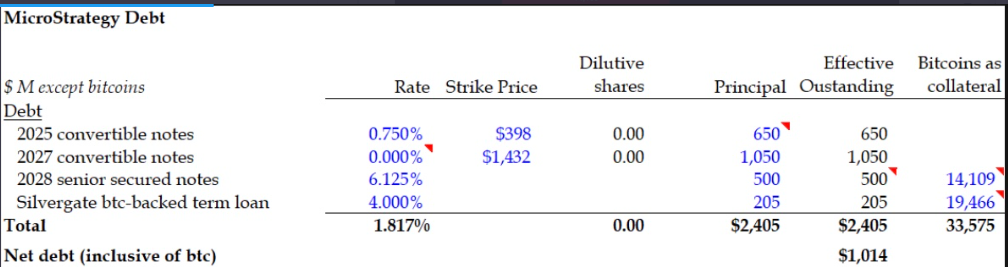

The operating business of MicroStrategy, Inc holds Note 14,109, while MacroStrategy, a subsidiary focused on bitcoin accumulation, holds the rest.

Here’s how much $MSTR owes:

MicroStategy, its cash flows and the 14k bitcoin held at the operating company – back the $500 million in 2028 senior secured notes.

$500 million is 5 times the company’s adjusted EBITDA of $100 million, which is conservative for an enterprise software company.

EBITDA, or earnings before interest, taxes, depreciation, and amortisation, is a financial performance indicator that can be used instead of net income in some situations. MicroStrategy should have no trouble refinancing the senior secured loan as long as its EBITDA in 2028 is greater than $100 million.

@808 Investor further details how Bitcoin might plummet to $21,062 (down 46% from today’s values and 70% from its peak) before the loan is liquidated.

Even then, MicroStrategy might use the remaining 95,643 bitcoin in MacroStrategy’s vault as collateral. MSTR would just double its promised bitcoins to “38,932 bitcorns” if btc fell to $21k.

@TajoCrypto also feels, Because the price of bitcoin will never go below $3,562, MicroStrategy will not be forced to deposit more collateral. Those who are wondering about MicroStrategy issuing a margin call should rest assured that this is not the case. MicroStrategy is a fantastic organisation.